A Complete Visual Guide to Carbon Markets

A Complete Visual Guide to Carbon Markets

Carbon markets enable the trading of carbon credits, also referred to as carbon offsets.

One carbon credit is equivalent to one metric ton of greenhouse gas (GHG) emissions. Going further, carbon markets help companies compensate for their emissions and work towards their climate goals. But how exactly do carbon markets work?

In this infographic sponsored by Carbon Streaming Corporation, we look at the fundamentals of carbon markets and why they show significant growth potential.

What Are Carbon Markets?

Carbon markets play an important role for many companies that want or are required to compensate for their carbon footprint along with meeting climate targets.

Companies buy carbon credits, which fund a GHG reduction or removal project such as reforestation. This allows the company to compensate for their GHG emissions. There are two main types of carbon markets, based on whether emission reductions are mandatory, or voluntary:

Compliance Markets:

Mandatory systems regulated by government organizations to cap emissions for specific industries.

Voluntary Carbon Markets:

Where carbon credits can be purchased by those that voluntarily want to compensate for their emissions.

As demand to cut emissions intensifies, voluntary carbon market volume has grown five-fold in three years.

Drivers of Carbon Market Demand

What factors are behind this surge in volume?

- Paris Agreement: Companies seeking alignment with these goals.

- Technological Gaps: Companies are limited by technologies that are available at scale and not cost-prohibitive.

- Time Gaps: Companies do not have the means to eliminate all emissions today.

- Stakeholder Pressure: Companies are facing pressure from stakeholders to address their emissions.

For these reasons, carbon markets are a useful tool to compensate for emissions today and help decarbonize the global economy.

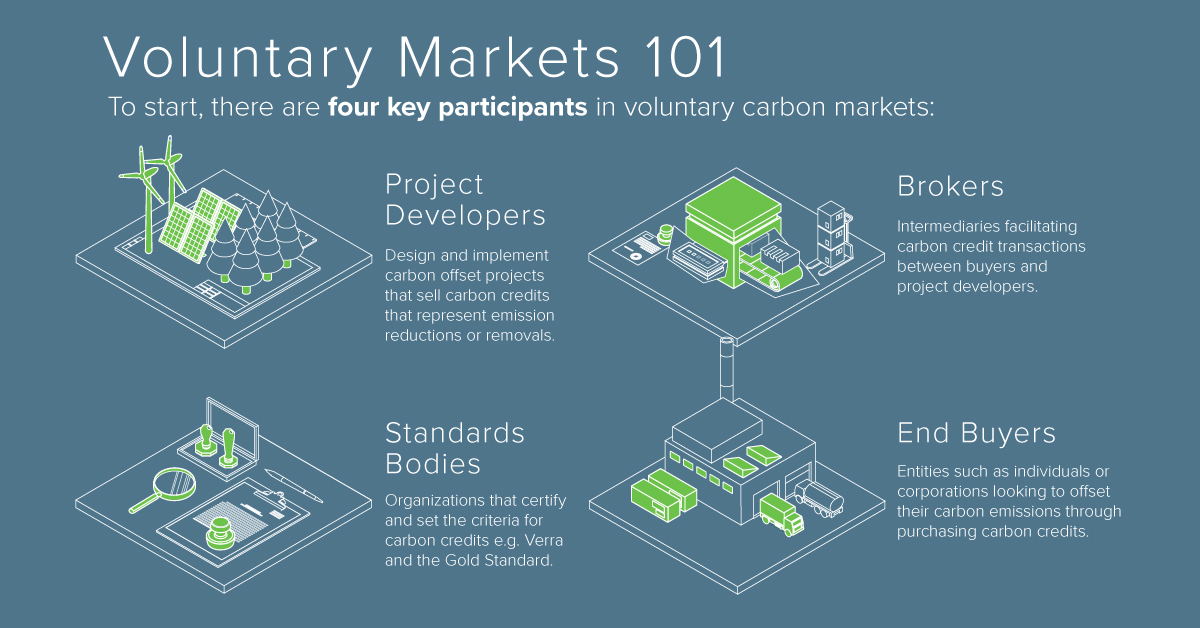

Voluntary Markets 101

To start, there are four key participants in voluntary carbon markets:

- Project Developers: Teams who design and implement carbon offset projects that generate carbon credits.

- Standards Bodies: Organizations that certify and set the criteria for carbon credits e.g. Verra and the Gold Standard.

- Brokers: Intermediaries facilitating carbon credit transactions between buyers and project developers.

- End Buyers: Entities such as individuals or corporations looking to offset their carbon emissions through purchasing carbon credits.

Secondly, carbon offset projects fall within one of two main categories.

Avoidance / reduction projects prevent or reduce the release of carbon into the atmosphere. These may include avoided deforestation or projects that provide fuel-efficient cookstoves.

Removal / sequestration projects, on the other hand, remove carbon from the atmosphere, where projects may focus on reforestation or biochar production.

In addition, carbon offset projects may offer co-benefits, which provide advantages that go beyond carbon reduction or removal.

What Are Co-Benefits?

When a carbon project offers co-benefits, it means that they provide features on top of carbon credits, such as social, environmental or economic characteristics, that may align with UN Sustainable Development Goals (SDGs).

Here are some examples of co-benefits a project may offer:

- Biodiversity: Protecting local wildlife that would otherwise be endangered through deforestation.

- Social: Promoting gender equality through the education of girls and women and supporting women in local business development.

- Economic: Creating job opportunities in local communities.

- Educational: Providing educational awareness of carbon mitigation within local areas, such as primary and secondary schools.

Often, companies are looking to buy carbon credits that make the greatest sustainable impact. Co-benefits can offer additional value that simultaneously address broader climate challenges.

Why Market Values Are Increasing

In 2021, market values in voluntary carbon markets were nearly $2 billion.

| Year | Traded Volume of Carbon Offsets (MtCO₂e) | Voluntary Market Transaction Value |

|---|---|---|

| 2017 | 46 | $146M |

| 2018 | 98 | $296M |

| 2019 | 104 | $320M |

| 2020 | 203 | $520M |

| 2021 | 493 | $1,985M |

Source: Ecosystem Marketplace (Aug 2022), Ecosystem Marketplace (Aug 2021)

Today, oil majors, banks, and airlines are active players in the market. As corporate climate targets multiply, future demand for carbon credits is projected to jump as much as four-fold by 2030 according to McKinsey.

What Qualifies as a High-Quality Carbon Offset?

Here are five key criteria for examining the quality of a carbon offset:

- Additionality: Projects are unable to exist without revenue derived from carbon credits.

- Verification: Monitored, reported, and verified by a credible third-party.

- Permanence: Carbon reduction or removal will not be reversed.

- Measurability: Calculated according to scientific data through a recognized methodology.

- Avoid Leakage: An increase in emissions should not occur elsewhere, or account for any that do occur.

In fact, the road to net-zero requires a 23 gigatonne (GT) annual reduction in CO₂ emissions relative to current levels. High quality carbon credits can help fund projects to meet this goal.

Fighting Climate Change

As the urgency to tackle global emissions accelerates, demand for carbon credits is poised to increase substantially—bringing much needed capital to innovative projects.

Not only do carbon credits fund nature-based projects, they also finance technological advancements and new innovations in carbon removal and reduction. For companies looking to reach their climate ambitions, carbon markets will continue to play a more concrete role.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology…

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.