Datastream

Seeing Red: Is the Heydey of Pandemic Stocks Over?

The Briefing

- Global equities are in a downward spiral, and experienced their worst week in more than a year.

- Worries about slowing post-COVID demand and rising rates fueled the selloff.

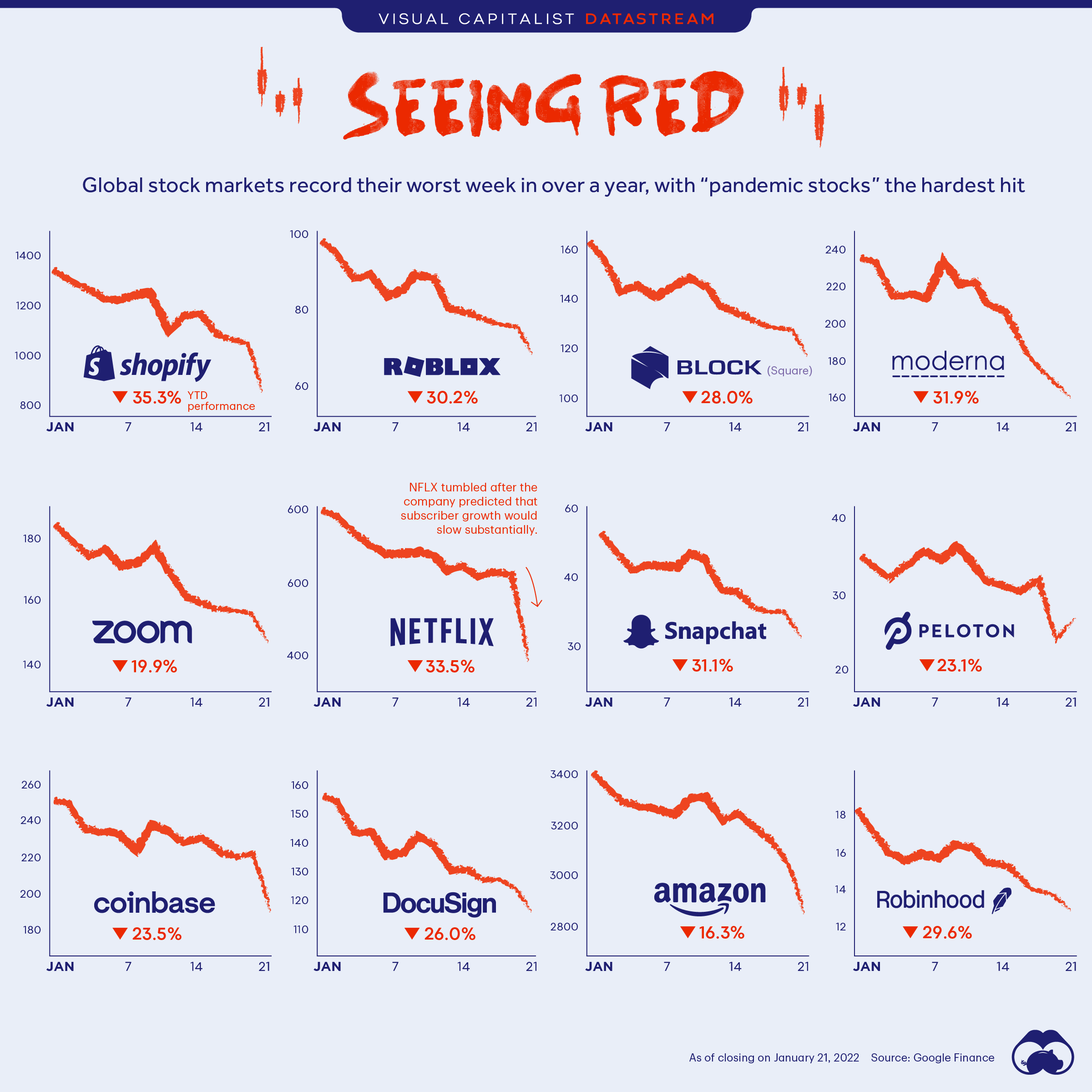

- Pandemic stocks were some of the hardest hit, with Shopify and Netflix dropping 35.3% and 33.5% respectively.

Seeing Red: Is the Heydey of Pandemic Stocks Over?

The stock market, and the stocks that flourished during the COVID-19 pandemic in particular, are off to a rough start in 2022. If you’ve been watching your investment accounts, chances are you’ve been seeing a lot of red. Shaken by the uncertainty of a pandemic recovery and future interest rate hikes, investors have been selling off their stocks.

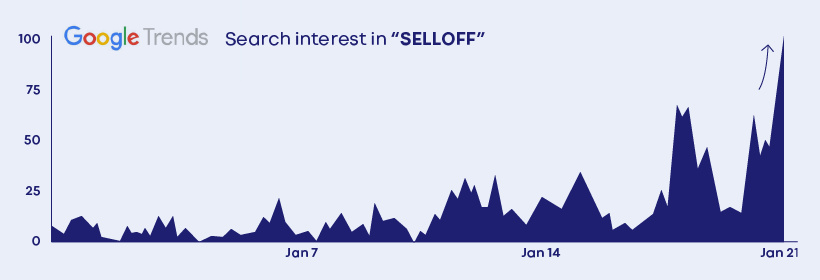

This market selloff—which occurs when investors sell a large volume of securities in a short period of time, leading to a rapid decline in price—has investors concerned. In fact, search interest for the term “selloff” recently reached peak interest of 100.

Which stocks were the hardest hit, and how much are their prices down so far this year?

The Lackluster Returns of Pandemic Stocks

Pandemic stocks and tech-centric companies have suffered the most. Here’s a closer look at the year-to-date price returns for select stocks.

| Company | Year-to-Date Price Return |

|---|---|

| Shopify | -35.3% |

| Roblox | -30.2% |

| Block | -28.0% |

| Moderna | -31.9% |

| Zoom | -19.9% |

| Netflix | -33.5% |

| Snapchat | -31.1% |

| Peloton | -23.1% |

| Coinbase | -23.5% |

| DocuSign | -26.0% |

| Amazon | -16.3% |

| Robinhood | -29.6% |

Price returns are in U.S. dollars based on data from January 3, 2022 to January 21, 2022.

Netflix fueled the selloff after it reported disappointing subscriber growth. The company added 8.28 million subscribers in the fourth quarter, which is less than the 8.5 million it added in the fourth quarter of 2020. It also projects to have slower year-over-year subscriber growth in the near term, citing competition from other streaming companies.

Meanwhile, Coinbase stock lost nearly a quarter of its value so far this year. As the price of cryptocurrencies such as Bitcoin have plummeted, investors worry Coinbase will see lower trading volume and therefore lower fees.

The contagion also spread to other pandemic stocks, such as Zoom and DocuSign, as investors began to doubt the staying power of stay-at-home stocks.

Following the Herd

While investor exuberance drove many of these stocks up last year, 2022 is beginning to paint a different picture.

Investors are worried that rising rates will negatively impact high-growth stocks, because it means it’s more expensive to borrow money. Not only that, but they also may see Netflix’s growth as harbinger of things to come for other pandemic stocks.

The psychology of the market cycle also plays a role—amid these fears, investors have adopted a herd mentality and begun selling their shares in droves.

Where does this data come from?

Source: Google Finance

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries