Technology

Visualized: A Snapshot of the Global Personal Tech Market

A Snapshot of the Global Personal Tech Market

For many, it’s become difficult to function in day-to-day life without the use of a mobile phone. The average American checks their phone 96 times a day—that’s once every 10 minutes.

But it’s not just mobile phones that have become increasingly intertwined with our everyday lives. A plethora of accessories and devices, known as smartphone multipliers, have surged in popularity—this market is set to generate $459 billion in revenue by the end of 2020.

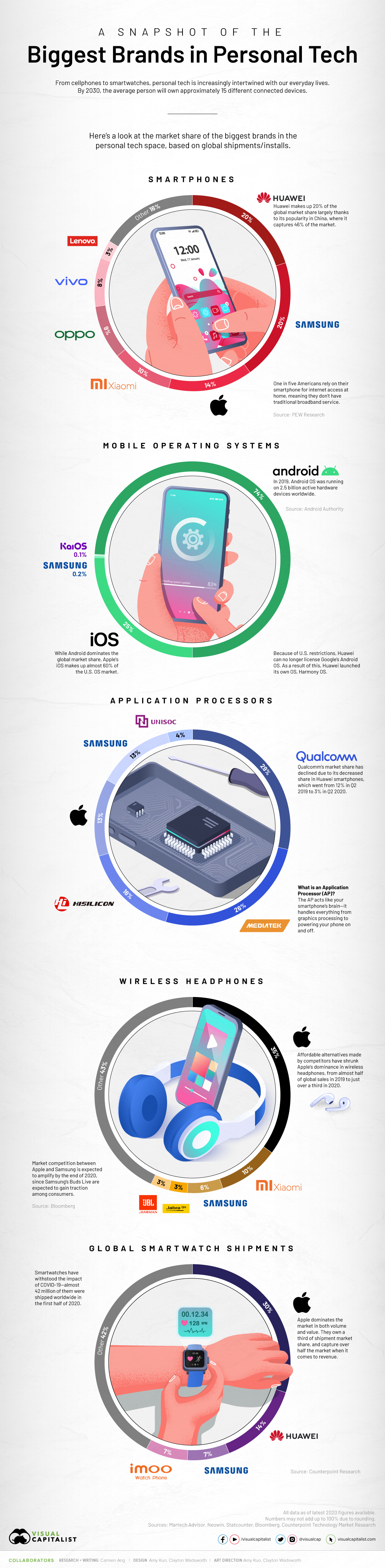

Which brands are capitalizing on this lucrative market? Today’s graphic provides a snapshot of the leading tech brands currently dominating the personal tech space, based on the most recent global market share data on shipments and installs.

How the Brands Stack Up, by Personal Tech Device

Though far from exhaustive, we’ve selected a few popular devices to hone in on, providing key insights on some of the top players in the personal tech space as of 2020.

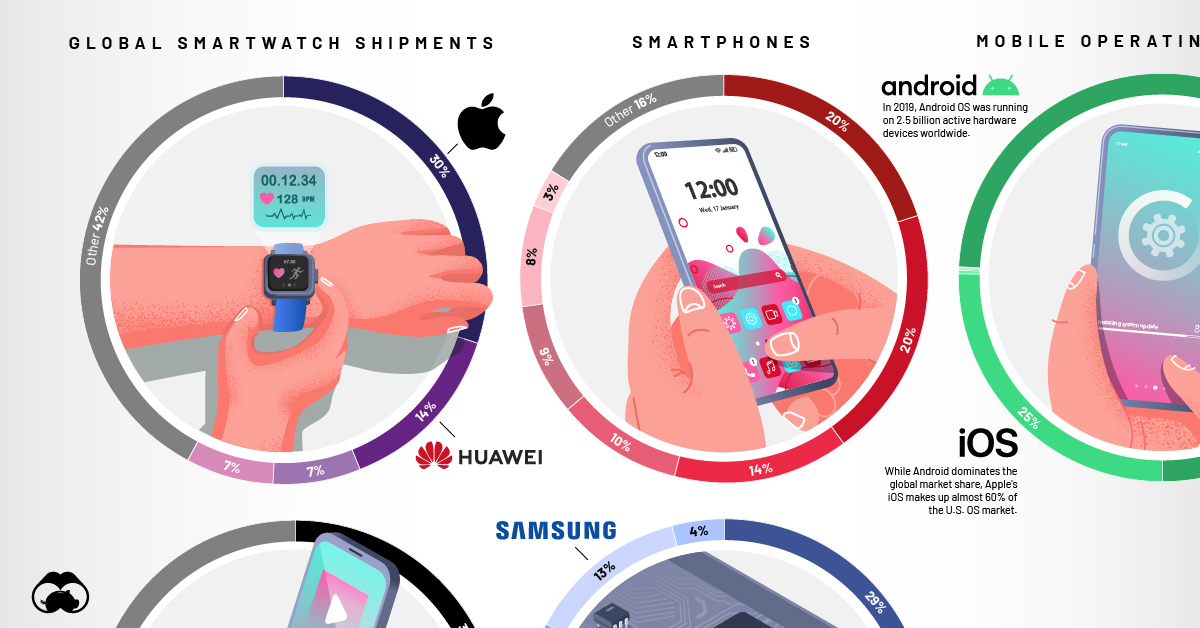

Smartphones

Smartphones are an essential part of the personal tech conversation—by 2025, there will be an estimated 5.8 billion smartphone users worldwide, or roughly 70% of the global population.

