Visual Capitalist

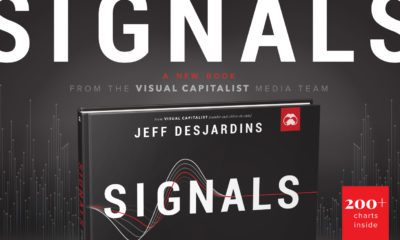

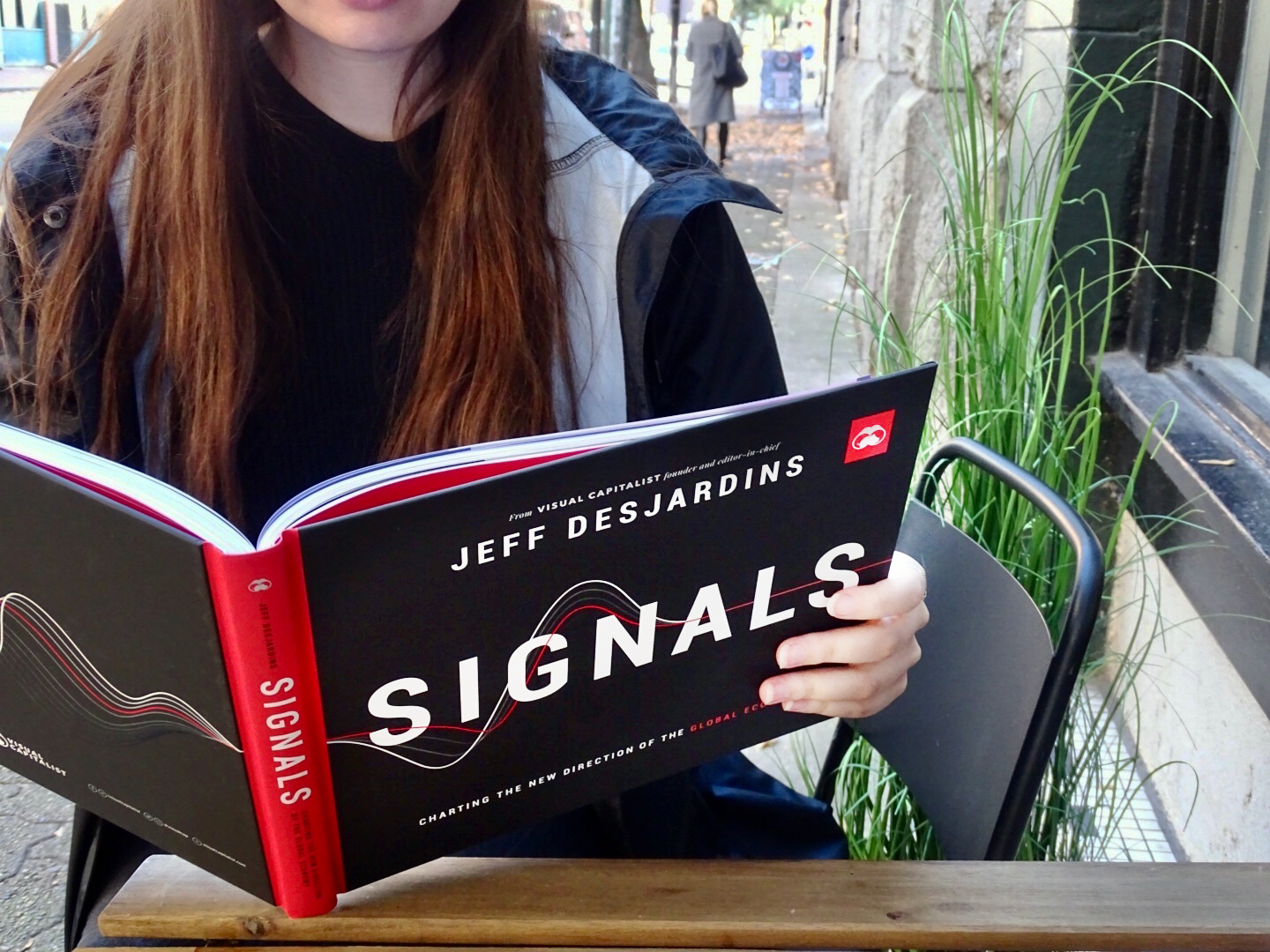

Our New Book “Signals” is Officially Published!

Earlier this year, we launched a campaign to help fund our second ever book, Signals: Charting the New Direction of the Global Economy. Thanks to over 1,200 backers, we reached our funding target, making the book a reality.

After months of research and design, we submitted Signals to the printers in September, and we are delighted to announce that it is officially available for purchase.

What’s Signals all About?

Did you know, that over the next three years humanity will have created more new data than in all of human history combined? More data inevitably means more complexity, which makes it harder to narrow down the root causes that will lead to future trends.

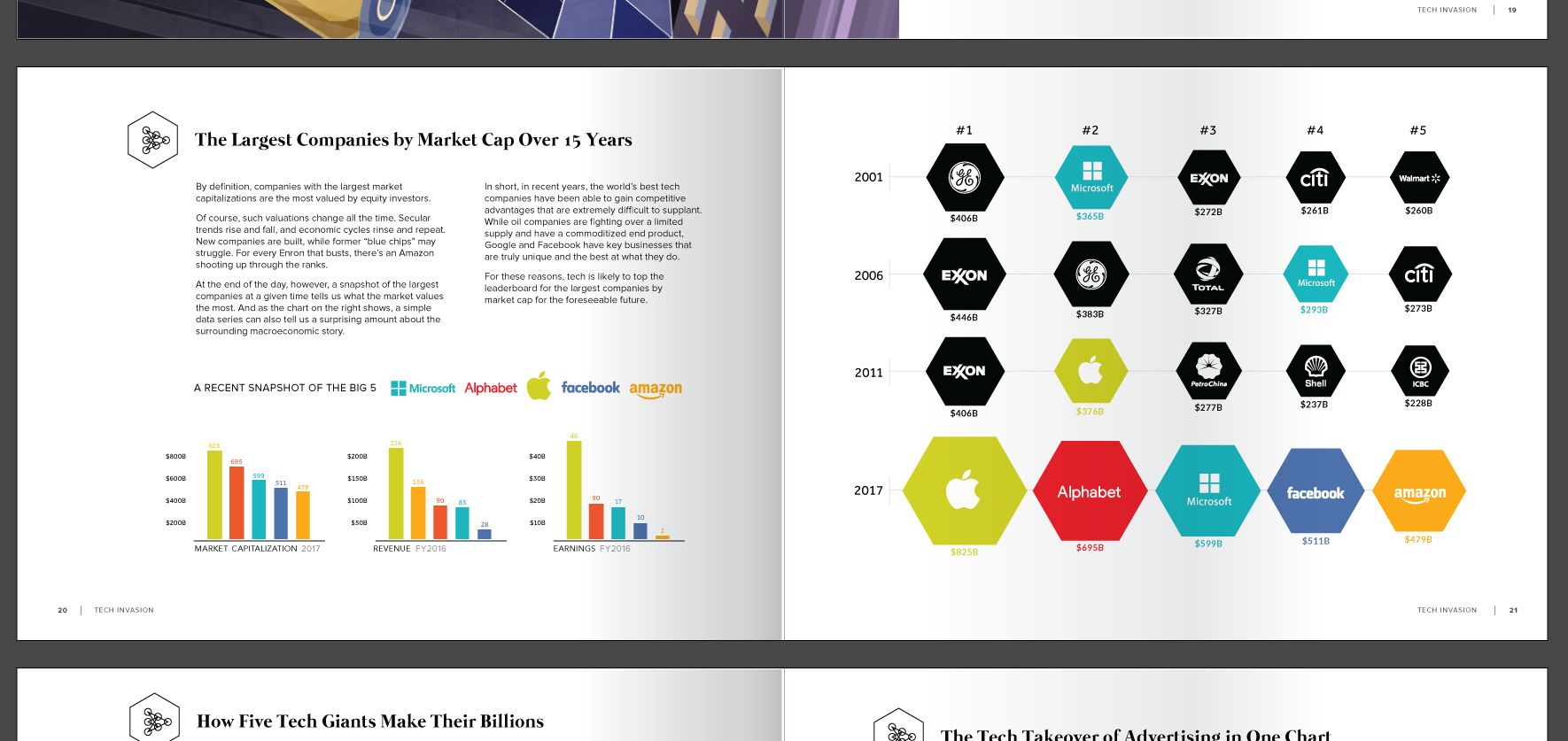

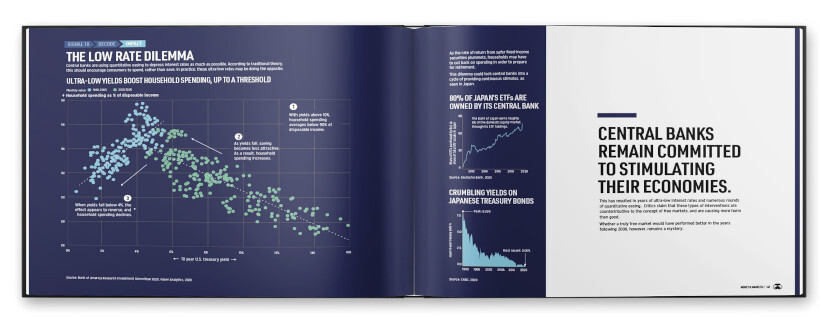

Our new data-driven book identifies clear takeaways—called ‘signals’— that are shaping the future of the global economy. Every chapter uses powerful charts and data visualizations to put each signal into perspective and simplify complex, global trends.

Each signal covered in the book comes with:

- A graphical road map to explain its journey

- A data-driven dashboard

- An indication of the signal’s overall strength

- Supporting charts and data visualizations that put each signal into perspective, showing its potential impact on the global economy

Still to get your copy of Signals? No problem, you can place your order through the Visual Capitalist Store below.

Still to get your copy of Signals? No problem, you can place your order through the Visual Capitalist Store below.

To learn the full backstory of Signals, please visit our Kickstarter page, where we shared regular updates.

