Technology

The Multi-Billion Dollar Industry That Makes Its Living From Your Data

The Multi-Billion Dollar Industry That Makes Its Living From Your Data

In the ocean ecosystem, plankton is the raw material that fuels an entire food chain. These tiny organisms on their own aren’t that remarkable, but en masse, they have a huge impact on the world.

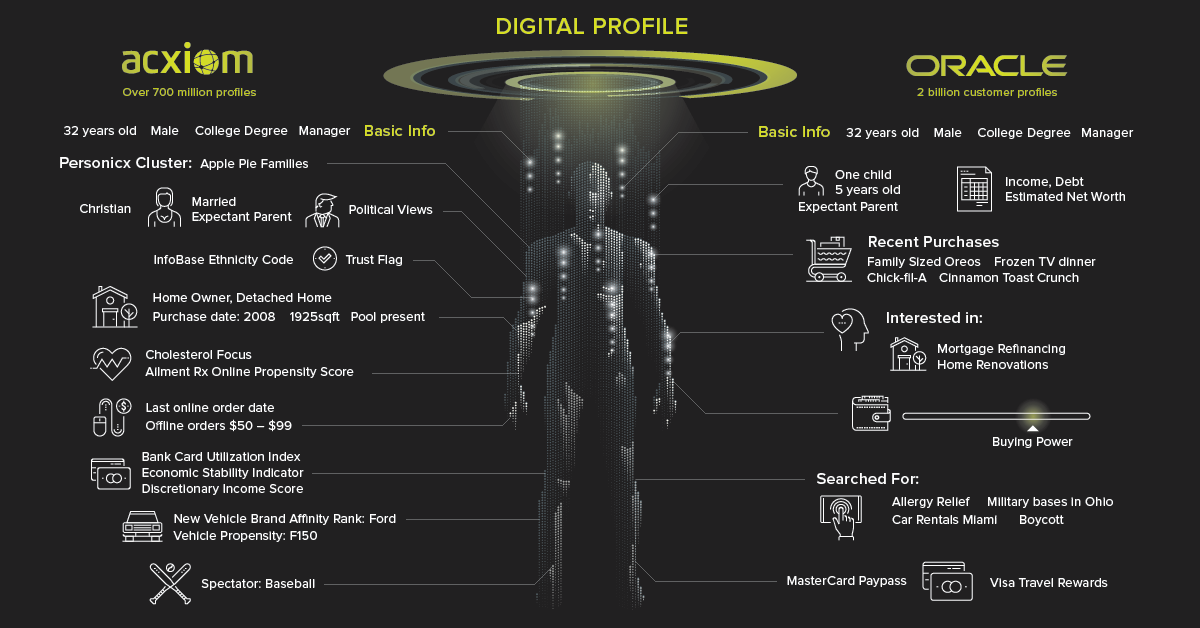

Here on dry land, the massive volume of content and meta data we produce fuels a marketing research industry that is worth nearly $50 billion. Every instant message, page click, and step you take now produces a data point that can be used to build a detailed profile of who you are.

Every breath you take, Every move you make

The coarse-grained demographics and contact information of yesteryear seems quaint compared to today’s sophisticated data collection battleground. In the past, marketers would make judgement calls on your likely income and family structure based on where you lived, and you’d receive “targeted” mail and calls from telemarketers. Loyalty programs and the emergence of web analytics pushed things a little further.

Today, the steady march of technological advancement has created a vast data collection empire that measures every aspect of your digital life and, increasingly, your offline life as well. Facebook alone uses nearly one hundred data points to target ads to you – everything from your marital status to whether you’ve been on vacation lately or not. Telecoms have access to extremely detailed information on your location. Apple has biometric data.

Also watching your every move are web trackers. “Cookie-syncing” is one of the sneaky ways advertisers can follow you around the internet. Basically, cookie-syncing allows third parties to share browsing information at such a large scale that even the NSA “piggybacks” off them for surveillance purposes.

The recent sales growth of smart speakers will only increase the breadth of data companies collect and analyze. Amazon and Google have both filed patents for technology that would essentially allow them to mine audio recordings for keywords. Advertisers could potentially target you with diapers before your family and friends even know you’re expecting a baby.

