Misc

The Shape of the World, According to Old Maps

The Shape of the World, According to Ancient Maps

A Babylonian clay tablet helped unlock an understanding for how our ancestors saw the world.

Dating all the way back to the 6th century BCE, the Imago Mundi is the oldest known world map, and it offers a unique glimpse into ancient perspectives on earth and the heavens.

While this is the first-known interpretation of such a map, it would certainly not be the last. Today’s visualization, designed by Reddit user PisseGuri82, won the “Best of 2018 Map Contest” for depicting the evolving shapes of man-made maps throughout history.

AD 150: Once Upon A Time in Egypt

In this former location of the Roman Empire, Ptolemy was the first to use positions of latitude and longitude to map countries into his text Geographia. After these ancient maps were lost for centuries, Ptolemy’s work was rediscovered and reconstructed in the 15th century, serving as a foundation for cartography throughout the Middle Ages.

1050: Pointing to the Heavens

The creation of this quintessential medieval T-and-O Beatine map is attributed not to an unknown French monk, but to the Spanish monk Beatus of Liébana. Although it shows several continents—Africa, Asia, and Europe—its main objective was to visualize Biblical locations. For example, because the sun rises in the east, Paradise (The Garden of Eden) can be seen pointing upwards and towards Asia on the map.

1154: The World Turned Upside Down

The Arabic geographer Muhammad al-Idrisi made one of the most advanced medieval world maps for King Roger II of Sicily. The Tabula Rogeriana, which literally translates to “the book of pleasant journeys into faraway lands”, was ahead of the curve compared to contemporaries because it used information from traveler and merchant accounts. The original map was oriented south-up, which is why modern depictions show it upside down.

1375: The Zenith of Medieval Map Work

The Jewish cartographer Abraham Cresques created the most important map of the medieval period, the Catalan Atlas, with his son for Prince John of Aragon. It covers the “East and the West, and everything that, from the Strait [of Gibraltar] leads to the West”. Many Indian and Chinese cities can be identified, based on various voyages by the explorers Marco Polo and Sir John Mandeville.

After this, the Age of Discovery truly began—and maps started to more closely resemble the world map as we know it today.

1489: Feeling Ptolemy and Polo’s Influences

The 15th century was a radical time for map-makers, once Ptolemy’s geographical drawings were re-discovered. Henricus Martellus expanded on Ptolemaic maps, and also relied on sources like Marco Polo’s travels to imagine the Old World. His milestone map closely resembles the oldest-surviving terrestrial globe, Erdapfel, created by cartographer Martin Behaim. Today, it’s preserved at the Yale University archives.

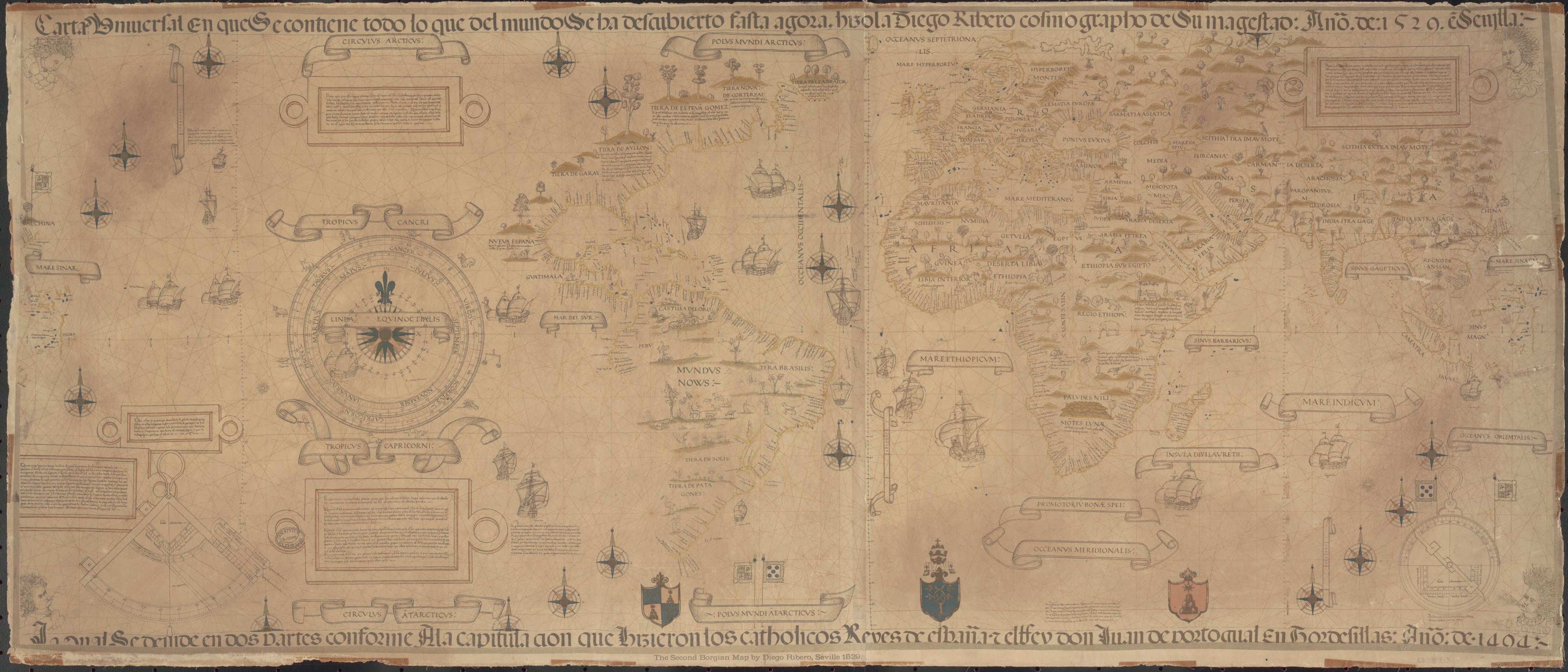

1529: A Well-Kept Spanish Secret

The first ever scientific world map is most widely attributed to the Portuguese cartographer Diego Ribero. The Padrón Real was the Spanish Crown’s official and secret master map, made from hundreds of sailors’ reports of any new lands and their coordinates.

1599: The Wright Idea

English mathematician and cartographer Edward Wright was the first to perfect the Mercator projection—which takes the Earth’s curvature into consideration. Otherwise known as a Wright-Molyneux world map, this linear representation of the earth’s cylindrical map quickly became the standard for navigation.

1778-1832: The Emergence of Modern World Maps

The invention of the marine chronometer transformed marine navigation—as ships were now able to detect both longitude and latitude. Jacques-Nicolas Bellin, a French geographer, was responsible for the 18th century’s highly accurate world maps and nautical charts. His designs favored functionality over the decorative flourishes of cartographers past.

Finally, the German cartographer and lawyer Adolf Stieler was the man behind Stieler’s Handatlas, the leading German world atlas until the mid-20th century. His maps were famous for being updated based on new explorations, making them the most reliable map possible.

Is There Uncharted Territory Left?

It is worth mentioning that these ancient maps above are mostly coming from a European perspective.

That said, the Islamic Golden Age also boasts an impressive cartographic record, reaching its peak partially in thanks to Muhammad al-Idrisi in the 11th century. Similarly, Ancient Chinese empires had a cartographic golden age after the invention of the compass as well.

Does this mean there’s nothing left to explore today? Quite the contrary. While we know so much about our landmasses, the undersea depths remain quite a mystery. In fact, we’ve explored more of outer space than we have 95% of our own oceans.

If you liked the visualization above, be sure to explore the world’s borders by age, broken down impressively by the same designer.

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our upcoming VC+ Special Dispatch will be available exclusively to VC+ members on Thursday, April 25th.

If you’re not already subscribed to VC+, make sure you sign up now to receive the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members can expect to receive.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members will receive the full Special Dispatch on Thursday, April 25th.

Make sure you join VC+ now to receive exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023