Graphene: The Wonder Material of the Future

The following content is sponsored by HydroGraph

Graphene: The Wonder Material of the Future

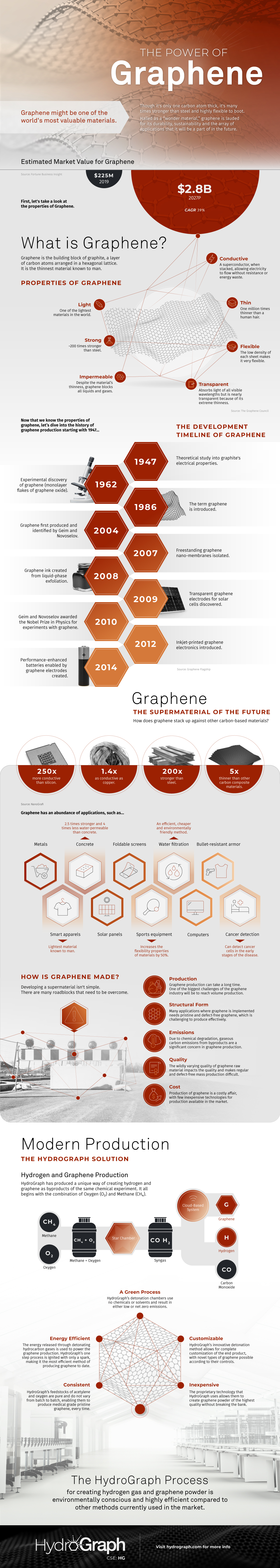

There is a new wonder material in town, and its name is graphene. Since it was first successfully isolated in 2004, graphene, with its honeycomb-like 2D structure and its wide gamut of interesting properties, has been keenly studied by material scientists.

This naturally transparent 1 millimeter thick lattice of carbon atoms has multiple applications and could even one day potentially solve the world’s water crisis.

The faith in the material is so strong that, according to numbers projected by Fortune Business Insights, its market value will be $2.8 billion in 2027.

In this infographic from HydroGraph, we are introduced to the fascinating world of graphene, including its properties, applications, history and production.

