Agriculture

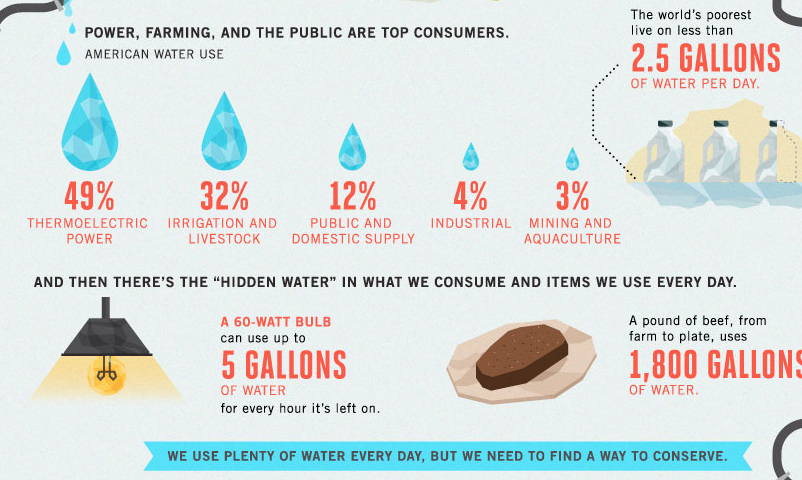

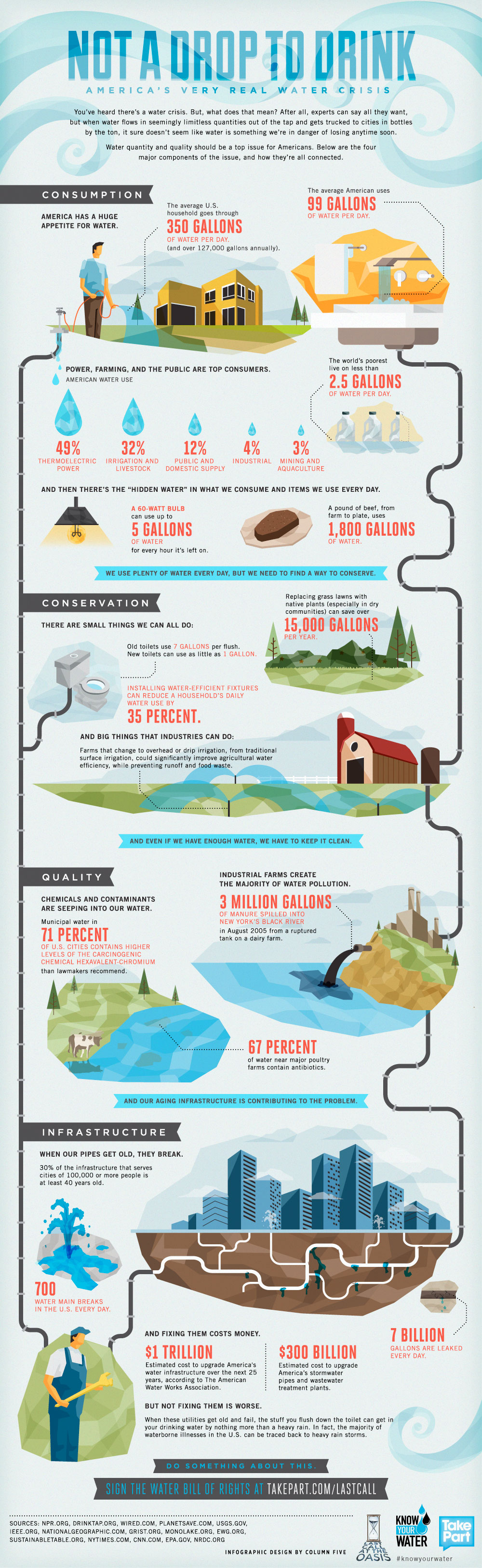

Not a Drop to Drink: America’s Water Crisis

Not a Drop to Drink: America’s Water Crisis

Almost a year ago, we had wrote about how we are potentially on the path to global Peak Water. Today’s infographic elaborates more on the problem in the United States on a national basis .

