Classifying Digital Assets With a New Framework: Datonomy

Classifying Digital Assets With a New Framework: Datonomy

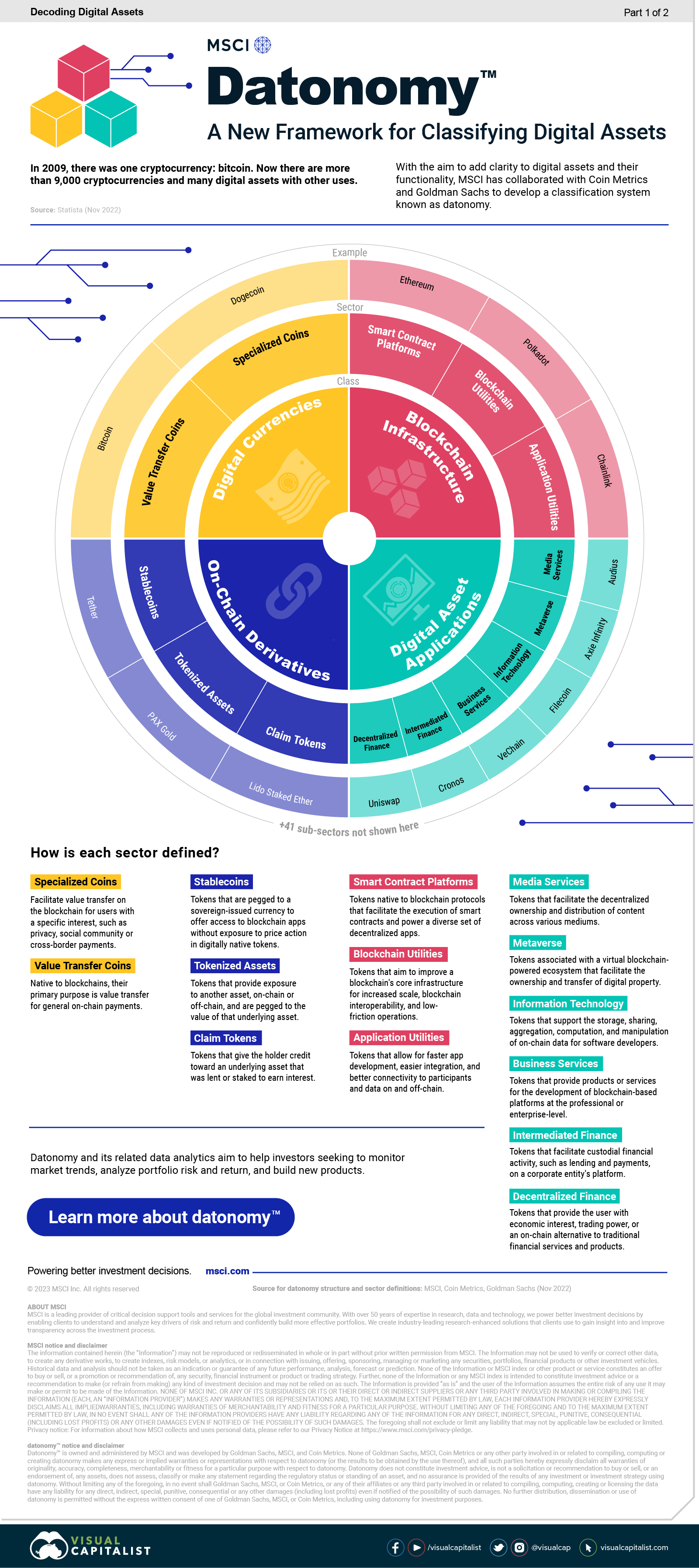

In 2009, there was one cryptocurrency: bitcoin. Now there are more than 9,000 cryptocurrencies and many digital assets with other uses.

As the ecosystem becomes more complex, investors need more structure and clarity to make sense of how assets relate. In this graphic from MSCI, we introduce a new classification framework known as Datonomy. It is the first in a two-part series on decoding digital assets.