Following the ones and zeros

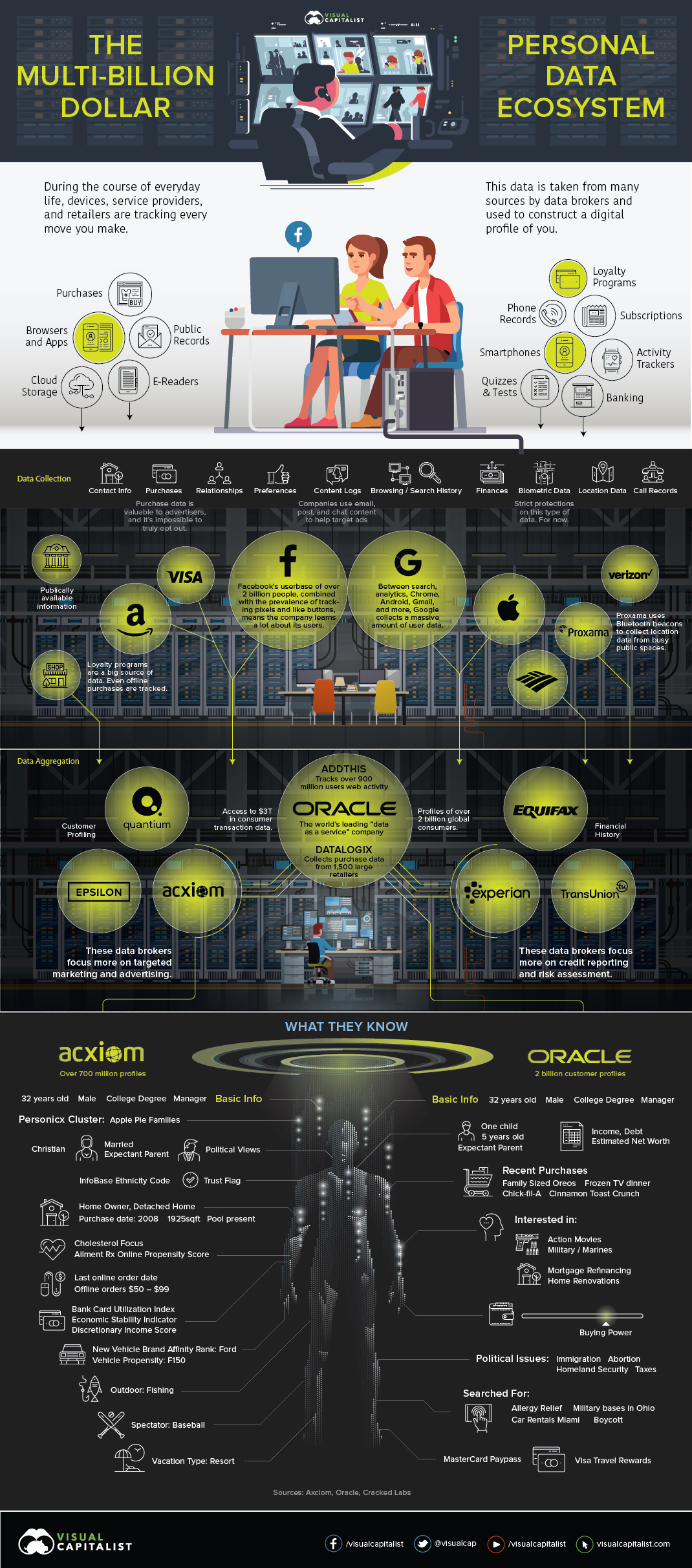

While web trackers and companies like Apple and Google are collecting a lot of personal and behavioral data, it’s the whales of the data ecosystem – data brokers – who are creating increasingly detailed profiles on almost everyone.

Data brokers trade on the privacy of consumers and operate in the shadows.

– Senator Al Franken (D-Minn)

The goal of data brokers, such as Experian or Acxiom, is to siphon up as much personal data as possible and apply it to profiles. This data comes from a wide variety of sources. Your purchases, financial history, internet activity, and even psychographic attributes are mixed with information from public records to create a robust dossier. Digital profiles are then sorted into one of thousands of categories to help optimize advertising efforts.

Fear the shadow profile?

According to Pew Research, 91% of Americans “agree” or “strongly agree” that people have lost control over how personal information is collected and used.

Though optimizing clickthroughs is a big business, companies are increasingly moving beyond advertising to extract value from their growing data pipeline. Amalgamated data is increasingly being viewed as a clever way to assess risk in the decision-making process (e.g. hiring, insurance, loan or housing applications), and the stakes for consumers are going up in the process.

For example, a man may feel comfortable sharing their HIV status on Grindr (for practical reasons), but may not want that information going to a third party. (Unfortunately, that really happened.)

In 2015, Facebook filed a patent for a service that would help insurance companies vet people based on the credit ratings of their social network.

The More You Know

Below the surface of our screens, our digital profiles continue to take shape.

Measures like adjusting website privacy controls and clearing cookies are a good start, but that’s only a fraction of the data companies are collecting. Not only do data brokers make it hard to officially opt out, their partnerships with corporations and advanced data collection methods cast such a wide net, that it’s almost impossible to exclude individual people.

Data brokers have operated with very little scrutiny or oversight, but that may be changing. Under intense public and governmental pressure, Facebook recently cut ties with data brokers. For a company that has bullishly pursued monetization of user data at every turn, the move is a sign that the public sentiment is changing.

The more information on the personal data industry, visit Cracked Labs’ report on the issue.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?