Thanks again to everyone who supported us along the way, we can’t wait to hear what you make of our latest book.

Best of

Best Visualizations of March on the Voronoi App

We round up the most popular, most discussed, and most liked visualizations of the month on Voronoi, our new data storytelling platform.

At the end of 2023, we publicly launched Voronoi, our free new data discovery app!

The initial response from both users and creators has been incredible. We now have millions of in-app views, and there are already more than 700 interesting visualizations to discover, many of which will never be published on Visual Capitalist.

For that reason, we’ve chosen to highlight some of the most popular visualizations and creators from March in this roundup. To see them and many others, make sure to download the app!

Let’s take a look at a popular creator worth highlighting, as well as the most viewed, most discussed, and most liked posts of the month.

POPULAR CREATOR

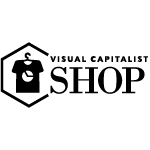

Ehsan Soltani

Visual Capitalist isn’t the only creator on the Voronoi app.

Instead, it features incredible data-driven charts and stories from many of the world’s best creators, like Ehsan Soltani.

Ehsan is an economist, and one of the most prolific creators on Voronoi so far. He’s published 41 visualizations on wide-ranging subjects such as:

- The world’s biggest “money printer” economies

- Global commodity returns

- Corruption by country

- Inflation rates in advanced economies

For those interested in what’s happening with the global economy, Ehsan Soltani is definitely worth a follow!

![]() View all of Ehsan’s visuals on Voronoi today.

View all of Ehsan’s visuals on Voronoi today.