The Main Uses of Digital Assets

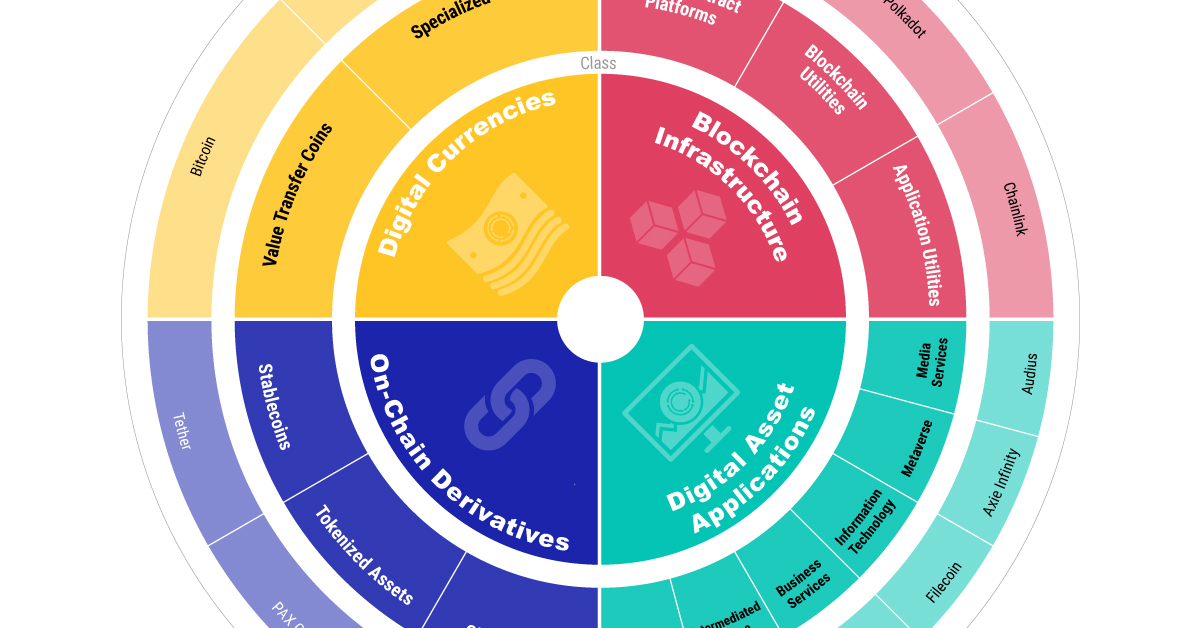

MSCI collaborated with Coin Metrics and Goldman Sachs to develop the framework, which classifies digital assets according to what they are primarily used for. It is hierarchical with three levels of classifications: classes, sectors, and subsectors.

We show the first two levels in the table below, along with examples of each sector.

| Class | Sector | Example |

|---|---|---|

| 💲Digital Currencies | Value Transfer Coins | Bitcoin |

| Specialized Coins | Dogecoin | |

| 🚧 Blockchain Infrastructure | Smart Contract Platforms | Ethereum |

| Blockchain Utilities | Polkadot | |

| Application Utilities | Chainlink | |

| 📱Digital Asset Applications | Decentralized Finance | Uniswap |

| Intermediated Finance | Cronos | |

| Business Services | VeChain | |

| Information Technology | Filecoin | |

| Metaverse | Axie Infinity | |

| Media Services | Audius | |

| ⛓️On-Chain Derivatives | Stablecoins | Tether |

| Tokenized Assets | PAX Gold | |

| Claim Tokens | Lido Staked Ether |

Let’s take a closer look at one sector within each class.

Specialized Coins facilitate value transfer on the blockchain for users with a specific interest, such as privacy, social community, or cross-border payments. Meme coins like Dogecoin fall under this sector, as do cryptocurrencies like Monero where every user is anonymous by default.

Smart Contract Platforms are tokens native to blockchain protocols that facilitate the execution of smart contracts and power a diverse set of decentralized applications. Following an “if this, then that” structure, smart contracts are essentially digital agreements that automatically execute when the terms are met. Ethereum is an example of a smart contract platform.

Decentralized Finance tokens provide the user with economic interest, trading power, or an on-chain alternative to traditional financial services and products. The sector includes things like exchanges (such as Uniswap), peer-to-peer loans, prediction markets for betting, and asset management.

Stablecoin tokens are pegged to a sovereign-issued currency to offer access to blockchain apps without exposure to price action in digitally native tokens. An example of a stablecoin is Tether, which has a 1-to-1 peg with a matching fiat currency such as the U.S. dollar.

A Structural Lens for Investors

As the digital assets universe continues to expand and evolve, investors need a consistent way to analyze the market.

Datonomy and its related data analytics aim to help investors seeking to monitor market trends, analyze portfolio risk and return, and build new products. Get insight on digital assets with MSCI’s data service, datonomy.

The second part of this series will explore how institutional investors can approach digital assets.

-

Technology23 hours ago

Technology23 hours agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Technology3 days ago

Technology3 days agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

Technology2 weeks ago

Technology2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

The Nvidia rocket ship is refusing to slow down, leading the pack of strong stock performance for most major U.S. chipmakers.

-

Technology3 weeks ago

Technology3 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

This graphic breaks down America’s most preferred smartphone brands, according to a December 2023 consumer survey.

-

Technology3 weeks ago

Technology3 weeks agoVisualizing Nvidia’s Revenue, by Product Line (2019-2024)

This graphic shows how Nvidia’s revenue sources have changed over time, highlighting how the AI boom has transformed its bottom line.