Markets

Ranked: The Most Popular Fast Food Brands in America

Ranked: The Most Popular Fast Food Brands in America

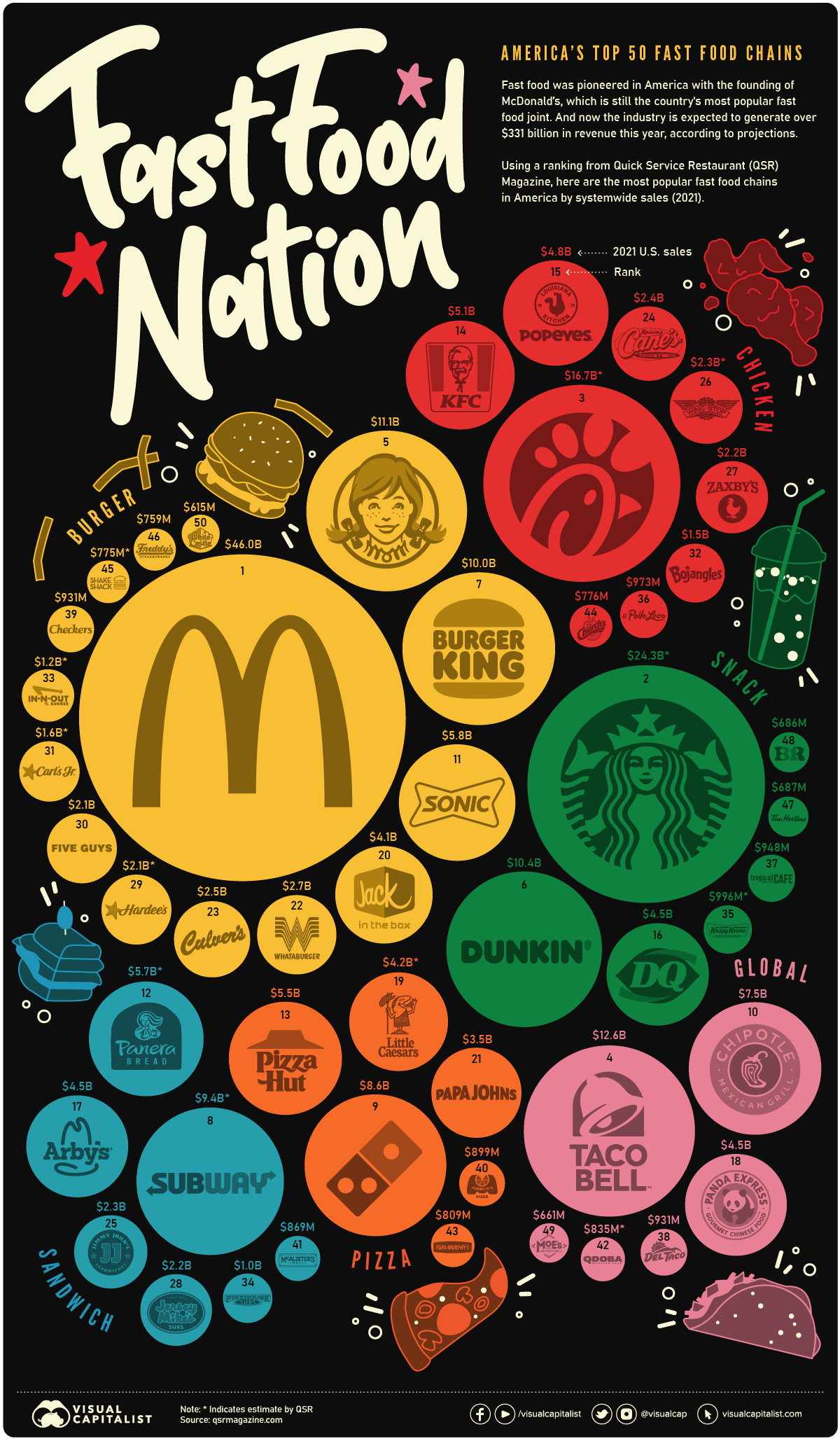

Ever since the McDonald brothers created the concept of fast food in 1940, the restaurant’s golden arches have continued to beckon customers to its quick, cheap, and tasty meals.

McDonald’s is still the most popular fast food brand in America today—with $46 billion in systemwide sales last year.

This graphic uses data from a report on America’s top 50 fast food chains by Quick Service Restaurant (QSR) Magazine. The popular brands are sized by their 2021 systemwide sales and broken down into six broad categories: Burger, Chicken, Snack, Pizza, Sandwich, and Global.

Note: a number of these figures are estimates. Unofficial figures are noted in the graphic with an asterisk.

The Most Popular Fast Food Companies

It’s indisputable that McDonald’s is America’s favorite fast food restaurant, if not the world’s. McDonald’s sales are almost double the second the place restaurant’s, Starbucks—totaling $46 billion compared to the coffee shop’s $24 billion.

Here’s a closer look at the numbers:

| Rank | Company | Systemwide Sales (2021) | Category |

|---|---|---|---|

| #1 | McDonald's | $46.0 billion | Burger |

| #2 | Starbucks | $24.3 billion | Snack |

| #3 | Chick-fil-A | $16.7 billion | Chicken |

| #4 | Taco Bell | $12.6 billion | Global |

| #5 | Wendy's | $11.1 billion | Burger |

| #6 | Dunkin' | $10.4 billion | Snack |

| #7 | Burger King | $10.0 billion | Burger |

| #8 | Subway | $9.4 billion | Sandwich |

| #9 | Domino's | $8.6 billion | Pizza |

| #10 | Chipotle | $7.5 billion | Global |

| #11 | Sonic Drive-In | $5.8 billion | Burger |

| #12 | Panera Bread | $5.7 billion | Sandwich |

| #13 | Pizza Hut | $5.5 billion | Pizza |

| #14 | KFC | $5.1 billion | Chicken |

| #15 | Popeyes Louisiana Kitchen | $4.8 billion | Chicken |

| #16 | Dairy Queen | $4.5 billion | Snack |

| #17 | Arby's | $4.5 billion | Sandwich |

| #18 | Panda Express | $4.5 billion | Global |

| #19 | Little Caesars | $4.2 billion | Pizza |

| #20 | Jack in the Box | $4.1 billion | Burger |

| #21 | Papa Johns | $3.5 billion | Pizza |

| #22 | Whataburger | $2.7 billion | Burger |

| #23 | Culver's | $2.5 billion | Burger |

| #24 | Raising Caine's | $2.4 billion | Chicken |

| #25 | Jimmy John's | $2.3 billion | Sandwich |

| #26 | Wingstop | $2.3 billion | Chicken |

| #27 | Zaxby's | $2.2 billion | Chicken |

| #28 | Jersey Mike's | $2.2 billion | Sandwich |

| #29 | Hardee's | $2.1 billion | Burger |

| #30 | Five Guys | $2.1 billion | Burger |

| #31 | Carl's Jr. | $1.6 billion | Burger |

| #32 | Bojangles | $1.5 billion | Chicken |

| #33 | In-N-Out Burger | $1.2 billion | Burger |

| #34 | Firehouse Subs | $1.0 billion | Sandwich |

| #35 | Krispy Kreme | $996 million | Snack |

| #36 | Pel Pollo Loco | $973 million | Chicken |

| #37 | Tropical Smoothie Cafe | $948 million | Snack |

| #38 | Del Taco | $931 million | Global |

| #39 | Checkers/Rally's | $931 million | Burger |

| #40 | Marco's Pizza | $899 million | Pizza |

| #41 | McAlister's Deli | $869 million | Sandwich |

| #42 | Qdoba | $835 million | Global |

| #43 | Papa Murphy's | $809 million | Pizza |

| #44 | Church's Chicken | $776 million | Chicken |

| #45 | Shake Shack | $775 million | Burger |

| #46 | Freddy's Frozen Custard & Steakburger | $759 million | Burger |

| #47 | Tim Hortons | $687 million | Snack |

| #48 | Baskin-Robbins | $686 million | Snack |

| #49 | Moe's | $661 million | Global |

| #50 | White Castle | $615 million | Burger |

Most of the top 20 restaurants are extremely well known, like Chick-fil-A in third place and Taco Bell in fourth. Some of these chains, however, will be unrecognizable depending on which part of the U.S. you live in. While Bojangles is ubiquitous in the Southeast, for example, many on the West Coast may have never heard of it.

Some of the lower ranking restaurants include Shake Shack (#45), White Castle (#50), and the Canadian-founded Tim Hortons (#47).

Fast Food Industry Trends

America’s fast food industry is expected to generate $331 billion in sales in 2022, and many restaurants are capitalizing on trends shaped in part by the pandemic.

Fast food companies are already somewhat ideal for pandemic conditions with drive-thrus, fast service, and a model that doesn’t encourage sitting down to eat.

Looking to the future, Starbucks, for example, has claimed 90% of its new stores will feature drive-thrus. Digital sales and transactions that limit contact, making fast food even more quick and convenient, are growing as well. Starbucks’ mobile order service has grown 400% over the last five years. And in 2021, the delivery side of their business grew 30% year-over-year, according to the QSR report.

Additionally, the report featured 50 up-and-coming fast food companies to watch in the industry. Here’s a look:

| Rank | Company | Systemwide Sales (2021) | Category |

|---|---|---|---|

| #1 | Smoothie King | $602 million | Snack |

| #2 | Habit Burger | $600 million | Burger |

| #3 | Auntie Anne's | $576 million | Snack |

| #4 | Captain D's | $567 million | Seafood |

| #5 | Steak 'N' Shake | $539 million | Burger |

| #6 | Portillo's | $526 million | Snack |

| #7 | Jamba | $505 million | Snack |

| #8 | Schlotzsky's | $332 million | Sandwich |

| #9 | Krystal | $323 million | Burger |

| #10 | Fazoli's | $298 million | Global |

| #11 | Pizza Ranch | $279 million | Pizza |

| #12 | Scooter's Coffee | $263 million | Snack |

| #13 | Penn Station | $258 million | Sandwich |

| #14 | Chicken Salad Chick | $255 million | Chicken |

| #15 | Mountain Mike's | $254 million | Pizza |

| #16 | Smashburger | $253 million | Burger |

| #17 | Cinnabon | $224 million | Snack |

| #18 | Wetzel's | $219 million | Snack |

| #19 | Donatos | $211 million | Pizza |

| #20 | Newk's | $208 million | Sandwich |

| #21 | Bonchon | $173 million | Chicken |

| #22 | Waba Grill | $170 million | Global |

| #23 | The Human Bean | $109 million | Snack |

| #24 | Capriotti's | $108 million | Sandwich |

| #25 | Great Harvest Bread Company | $108 million | Sandwich |

| #26 | Teriyaki Madness | $90 million | Global |

| #27 | Roy Rogers | $82 million | Burger |

| #28 | Pizza Guys | $79 million | Pizza |

| #29 | Mooyah | $71 million | Burger |

| #30 | Salsarita's | $68 million | Global |

| #31 | Dog Haus | $67 million | Snack |

| #32 | Gold Star | $61 million | Burger |

| #33 | Hawaiian Bros | $55 million | Global |

| #34 | Honeygrow | $55 million | Global |

| #35 | Robeks | $50 million | Snack |

| #36 | PJ’s Coffee of New Orleans | $46 million | Snack |

| #37 | Kolache Factory | $46 million | Snack |

| #38 | Juice it Up! | $43 million | Snack |

| #39 | Happy Joe's | $38 million | Pizza |

| #40 | Rusty Taco | $35 million | Global |

| #41 | Wing Zone | $34 million | Chicken |

| #42 | Swig | $29 million | Snack |

| #43 | Pickleman's | $29 million | Sandwich |

| #44 | Killer Burger | $17 million | Burger |

| #45 | Wing Snob | $15 million | Chicken |

| #46 | Sobol | $13 million | Global |

| #47 | Bad Ass Coffee of Hawaii | $12 million | Snack |

| #48 | Asian Box | $11 million | Global |

| #49 | Sauce on the Side | $9 million | Global |

| #50 | Mici Italian | $6 million | Global |

Some of these are well-established fast food joints that are simply growing their sales, like Cinnabon, while others are newer to the scene.

America’s Favorite Fast Food

Using the ranking’s food categories, we calculated the total sales in each category from the top 50 to figure out which foods are America’s favorites. The winner is evidently burgers, with $92.2 billion in collective sales. Here’s a look at the breakdown:

| Rank | Food Category | Category Cumulative Sales |

|---|---|---|

| #1 | Burger | $92.2 billion |

| #2 | Snack | $42.5 billion |

| #3 | Chicken | $36.7 billion |

| #4 | Global | $27.0 billion |

| #5 | Sandwich | $25.9 billion |

| #6 | Pizza | $23.5 billion |

Sales at Burger restaurants were more than double the runner-up, which was Snacks. After all, nothing is more American than a classic hamburger and fries.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue