Making Moves in the Gaming Market

The following content is sponsored by eToro

Making Moves in the Gaming Market

Gaming is a massive and hard-to-ignore market, but its continued rise has eluded many companies.

Though it has grown into a hundred-billion-dollar market, major tech giants and conglomerates had avoided entering the gaming sector in the past. It was seen as a very difficult market to succeed in, and rightfully so, with many commercial failures and failed investments.

But despite lackluster console launches like Nokia’s N-Gage and losses on big-name games like Square Enix’s Marvel’s Avengers, the gaming market is making more money than ever before, and the majors are starting to enter the playing field.

Today’s infographic from eToro shines a spotlight on the major moves and ongoing developments happening in the gaming market.

The Streaming Wars: Gaming Edition

Similar to the current fight for media supremacy in other mediums, the new gaming wars are focused on streaming and mobile.

One reason is that mobile is far and away the largest segment of the gaming market, and the fastest growing as well. At an estimated $85 billion, sales generated from mobile gaming will account for more than 50% of gaming revenue in 2020.

At the same time, mobile is one of the many sectors targeted by streaming services that can reach multiple devices (while console launches or exclusives limit competitors to a single device). The influx of cloud-based streaming services and their consistent subscription revenues have created a scramble to become the “Netflix” of gaming.

Enter traditional plays like Sony and Microsoft and tech giants Apple, Google, and Amazon. Each has launched either a cloud streaming service for games or a game subscription service, and in many cases a combination of both.

| Company | Service | Type | Launched (Year) |

|---|---|---|---|

| Electronic Arts | EA Play | Game Subscription | 2014 |

| Sony | PlayStation Now | Cloud Gaming | 2015 |

| Microsoft | Xbox Game Pass | Game Subscription | 2017 |

| Apple | Apple Arcade | Game Subscription | 2019 |

| Google Play Pass | Game Subscription | 2019 | |

| Stadia | Cloud Gaming | 2019 | |

| Nvidia | GeForce Now | Cloud Gaming | 2020 |

| Microsoft | xCloud | Cloud Gaming | 2020 |

| Amazon | Luna | Cloud Gaming | 2020 |

And with others like Walmart and Verizon considering their own gaming services, the field might become even wider in the near future.

Massive Acquisitions and Investments

While new companies are entering the gaming space, existing players are solidifying their positions.

Similar to what’s happening in television and film, one of the big markers of the gaming industry’s growth over the last decade is the increasing value of intellectual property and the ongoing drive to consolidate.

It’s especially notable when investments once considered outrageous have quickly recouped themselves. When Microsoft purchased Minecraft developer Mojang for $2.5 billion in 2014, the sandbox development game had sold more than 50 million copies. Fast forward to 2020, and Minecraft has sold over 200 million copies with almost 132 million monthly active users.

And Microsoft isn’t alone in buying third-party studios. Sony, Electronic Arts, and Activision Blizzard have all been purchasing other developers. Social game juggernaut Zynga has continued to buy rival mobile games, and Chinese giant Tencent’s 2016 acquisition of Clash of Clans developer Supercell was the most expensive ever at $8.6 billion.

Other companies are finding different avenues to join the fray. Amazon purchased streaming service Twitch for $970 million in 2014, which seems to have paid off with more than $230 million in yearly ad revenue by 2018, despite the company hoping for double that figure.

Meanwhile, Facebook opted to enter the nascent virtual reality gaming space with a $3 billion acquisition of VR device maker Oculus in 2014, though it has still far from recouped that investment.

Gaming Valuations Keep Climbing

The biggest reason new and old players alike are trying to enter the gaming market is simple: money in gaming keeps growing.

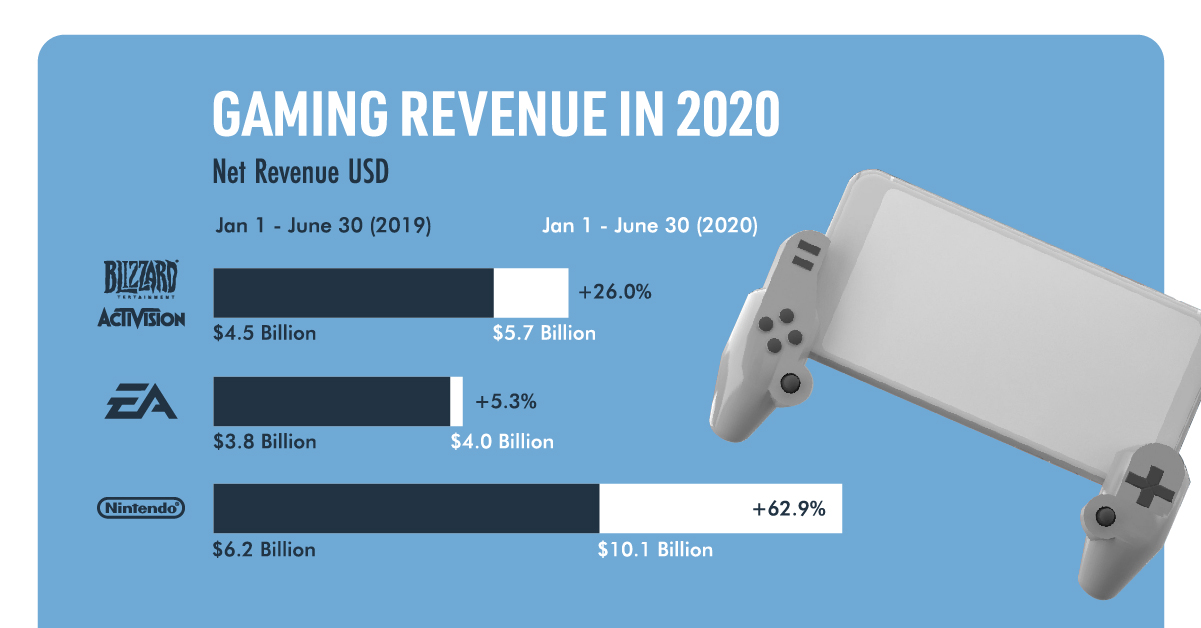

The largest gaming companies in the West, Activision Blizzard and Electronic Arts, saw multibillion-dollar revenues climb by more than 15% from 2019 to 2020 according to company earnings. In Asia, Nintendo saw an 80% jump in revenues over the same period, while the largest gaming and tech conglomerate Tencent saw a year-over-year increase of 29% for Q2 2020.

On one hand, the catalyst of COVID-19 keeping potential consumers at home and more willing to engage with games has been a boon to the market. On the other, those developments were already underway before the pandemic began, with exponential growth in subscription and recurring revenues.

That’s why investors are eager to capitalize on the market. Game and software developer Epic Games, which scored massive successes with Fortnite and its Unreal game development engine, raised $1.78 billion in capital investments in 2020 for a valuation of $17.3 billion before a potential IPO.

And the esports market is no exception. North America’s professional League of Legends league is projected to become fully profitable in 2021, and franchise spots for teams that cost up to $25 million are now worth upwards of $100 million. Big-name advertisers including Mastercard, Nike, Verizon, and BMW are partnering with either the league or teams directly.

Considering gamers make up an estimated 34% of the global population, and more developments on the horizon for the gaming market including new consoles and mediums, the industry’s rise isn’t expected to slow down anytime soon.

How Can Investors Take Part?

eToro’s InTheGame CopyPortfolio* gives investors direct access to the growing gaming market.

Curated by experienced and proven investment teams, the thematic portfolio offers exposure to a broad range of developers and companies invested in gaming, with no management fees.

*Your capital is at risk.

CopyPortfolios is a portfolio management product, provided by eToro Europe Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

CopyPortfolios should not be considered as exchange traded funds, nor as hedge funds.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.