Datastream

White Hot North: Residential Real Estate Investment in Canada

The Briefing

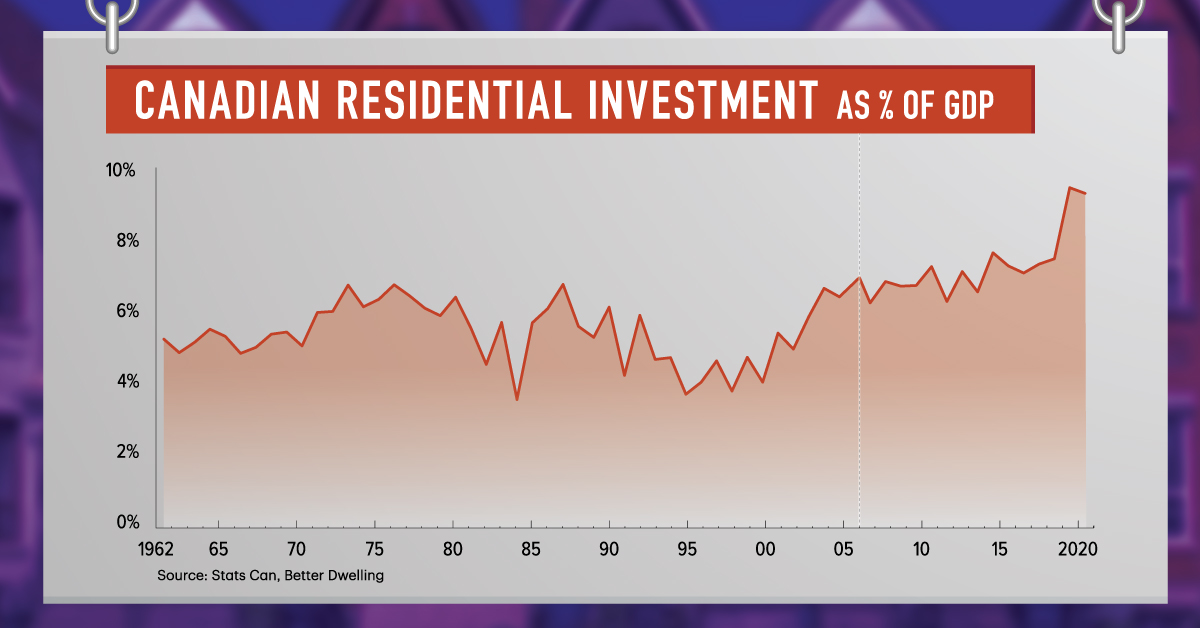

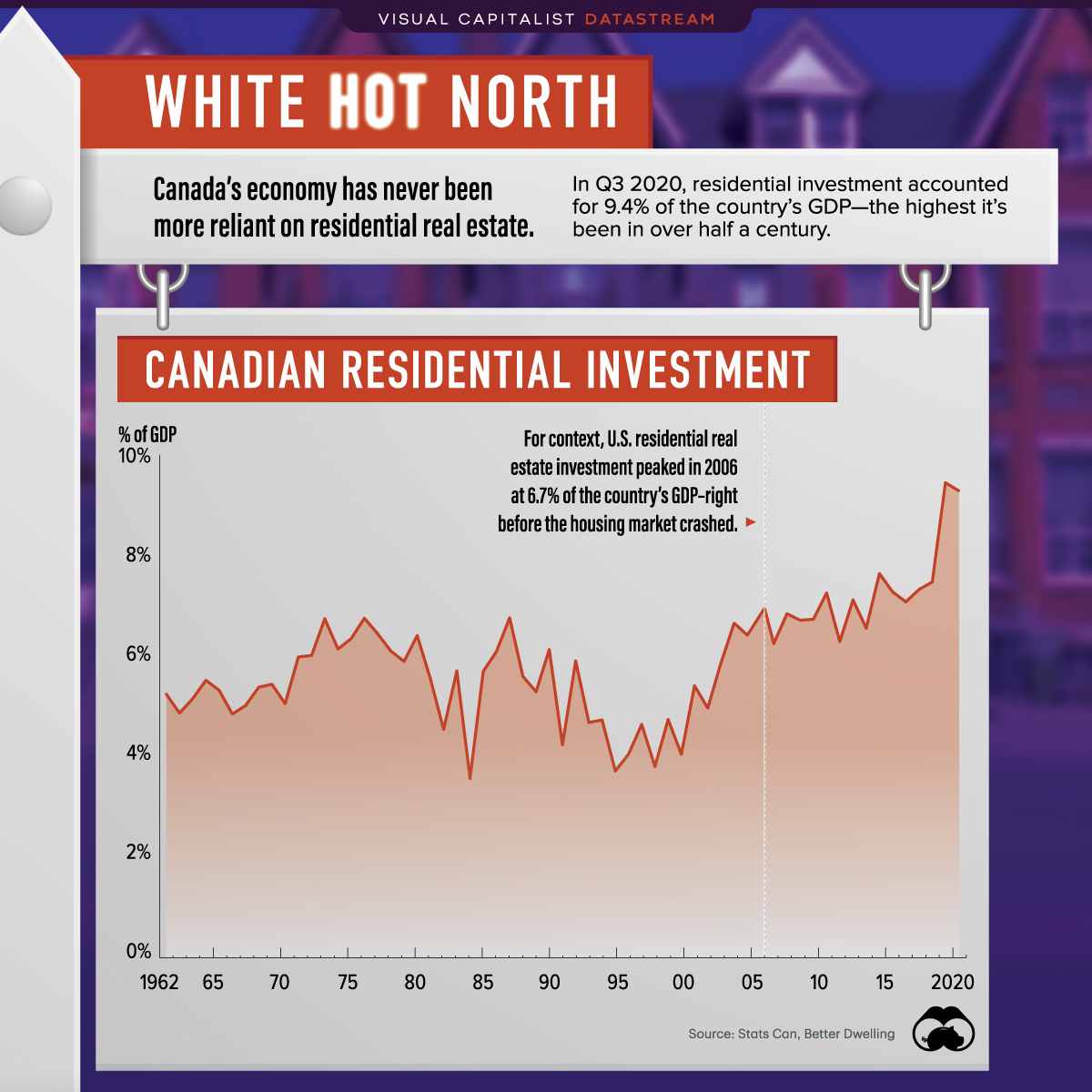

- Residential investment made up 9.3% of Canada’s GDP as of Q4’2020

- For context, U.S. residential real estate investment peaked in 2006 at 6.7% of the country’s GDP (just before the infamous housing crash) and it currently sits at 4.3%

White Hot North: Residential Real Estate Investment in Canada

Residential real estate is breaking records in Canada. As of Q4’2020, it accounted for 9.3% of the country’s GDP.

The purchase, sale, and construction of new homes in Canada currently makes up more of the country’s economy than it does in any other developed country.

There’s No Place Like Home

So why is there so much investment going into building residential structures? Here’s a look at just a few reasons:

- Increased immigration to Canada

- Falling mortgage rates

- Increased saving rates

The steady flow of immigration into Canada is a significant factor behind increased residential real estate investment. Prior to the pandemic, the country welcomed around 300,000 newcomers per year—increasing the demand for housing, particularly in urban hubs like Toronto and Vancouver.

Mortgage rates have also been steadily falling, making it easier to purchase a home. As of the latest 2020 data Canadian 5-year uninsured mortgage rates sat at 2.1%, compared to a steep peak in the beginning of 2019 at 3.7%.

Additionally, some individuals may have become more capable of affording a new home as increased saving rates have become a widespread trend during the pandemic, potentially adding to demand. This combined with increasingly flexible remote work options are increasing real estate activity around the country.

Higher Stress Tests

The increased demand has caused prices to skyrocket. As it stands now, if the housing bubble doesn’t burst, prices will continue to rise, and could become a major wedge separating those who can afford the increasing prices and those who cannot.

Two major Canadian cities—Vancouver and Toronto—are already among the least affordable cities in the world due to low vacancy rates and the immense demand.

According to CBC, the country’s top banking regulator is making a proposal to raise the mortgage stress test level. The idea is to raise it to 5.25% or 2 percentage points above the market rate, whichever is higher. This would be up from the current rate of 4.79% posted rate at Canada’s biggest lenders.

Borrowers will have to prove their ability to take out a loan at the higher rate, regardless of the lender’s ability to provide the loan at a lower one, in order to relieve some of the pressure on housing prices.

Where does this data come from?

Source: Stats Can, Better Dwelling

Notes: The definition of what constitutes residential construction includes major renovations, construction, and ownership transfer fees.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075