Recycling in America: How Can Investors Help Fix a Broken System?

The following content is sponsored by The Recycling Partnership.

Recycling in America: Can Investors Help Fix a Broken System?

Reduce, reuse, recycle. Many are familiar with this mantra, but it’s not always easy to practice what we preach.

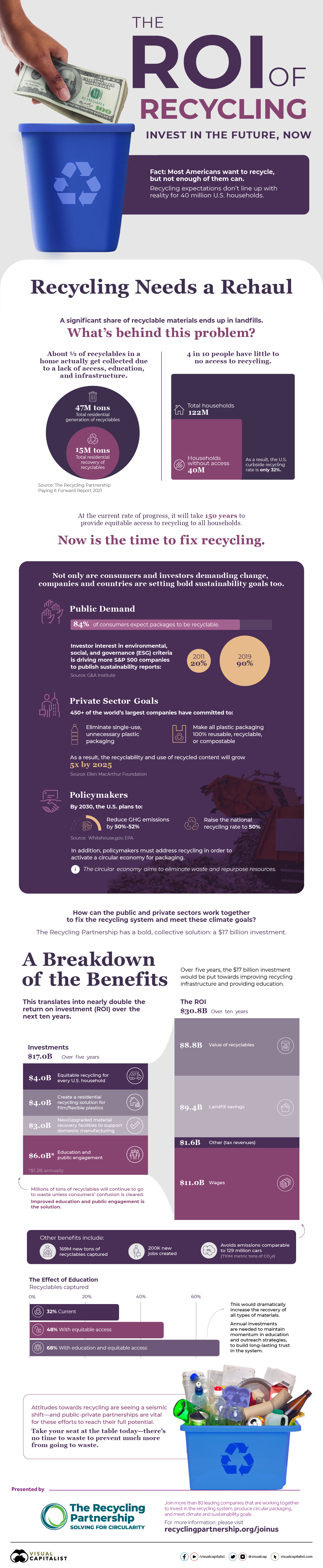

Even though most Americans want to recycle, not enough of them actually can. In fact, nearly 40 million households in the U.S. have little to no access to recycling.

This infographic from the Recycling Partnership highlights why this gap persists, and provides solutions to help bridge it. It also explains why bold investments in recycling now could have potential payoffs down the line.

The Reality of Recycling Issues in America

Of 47 million tons of total generated recyclables in a year, only one-third is actually recovered. This disparity is attributed to a combination of factors: lack of recycling access, education, and infrastructure.

As a result, the curbside recycling rate in the U.S. is only 32%. If progress continues at this glacial pace, the country will only achieve equitable access to recycling for all households in 150 years.

Recycling in America is broken—so why is now the opportune time to fix it?

Consumer Demands Are Fueling Global Targets

First and foremost, consumers are demanding change: 84% of consumers expect packages to be recyclable. The corporate sector is responding positively to these demands. Over 450 of the world’s largest companies have come together to sign a commitment to:

- Eliminate single-use, unnecessary plastic packaging

- Make all plastic packaging 100% reusable, recyclable, or compostable

This move will not only boost recyclability rates, but also raise recyclable content up 5x by the year 2025.

Because of these shifting winds, investors are wanting to incorporate more environmental, social, and governance (ESG) factors in their financial decisions. As a result, the number of S&P 500 companies publishing sustainability reports has leapt from just 20% in 2011 up to 90% in 2019.

Finally, at the highest level of action, America is also committing to bold climate-related goals, which are to:

Policymakers also stress the importance of a circular economy for packaging (which aims to eliminate waste and repurpose resources) which would mean rethinking America’s current recycling system.

How can the public and private sectors work together on these goals? The Recycling Partnership has a collective solution: a $17 billion investment for a better future.

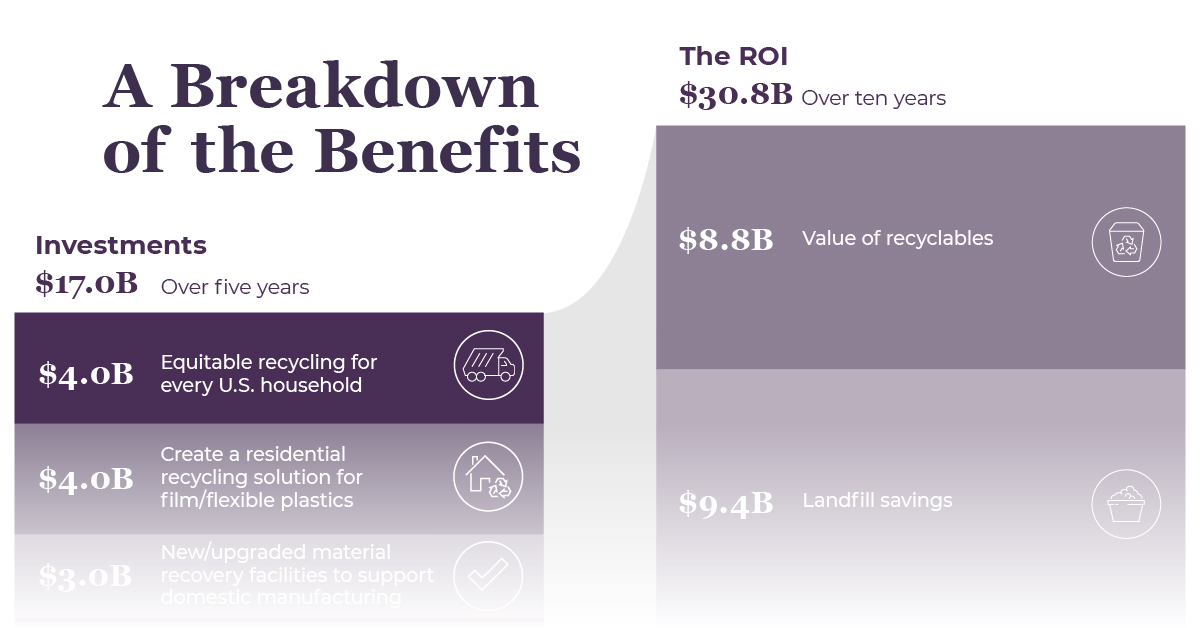

A Breakdown of the Benefits

Spread over five years, this $17 billion investment could improve recycling infrastructure, and bolster the need for recycling-related education in the process.

Here’s what goes into this calculation:

- $4 billion

Equitable recycling for every U.S. household - $4 billion

Create a residential recycling solution for film/flexible plastics - $3 billion

New/upgraded material recovery facilities to support domestic manufacturing - $6 billion

Education and public engagement (breaks down to just $1.2 billion annually)

The last factor is worth looking into a bit deeper, seeing as it makes up the biggest portion of the required investment for a reason.

Education’s Role in Helping Fix Recycling in America

Consumers express high levels of confusion over what they can and can’t recycle, leading to more recyclables ending up in landfills. For example, did you know that most plastic container lids can’t be recycled? By some estimates, barely ¼ of plastic waste is actually recycled, while the rest is incinerated or ends up in landfills.

Unless this confusion is cleared, millions of tons of recyclables will continue to go to waste. Improved education and public engagement is the solution.

This table highlights the significant knock-on effect that public education can have on recycling rates and the recovery of all types of materials:

| Recyclables captured | |

|---|---|

| Current rate | 32% |

| With equitable recycling access alone | 48% |

| With both equitable recycling access and education | 68% |

That’s why consistent annual investments are needed to maintain momentum in education and outreach strategies, to build long-lasting trust in the recycling system.

How Recycling Investments Can Pay Dividends

In the long run, the potential return on investment (ROI) in recycling in America could be nearly double the amount of the initial amount put in. Over 10 years, $30.8 billion could be made back or saved, in the form of:

- $11 billion in wages

- $9.4 billion in landfill savings

- $8.8 billion from the value of recyclables

- $1.6 billion from other avenues (including tax revenues)

Other more intangible benefits include avoiding emissions comparable to 129 million cars, the creation of 200,000 jobs, and capturing 169 million new tons of recyclables.

It’s clear that consumer and corporate attitudes towards recycling are seeing a seismic shift. Public-private partnerships are thus vital for these efforts to reach their full potential.

The Recycling Partnership is bringing together various stakeholders at the same table, to rebuild the recycling system in America and achieve just that.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.