Right now, the average American consumes about 100 gallons of water per day both directly and indirectly. This is a problem of conservation and efficiency as much as it is supply, as the aging water infrastructure had its last upgrade during the Reagan era.

In the next 20 years, it is expected that $1.5 trillion needs to be spent on building new infrastructure alone.

At the same time, only 0.3% of freshwater occurs in lakes and streams. With massive droughts occurring in the West of the United States and rivers such as the Colorado River drying up, clearly initial supply is just as much of a concern in America’s water crisis.

To solve the problem of less reliable freshwater supply, countries such as Israel have been turning to desalination. Recently, the government built a megascale $500 million desalination plant to supply up to 20% of the households with regular water supply.

Investors know that with every great problem, there are opportunities abound in companies that can provide solutions. Previously, Sprott Global had outlined three distinct areas that people looking to invest in water management solutions should consider: adaption to water systems to handle changing weather patterns, improving water safety, and managing storm water in urban areas.

Original graphic by: Last Call at the Oasis

Markets

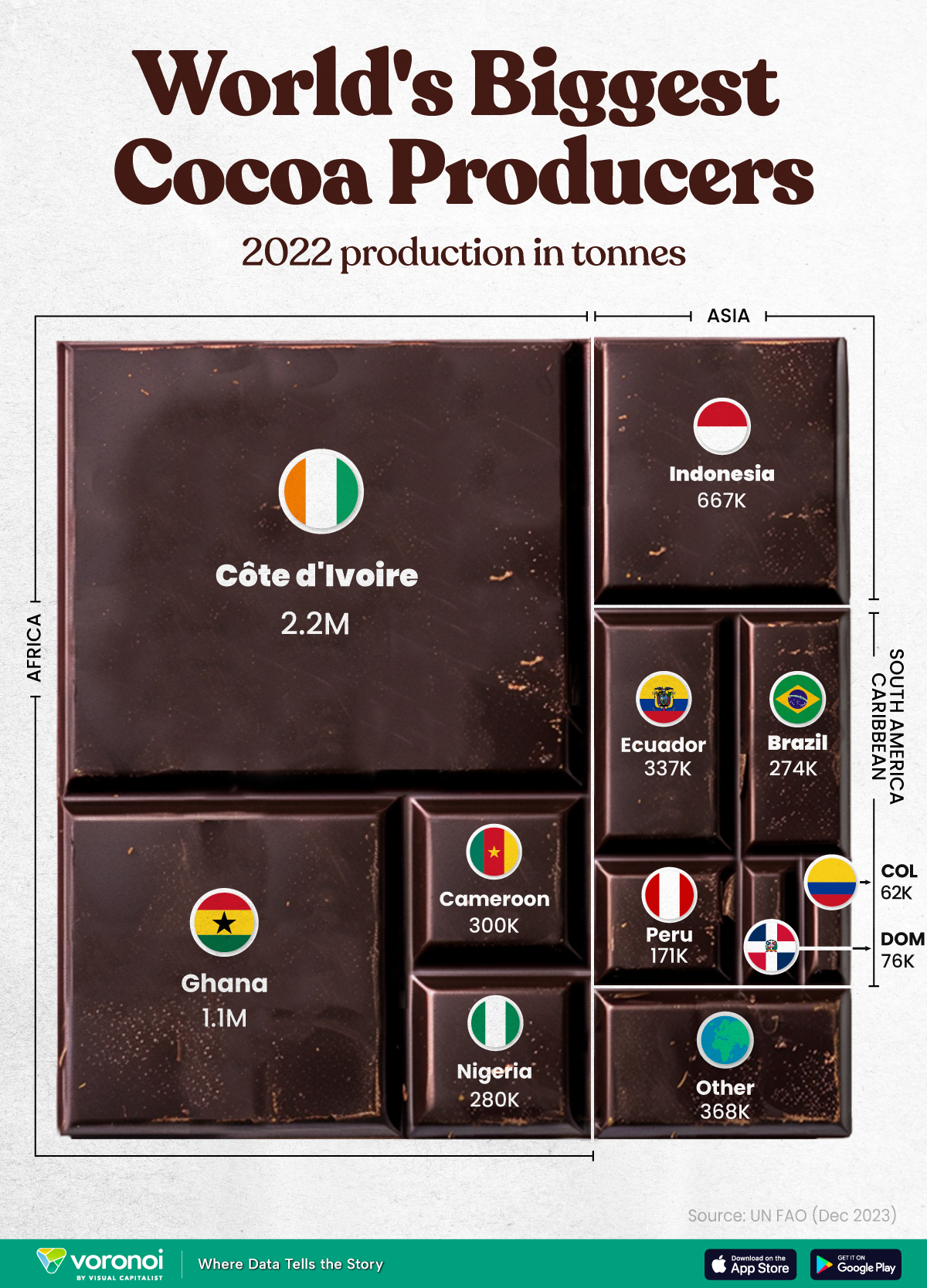

The World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

The World’s Top Cocoa Producing Countries

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

West Africa is home to the largest cocoa producing countries worldwide, with 3.9 million tonnes of production in 2022.

In fact, there are about one million farmers in Côte d’Ivoire supplying cocoa to key customers such as Nestlé, Mars, and Hershey. But the massive influence of this industry has led to significant forest loss to plant cocoa trees.

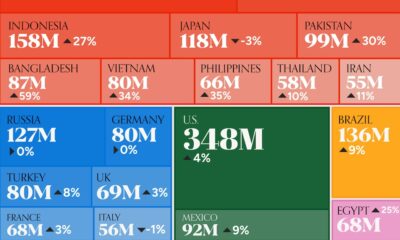

This graphic shows the leading producers of cocoa, based on data from the UN FAO.

Global Hotspots for Cocoa Production

Below, we break down the top cocoa producing countries as of 2022:

| Country | 2022 Production, Tonnes |

|---|---|

| 🇨🇮 Côte d'Ivoire | 2.2M |

| 🇬🇭 Ghana | 1.1M |

| 🇮🇩 Indonesia | 667K |

| 🇪🇨 Ecuador | 337K |

| 🇨🇲 Cameroon | 300K |

| 🇳🇬 Nigeria | 280K |

| 🇧🇷 Brazil | 274K |

| 🇵🇪 Peru | 171K |

| 🇩🇴 Dominican Republic | 76K |

| 🌍 Other | 386K |

With 2.2 million tonnes of cocoa in 2022, Côte d’Ivoire is the world’s largest producer, accounting for a third of the global total.

For many reasons, the cocoa trade in Côte d’Ivoire and Western Africa has been controversial. Often, farmers make about 5% of the retail price of a chocolate bar, and earn $1.20 each day. Adding to this, roughly a third of cocoa farms operate on forests that are meant to be protected.

As the third largest producer, Indonesia produced 667,000 tonnes of cocoa with the U.S., Malaysia, and Singapore as major importers. Overall, small-scale farmers produce 95% of cocoa in the country, but face several challenges such as low pay and unwanted impacts from climate change. Alongside aging trees in the country, these setbacks have led productivity to decline.

In South America, major producers include Ecuador and Brazil. In the early 1900s, Ecuador was the world’s largest cocoa producing country, however shifts in the global marketplace and crop disease led its position to fall. Today, the country is most known for its high-grade single-origin chocolate, with farms seen across the Amazon rainforest.

Altogether, global cocoa production reached 6.5 million tonnes, supported by strong demand. On average, the market has grown 3% annually over the last several decades.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries