Technology

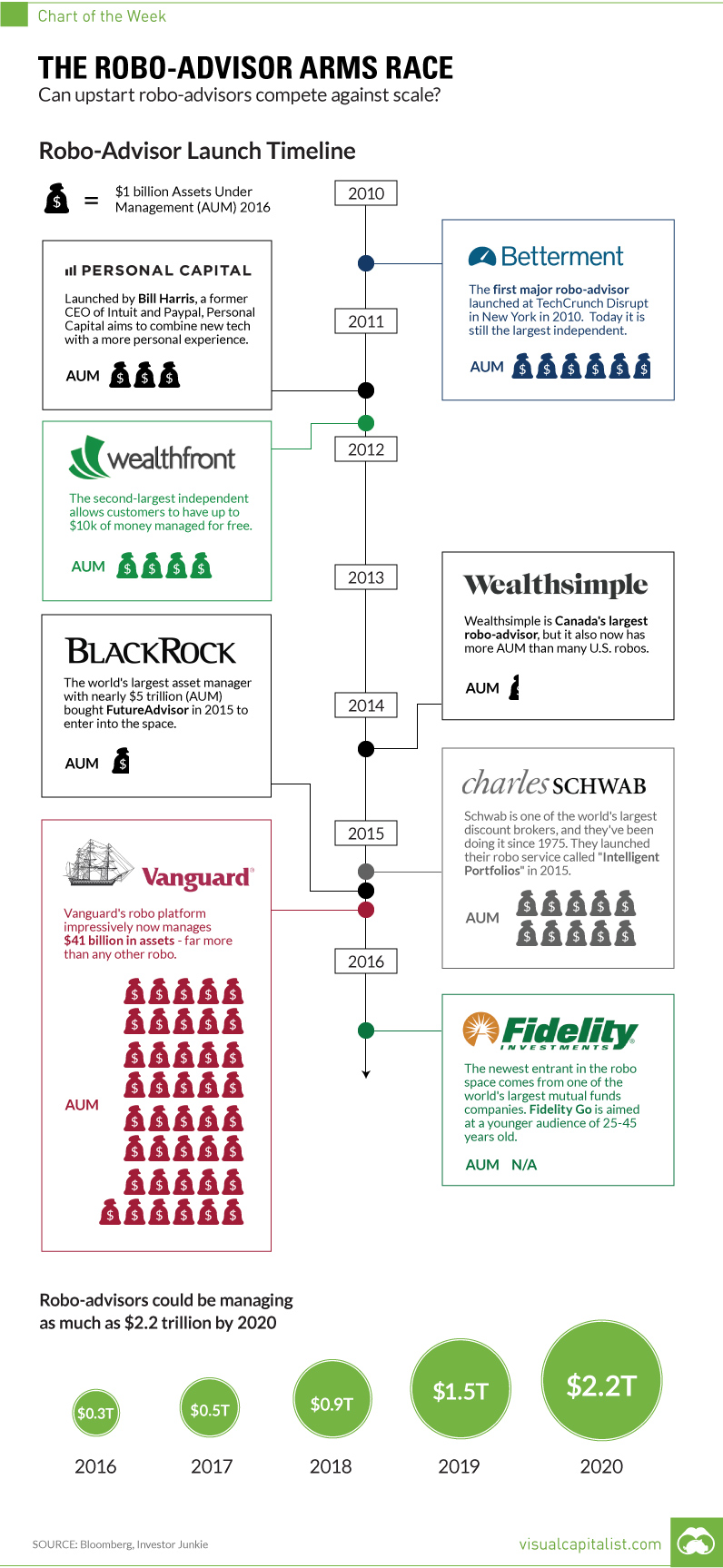

Chart: The Robo-Advisor Arms Race

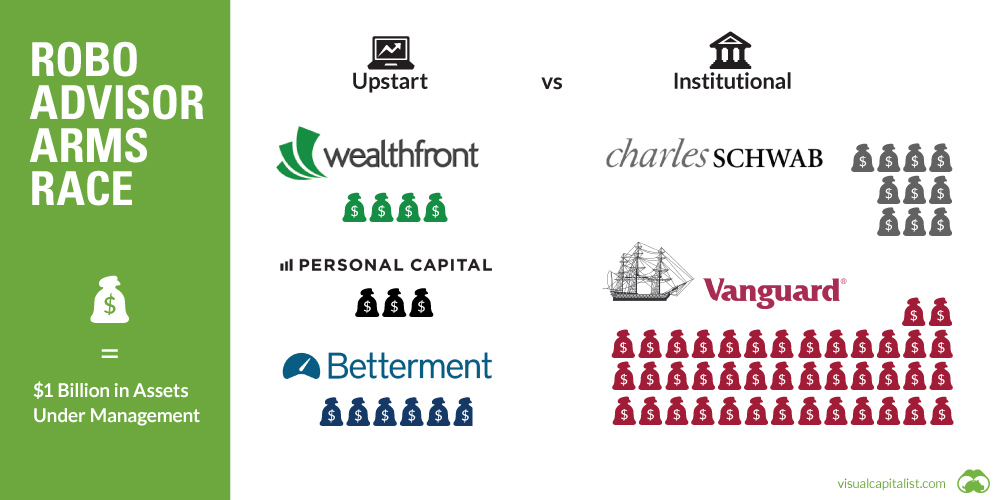

The Robo-Advisor Arms Race

Can upstart robo-advisors compete against scale?

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

It was going to happen sooner or later.

When they launched roughly five years ago, tech-driven companies such as Betterment or Wealthfront had the audacious and laudable goal of taking on the incumbents of the gargantuan wealth management industry. Many traditional wealth managers were skeptical of portfolios being driven by artificial intelligence, and adopted a “wait and see” approach. If it became clear that the machines were indeed taking over the wealth management industry, they could then find some way to reverse-engineer their way into the market, using their scale and connections to make up ground.

As the upstarts won new accounts and proved out the robo-advisor business model, the incumbents that dominate the traditional finance scene leaped into action. In 2015, behemoths like Vanguard and Charles Schwab, which each manage trillions of dollars of assets, fought back by introducing their own robo-advisor products. Meanwhile, Blackrock made an acquisition of an existing platform (FutureAdvisor) to enter the market, and just months ago mutual fund giant Fidelity launched its own robo-product called Fidelity Go.

The scale of these companies meant that domination would become inevitable. Vanguard, for example, took its Personal Advisor Services platform from $0 in assets under management (AUM) last year to $41 billion today. By our math, that’s more than all other major U.S. robo-advisors combined.

Charles Schwab, which has 9.3 million existing customers for its discount brokerage services, had no problem bringing customers over to its new platform. It also has $10 billion in AUM already in just a year, which is more than Betterment and Wealthfront combined.

Spokespeople for the independent robo-advisors will tell you that they are building products for millennials, with an eye on a bigger prize. As wealth is transferred to the millennial generation over the coming years, they will be in position to take advantage of this as the brands that millennials trust. We are certain that these startups can evolve into great companies with this mission, but we also wonder if they ultimately left money on the table.

Were they not aggressive enough? Could they have partnered with a bigger institution to roll out their product faster? Could they have gotten a bigger piece of the pie?

It’s hard to say, but the robo-advisor space continues to be an interesting one to watch. It also teaches us an interesting lesson about trying to compete with mega-sized companies, which have scale, expertise, and resources at their disposal.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?