Money

The Richest People in Human History, to the Industrial Revolution

Click here or on the graphic to view the full-screen version.

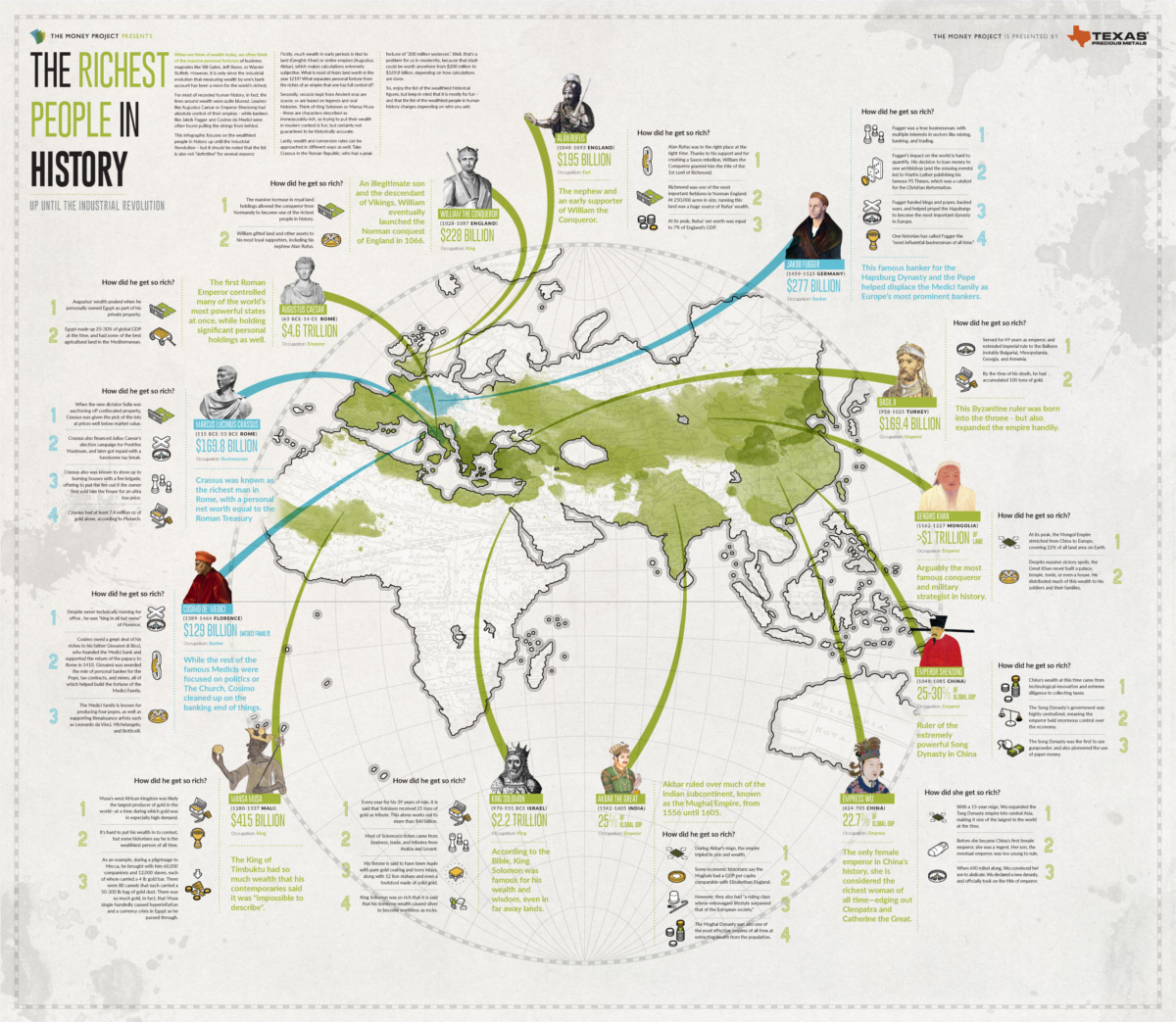

The Richest People in Human History, to the Industrial Revolution

Click here for a larger, more legible version of the infographic that you can explore in-depth.

When we think of wealth today, we often think of the massive personal fortunes of business magnates like Bill Gates, Elon Musk, Jeff Bezos, or Warren Buffett. However, it is only since the Industrial Revolution that measuring wealth by one’s bank account has been a norm for the world’s richest.

For most of recorded human history, in fact, the lines around wealth were quite blurred. Leaders like Augustus Caesar or Emperor Shenzong had absolute control of their empires—while bankers like Jakob Fogger and Cosimo de Medici were often found pulling the strings from behind.

This infographic we created with Texas Precious Metals focuses on the richest people in history up until the Industrial Revolution, and it highlights key facts and anecdotes on how they created their wealth.

Is This List of People Definitive?

While it is certainly fun to speculate on the wealth of people from centuries past, putting together this list is exceptionally difficult and certainly not definitive.

