Markets

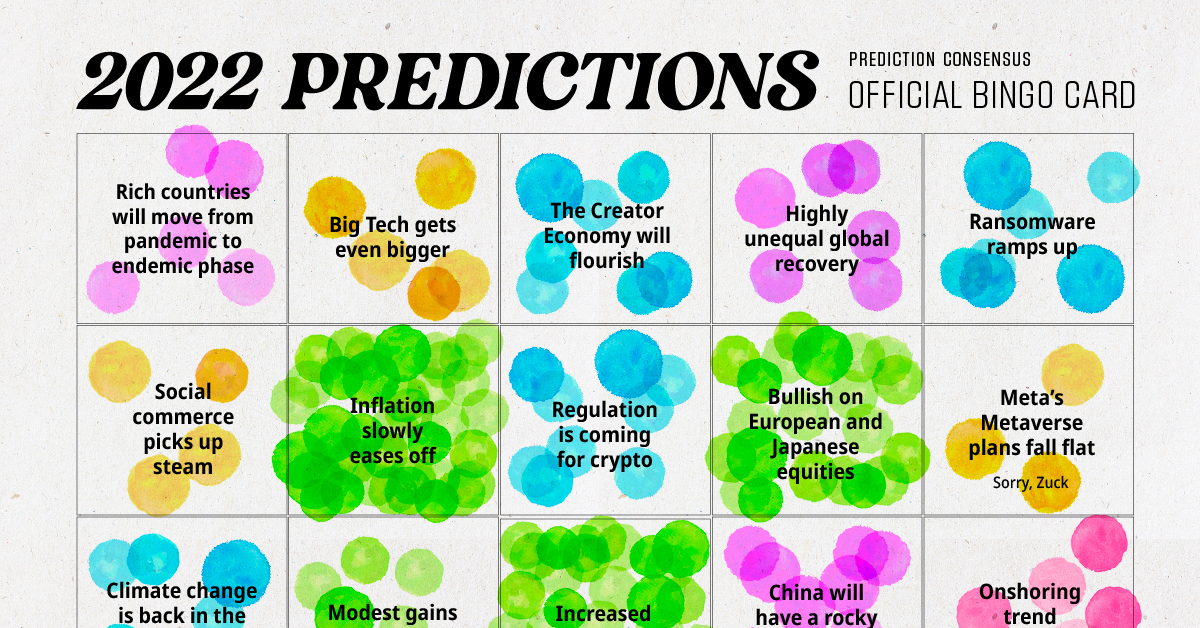

Prediction Consensus: What the Experts See Coming in 2022

What the Experts See Coming in 2022

Even at the best of times, it’s human nature to want to decode the future.

During times of uncertainty though, we’re even more eager to predict what’s to come. To satisfy this demand, thousands of prognosticators share their views publicly as one year closes and another begins. In hindsight, we see varying levels of success at predicting the future.

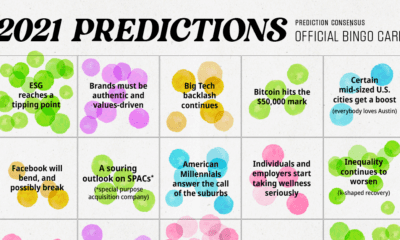

In truth, experts are merely guessing at what will happen over the coming year. In 2020, almost nobody had a pandemic on their bingo card. In 2021, NFTs completely flew under the radar of experts, and nobody saw a container ship get lodged in the Suez Canal in their crystal ball.

So, why should we pay any attention to predictions at all? Are they, as Barry Ritholtz says, “wrong, random, or worse”?

For one, these guesses are backed by expertise and experience, so the accompanying analysis is informative. Perhaps more importantly though, influential people and companies are in a position to shape the future with their predictions. In some cases, sentiment and actions can turn a prediction into a self-fulfilling prophecy.

