Why Does the Automotive Industry Need PGMs?

What are PGMs and Why Does the Automotive Industry Need Them?

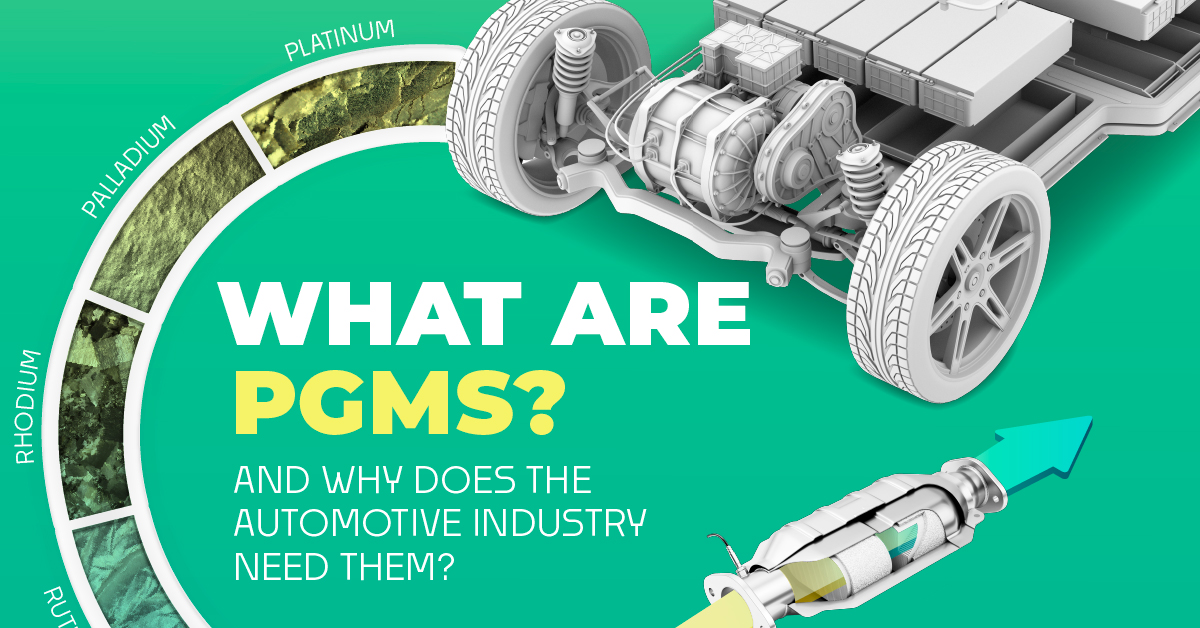

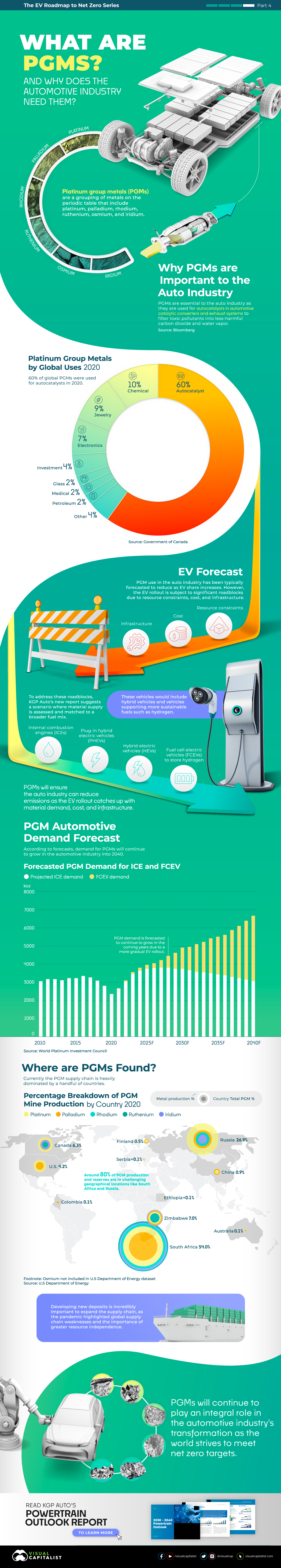

Platinum group metals (PGMs) are a category of metals that include platinum, palladium, rhodium, ruthenium, osmium, and iridium.

