Antimony: A Mineral with a Critical Role in the Green Future

The following content is sponsored by Perpetua Resources

Antimony: A Mineral with a Critical Role in the Green Future

If someone asked you to name the first mineral that came to mind, odds are, it wouldn’t be antimony.

Yet, despite its lack of fanfare, it plays a significant role in our day-to-day lives. This graphic from Perpetua Resources provides an overview of antimony’s key uses, and the critical role it plays in the movement towards clean energy, among other uses.

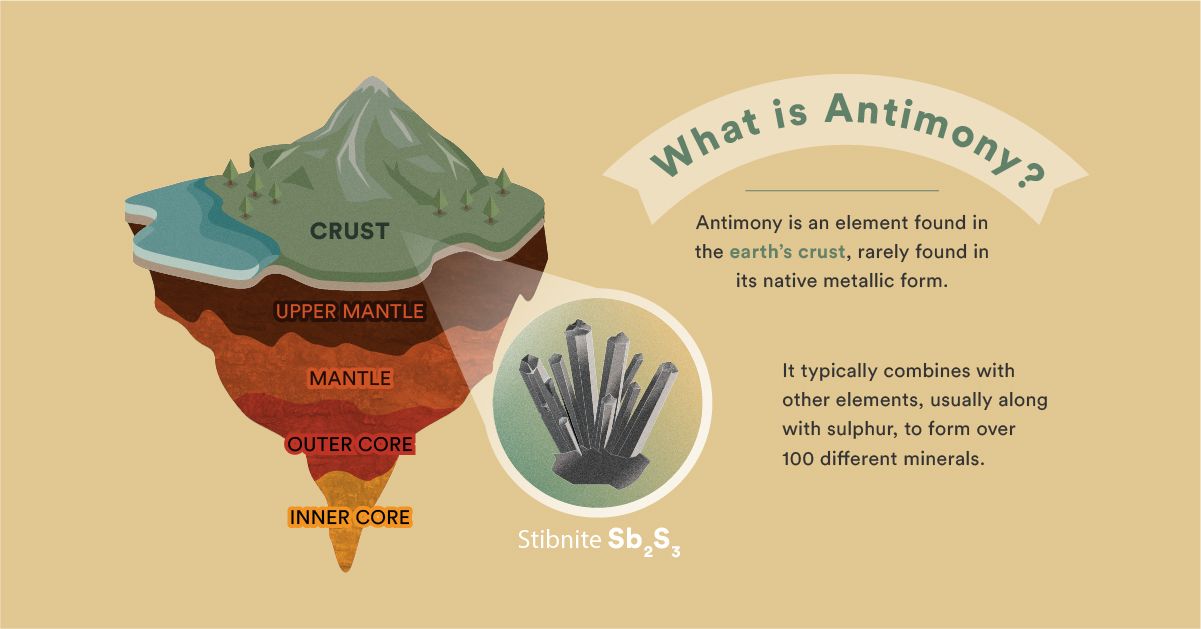

What even is Antimony?

Antimony is an element found in the earth’s crust. Rarely found in its native metallic form, it is primarily extracted from the sulfide mineral stibnite.

It has a variety of uses and is found in everything from household items to military-grade equipment. Because it conducts heat poorly, it’s used as a flame retardant in industrial uniforms, equipment, and even children’s clothing.

| End Use | % of antimony consumption in the U.S. |

|---|---|

| Flame retardant | 35% |

| Transportation and batteries | 29% |

| Chemicals | 16% |

| Ceramics and glass | 12% |

| Other | 8% |

Its second most common use, according to USGS, is in transportation and batteries. Traditionally, antimony has been combined with lead to create a strong, corrosion-resistant metal alloy, which is particularly useful in lead-acid batteries.

However, recent innovation has found a new use for antimony—it now plays an essential role in large-scale renewable energy storage, which is critical to the clean energy movement.

Antimony’s Role in Clean Energy

Large-scale renewable energy storage has been a massive hurdle for the clean energy transition because it’s hard to consistently generate renewable power. For instance, wind and solar farms might have a surplus of energy on windy or sunny days, but can fall short when the weather isn’t sunny, or when the wind stops.

Because of this, mass storage of renewable energy is key, in order to transition from fossil fuels to clean energy. Recent research points to liquid metal batteries as a potential storage solution—and these batteries heavily rely on antimony.

But there’s a finite supply, and with China currently dominating antimony production and processing, the U.S. could be at the mercy of its economic rival.

| Country | Production in 2020 (tons) | Reserves (tons) |

|---|---|---|

| China | 80,000 | 480,000 |

| Russia | 30,000 | 350,000 |

| Tajikistan | 28,000 | 50,000 |

| Bolivia | 3,000 | 310,000 |

| Turkey | 2,000 | 100,000 |

| Australia | 2,000 | 140,000 |

| United States | --- | 60,000 |

In 2020, there was no domestically mined production of antimony in America—meaning the U.S. relied on other countries, primarily China, for its antimony supply.

In the past, China has imposed restrictions on the exports of antimony-based products to the U.S., which reduced availability and increased prices. Because of this, antimony was identified as one of the 35 minerals that are critical to U.S. national security.

Tapping into Domestic Supply

To decrease foreign dependence, the U.S. could tap into domestic resources of antimony and build up its local supply chain.

The only major antimony deposit in North America is located in the Stibnite-Yellow Pine Mining District of central Idaho. This site is the largest reserve in the nation and is expected to supply roughly 35% of U.S. antimony demand on average for the first six years of production.

Domestic production would not only allow the U.S. to reduce its import reliance, but it would also create jobs, providing economic support for the local community.

In the near future, antimony demand could soar as a result of its critical role in clean energy storage—and domestic production via the Stibnite-Yellow Pine Mining district could play a key role in meeting this rising demand.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.