Technology

Amazon vs. Google: The Battle for Smart Speaker Market Share

View the full resolution version of this infographic.

Amazon vs. Google: The Battle for Smart Speaker Market Share

To see the full resolution version of this infographic that has higher legibility, click here.

Steve Rabuchin, the VP of Amazon Alexa, has a vision. He dreams of customers having a conversation – not just with voice-enabled devices like the Amazon Echo, but with appliances, cars, and everything in between.

Though that dream may not be realized in the short term, sales of smart speakers are increasing as people warm up to the idea of using voice-assisted devices in their homes.

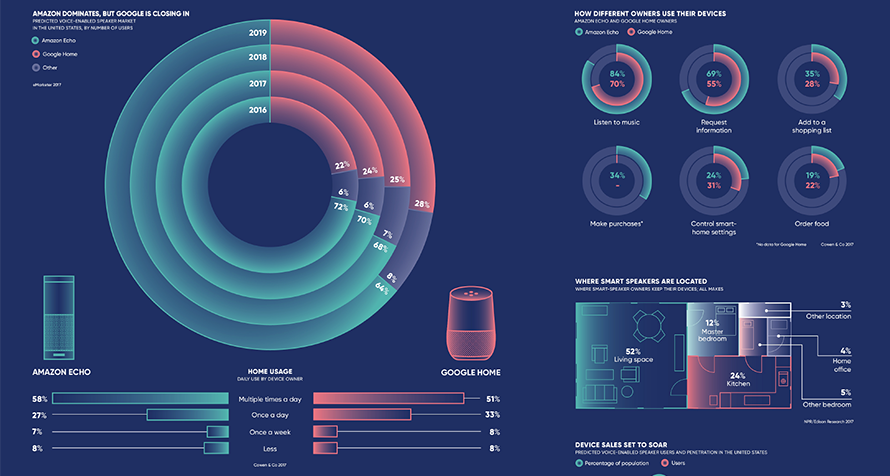

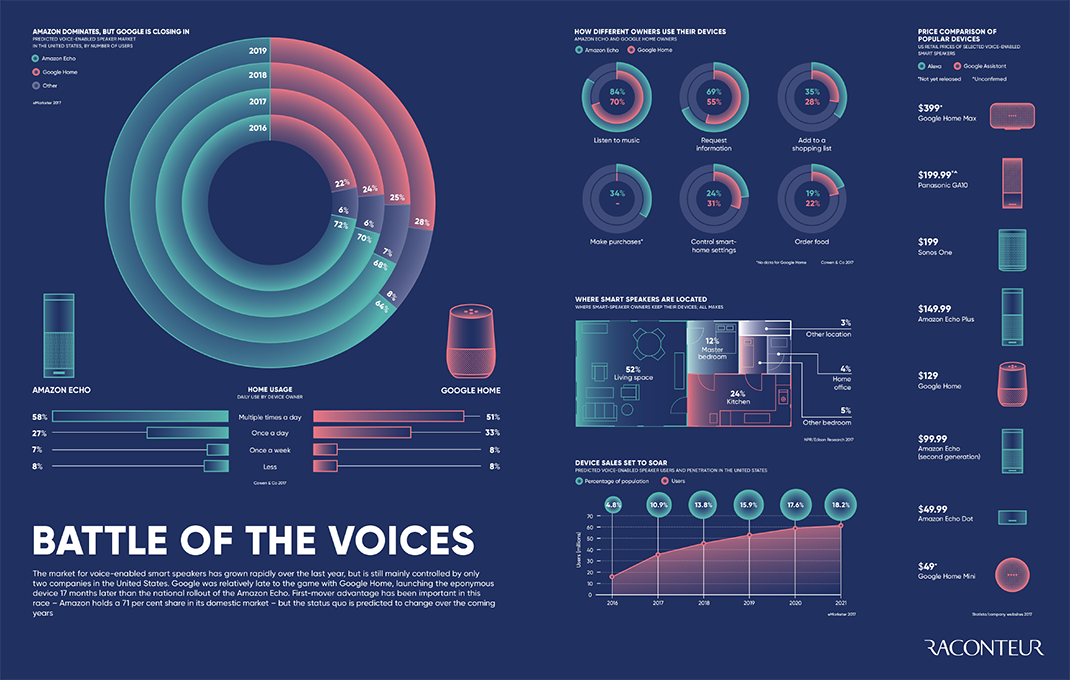

Today’s infographic, from Raconteur, sheds light on the fight for smart speaker market share, how early adopters are using the devices, and the growing array of voice-enabled devices currently on the market.

Moving into the Mainstream

When the Amazon Echo entered the market in 2015, it kicked off a new wave of demand for voice-activated smart speakers. At the time, it was unclear whether a large segment of the population would use a smart speaker, but consecutive years of rising sales are putting those worries to rest.

A recent study from Juniper Research found that smart speakers such as Amazon Echo, Google Home, and the Sonos One will be installed in over 70 million U.S. households by 2022, reaching 55% of all homes.

The recent flurry of holiday device buying seems to support this prediction. Smart speaker sales in the U.S. rose sharply to nearly 25 million in 2017, with close to 11 million purchased during the holiday season. Thanks to lower price points and wider distribution, this trend will likely continue through 2018 and beyond.

Competition is Heating Up

Amazon’s first-mover advantage resulted in an imposing 94% market share by Q3 2016 – but since then, Google Home has been eating into that lead. Experts predict that Echo will remain the top smart speaker in the future, but that Google and Chinese brands like JD and Xiaomi will continue to grow in popularity.