Here’s why:

Firstly, much wealth in early periods is tied to land (Genghis Khan) or entire empires (Augustus, Akbar), which makes calculations extremely subjective. What is most of Asia’s land worth in the year 1219? What separates personal fortune from the riches of an empire that one has full control of? There are a wide variety of answers to these questions, and they all influence the figures chosen to be represented.

Secondly, records kept from Ancient eras are scarce, exaggerated, or based on legends and oral histories. Think of King Solomon or Mansa Musa—these are characters described as immeasurably rich, so trying to put their wealth in modern context is fun, but certainly not guaranteed to be historically accurate.

Lastly, wealth and conversion rates can be approached in different ways as well. Take Crassus in the Roman Republic, who had a peak fortune of “200 million sesterces”. Well, that’s a problem for us in modernity, because that stash could be worth anywhere from $200 million to $169.8 billion, depending on how calculations are done.

So, enjoy this list of the wealthiest historical figures, but keep in mind that it is mostly for fun—and that the list of the richest people in history may change depending on who you ask!

Money

Charted: Who Has Savings in This Economy?

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

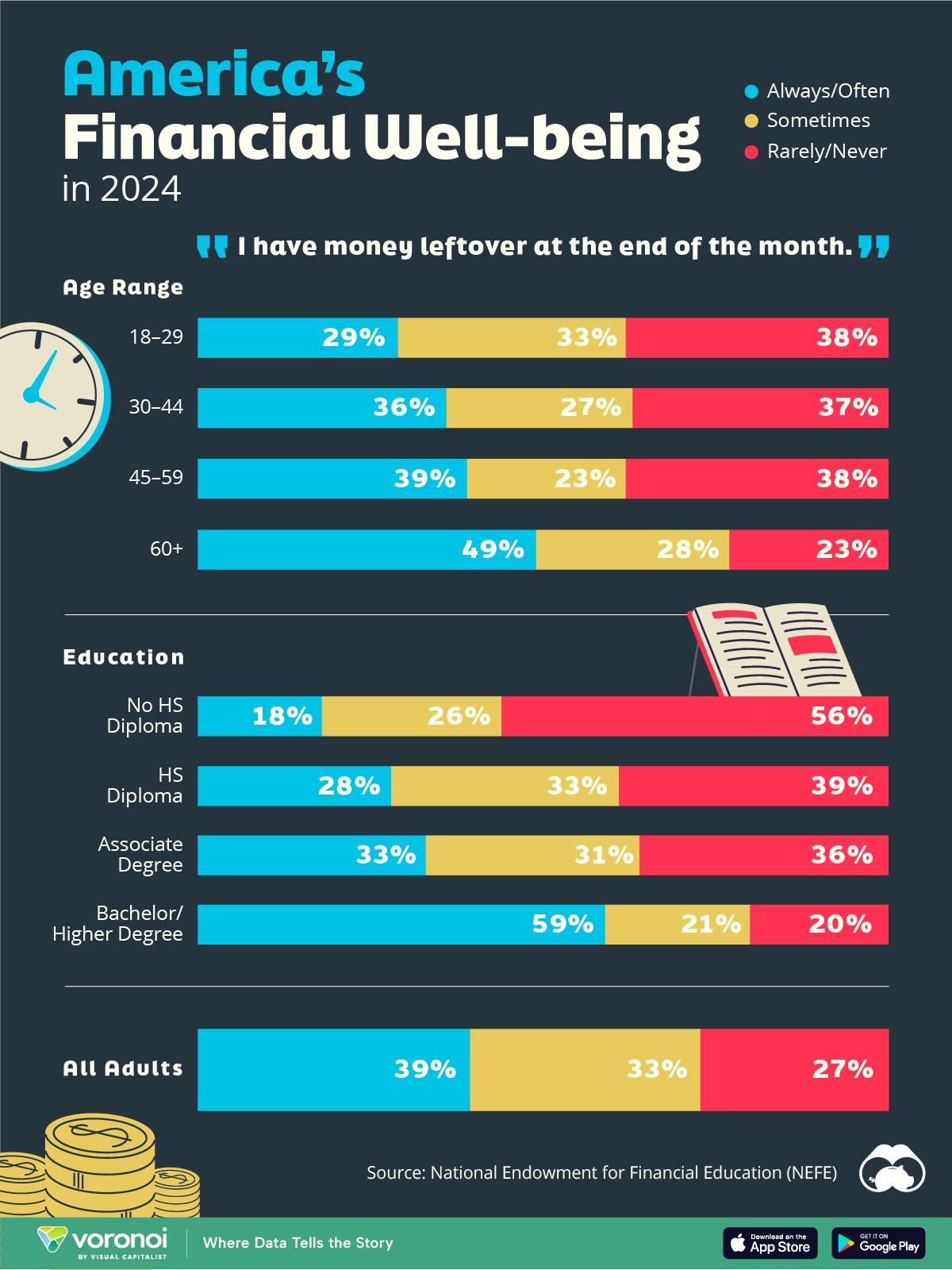

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023