The Regional Breakdown of Stock Market Sectors Over Time

The following content is sponsored by MSCI

A Regional Breakdown of Stock Market Sectors

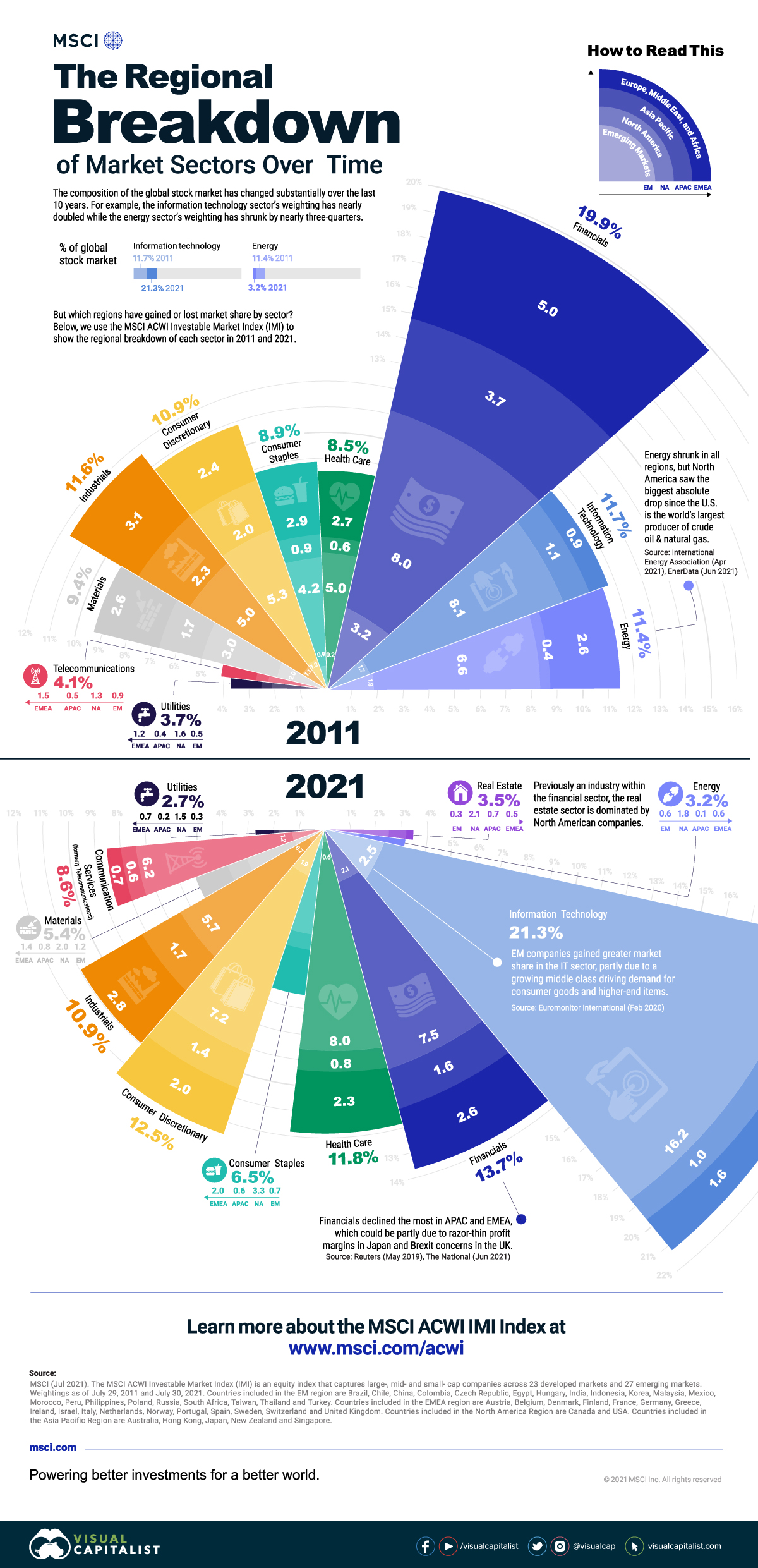

Over the last decade, the composition of global stock market sectors has changed substantially. For example, the information technology sector’s weighting has nearly doubled while the energy sector’s weighting has shrunk by nearly three-quarters.

But which regions have gained or lost market share within the stock market sectors? In this graphic from MSCI, we show the regional breakdown of each sector in 2011 and 2021.

Regional Weights by Stock Market Sector

We’ve based our data on the MSCI ACWI Investable Market Index (IMI), a global equity index intended to represent the entire stock market.