PGMs are crucial to the automotive industry as they are required for autocatalysts within automotive catalytic converters and exhaust systems. These convert harmful pollutants into less dangerous carbon dioxide and water vapor.

In 2020, 60% of global PGMs were utilized for autocatalysts, demonstrating the significance of PGMs to the auto industry.

In the above graphic sponsor, KGP Auto takes a look at the role PGMs will play in the future of decarbonizing the automotive industry.

EV Forecasts

PGM use in the auto industry has been typically forecasted to reduce as battery electric vehicle (BEV) share increases. This is due to the fact that BEVs do not need PGMs for catalytic converters.

However, the rollout of BEVs faces major challenges such as resource limitations, cost, and infrastructure.

According to projections by KGP Auto, BEVs will only make up 38% of the automotive market by 2040, far short of the 65% needed to achieve net-zero emissions.

To address this, KGP Auto’s recent report proposes a scenario in which material supply is matched to a broader fuel mix.

The Mix

This broader fuel mix will be intended for hybrid vehicles and other vehicles that can support more sustainable fuels like hydrogen.

These include a mix of internal combustion engines (ICEs), plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs).

PGMs used within these types of vehicles will ensure that the automotive industry can reduce emissions as the EV rollout catches up with material demand, cost, and infrastructure.

According to the World Platinum Investment Council, demand for PGMs will continue to grow in the automotive sector into 2040.

PGM Supply

With forecasted demand in the coming years, it’s important to look at global PGM supply.

Mine production of PGMs is currently dominated by a few countries, as is seen in the table below.

| Country | % of PGMs |

|---|---|

| 🇿🇦 South Africa | 54.0% |

| 🇷🇺 Russia | 26.9% |

| 🇿🇼 Zimbabwe | 7.0% |

| 🇨🇦 Canada | 6.3% |

| 🇺🇸 United States | 4.2% |

| 🇨🇳 China | 0.9% |

| 🇫🇮 Finland | 0.5% |

| 🇦🇺 Australia | 0.1% |

| 🇨🇴 Colombia | 0.1% |

| 🇪🇹 Ethiopia | <0.1% |

| 🇷🇸 Serbia | <0.1% |

Around 80% of PGM production in 2020, was situated in challenging geographical locations like South Africa and Russia.

The development of new PGM deposits is critical as these metals will continue to play an important role in the transformation of the automotive industry as the world aims to achieve net zero targets.

Read KGP Auto’s Powertrain Outlook Report to learn more.

-

Mining3 days ago

Mining3 days agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

While the price of gold has reached new record highs in 2024, gold mining stocks are still far from their 2011 peaks.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Markets3 months ago

Markets3 months agoThe Periodic Table of Commodity Returns (2014-2023)

Commodity returns in 2023 took a hit. This graphic shows the performance of commodities like gold, oil, nickel, and corn over the last decade.

-

Strategic Metals3 months ago

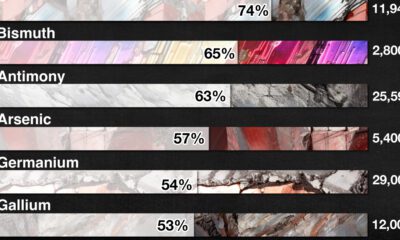

Strategic Metals3 months agoChina Dominates the Supply of U.S. Critical Minerals List

The U.S. Geological Survey estimates that in 2022, China was the world’s leading producer of 30 out of 50 entries on the U.S. critical minerals list.

-

Mining5 months ago

Mining5 months agoThe Critical Minerals to China, EU, and U.S. National Security

Ten materials, including cobalt, lithium, graphite, and rare earths, are deemed critical by all three.