MOST VIEWED

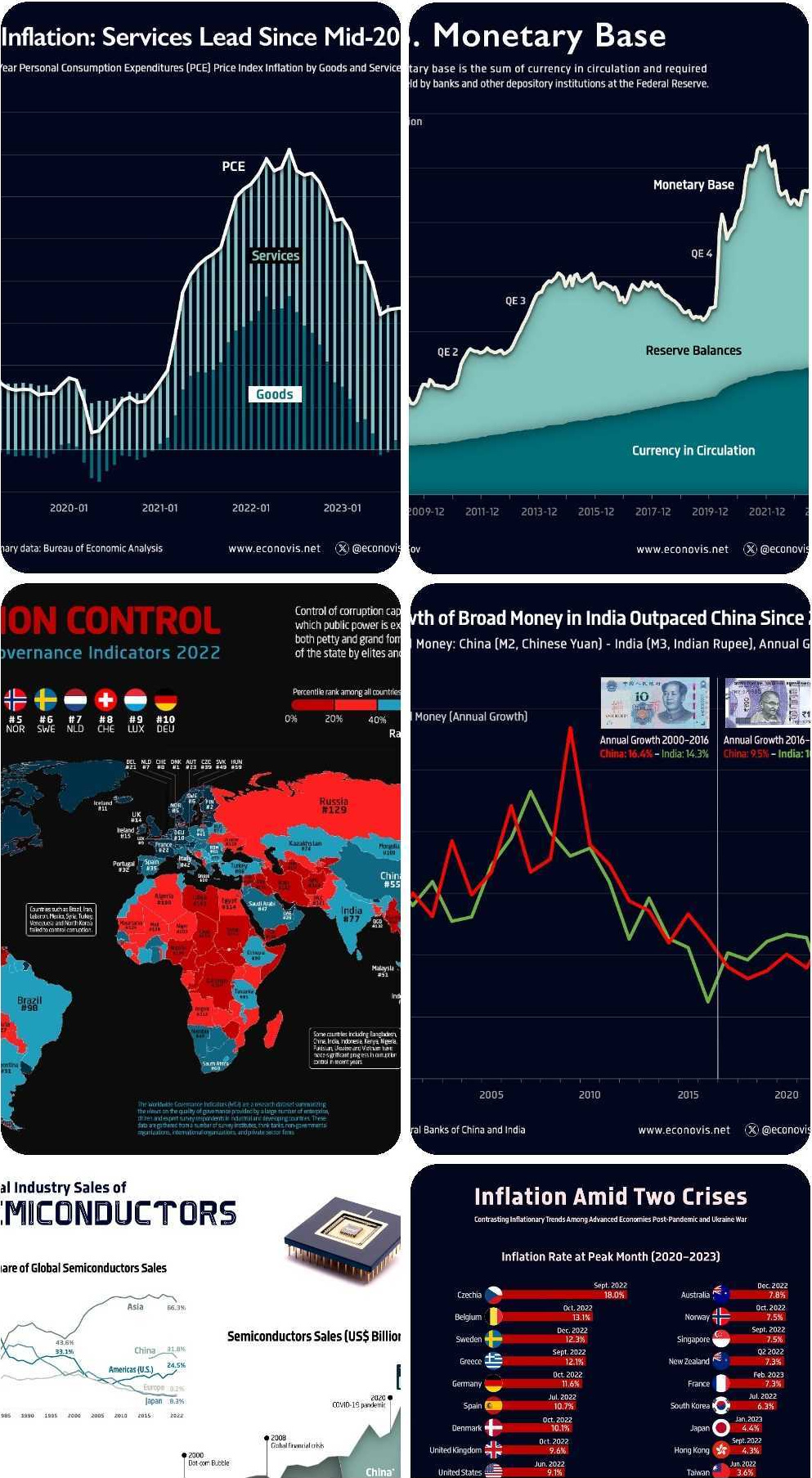

The 12 Most Spoken Languages in 2023

Which languages are most commonly spoken around the world by native speakers?

This visualization from Visual Capitalist was one of the most viewed by users, and it highlights the top languages spoken around the world.