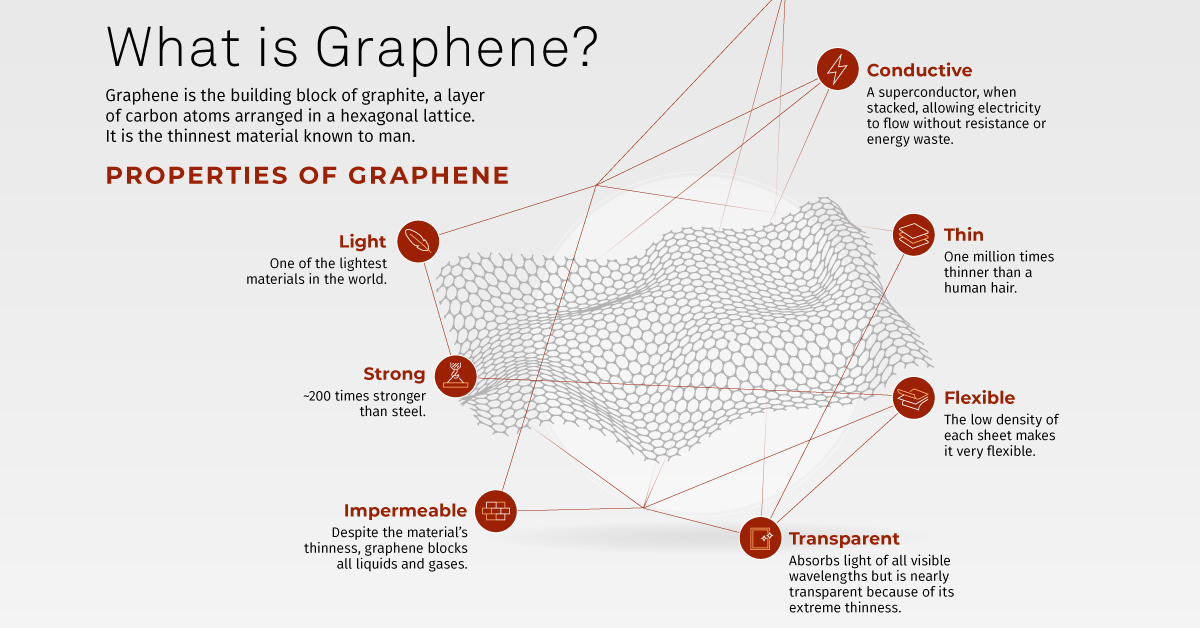

What is Graphene?

It is a single layer (monolayer) of carbon atoms, tightly bound in a hexagonal honeycomb lattice. It is the building block of graphite, which is made up of multiple layers of these monolayer carbon atoms on top of each other.

Here is a quick breakdown of its properties:

- It is the lightest material known to man, with 1 square meter weighing only 0.77 milligrams.

- Despite its light weight, it is still 200 times stronger than steel.

- It is one of the strongest conductors of heat and electricity.

- It also has uniform absorption of light across the visible and near-infrared parts of the spectrum.

Given that graphene is a pure carbon-based material, it is potentially a sustainable solution for an almost limitless number of applications.

Importance of the Material in Future Applications

The future of science and technology is boundless, and graphene can help accomplish that future sooner than we expect.

Here are several profound inventions to look forward to in the near future:

Fuel from Air

A team of UK researchers led by Nobel Laureate Andre Geim have shown that graphene can be used as a proton exchange membrane in fuel cells.

The find surprised everybody since no one expected the membranes to allow protons to pass through its tight, one-atom-thick hexagon structure. In addition, graphene membranes could be used to sieve hydrogen gas out of the atmosphere, making it possible for mobile fuel cells to run on nothing but air.

More Drinkable Water

Graphene could help solve the world’s water crisis. Membranes made from graphene can be big enough to let water through, but small enough to filter out the salt. In other words, these membranes could revolutionize desalination technology.

In fact, a type of graphene has proven so effective at water filtration that it rendered water samples from Sydney Harbor safe to drink after passing through the filter just once.

Australia’s Commonwealth Scientific and Industrial Research Organization (CSIRO) used “graphair” to make seawater drinkable after a single treatment.

A World Without Rust

Because it is virtually impermeable, a coat of graphene-based paint could one day be used to eradicate corrosion and rust. This is highly important because the estimated global cost of corrosion is $2.5 trillion annually.

Researchers have also recommended using glassware or copper plates covered with graphene paint as containers for strongly corrosive acids.

Saving Artwork from Fading

Graphene offers several material advantages: it can be produced in large, thin sheets; it blocks ultraviolet light; and is impermeable to oxygen, moisture, and other corrosive agents.

Layered overtop an artwork, researchers posited that it could prevent irreversible color fading due to light exposure and oxidizing agents (like air). Their findings revealed that a single protective layer could avert color fading by up to 70%.

Why Hasn’t the Wonder Material Taken Over?

Work still needs to be done before there can be widespread adoption of the material. Several production issues need to be addressed before more advanced sectors opt to implement it.

One current challenge of mass production revolves around chemical vapor deposition (CVD). While it is the best method for producing single-layer graphene, it is not ideal in terms of scale.

These challenges also make mass production a costly affair. It takes about $100 to produce a single gram of graphene. Even then, the methods used for mass-producing graphene yield low-quality products and release carbon into the environment.

Solving the Graphene Production Problem

To overcome these issues, HydroGraph has created a process to mass-produce graphene powder. It is environmentally conscious and highly efficient compared to other methods currently used in the market.

The HydroGraph process is the next step in the energy-efficient, environmentally friendly and customizable mass production of graphene.

Click here to learn more about HydroGraph and its wide array of product offerings.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.