Global Trade Series: The Benefits of Free Trade

The Benefits of Free Trade

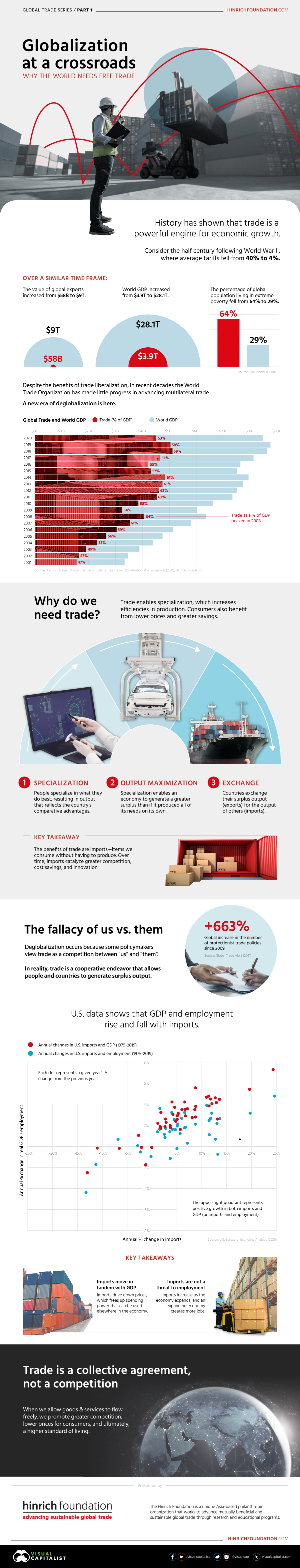

History has shown that trade can be a powerful engine for economic growth. Despite this, the number of protectionist policies enacted around the world has increased.

This is due to a rising tendency to view trade as a competition, rather than a cooperative endeavor. For evidence, consider the ongoing China-U.S. trade war, which has impacted everything from electronics to soybeans.

The economic costs of this dispute are well-documented. In 2019, Moody’s Analytics found that the trade war had cost America 300,000 jobs. In 2020, the Federal Reserve concluded that U.S. firms had lost $1.7 trillion in market capitalization due to the introduction of new tariffs.

In this infographic from the Hinrich Foundation—the first of a three-part series on global trade—we explain the theory behind free trade and explore a powerful dataset that disproves the rationale for protectionist policies.

Why Do We Trade?

The main reason countries trade is to specialize their production. This is when a country’s population is able to focus on what it does best. For example, consider Germany’s expertise in automobiles, or America’s leadership in tech.

These countries use their comparative advantages to generate a greater surplus than if they produced all of their needs on their own. Through exchange, they can trade their surplus output (exports) for the output of others (imports).

Imports are what facilitate the benefits of trade. These are goods that people consume without having to produce, and they can help reduce costs, catalyze greater competition, and even spark innovation.

A New Era of Deglobalization

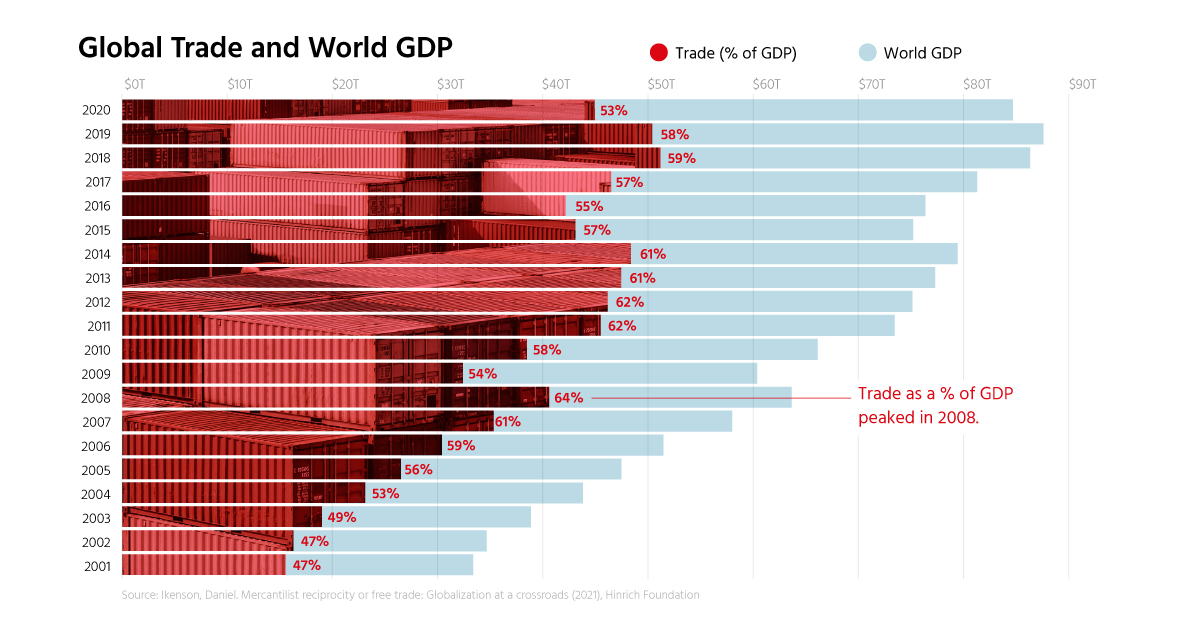

Between 2001 and 2008, trade grew immensely. In dollar terms, it rose from $15.6 trillion to $40.7 trillion, representing a 160% increase. More importantly, as a share of global GDP, it rose from 47% to a peak of 64%.

| Year | Trade (Export + Import) | World GDP (USD) | Trade (% of GDP) |

|---|---|---|---|

| 2001 | $15.7T | $33.4T | 47% |

| 2002 | $16.4T | $34.7T | 47% |

| 2003 | $19.1T | $38.9T | 49% |

| 2004 | $23.2T | $43.9T | 53% |

| 2005 | $26.6T | $47.5T | 56% |

| 2006 | $30.5T | $51.5T | 59% |

| 2007 | $35.4T | $58.1T | 61% |

| 2008 | $40.7T | $63.7T | 64% |

| 2009 | $32.5T | $60.4T | 54% |

| 2010 | $38.6T | $66.1T | 58% |

| 2011 | $45.6T | $73.5T | 62% |

| 2012 | $46.2T | $75.2T | 62% |

| 2013 | $47.5T | $77.3T | 61% |

| 2014 | $48.5T | $79.5T | 61% |

| 2015 | $43.2T | $75.2T | 57% |

| 2016 | $42.3T | $76.4T | 55% |

| 2017 | $46.6T | $81.3T | 57% |

| 2018 | $51.3T | $86.3T | 59% |

| 2019 | $50.5T | $87.6T | 58% |

| 2020 | $45.1T | $84.7T | 53% |

Since then, the number of protectionist trade policies has increased by 663%. This includes tariffs, which are taxes on foreign goods, and import quotas, which are limits on the amount of goods imported.

These measures appear to be having a material effect on trade. As a share of GDP, it has never returned to its 2008 high, and in 2020, it dipped an alarming five percentage points.

The Fallacy of Us Vs. Them

A growing number of governments view trade as a competition between “us” and “them”. This could be because the costs of trade are visible, while the benefits are largely unseen.

Consider a company that struggles to compete with foreign low-cost producers. It winds down its operations, resulting in job losses and an abandoned factory. These are the visible costs of trade, and when they’re covered in the media, trade is painted in a bad light.

So what exactly are the benefits? For starters, consumers benefit from the availability of cheaper goods. Not only can they buy the same things for less, they also have more money leftover for other goods and services. This extra spending will then contribute to growth in other areas of the economy.

“The benefits of trade are the resources that become available for investment in promising new firms and industries. Putting resources to better use is how we increase living standards and wealth.”

– Daniel Ikenson, Economist

To see if these benefits outweigh the costs, we analyzed U.S. economic performance from 1975 to 2019. In the vast majority of these years, GDP moved in the same direction as imports. This means that in years when imports grew, so too did GDP.

However, this doesn’t mean that an increase in imports will directly grow GDP. Rather, GDP grows when the extra spending that was freed up is allocated efficiently. The same positive relationship is seen between imports and employment—disputing the belief that imports cause a net loss in jobs. This is because imports increase when an economy expands, and an expanding economy creates more jobs.

The Case for Trade Liberalization

When it comes to free trade, domestic politics and geopolitical struggles appear to be taking the front seat. Consider the shortages of medical equipment seen in the early stages of the COVID-19 pandemic—this was partly due to harmful tariffs which disrupted the free flow of goods.

This is problematic because the most powerful benefits of trade are realized through imports. These cheaper goods give consumers greater spending power, which benefits other areas of the economy.

In the next part of the Global Trade Series sponsored by the Hinrich Foundation, we’ll explore digital trade and how it will impact the world economy.

-

Economy1 day ago

Economy1 day agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States1 week ago

United States1 week agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy4 weeks ago

Economy4 weeks agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy1 month ago

Economy1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?