Here is how regional weights by stock market sectors have changed in percentage point terms over the last decade. For example, emerging markets’ utility weighting shrunk from 0.5% to 0.3% of the global stock market, a decline of 0.2 percentage points.

| Emerging Markets | North America | Asia Pacific | Europe, Middle East, and Africa | Total | |

|---|---|---|---|---|---|

| Utilities | -0.2 | -0.1 | -0.3 | -0.5 | -1.0 |

| Communication Services | 0.3 | 4.9 | 0.1 | -0.8 | 4.5 |

| Materials | -0.9 | -1.0 | -0.9 | -1.2 | -4.0 |

| Industrials | -0.4 | 0.7 | -0.6 | -0.3 | -0.7 |

| Consumer Discretionary | 0.7 | 2.0 | -0.6 | -0.4 | 1.6 |

| Consumer Staples | -0.3 | -0.9 | -0.3 | -1.0 | -2.4 |

| Health Care | 0.4 | 2.9 | 0.2 | -0.3 | 3.2 |

| Financials | -1.1 | -0.5 | -2.1 | -2.4 | -6.1 |

| Information Technology | 0.8 | 8.2 | -0.2 | 0.7 | 9.5 |

| Energy | -1.2 | -4.8 | -0.3 | -2.0 | -8.2 |

| Real Estate | 0.3 | 2.1 | 0.7 | 0.5 | 3.5 |

Financials shrunk the most in the Asia Pacific region and Europe, Middle East, and Africa (EMEA). The most dominant country in the Asia Pacific region, Japan has seen banking troubles due to shrinking populations and ultra-low interest rates that created razor thin profit margins. In EMEA, the UK’s financial services sector was hit hard when billions of dollars were moved out of London into new centers like Frankfurt after Brexit.

The energy sector, composed almost entirely of oil and gas companies, saw declines in all regions. Given that the U.S. is the biggest producer of crude oil and natural gas in the world, North America had the furthest to fall and experienced the largest drop.

On the other hand, North America saw the biggest increases in sectors like health care, real estate, and communication services. The latter is due to the telecommunications sector being broadened and renamed as the communication services sector in 2018. This newer sector reflects the way people share information and entertain themselves, and includes big U.S. names like Meta, Alphabet and Netflix.

A Different Perspective: Percentage Changes

By far the largest region in the global stock market, North America dominates the biggest changes in absolute terms. But what if we looked at things a different way?

We explored how region weights by stock market sectors have changed in percentage terms over the last decade for a more apples-to-apples comparison. For example, emerging markets’ utility weighting shrunk from 0.5% to 0.3%, a decline of nearly 42%.

| Emerging Markets | North America | Asia Pacific | Europe, Middle East, and Africa | Total | |

|---|---|---|---|---|---|

| Utilities | -41.7% | -4.4% | -56.1% | -41.3% | -27.1% |

| Communication Services | 32.0% | 381.3% | 20.2% | -54.1% | 108.5% |

| Materials | -43.2% | -33.1% | -53.7% | -45.7% | -42.6% |

| Industrials | -35.1% | 13.2% | -27.5% | -8.9% | -5.6% |

| Consumer Discretionary | 56.9% | 37.2% | -31.2% | -15.0% | 15.1% |

| Consumer Staples | -28.4% | -20.8% | -30.6% | -33.3% | -26.7% |

| Health Care | 219.2% | 58.4% | 28.9% | -12.9% | 37.7% |

| Financials | -34.6% | -6.7% | -57.2% | -48.1% | -30.9% |

| Information Technology | 50.2% | 101.0% | -13.7% | 77.3% | 81.2% |

| Energy | -68.2% | -72.0% | -73.4% | -75.2% | -72.2% |

| Real Estate | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

Note: Real estate was part of the financials sector in 2011, and has since been split out into a distinct sector.

Using this view, the energy drops are similar across all regions. Investors are focusing on net-zero goals and reducing their exposure to fossil fuels, which has contributed to the sector’s decline.

Emerging markets have seen strong market share growth in the health care, consumer discretionary, and information technology sectors. Health care in particular has exploded, due to a variety of factors:

- Rapid urbanization and rising income are fueling demand for health care services

- Cases of non-communicable diseases such as diabetes and cancer are rising

- Countries are beginning to increase health care spending after years of underinvestment

In the consumer discretionary and information technology sectors, emerging markets’ rising middle class has fueled demand for higher end items. This has led to the rise of eCommerce giants like Alibaba and Meituan in China, which are among the largest companies in the world.

Regional Shifts Within Stock Market Sectors

Investors are likely familiar with the shifts in overall sector weightings. However, this data sheds new light on which regions have become more or less dominant within stock market sectors.

North America increased its overall weighting, thanks in part to the ballooning market valuations of U.S. big tech companies. Relative to their starting weight, emerging markets have seen impressive growth in numerous sectors. On the other hand, Asia Pacific and EMEA have shrunk nearly across the board.

Investors looking to invest in international equity may want to be mindful of these trends within stock market sectors. As geopolitical dynamics and business environments shift, what will regional weightings look like in another 10 years?

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.