Technology

Ranked: The World’s Most Downloaded Apps

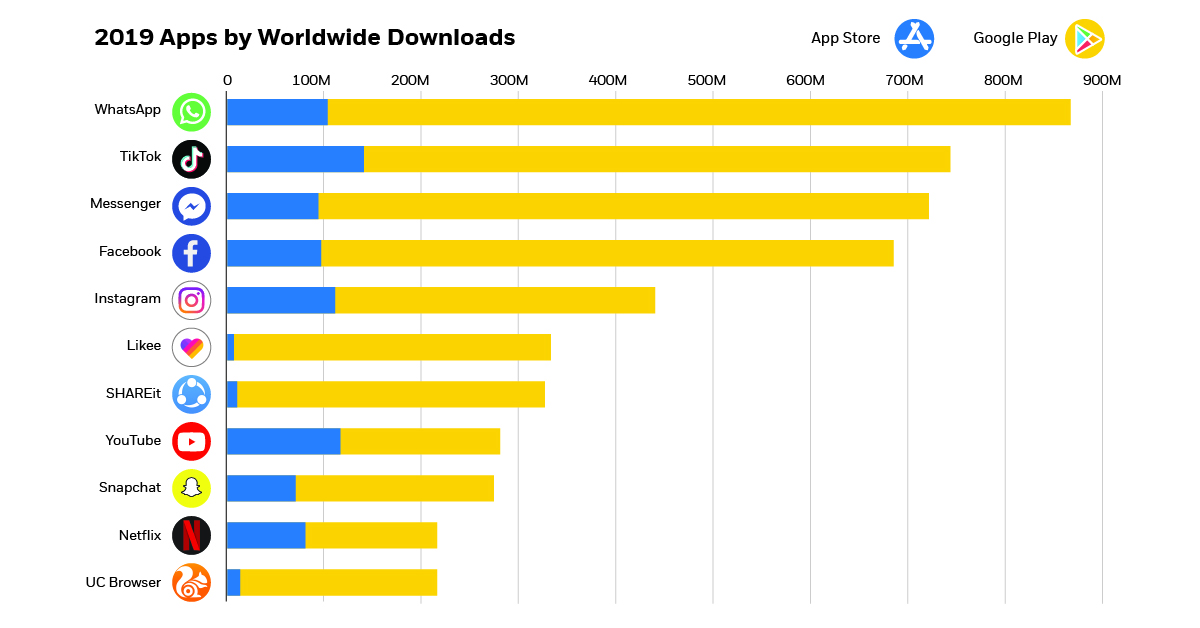

Note: Estimates include unique installs on iPhone, iPad, and Google Play from Jan. 1 through Dec. 31, 2019. Pre-installed apps for Apple and Google are excluded.

Ranked: The World’s Most Downloaded Apps

From strategically finding love, to helping researchers search for extraterrestrial life—there is quite literally an app for almost anything these days.

It is therefore no surprise that apps have become one of the largest consumer ecosystems on the planet, with the global app economy expected to reach $6.3 trillion by 2021.

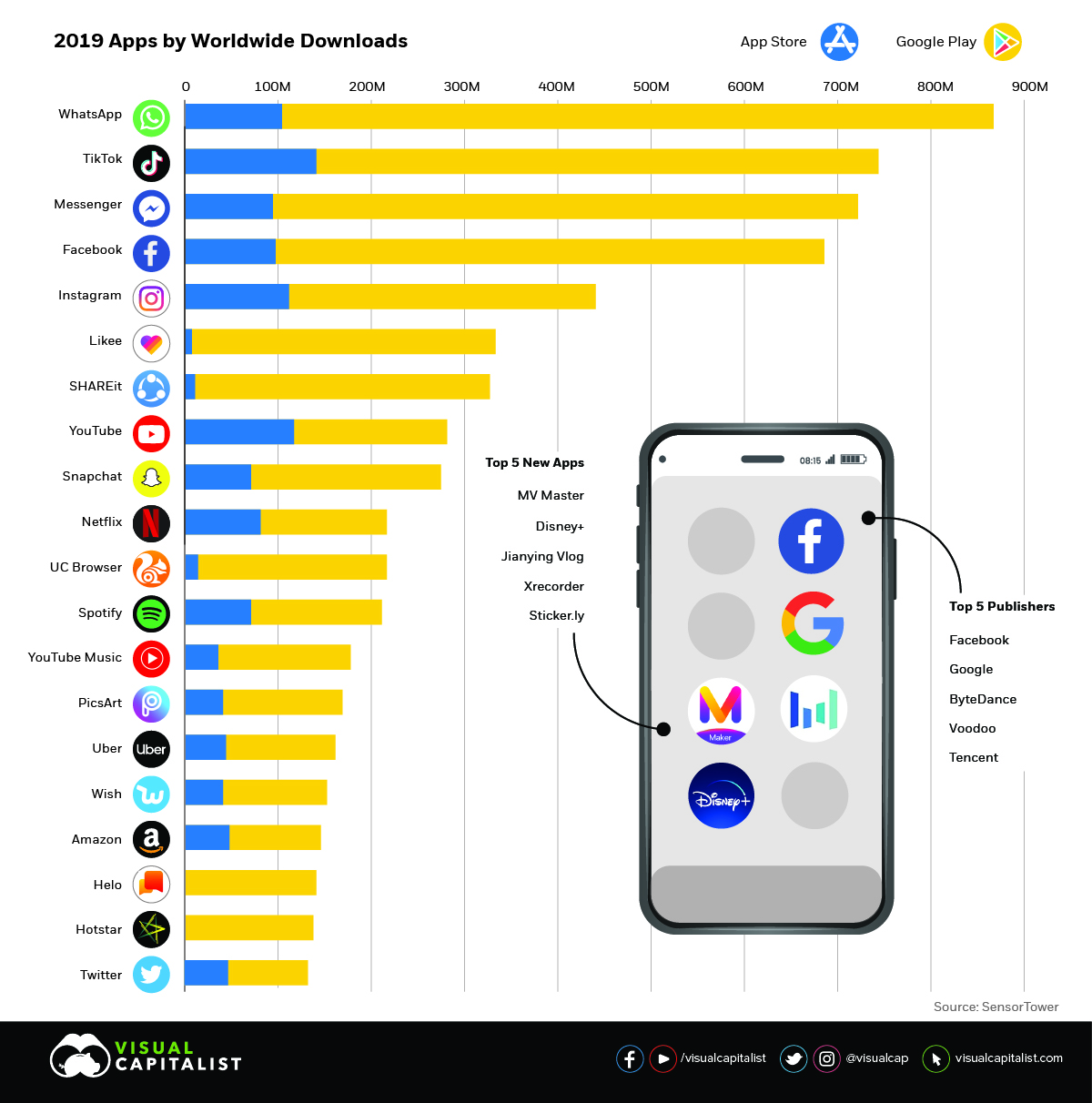

Today’s graphics pull data from a recent report by Sensor Tower that ranks the top 20 most downloaded apps of 2019. New entrants are rising up and threatening the dominance of more established tech companies—but can they sustain their current position on the leaderboard?

The Champions of the App Economy

According to the report, total app downloads grew to 115 billion in 2019, including almost 31 billion downloads on the App Store and 84 billion on Google Play.

Social media giant Facebook owns four out of five of 2019’s most downloaded apps: Facebook, Facebook Messenger, WhatsApp, and Instagram. Collectively, they boast an eye-watering 16 billion downloads—with WhatsApp holding the top spot for the fourth year running.

Growth in the short-form video category is apparent. The video creation app Likee joined this year’s ranking and sits in sixth place, with the majority of the app’s 330 million downloads coming from India.

The app lets users edit videos using a wide variety of effects, and directly competes with TikTok—a lip syncing app that entered the ranking in 2018 and now threatens WhatsApp’s position at the top of the leaderboard.

Which Apps Are Climbing the Ranks?

TikTok is the newest platform to turn its users into viral sensations, grossing $177 million in 2019. This is equal to more than five times its 2018 revenue. TikTok also bypassed Instagram in 2018, breaking Facebook’s foothold on the top four apps globally.

TikTok is owned by Chinese tech firm ByteDance, the most valuable private company in the world—and 78% of TikTok’s total Q4’2019 revenue came from its native country.

Aside from several short-form video entrants, new players from other industries continue to storm up the ranks. While they don’t make the list of most downloaded apps yet, their recent success could change that.

Streaming Services

Netflix is the only streaming service to make it into the top 20 most downloaded apps, but the launch of Disney+ could potentially change that.

Despite a November launch, Disney+ became the second most popular new app of 2019. Within a month, the service generated $50 million in revenue.

To put this into context, Disney+ acquired 34% of all streaming app downloads in less than three months, or 30 million subscribers—half of Netflix’s current 60 million U.S. subscribers. That figure also surpasses Hulu and Amazon Prime’s figures for the entirety of 2019.

Gaming

With 2.4 billion people playing mobile games in 2019, gaming is also set to become a major player in the app economy.

Two popular console franchises, Call of Duty and Mario Kart, recently entered the mobile market to become two of the most successful games in the category.

The free mobile version of Call of Duty had the second best quarter of any mobile game ever, with 170 million worldwide downloads. Only Pokémon GO had a better quarter, with more than 300 million installs when it launched in 2016.

The success of these apps can be attributed to their already established consumer base, and the evident shift in more gamers moving to mobile platforms as smartphone technology and processing speeds improve.

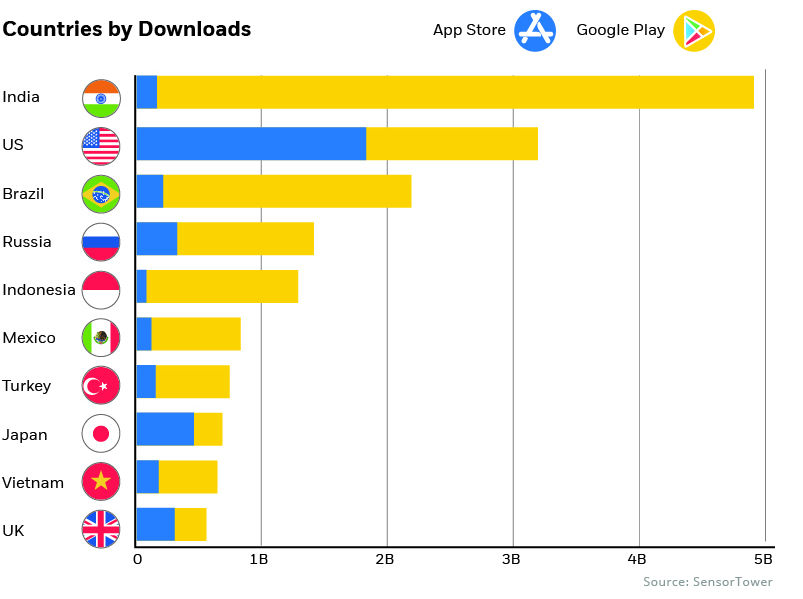

Countries Leading the App Economy

The app economy is also being fueled by growth in emerging markets including China, India, Brazil and Russia, thanks to faster internet speeds and increasing smartphone adoption rates.

Specifically, India’s increasing digitization is driving significant growth in the market. The country witnessed nearly 5 billion app installs in the last quarter of 2019—surging ahead of the U.S. with just over 3 billion installs.

Note: As Google Play is not available in China, the country was excluded from this chart.

India’s demand could be attributed to the fact that half of its 1.3 billion population is under the age of 25. A younger, tech savvy audience has resulted in India becoming TikTok’s top market, commanding 45% of the app’s first time downloads in 2019.

The App Economy 2.0

With an explosion in user spending, and seemingly endless opportunities for innovation, the global app economy shows a tremendous amount of promise, but is still in its early days.

Consumers spent $101 billion on apps globally in 2018. This is double the size of the global sneaker market, and nearly three times the size of the oral care industry.

—Danielle Levitas, EVP of Global Marketing & Market Insights at App Annie

Rising consumer spend combined with other forms of monetization, such as advertising and mobile commerce, could soon enable the app market to surpass the trillion dollar barrier in revenue.

While many experts claimed that the app industry was dead in its tracks, it’s safe to say that those predictions are now being irrefutably challenged.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?