Data here comes from the Ethnologue database, the most rigorous and comprehensive language database globally. It’s worth noting that it highlights languages spoken by native speakers only, so second languages are not counted here.

![]() Get the data behind this visual on Voronoi today.

Get the data behind this visual on Voronoi today.

MOST DISCUSSED

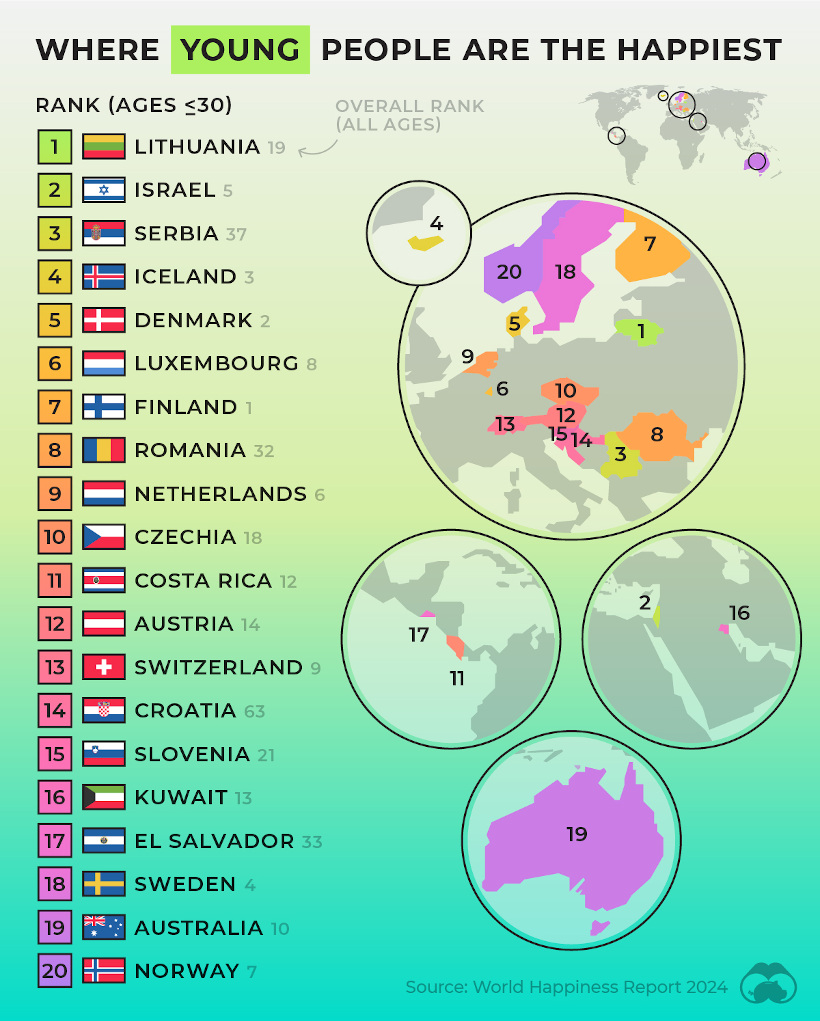

Where Young People are Happiest

The most commented on visualization from Visual Capitalist showed the countries with the happiest young people (under 30 years old).

This comes from the World Happiness Report, which Visual Capitalist covers extensively every year.

In this year’s edition, one particularly interesting feature focused on happiness discrepancies between age groups. For example, in some countries, younger people were much happier than the average population—in others, older populations were far happier.

![]() To join the conversation, download Voronoi today.

To join the conversation, download Voronoi today.

MOST LIKED

The Fastest Growing Brands in the U.S.

The most liked visual on Voronoi in March came from Visual Capitalist, showing the brands that are growing the fastest in the United States.

The data here comes from Morning Consult, and shows the share of customers that were considering purchasing a brand in October 1-24, 2023, and subtracted the share of those who said the same between Jan 1-31, 2023.

![]() Get the data behind this visual on Voronoi today.

Get the data behind this visual on Voronoi today.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population