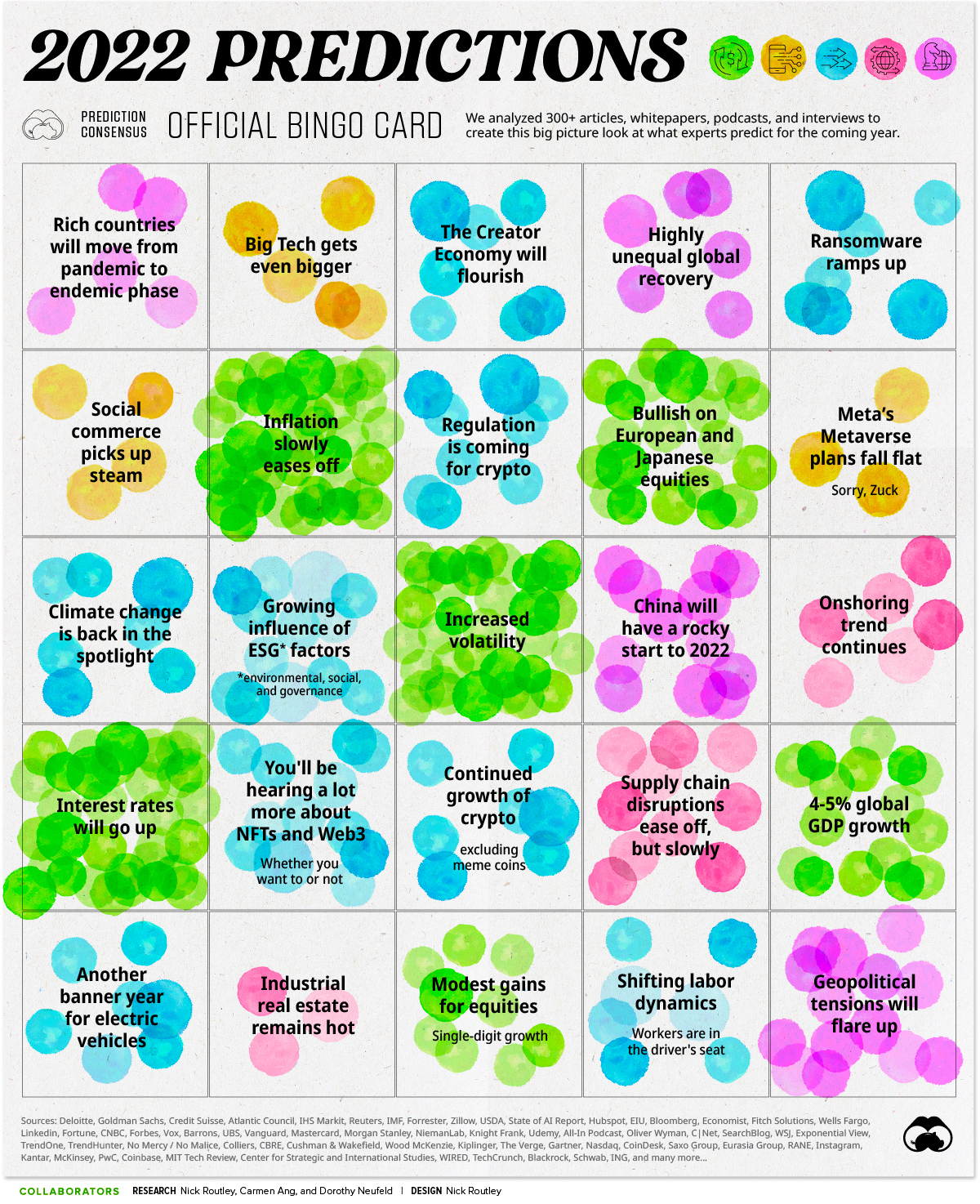

Regardless, whether for research or pure entertainment purposes, we’ve sifted through hundreds of reports, interviews, and articles to see which predictions are generally the most agreed upon. Where do experts see the ball moving over the next year? Our bingo card sums up the top 25, and below, we’ll dig into some of the trends that could shape 2022.

Join us for our interactive webinar on Jan 13th, 2022 by becoming a VC+ member:

Join VC+ Today

Vibe Check: What’s the General Outlook for 2022?

Based on the hundreds of predictions we analyzed, the general mood can be described as cautiously optimistic.

