Green

Visualizing the Global Rise of Sustainable Investing

No matter where you look, climate change is at the centre of every conversation.

With a wide range of global sustainability challenges and complex risks on the rise, investors are starting to re-evaluate traditional portfolio approaches.

The ESG Boom

Today, many investors want their money to align with a higher purpose beyond profit. This infographic from iShares unpacks the prolific rise of sustainable investing, and how its trillion-dollar potential is sweeping across the world.

What is Sustainable Investing?

Sustainable investing considers environmental, social, and governance (ESG) factors that create a lasting, positive impact on the world. As the term ‘ESG’ suggests, its scope goes well beyond environmental concerns alone. Examples include:

- Environmental: Climate risks, resource scarcity, and clean energy

- Social: Diversity, human rights, and cybersecurity

- Governance: Business ethics, transparency, and anti-corruption

Simply put, it’s a force for good.

Although sustainable investing emerged in the 1970s, the movement has gained impressive traction in the last few years.

How Global Assets are Growing

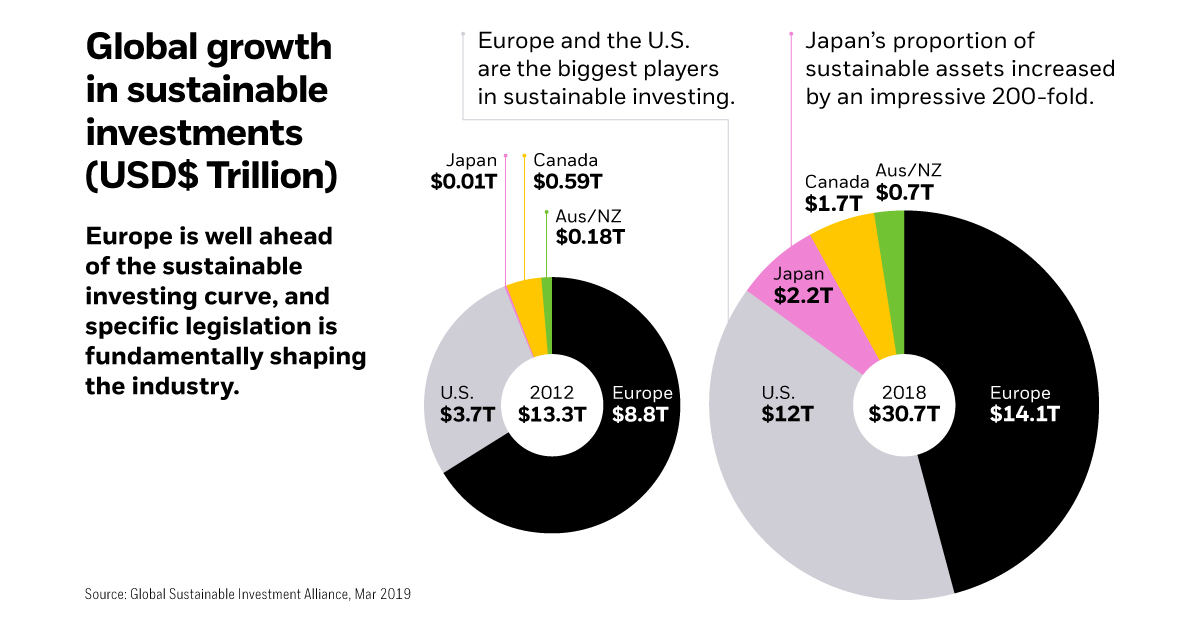

Since 2012, total assets in sustainable investing have more than doubled:

| Region | 2012 Assets | 2018 Assets |

|---|---|---|

| Europe | $8.8 trillion | $14.1 trillion |

| U.S. | $3.7 trillion | $12.0 trillion |

| Japan | $0.01 trillion | $2.2 trillion |

| Canada | $0.59 trillion | $1.7 trillion |

| Australia and New Zealand | $0.18 trillion | $0.7 trillion |

| Total | $13.3 trillion | $30.7 trillion |

The U.S. and Europe are major players in this shift. In particular, specific legislation across European countries will continue driving ESG investment for years to come.

The European ESG Landscape

Across major economies in Europe, cultural shifts and new regulations are shaping the landscape of sustainable investing.

- The UK has an ambitious net-zero greenhouse gas emissions target by 2050.

Result: Most sectors will significantly ramp up their decarbonisation efforts to meet this goal. - As per France’s Article 173 (Energy Transition Law), investors must explain how they incorporate ESG factors into their investment strategies.

Result: A majority of French institutional investors now manage their assets with ESG criteria in mind. - Nordic countries consider sustainability and social responsibility a cornerstone of their cultural mindset.

Result: Nordic investors are increasingly integrating all three ESG aspects into their investments.

If Europe’s trajectory is any indication, sustainable investing will soon become second nature in other parts of the world too.

No Industry is Untouched

The rise of sustainable investing is a global phenomenon, and reaches a myriad of industries.

Here is a summary of just a few ESG efforts of some of the world’s most sustainable corporations:

| Company | Industry | Country | ESG Efforts |

|---|---|---|---|

| Chr. Hansen A/S | Bioscience | 🇩🇰 Denmark | • 100% green operations commitment by Apr 2020 • 82% of revenue directly supports UN Global Goals |

| Autodesk | Software | 🇺🇸 U.S. | • 100% renewable energy-run cloud services and offices • 44% women on the Board |

| Banco do Brazil | Finance | 🇧🇷 Brazil | • $51 billion earmarked for green economy spending • 99% adherence to Code of Ethics and Conduct Standards |

| City Developments Ltd | Real Estate | 🇸🇬 Singapore | • S$100 million fully-allocated Green Bond • 59% carbon emissions reduction target by 2030 |

The business world agrees: sustainable investing is smart investing.

How Can Investors Think Sustainably?

Many investment products allow investors to easily access sustainable investing, such as exchange-traded funds (ETFs) and index funds. These provide complete transparency—allowing investors to align their approach with the objectives that matter most to them.

Investors are able to:

- Screen out companies involved in controversial businesses

- Invest in companies with high ESG standards

- Advocate for specific issues like climate change

Not only this, but sustainable investing also has the potential to improve portfolio returns. In a 2015 paper covering ESG investing since the 1970s, 90% of ESG investing matched or overperformed traditional approaches.

The Bottom Line

Investors see a triple bottom line from sustainable investing: strong financial returns, and a lasting impact on both people and the planet.

As sustainable investing goes mainstream, it won’t simply act as a niche in a broader strategy—instead, it’ll be naturally integrated throughout a portfolio.

“With the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward.

—Larry Fink, BlackRock Chairman and CEO

Sustainability is a global force that will continue to factor into everyday decisions.

Soon, sustainable investing will simply be considered “investing”.

Green

How Carbon Credits Can Help Close the Climate Funding Gap

To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030, and carbon credits could help close the gap.

How Carbon Credits Can Help Close the Climate Funding Gap

Governments around the world have committed to the goals of the Paris Agreement, but their climate pledges are insufficient. To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030.

Bold and immediate action is essential, but so are resources that will make it happen.

In this graphic, we have partnered with Carbon Streaming to look at the role that the voluntary carbon market and carbon credits can play in closing that gap.

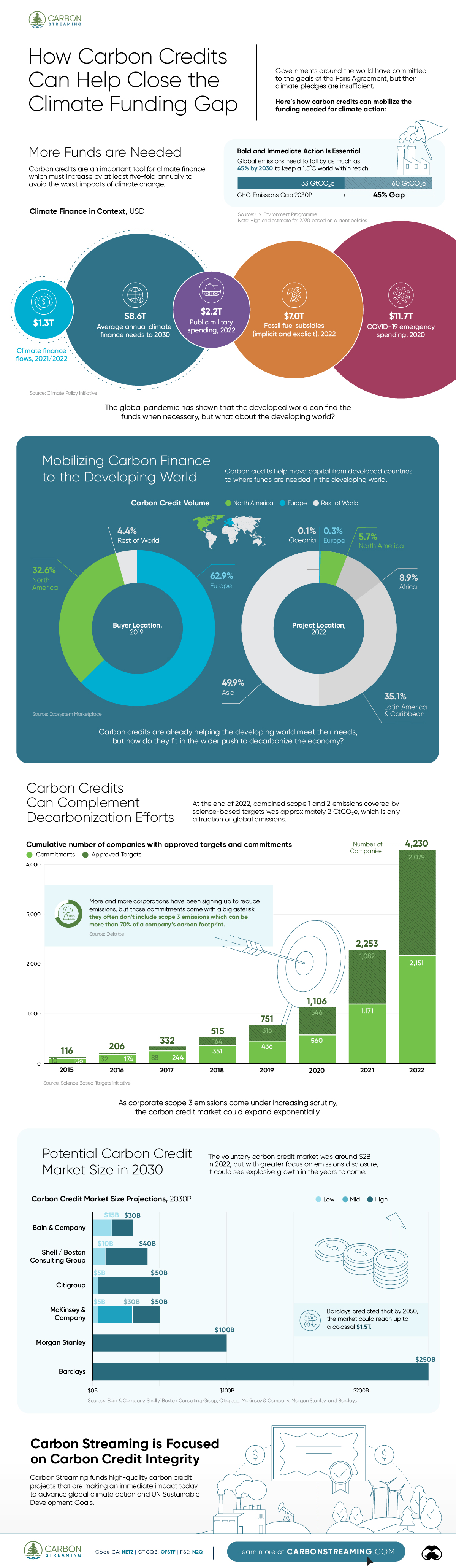

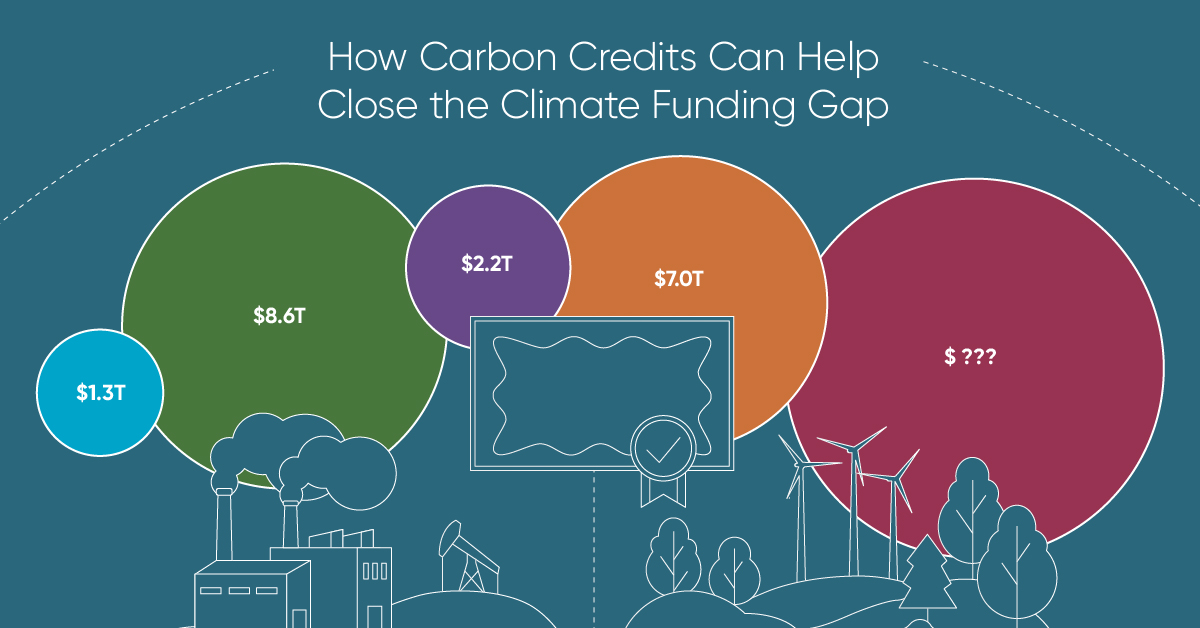

More Funds are Needed for Climate Finance

According to data from the Climate Policy Initiative, climate finance, which includes funds for both adaptation and mitigation, needs to increase at least five-fold, from $1.3T in 2021/2022, to an average $8.6T annually until 2030, and then to just over $10T in the two decades leading up to 2050.

That adds up to a very large number, but consider that in 2022, $7.0T went to fossil fuel subsidies, which almost covers the annual estimated outlay. And the world has shown that when pressed, governments can come up with the money, if the global pandemic is any indication.

Mobilizing Carbon Finance to the Developing World

But the same cannot be said of the developing world, where debt, inequality, and poverty reduce the ability of governments to act. And this is where carbon credits can play an important role. According to analyses from Ecosystem Marketplace, carbon credits help move capital from developed countries, to where funds are needed in the developing world.

For example, in 2019, 69.2% of the carbon credits by volume in the voluntary carbon market were purchased by buyers in Europe, and nearly a third from North America. Compare that to over 90% of the volume of carbon credits sold in the voluntary carbon market in 2022 came from projects that were located outside of those two regions.

Carbon Credits Can Complement Decarbonization Efforts

Carbon credits can also complement decarbonization efforts in the corporate world, where more and more companies have been signing up to reduce emissions. According to the 2022 monitoring report from the Science Based Targets initiative, 4,230 companies around the world had approved targets and commitments, which represented an 88% increase from the prior year. However, as of year end 2022, combined scope 1 and 2 emissions covered by science-based targets totaled approximately 2 GtCO2e, which represents just a fraction of global emissions.

The fine print is that this is just scope 1 and 2 emissions, and doesn’t include scope 3 emissions, which can account for more than 70% of a company’s total emissions. And as these emissions come under greater and greater scrutiny the closer we get to 2030 and beyond, the voluntary carbon credit market could expand exponentially to help meet the need to compensate for these emissions.

Potential Carbon Credit Market Size in 2030

OK, but how big? In 2022, the voluntary carbon credit market was around $2B, but some analysts predict that it could grow to between $5–250 billion by 2030.

| Firm | Low Estimate | High Estimate |

|---|---|---|

| Bain & Company | $15B | $30B |

| Barclays | N/A | $250B |

| Citigroup | $5B | $50B |

| McKinsey & Company | $5B | $50B |

| Morgan Stanley | N/A | $100B |

| Shell / Boston Consulting Group | $10B | $40B |

Morgan Stanley and Barclays were the most bullish on the size of the voluntary carbon credit market in 2030, but the latter firm was even more optimistic about 2050, and predicted that the voluntary carbon credit market could grow to a colossal $1.5 trillion.

Carbon Streaming is Focused on Carbon Credit Integrity

Ultimately, carbon credits could have an important role to play in marshaling the resources needed to keep the world on track to net zero by 2050, and avoiding the worst consequences of a warming world.

Carbon Streaming uses streaming transactions, a proven and flexible funding model, to scale high-integrity carbon credit projects to advance global climate action and UN Sustainable Development Goals.

Learn more at www.carbonstreaming.com.

-

Green7 days ago

Green7 days agoRanking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

South Asian nations are the global hotspot for pollution. In this graphic, we rank the world’s most polluted countries according to IQAir.

-

Environment1 week ago

Environment1 week agoTop Countries By Forest Growth Since 2001

One country is taking reforestation very seriously, registering more than 400,000 square km of forest growth in two decades.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

The country with the most forest loss since 2001 lost as much forest cover as the next four countries combined.

-

Markets2 months ago

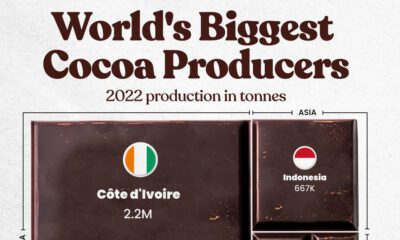

Markets2 months agoThe World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

-

Environment2 months ago

Environment2 months agoCharted: Share of World Forests by Country

We visualize which countries have the biggest share of world forests by area—and while country size plays a factor, so too, does the environment.

-

Travel1 week ago

Travel1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America