Premium Cannabis: The Next Big Wave

The following content is sponsored by Next Green Wave.

Loosening cannabis laws have resulted in the rapid influx of new products across North America. Substantial growth in the Californian market—valued at $5.1 billion—has led to changing consumer needs, including the need for more premium products and experiences.

Today’s infographic from Next Green Wave explores the demand for these premium experiences and the implications for the future of the cannabis industry.

Premium Cannabis: The Next Big Wave

Modern day cannabis consumers are empowered by information and are willing to invest in a better cannabis experience.

As cannabis evolves from being a novelty to part of a healthier lifestyle, premium products are becoming more prevalent. Consumers are looking for three things: variety of choices, better quality, and to be part of something bigger than themselves.

1. Choices, Choices

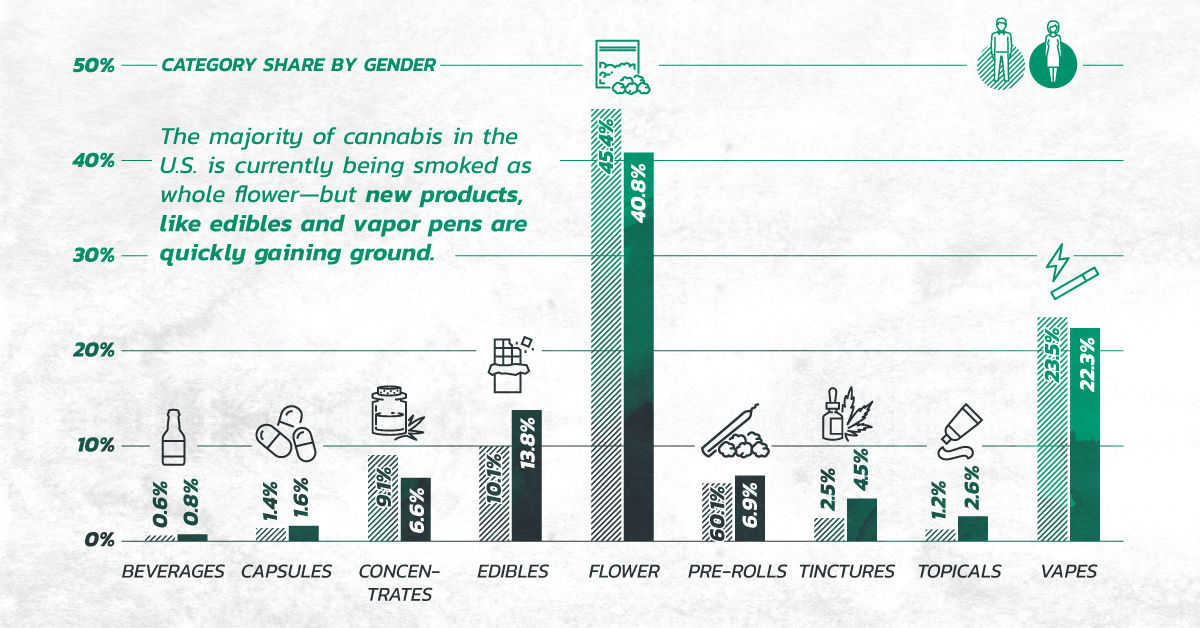

The majority of cannabis in the U.S. is currently being smoked as whole flower—but new products like edibles and vapor pens are quickly gaining ground. These products address long-standing concerns with traditional formats, which include:

- Indiscreetness of smoking

- Difficult to use

- Inaccurate dosing

- Safety hazard

- Complete Control

Ability to control climate and air circulation - Increased Productivity

Consistent production all year round - Hygienic Environment

Reduced risk of micro-bacteria and pests - Standardized Product

Especially important for medical grade cannabis

According to Headset, female shoppers prefer edibles and tinctures, whereas men buy significantly more concentrates.

While millennial women rely on these formats primarily for wellness, baby boomers look to cannabidiol (CBD) for pain management and other health issues.

2. Quality is Key

The journey to a premium, quality product starts with the seed. Cultivation in a controlled environment—where careful attention is paid to every stage of the process—is paramount.

Indoor cultivation is an example of a controlled environment, and benefits to this practice include:

3. The Need to Belong

Consumers are looking to satiate their need to belong to a community, and cannabis is providing a wealth of opportunities to do so. Different cannabis formats are used to enhance socializing, with many millennials replacing alcohol with cannabis products entirely. Companies are taking advantage of this mindset by hosting unique cannabis events and pop-up experiences.

As more people veer towards making cannabis central to their lifestyle, more use cases appear. Using CBD for pets or as a pre-workout boost are other ways products have been seamlessly incorporated into everyday life. Brands who capitalize on these cannabis communities by providing memorable and premium experiences will come out on top.

About Next Green Wave

Next Green Wave cultivates premium cannabis products in California. With 25 years of industry experience, Next Green Wave prides itself on their completely integrated operations, covering the entire seed-to-sale process. They are committed to becoming the #1 premium consumer packaged goods brand in California.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.