For starters, the global economy will likely keep growing, but not at the rate it did in 2021. We aggregated 40+ predictions from reputable sources such as the IMF and Goldman Sachs to determine median GDP estimates for the world, and select regions:

| Country / Region | Median GDP Estimate |

|---|---|

| World | 4.5% |

| United States | 4.0% |

| Eurozone | 4.3% |

| China | 5.3% |

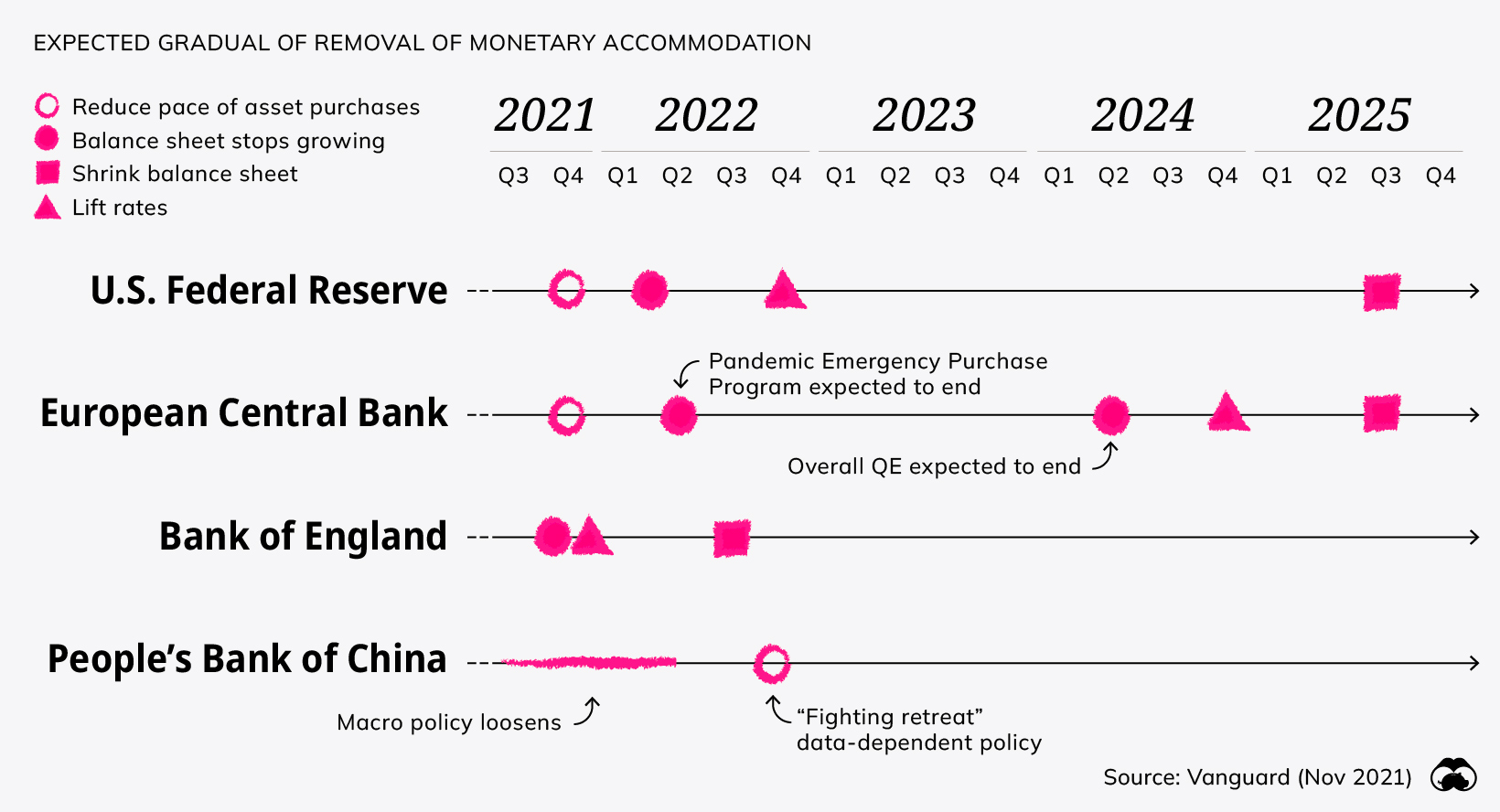

Next, there’s broad agreement that monetary policy will begin to tighten over the next 12 months. Here’s what major central banks are predicted to do:

Multiple experts described an era of lower equity returns and increased volatility. Many of the issues that plagued 2021 have carried over into 2022.

Technological disruption continues to reshape industries, and climate change and cybersecurity issues will be top of mind this year. Geopolitical tensions are heating up as well, now that countries have acclimated to the immediate challenges posed by the pandemic.

In short, nobody expects 2022 to be uneventful.

Trends that Will Shape 2022

Some of the predictions above are straightforward. GDP targets and explicit binary statements don’t require too much explanation.

Below are some of the predictions experts agreed on that are worth digging into in more detail:

1. Geopolitical Tensions Will Flare Up

There are a number of potential hotspots around the world, but here are a few that experts are watching in 2022.

Iran: Tensions ratcheted up between the U.S. and Iran after an attack on a U.S. military base in southern Syria in the fall of 2021. Further, the tension between Iran and Israel has the potential to escalate further in 2022, drawing in other nations in the region into a conflict.

Ukraine: This is a continuation of tensions that flared up after Russian annexation of Crimea in 2014. Europe’s dependence on Russian gas and Ukraine’s position as a key gas transit hub makes this a situation experts are watching very closely.

Taiwan: The risk that China will make a move on Taiwan has elevated in the minds of experts, though actions may contain “more bark than bite”.

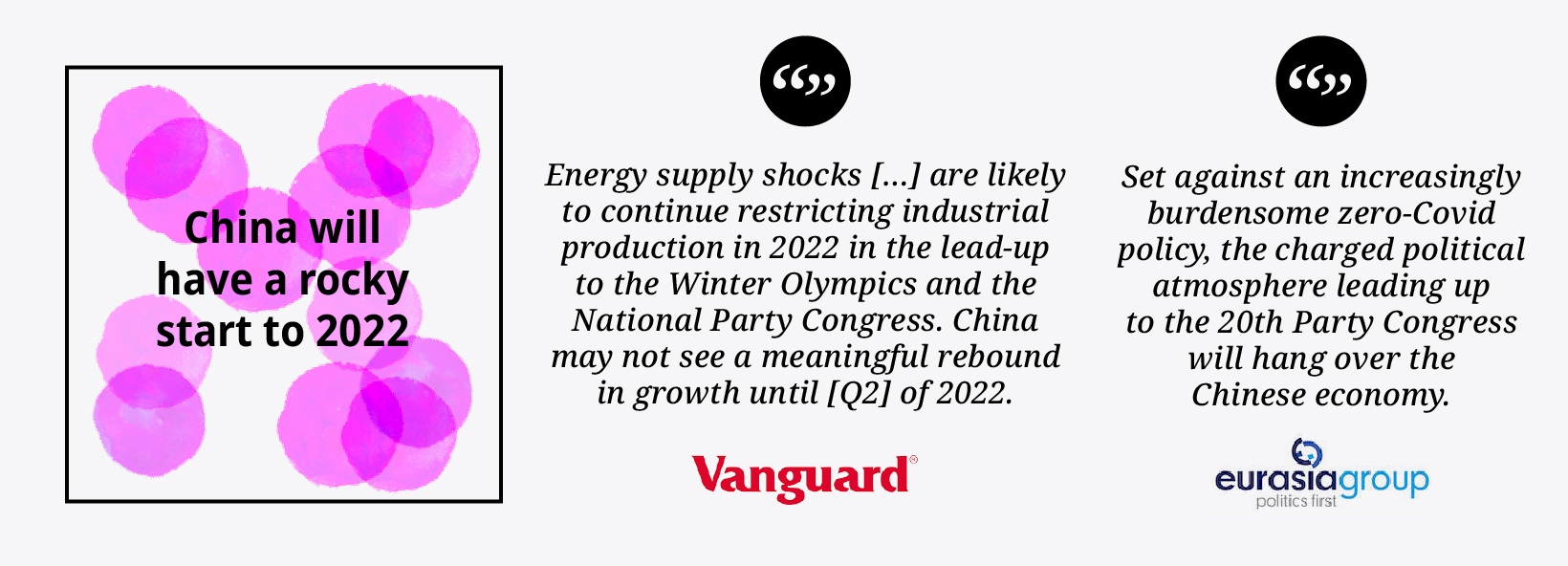

2. China’s Rocky Start to 2022

At the dawn of 2021, many of the predictions around China were largely optimistic as the country had entered a recovery phase sooner than the rest of the world.

Fast forward to 2022, and the predictions are the polar opposite as China faces challenges on a number of fronts. To begin with, there is pessimism around China’s zero-COVID strategy, which even today sees entire cities fall under strict lockdown orders. This strategy has unavoidable economic impacts.

Secondly, uncertainty around power shortages, a potential housing crisis, and regulatory crackdowns have dampened enthusiasm for the country’s near-term prospects.

Finally, Xi Jinping eliminated term limits on the presidency in 2018, potentially positioning himself to lead China indefinitely. As the Chinese Communist Party’s 20th National Party Congress approaches later in the year, if the country is still on uncertain footing, it could create a tense political atmosphere in Beijing.

3. The Year of the Worker

Labor dynamics have stayed in the spotlight since the pandemic upended the world of work. There are a number of trends that emerge from this broader theme:

- The labor shortages that emerged during the pandemic will remain in place in 2022 and beyond. Certain sectors, such as cybersecurity, are facing acute shortages of skilled workers

- There is a broad consensus that the future of office work is “hybrid”. Companies that don’t offer flexibility will face a disadvantage in attracting talent

- The internet and social media have opened up a number of career pathways for individuals to earn an income beyond simply working for a company

- Work/life balance and burnout will be central points in discussions around workplace culture

4. The Changing Digital Ecosystem

If predictions are any indication, we’ll be hearing a lot more about NFTs and Web3. There are plenty of opinions on the former, and they run the spectrum from exuberant to outright bearish. Whether the hype surrounding profile picture NFTs dies down is anyone’s guess, but the technology has opened the door to a lot of experimentation for artists and creators.

On that note, experts are generally excited about the prospects of the burgeoning “Creator Economy”—a catch-all term describing the new technological ecosystem and growing infrastructure that is allowing individual content creators to monetize and flourish.

Another trend that is picking up steam is ecommerce centered around social media. The ability to purchase products straight from influencers is becoming more common on major social platforms, and ecommerce companies are creating more products to support influencers in their marketing endeavors.

By 2026, Gartner estimates that 60% of Millennial and Gen Z consumers will prefer making purchases on social platforms over traditional digital commerce platforms.

5. Inflation Slowly Eases Off

Worries about inflation have always cropped up here and there, but in countries like the U.S., truly damaging amounts of inflation haven’t been seen since the 1980s.

Last year, the narrative changed.

After trillions of dollars of pandemic stimulus and borrowing, inflation suddenly came back on the radar—and it was not “transitory” as early central bank statements hoped. Now, going into 2022, experts expect higher-than-normal inflation levels to continue.

While inflation is expected to have an impact going forward, experts also see it leveling off (relative to 2021) as supply chain disruptions work themselves out.

6. Another Banner Year of Electric Vehicles

As climate change dominates more of the spotlight in 2022, regulatory actions will force automakers to consider the future of their fossil-fuel models.

Even as incentives are slowly rolled back in a number of markets, EV sales are expected to set new records this year. As well, electrification of fleets will be a trend that gathers momentum.

Industrial and battery metals like lithium and cobalt surged by 477% and 208%, respectively, in 2021, a trend that many experts believe will stretch into 2022.

The Good Stuff

Of the hundreds of sources we looked at, here were a few that stood out as memorable and comprehensive:

- Bloomberg’s Outlook 2022: This article compiled over 500 predictions from Wall Street banks and investment firms.

- The All-In Podcast’s 2022 predictions: This lively podcast, featuring Chamath Palihapitiya, Jason Calacanis, David Sacks, and David Friedberg, is always entertaining and informative. In this predictions episode, biggest business winners and losers is great, as is best performing asset.

- Eurasia Group’s Top Risks for 2022: This comprehensive group of articles covers a lot of ground, and offers up some very credible predictions as to what might happen on the world stage this year.

- Wood Mackenzie’s Predictions for 2022: Wood Mackenzie analysts offer 10 predictions for key developments expected in the energy and natural resources industries in 2022.

Lastly, if you’ve found our Prediction Consensus useful, we’re going to be diving even deeper into this subject matter in the coming weeks.

Our VC+ members get access to the whole Global Forecast 2022 series, which features a webinar and additional articles that flesh out predictions for the coming year in even more detail. You can learn more about it here.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001