Deep Diving for Metals: Visualizing Ocean Mining

The following content is sponsored by Prospector

Deep Diving for Metals: Visualizing Ocean Mining

The mining sector has been one of the biggest beneficiaries in the COVID-19 recovery.

Several countries’ recovery packages have ignited demand for commodities like copper, iron ore and lithium. Given that more metals are necessary for electrification and the clean energy transition, many companies are looking at an unexplored market: ocean mining.

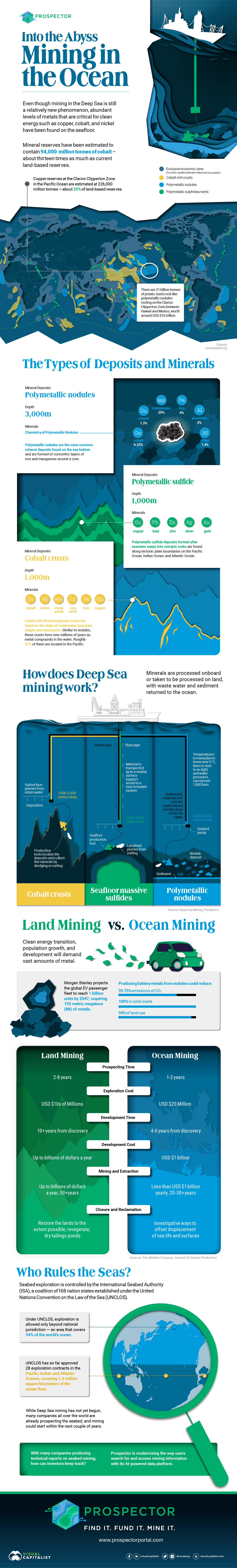

Mining of the Deep Sea is still under study but metals are abundant on the seafloor. Reserves are estimated to be worth anywhere from $8 trillion to more than $16 trillion.

This infographic from Prospector provides a visual overview of the seabed mining process.

Down in the Depths

The most prolific area for ocean mining is the Clarion Clipperton Zone (CCZ) in the Eastern Pacific Ocean, between Hawaii and Mexico. Almost 20 international mining companies have contracts to explore the region which spans over 5,000 kilometers.

Most of the metals are found in potato-sized rock-like polymetallic nodules. Millions of years old, the nodules grow by absorbing metals from the seawater, expanding slowly around the core of shell, bone, or rock.

| Mineral Deposits | Depth | Minerals |

|---|---|---|

| Polymetallic sulfide | 1,000 to 4,000m | Copper, lead, zinc, silver, and gold |

| Polymetallic nodules | 3,000 to 6,500m | Nickel, cobalt, manganese, copper, ammonium sulfate |

| Cobalt crusts | 1,000 to 2,500m | Cobalt, nickel, manganese, rare earth, iron, copper |

Source: The Pew Charitable Trusts

It is estimated that there are 21 billion tonnes of polymetallic nodules resting on the ocean floor in the CCZ, containing an estimated:

- 6 billion tonnes of manganese

- 226 million tonnes of copper – about 25% of land-based reserves

- 94,000 million tonnes of cobalt – about six times as much as current land-based reserves

- 270 million tonnes of nickel – 100 times the annual global nickel production in 2019

Cobalt-rich ferromanganese crusts are found on the sides of underwater mountain ranges and seamounts. Similar to nodules, these crusts form over millions of years as metal compounds in the water. Roughly 57% of them are located in the Pacific.

Polymetallic sulfide deposits formed after seawater seeps into volcanic rocks can be found along tectonic plate boundaries on the Pacific Ocean, Indian Ocean, and the Atlantic Ocean.

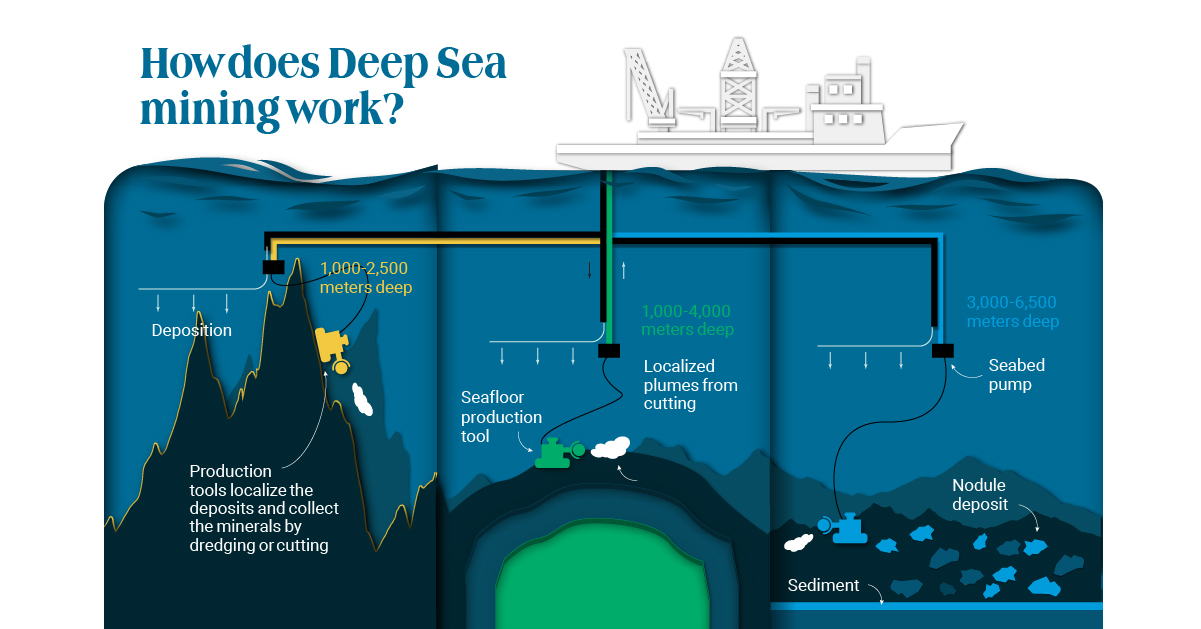

How Does Ocean Mining Work?

Extraction of minerals from the seafloor is planned to involve either modified dredging (for nodules), cutting (for massive sulphides and crusts), and transport of the material as a slurry in a riser or basket system to a surface support vessel.

The mineral-bearing material is then processed in a ship (cleaning and dewatering – with the wastewater and sediment being returned to the ocean) and then transferred to a barge for transport to shore where it will be further processed to extract the target metals.

Towards a Greener Future

Growing demand for batteries to power electric cars and store wind and solar energy has driven up the cost of many metals and bolstered the business case for seabed mining.

According to a study published in the Journal of Cleaner Production, producing battery metals from nodules could reduce emissions of CO² by 70-75%, cut land use by 94% and eliminate 100% of solid waste.

Here is a look at how ocean and land mining compares:

| Process | Ocean Mining | Land Mining |

|---|---|---|

| Prospecting time | 1-2 years | 2-8 years |

| Exploration cost | USD $20 million | USD $10 million |

| Development time | 4-6 years from discovery | 10+ years from discovery |

| Development cost | USD $1 billion | Up to billions of dollars a year |

| Mining and extraction | Less than USD $1 billion yearly, 20-30+ years | Up to billions of dollars a year, 50+ years |

| Closure and reclamation | Investigative ways to offset displacement of sea life and surfaces | Restore the lands to the extent possible, revegetate, dry tailings ponds |

Source: The Metals Company

The United Nations Convention on the Law of the Sea (UNCLOS) has so far approved 28 exploration contracts in the Pacific, Indian and Atlantic Oceans, covering 1.3 million square kilometers of the ocean floor.

With many companies turning their eyes to the unexplored riches of the ocean, seabed mining could offer a wealth of untapped minerals on the ocean floor.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.