The two tech giants are fighting hard for the early majority because smart speakers are such a powerful gateway into their ecosystem of services and data collection.

Perhaps anticipating a binary market, Sonos is looking to win by taking a slightly different approach. Since the company is doesn’t have an existing suite of consumer services, it’s shipping devices with Alexa integration and opening up the platform to developers (think voice-activated apps). Customers who are suspicious of ulterior motives and integration limitations of the larger brands may gravitate toward a more open, agnostic approach.

You have no idea what people are going to build. When Apple opened iOS, the first thing people made was the fart app.

– Antoine Leblond, VP of Software Development at Sonos

To add even more excitement to the race for market share dominance, Apple is launching a smart speaker called HomePod in early 2018.

The Path to IoT is Voice Enabled

For now, smart speakers are primarily a fancy way to people to stream music or get tomorrow’s weather forecast, but they are a critical first step in the impending shift toward the “connected home”.

Most people don’t currently live in a place that supports full-on integration with smart speakers, but once they begin using voice-enabled devices, they are more likely to take smaller steps such as rewiring light switches.

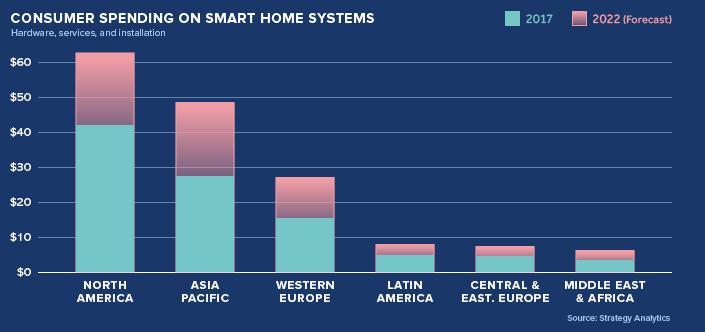

The shift towards smart homes is predicted to generate a lot of revenue in coming years – and companies like Amazon and Google see smart speakers as a foot-in-the-door. If trends continue, these tech giants stand a good chance of taking over as the nerve center for peoples’ homes as an IoT-driven future unfolds.

33 years after the debut of The Clapper, tech companies have found a better (and far more profitable) hands-free way to turn the lights out.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Misc1 week ago

Misc1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Environment1 week ago

Environment1 week agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue