Automotive

Putting EV Valuations Into Perspective

Putting EV Valuations Into Perspective

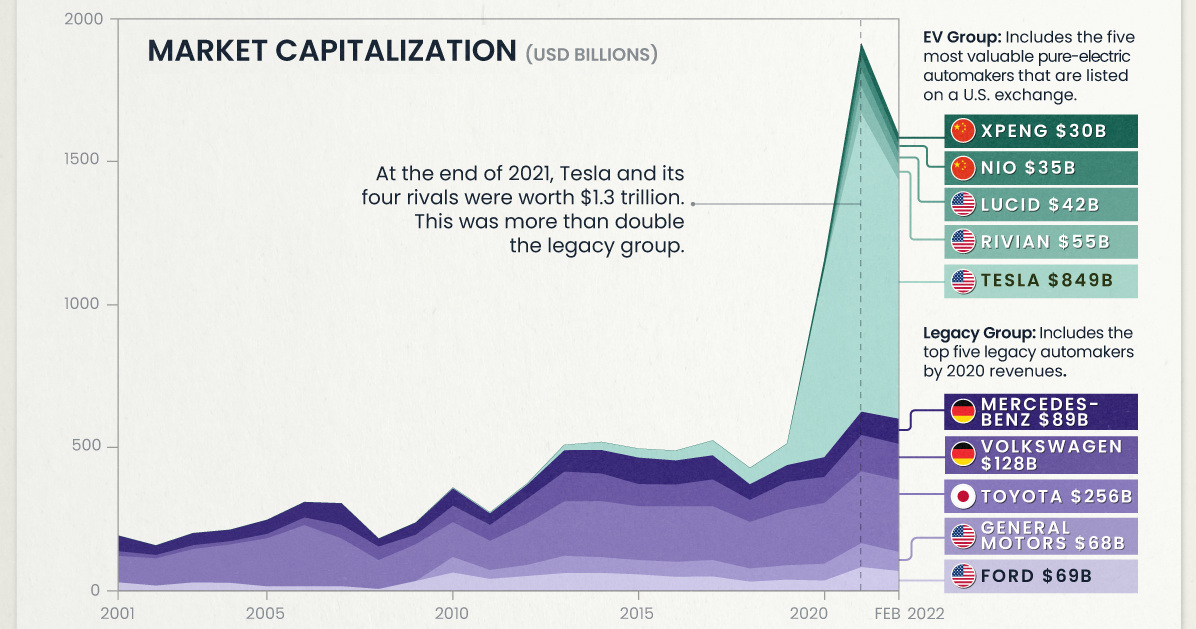

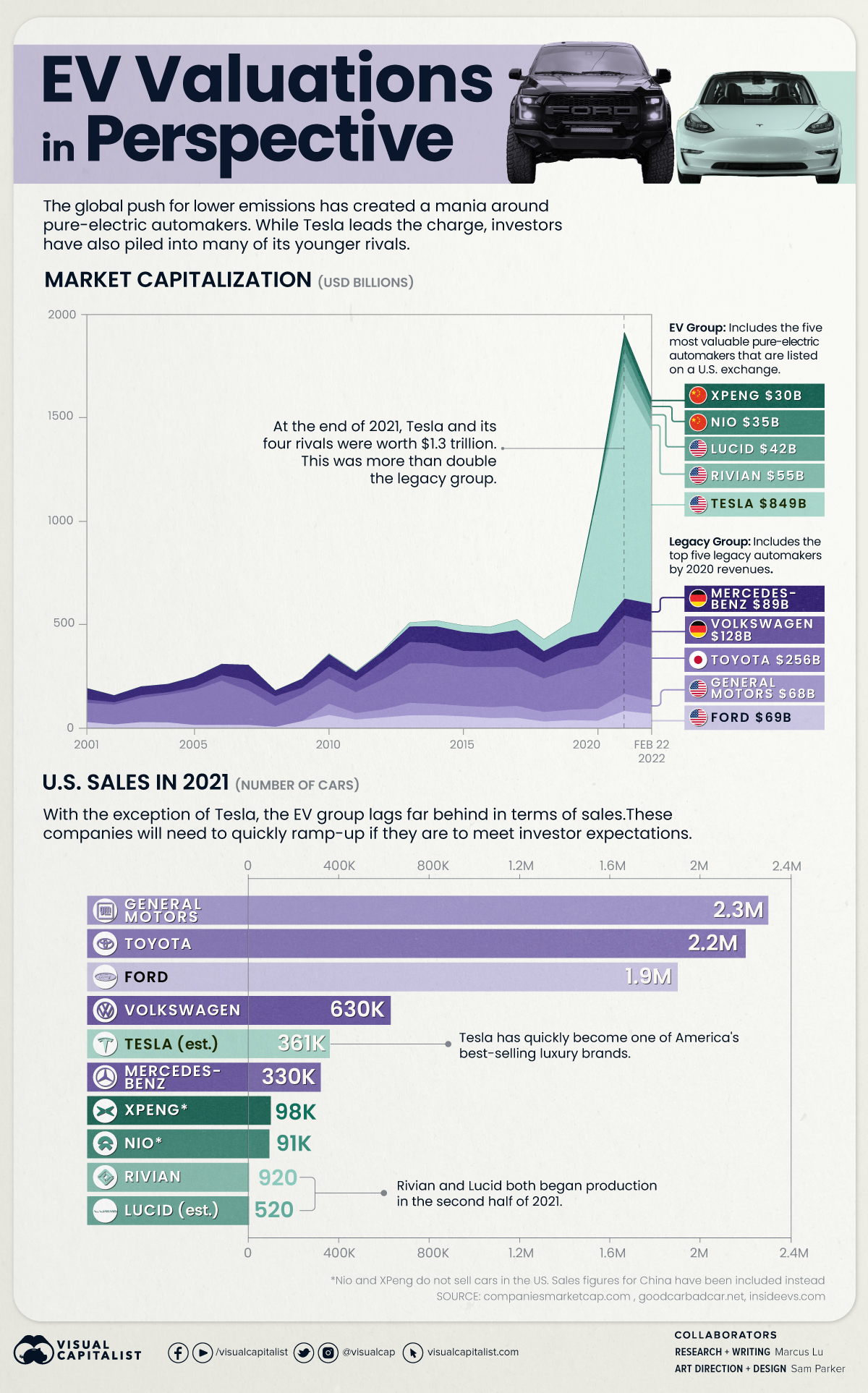

The global push for lower emissions has created a mania around pure-electric automakers. While Tesla leads the charge, institutional investors have also piled into many of its younger rivals.

For example, in 2019, Saudi Arabia’s sovereign wealth fund invested $1.3 billion into Lucid Motors. One year later, it was revealed that Amazon had a 20% stake (worth $3.8B) in Rivian.

To see how quickly EV valuations have ballooned, we’ve visualized the historical market capitalizations (market caps) of 10 prominent automakers.

Legacy vs Pure-Electric

The legacy group includes five top traditional automakers, while the EV group includes the five most valuable pure-electric automakers that are listed on an American exchange.

The following table lists the market caps of these companies at various dates. While XPeng and NIO are listed on the New York Stock Exchange, they do not currently sell cars in the U.S.

| Automaker | Type | 2010 | 2015 | 2021 | 02/22/2022 |

|---|---|---|---|---|---|

| 🇺🇸 Tesla | EV | $3B | $31B | $1,061B | $849B |

| 🇯🇵 Toyota | Legacy | $124B | $191B | $255B | $256B |

| 🇩🇪 Volkswagen Group | Legacy | $59B | $79B | $129B | $128B |

| 🇩🇪 Mercedes-Benz | Legacy | $61B | $94B | $83B | $89B |

| 🇺🇸 Ford | Legacy | $63B | $57B | $83B | $69B |

| 🇺🇸 General Motors | Legacy | $55B | $51B | $85B | $68B |

| 🇺🇸 Rivian | EV | N/A | N/A | $93B | $55B |

| 🇺🇸 Lucid | EV | N/A | N/A | $63B | $42B |

| 🇨🇳 NIO | EV | N/A | N/A | $50B | $35B |

| 🇨🇳 Xpeng | EV | N/A | N/A | $41B | $30B |

Source: Companies Market Cap

At the end of 2021, Tesla and its four EV rivals were worth a combined $1.3 trillion. This was more than double of the legacy group, which was worth $635 billion. EV valuations have cooled since then, though Tesla is still the world’s most valuable automaker by a significant margin.

U.S. Sales in 2021

Comparing U.S. sales gives an interesting perspective on these companies’ relative scale. Once again, note that XPeng and NIO do not sell cars in America. We’ve provided figures for their home market (China) instead.

| Automaker | U.S. Sales in 2021 |

|---|---|

| General Motors | 2.3 million |

| Toyota | 2.2 million |

| Ford | 1.9 million |

| Volkswagen Group | 630,000 |

| Tesla | 361,000 (est.) |

| Mercedes-Benz | 330,000 |

| XPeng | 98,000 (China) |

| NIO | 91,000 (China) |

| Rivian | 920 |

| Lucid | 520 (est.) |

Source: Good Car Bad Car

Impressively, Tesla has overtaken Mercedes in the U.S. to become one of the country’s top luxury brands.

The Long Road Ahead

To satisfy investor expectations, Rivian and Lucid will need to rapidly scale their production and sales. Failing to do so could lead to significant stock price volatility.

Investors should also note that both companies could experience similar challenges as Tesla, which Musk has referred to as “production hell”. Rivian has already pushed back deliveries of its first SUV, while Lucid customers have been notified of delays due to “fit and finish” issues.

Nevertheless, these young manufacturers are setting some serious goals. Rivian aims to produce one million cars annually by the year 2030, while Lucid is targeting a more conservative 49,000 cars in 2023.

Tesla Goes on the Defensive

Tesla is still the undisputed EV leader, but competition is rapidly heating up.

On one hand, legacy automakers have been investing heavily in EV development, and new models are coming en masse. The Volkswagen Group is the biggest threat, selling 453,000 EVs globally in 2021 (up 96% over 2020). For reference, Tesla reported global sales of 936,000 in 2021.

On the other hand, Tesla must also defend its market share from an onslaught of Chinese entrants. This includes XPeng and NIO, which appear to be on similar trajectories. Both firms were founded in 2014, both sold nearly 100,000 EVs in 2021, and both have recently expanded into European markets. A U.S. expansion also seems to be imminent.

With the entire auto industry moving towards battery powered vehicles, will the market rethink its valuation of Tesla?

Misc

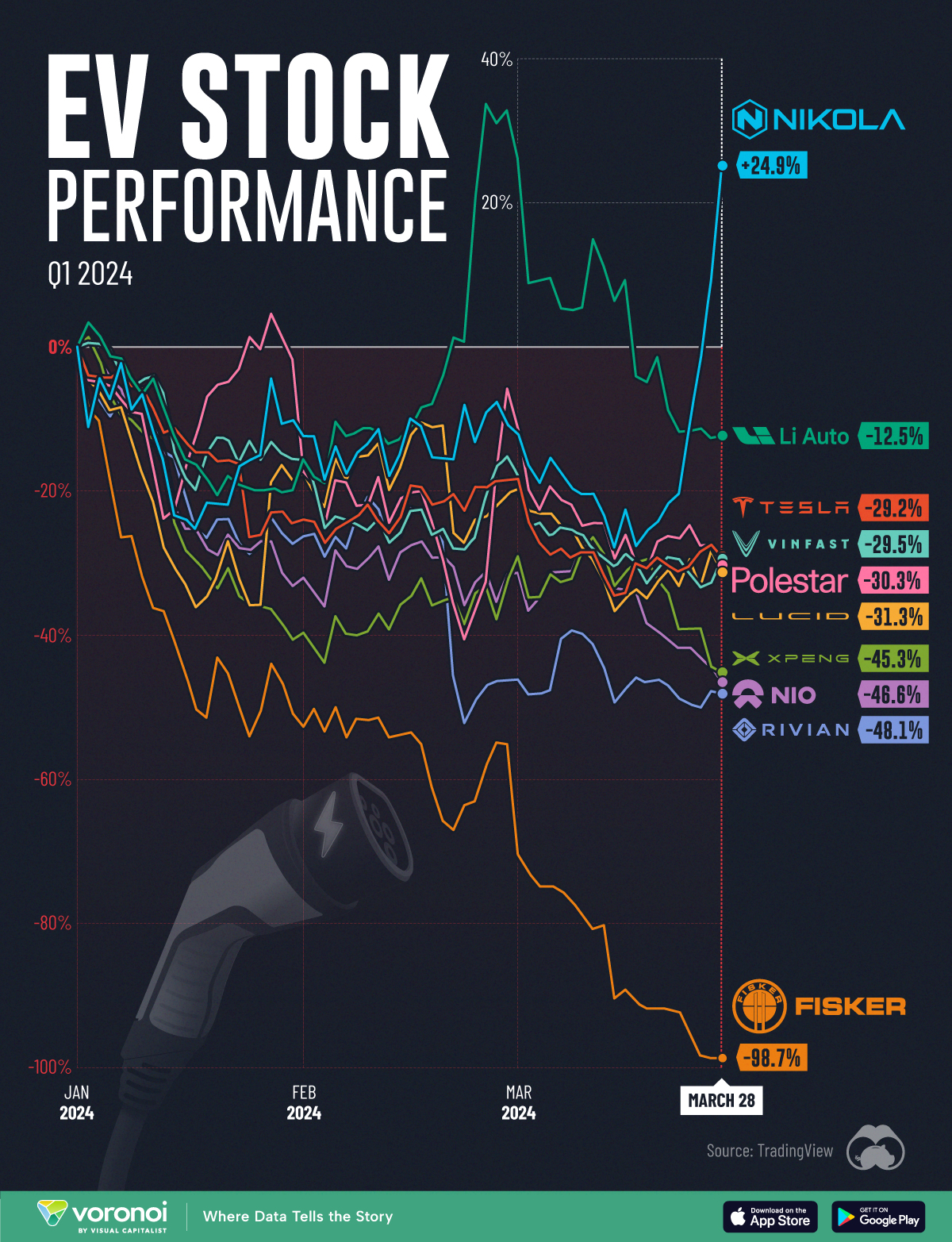

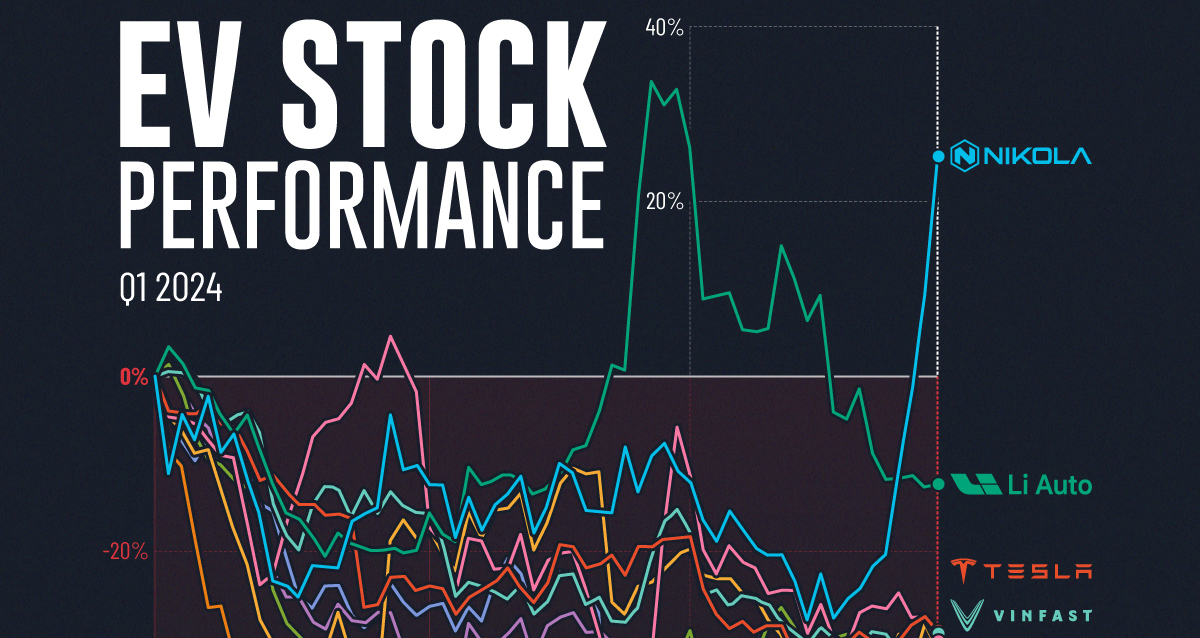

Almost Every EV Stock is Down After Q1 2024

We compiled the performance of 10 pure play EV stocks into one chart, revealing one company that bucked the broader trend.

Almost Every EV Stock is Down After Q1 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

While the S&P 500 index climbed over 10% in Q1 2024, the majority of EV stocks declined by double digit percentages over the period.

This is surprising, given that EVs were once the hottest trend in tech (before artificial intelligence came around).

In this graphic, we’ve visualized the Q1 2024 performance of 10 prominent pure play EV companies. Pure play in this context means companies that only focus on electric vehicles.

EV Stock Performance

The data we used to create this graphic can be found in the table below. Note the two biggest outliers: Nikola (+24.9%) and Fisker (-98.7%).

| Company | Q1 Price Change (%) |

|---|---|

| Nikola | +24.9 |

| Li Auto | -12.5 |

| Tesla | -29.2 |

| VinFast | -29.5 |

| Polestar | -30.3 |

| Lucid | -31.3 |

| XPeng | -45.3 |

| Nio | -46.6 |

| Rivian | -48.1 |

| Fisker | -98.7 |

The majority of EV stocks have fallen due to slowing demand in major markets like the U.S. and China. This is a serious problem for startups like Rivian and Lucid, which are not yet profitable.

In fact, legacy automakers like Ford are looking to expand production of hybrid vehicles, which is likely causing many investors to avoid pure EV stocks.

Two Outliers Emerge

Nikola shares have rallied in recent weeks as the company reported positive momentum in its hydrogen fuel cell truck business. The company also opened its first hydrogen refueling station in Southern California, and has five more in the works.

On the flipside, Fisker Inc. has struggled enormously, even being delisted from the NYSE in late March 2024. Fisker Inc. is the successor to Fisker Automotive, which went bankrupt in 2013. Fisker Automotive was known for producing the Karma, a luxury EV sedan that competed with the Tesla Model S.

Back to today’s Fisker, the company is once again in hot water. Over 40,000 customers have cancelled reservations for the company’s “Ocean” electric SUV, which is currently under investigation for door malfunctions.

Other Major EV Developments

In other news, Tesla is once again the world’s best-selling EV company, after outselling China’s BYD by 87,000 units in Q1 2024.

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?