Markets

Ranked: The Most Valuable Brands in the World

Ranking The World’s Most Valuable Brands

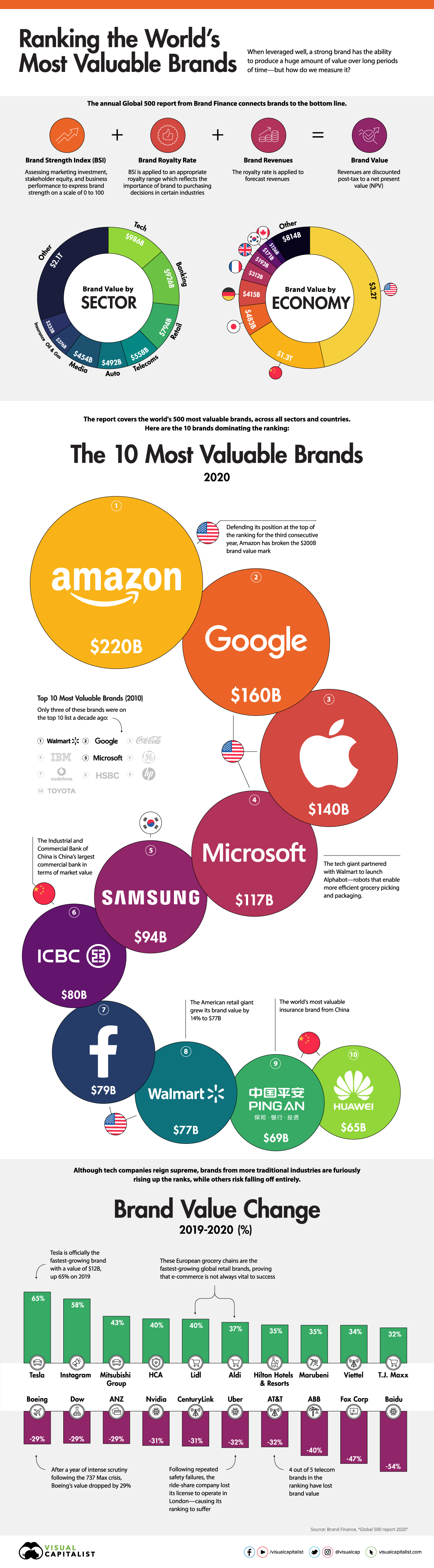

Due to its intangible nature, the power of a brand can be difficult to translate to a balance sheet. That said, a brand that truly connects with consumers and stands the test of time can deliver immense financial value.

Today’s graphic pulls data from the 2020 edition of Brand Finance’s annual Global 500 report, which ranks the world’s top brands by value using a multi-dimensional formula.

By quantifying the true value of a brand, investors and key decision makers can identify value that extends beyond quarterly earnings reports.

How much are brands really worth?

A Closer Look at the Leaderboard

With 18% growth in the last year resulting in an eye-watering brand value of $220 billion, Amazon is a clear winner as the world’s most valuable brand—towering over Google and Apple’s brand valuations. As the largest online marketplace on the planet, Amazon relies on innovative technologies and investments in fast-growing sectors, such as healthcare, to create a diverse retail ecosystem.

Although tech companies command five of the top 10 spots in the ranking, brands from more traditional industries are hot on their tails.

Here are the top 100 most valuable brands according to the report:

| Ranking | Brand | 2020 Brand Value | YoY % Change | Country | Sector |

|---|---|---|---|---|---|

| #1 | Amazon | $220B | 17.5% | United States | Retail |

| #2 | $160B | 11.9% | United States | Tech | |

| #3 | Apple | $140B | -8.5% | United States | Tech |

| #4 | Microsoft | $117B | -2.1% | United States | Tech |

| #5 | Samsung | $94B | 3.5% | South Korea | Tech |

| #6 | ICBC | $80B | 1.2% | China | Banking |

| #7 | $79B | -4.1% | United States | Media | |

| #8 | Walmart | $77B | 14.2% | United States | Retail |

| #9 | Ping An | $69B | 19.8% | China | Insurance |

| #10 | Huawei | $65B | 4.5% | China | Tech |

| #11 | Mercedes-Benz | $65B | 7.8% | Germany | Automobiles |

| #12 | Verizon | $63B | -10.5% | United States | Telecoms |

| #13 | China Construction Bank | $62B | -10.2% | China | Banking |

| #14 | AT&T | $59B | -32% | United States | Telecoms |

| #15 | Toyota | $58B | 11.1% | Japan | Automobiles |

| #16 | State Grid | $57B | 11.1% | China | Utilities |

| #17 | Disney | $56B | 22.7% | United States | Media |

| #18 | Agricultural Bank of China | $55B | -0.7% | China | Banking |

| #19 | $54B | 6.8% | China | Media | |

| #20 | Bank of China | $51B | -0.7% | China | Banking |

| #21 | The Home Depot | $50B | 7.3% | United States | Retail |

| #22 | China Mobile | $49B | -11.9% | China | Telecoms |

| #23 | Shell | $47B | 12.4% | Netherlands | Oil & Gas |

| #24 | Saudi Aramco | $47B | N/A | Saudi Arabia | Oil & Gas |

| #25 | Volkswagen | $45B | 7.6% | Germany | Automobiles |

| #26 | YouTube | $44B | 17.5% | United States | Media |

| #27 | Tencent QQ | $44B | -11.3% | China | Media |

| #28 | Starbucks | $41B | 4.5% | United States | Restaurants |

| #29 | Wells Fargo | $41B | 2.3% | United States | Banking |

| #30 | BMW | $40B | 0.0% | Germany | Automobiles |

| #31 | Deutsche Telekom | $40B | -13.6% | Germany | Telecoms |

| #32 | Moutai | $39B | 29.1% | Germany | Spirits |

| #33 | PetroChina | $38B | 3.3% | China | Oil & Gas |

| #34 | Coca-Cola | $38B | 4.8% | United States | Soft Drinks |

| #35 | Mitsubishi Group | $38B | 42.8% | Japan | Automobiles |

| #36 | McDonald’s | $37B | 18.9% | United States | Restaurants |

| #37 | Taobao | $37B | -20.7 | China | Retail |

| #38 | NTT Group | $36B | -12.8% | Japan | Telecoms |

| #39 | Bank of America | $35B | -3.6% | United States | Banking |

| #40 | Nike | $35B | 7.3% | United States | Apparel |

| #41 | Porsche | $33B | 15.6% | Germany | Automobiles |

| #42 | Sinopec | $33B | 14.7% | China | Oil & Gas |

| #43 | IBM | $33B | 1.5% | United States | Tech |

| #44 | CITI | $33B | -9% | United States | Banking |

| #45 | Honda | $33B | 28.6% | Japan | Automobiles |

| #46 | Marlboro | $33B | -2.7% | United States | Tobacco |

| #47 | Deloitte | $32B | 9.6% | United States | Commercial Services |

| #48 | Chase | $31B | -13.8% | United States | Banking |

| #49 | Tmall | $31B | -15.9% | China | Retail |

| #50 | UPS | $29B | 0.6% | United States | Logistics |

| #51 | American Express | $29B | 6.2% | United States | Commercial Services |

| #52 | Xfinity | $29B | 6.4% | United States | Telecoms |

| #53 | United Healthcare | $28B | -7.4% | United States | Healthcare |

| #54 | Sumitomo Group | $28B | 4.5% | Japan | Mining, Iron & Steel |

| #55 | Intel | $27B | -5.5% | United States | Tech |

| #56 | VISA | $27B | -3% | United States | Commercial Services |

| #57 | $27B | 58% | United States | Media | |

| #58 | China Life | $25B | -4.4% | China | Insurance |

| #59 | Accenture | $25B | -3.8% | United States | IT Services |

| #60 | Allianz | $25B | 7.5% | Germany | Insurance |

| #61 | CSCEC | $25B | -3.3% | China | Engineering & Construction |

| #62 | PWC | $25B | -0.3% | United States | Commercial Services |

| #63 | Lowe’s | $25B | 3.4% | United States | Retail |

| #64 | Mitsui | $24B | 15.8% | Japan | Mining, Iron & Steel |

| #65 | General Electric | $24B | -14.4% | United States | Engineering & Construction |

| #66 | EY | $24B | 2.1% | United Kingdom | Commercial Services |

| #67 | Oracle | $24B | -6.7% | United States | Tech |

| #68 | Cisco | $24B | 7.1% | United States | Tech |

| #69 | BP | $23B | 2.6% | United Kingdom | Oil & Gas |

| #70 | CVS | $23B | 9.1% | United Kingdom | Retail |

| #71 | Total | $23B | 8.1% | France | Oil & Gas |

| #72 | FedEx | $23B | -5.1% | United States | Logistics |

| #73 | Netflix | $23B | 8.4% | United States | Media |

| #74 | China Merchants Bank | $23B | 1.8% | China | Banking |

| #75 | JP Morgan | $23B | 15.3% | United States | Banking |

| #76 | Boeing | $23B | -29% | United States | Aerospace & Defence |

| #77 | Costco | $23B | 32.1% | United States | Retail |

| #78 | SK Group | $22B | -17.5% | South Korea | Telecoms |

| #79 | Wuliangye | $21B | 30.1% | China | Spirits |

| #80 | Evergrande | $21B | 0.5% | China | Real Estate |

| #81 | Nestle | $21B | 3.4% | Switzerland | Food |

| #82 | Hyundai Group | $21B | -2.8% | South Korea | Automobiles |

| #83 | China Telecom | $21B | -2.8% | China | Telecoms |

| #84 | Siemens | $21B | -7.2% | Germany | Engineering & Construction |

| #85 | TATA Group | $21B | 2.3% | India | Engineering & Construction |

| #86 | Mastercard | $21B | 8.4% | United States | Commercial Services |

| #87 | Bosch | $20B | -14.6% | Germany | Engineering & Construction |

| #88 | IKEA | $19B | -9.4% | Sweden | Retail |

| #89 | HSBC | $19B | -3.6% | United Kingdom | Banking |

| #90 | Spectrum | $19B | 25% | United States | Telecoms |

| #91 | Vodafone | $19B | -10.3% | United Kingdom | Telecoms |

| #92 | Pepsi | $19B | 2.2% | United States | Soft Drinks |

| #93 | Alibaba | $19B | 28.8% | China | Retail |

| #94 | Ford | $18B | -1.4% | United States | Automobiles |

| #95 | AIA | $18B | 17.3% | China | Insurance |

| #96 | Orange | $18B | -13.7% | France | Telecoms |

| #97 | Nissan | $18B | -4.5% | Japan | Automobiles |

| #98 | Chevron | $18B | 4.7% | United States | Oil & Gas |

| #99 | GUCCI | $18B | 20.2% | Italy | Apparel |

| #100 | Dell Technologies | $18B | -22.9% | United States | Tech |

American retail giant Walmart enters 2020’s top 10 ranking with an impressive brand value increase of 14% to $77.5 billion. The retailer’s recent success could be partially attributed to its growing strategic partnership with Microsoft—which currently sits in sixth place. By tapping into Microsoft’s cloud services, Walmart can now provide a digital first retail experience for its customers.

Another brand that has experienced remarkable growth is China’s leading insurance company, Ping An. With 19.8% growth, resulting in a brand value of $69 billion, the financial conglomerate’s aggressive focus on fintech R&D has garnered the company 200 million retail customers and 500 million internet users—making it one of the largest financial services companies in the world.

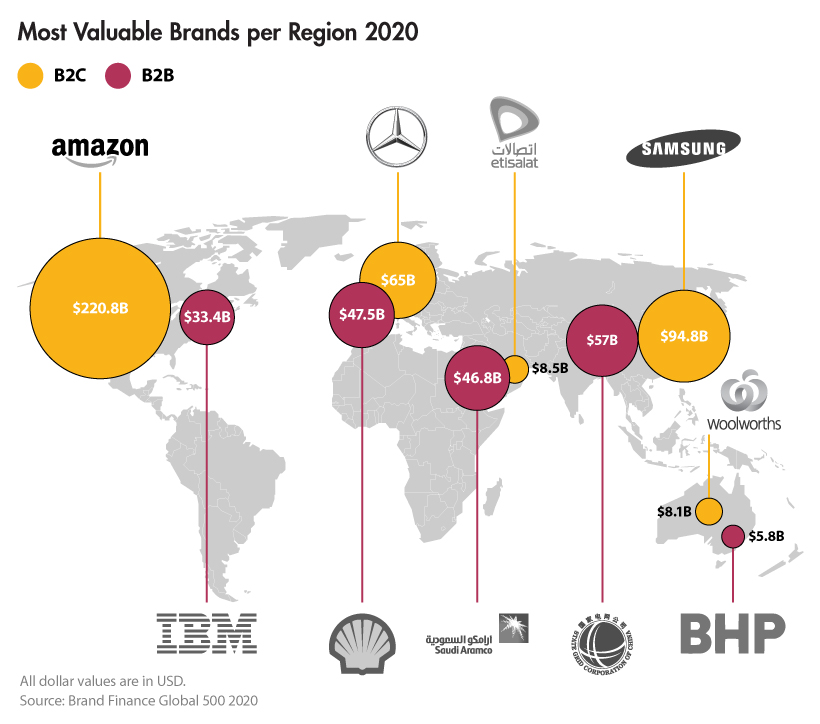

While the majority of the world’s most valuable brands hail from the U.S. or China, which brands lead by region?

Most Valuable Brands by Region

Not surprisingly, Amazon leads as the most valuable B2C brand across the Americas, with the exception of Latin America. Beer brand Corona, was crowned as the leader in this region, boasting a brand value of $8.1 billion.

In Europe, German companies outperformed other countries, with automotive brand Mercedes-Benz holding the title for the most valuable B2C brand for that continent—despite China being its biggest market.

On the other side of the world, Samsung reigns as Asia’s most valuable B2C brand. The company owns 54% of the nascent 5G market globally, having shipped 6.7 million 5G phones in the last year alone.

A Brand Eat Brand World

Whether brands are regional or global leaders, they still face the threat of being knocked of their perch by brands experiencing significant growth.

Climbing to the Top

With an increase of 65% to $12.4 billion, Tesla is officially the fastest-growing brand in the world. Despite concerns over not being able to keep up with demand, the electric car company is expected to exceed 500,000 vehicle deliveries in 2020. Having recently posted over $7 billion of revenue in the fourth quarter of 2019, the success of Tesla’s innovative models is sure to rattle the automotive brands in the ranking.

However, not everything comes down to innovation. European retailers Lidl and Aldi have seen growth of 40% and 37% respectively, and are only getting started.

After disrupting Europe’s entire supermarket industry by offering quality products at significantly lower prices, the chains now have their sights set on the U.S. market, with Aldi expected to surpass Kroger in sales.

Despite the unprecedented disruption caused by e-commerce, the popular assertion that entering digital operations brings instant success while bricks and mortar stores are doomed for extinction is being proved wrong

—David Haigh, CEO Brand Finance

In contrast, there are also well established brands that have struggled to retain brand value.

Racing to the Bottom

Chinese search engine Baidu—also known as the Google of China—recorded the largest drop in brand value, decreasing by 54% to $8.9 billion. The brand has struggled with a poor reputation and intensifying market competition. As a result, the brand’s revenues and subsequently its brand value were heavily impacted.

Boeing is a prime example of the unpredictability of brand value. As a company that once imbued trust and excellent safety standards, the brand’s value has dropped by 29% due to the recent reports of accidents that have tarnished its reputation.

The True Power of Brand

Boeing’s recent hardships reflect the volatile nature of brand value. While 244 brands in the entire ranking have increased their brand value year-over-year, another 212 have taken a hit.

Part of a brand’s purpose is to manage reputation, retain loyal customers, and generate awareness. Given that a brand is the sum of its parts, the ranking proves that an issue with any of these things could trigger a chain reaction, negatively impacting a brand’s bottom line.

So is it worth companies investing in their brand? All signs point to yes, for now.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024