| Brand | Global Smartphone Shipments Market Share |

|---|---|

| Huawei | 20% |

| Samsung | 20% |

| Apple | 14% |

| Xiaomi | 10% |

| Oppo | 9% |

| Vivo | 8% |

| Lenovo | 3% |

| Other | 16% |

Currently, Huawei and Samsung hold the largest share of the global market, at 20% each. Chinese company Huawei’s dominance is concentrated in its home country, where it captures almost half of smartphone sales. Like Huawei, Samsung’s market dominance is amplified in its home country South Korea, where it makes up 67% of the market.

While Apple lags slightly behind Huawei and Samsung in global sales, the company rules in the U.S., where it captures 46% of market share.

Why isn’t Apple as successful in other parts of the world? A big factor is price. For instance, 90% of smartphones in India cost around $300, while iPhones start at $999.

Smartphone Operating Systems

Of course, smartphones are useless without an operating system (OS). Each smartphone OS essentially acts as your phone’s nervous system, running all applications and programs, as well as managing network and WiFi connectivity.

| Brand | Global Market Share (by units) |

|---|---|

| Android | 74.3% |

| iOS | 25.2% |

| Samsung | 0.2% |

| KaiOS | 0.1% |

| Unknown | 0.1% |

When it comes to the OS market, Google-owned Android dominates by a landslide, making up 74% of global market share. This makes sense, considering that both the leading smartphone companies, Huawei and Samsung, use Android OS on a number of their devices.

However, it’s important to note that newer Huawei phones won’t operate on Android. When the Chinese tech giant was blacklisted in the U.S., it was no longer able to license Android’s OS. As a result, Huawei launched its own HarmonyOS to fill the gap.

Smartphone Application Processors

If a smartphone’s OS acts like its nervous system, then the application processor (AP) functions like a brain. APs handle everything from image processing and graphics to powering your phone on and off.

| Brand | Global Market Share (by units) |

|---|---|

| Qualcomm | 29% |

| MediaTek | 26% |

| HiSilicon | 16% |

| Apple | 13% |

| Samsung | 13% |

| Unisoc | 4% |

Qualcomm is currently the largest provider of application processors, capturing almost 30% of the global market share. While it currently holds the top spot, its market share has declined since 2019, largely due to a decrease in usage in Huawei products.

After being banned in the U.S., Huawei shifted suppliers for this crucial part. Instead of buying from Qualcomm—an American company—it now relies on HiSilicon, which is based in China.

Wireless Headphones

The wireless headphone market is growing fast—in 2019, it was valued at $2.5 billion. Between 2020 to 2027, it’s set to increase at a compound annual growth rate (CAGR) of 20.3%.

| Brand | Global Sales Units Market Share |

|---|---|

| Apple | 35% |

| Xiaomi | 10% |

| Samsung | 6% |

| Jabra | 3% |

| JBL | 3% |

| Other | 43% |

Apple currently dominates the wireless headphone space, making up over a third of global market share. The company is expected to sell 82 million units by the end of 2020.

Despite this, it’s important to note that Apple’s dominance has decreased significantly in 2020 compared to 2019, when it captured over 50% of the global market. Apple’s decline is likely due to the emergence of cheaper alternatives from companies like Lypertek Tevi or 1More, which offer comparable products at about half the cost of Apple’s AirPods.

Smartwatches

Health and wellness have been top priorities among consumers recently, which has had a positive impact on the global smartwatch market—in the first half of 2020, it’s shown a 20% growth in revenue, compared to a year prior.

| Brand | Global Smartwatch Shipments Market Share |

|---|---|

| Apple | 30% |

| Huawei | 14% |

| Samsung | 7% |

| imoo | 7% |

| Other | 42% |

Like wireless headphones, Apple dominates the smartwatch market, in both volume and value. When looking at global shipments in Q2 2020, the company makes up 30% of the market share—however, in terms of revenue, Apple’s piece of the pie rises to 50%.

The Only Constant is Change

It’s clear that no matter who leads the list for each type of personal tech, these spots are never static—there’s always room for disruption.

How long will Apple hold its top spot in the wireless headphone market? Will Qualcomm’s dominance of the AP market continue to shrink?

Things are certain to change—the only question is, how?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?