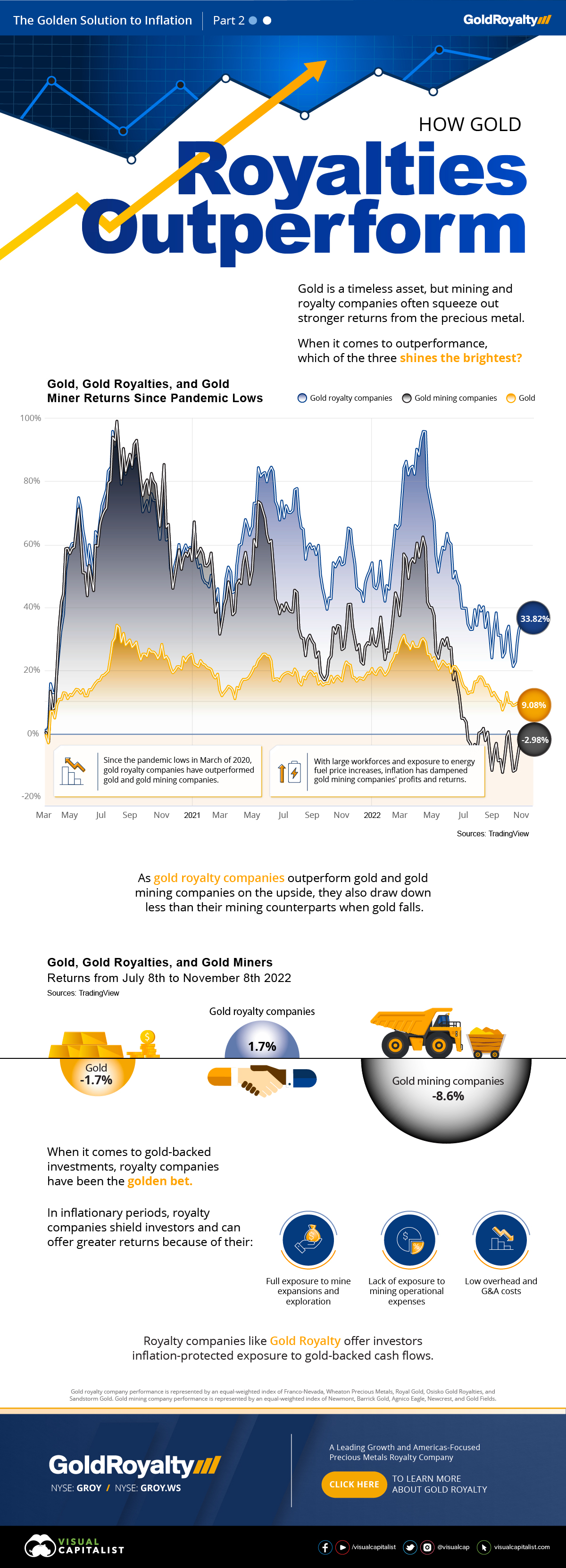

How Gold Royalties Outperform Gold and Mining Stocks

How Gold Royalties Outperform Gold and Mining Stocks

Gold and gold mining companies have long provided a diverse option for investors looking for gold-backed returns, however royalty companies have quietly been outperforming both.

While inflation’s recent surge has dampened profits for gold mining companies, royalty companies have remained immune thanks to their unique structure, offering stronger returns in both the short and long term.

After Part One of this series sponsored by Gold Royalty explained exactly how gold royalties avoid rising expenses caused by inflation, Part Two showcases the resulting stronger returns royalty companies can offer.

Comparing Returns

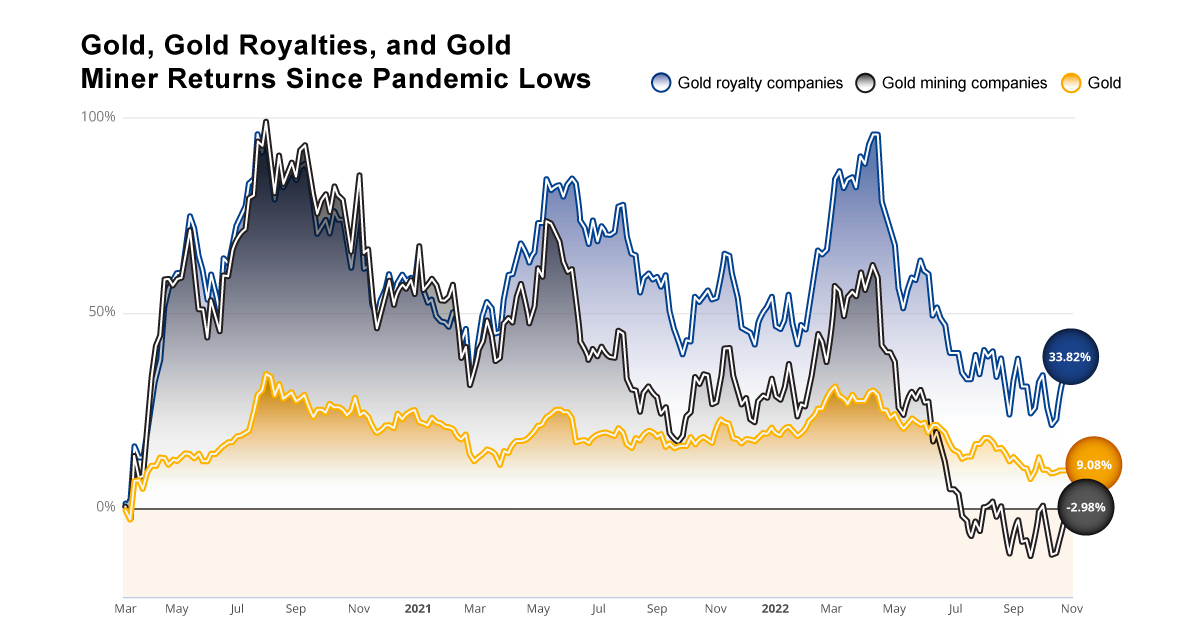

Since the pandemic lows in mid-March of 2020, gold royalty companies have greatly outperformed both gold and gold mining companies, shining especially bright in the past year’s highly inflationary environment.

While gold is up by 9% since the lows, gold mining companies are down by almost 3% over the same time period. On the other hand, gold royalty companies have offered an impressive 33% return for investors.

In the graphic above, you can see how gold royalty and gold mining company returns were closely matched during 2020, but when inflation rose in 2021, royalty companies held strong while mining company returns fell downwards.

| Returns since the pandemic lows (Mid-March 2020) | Returns of the past four months (July 8-November 8, 2022) |

|

|---|---|---|

| Gold Royalty Companies | 33.8% | 1.7% |

| Gold | 9.1% | -1.7% |

| Gold Mining Companies | -3.0% | -8.6% |

Even over the last four months as gold’s price fell by 1.7%, royalty companies managed to squeeze out a positive 1.7% return while gold mining companies dropped by 8.6%.

Gold Royalty Dividends Compared to Gold Mining Companies

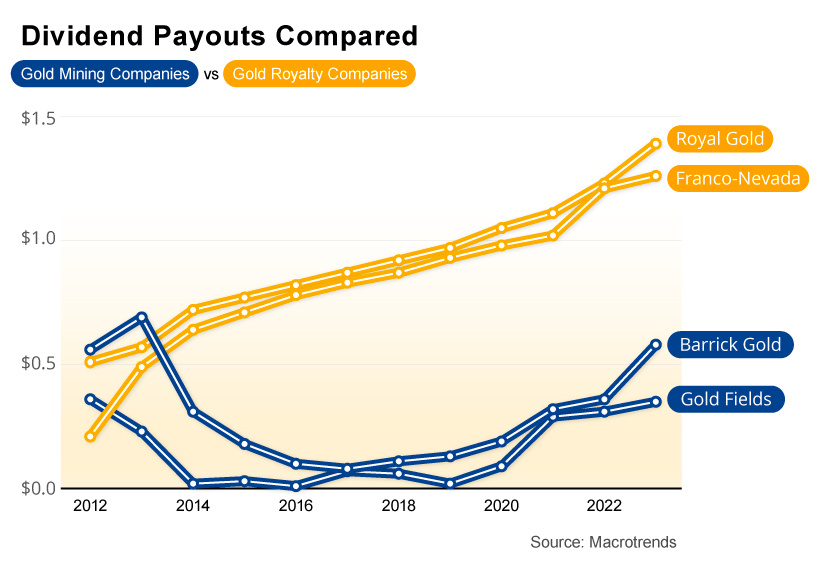

Along with more resilient returns, gold royalty companies also offer significantly more stability than gold mining companies when it comes to dividend payouts.

Gold mining companies have highly volatile dividend payouts that are significantly adjusted depending on gold’s price. While this has provided high dividend payouts when gold’s price increases, it also results in huge dividend cuts when gold’s price falls as seen in the chart below.

Rather than following gold’s price, royalty companies seek to provide growing stability with their dividend payouts, adjusting them so that shareholders are consistently rewarded.

Over the last 10 years, dividend-paying royalty companies have steadily increased their payouts, offering stability even when gold prices fall.

Why Gold Royalty Companies Outperform During Inflation

Gold has provided investors with the stability of a hard monetary asset for centuries, with mining companies offering a riskier high volatility bet on gold-backed cash flows. However, when gold prices fall or inflation increases operational costs, gold mining companies fall significantly more than the precious metal.

Gold royalty companies manage to avoid inflation’s bite or falling gold prices’ crunch on profit margins as they have no exposure to rising operational expenses like wages and energy fuels while also having a much smaller headcount and lower G&A expenses as a result.

Along with avoiding rising expenses, gold royalty companies still retain exposure to mine expansions and exploration, offering just as much upside as mining companies when projects grow.

Gold Royalty offers inflation-resistant gold exposure with a portfolio of royalties on top-tier mines across the Americas. Click here to find out more about Gold Royalty.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining7 months ago

Mining7 months ago200 Years of Global Gold Production, by Country

Global gold production has grown exponentially since the 1800s, with 86% of all above-ground gold mined in the last 200 years.

-

Mining1 year ago

Mining1 year agoCharted: 30 Years of Central Bank Gold Demand

Globally, central banks bought a record 1,136 tonnes of gold in 2022. How has central bank gold demand changed over the last three decades?

-

Mining2 years ago

Mining2 years agoMapped: The 10 Largest Gold Mines in the World, by Production

Gold mining companies produced over 3,500 tonnes of gold in 2021. Where in the world are the largest gold mines?

-

Financing3 years ago

Financing3 years agoHow to Avoid Common Mistakes With Mining Stocks (Part 5: Funding Strength)

A mining company’s past projects and funding strength are interlinked. This infographic outlines how a company’s ability to raise capital can determine the fate of a…

-

Gold3 years ago

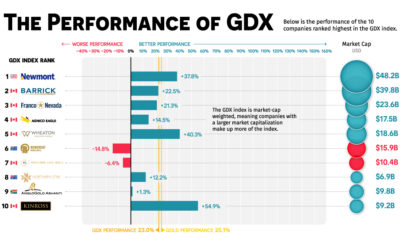

Gold3 years agoHow the World’s Top Gold Mining Stocks Performed in 2020

The GDX is an ETF that tracks the performance of the top gold mining stocks. How did the GDX and its constituents perform in 2020?