Clearing the Clutter: Mining Research, the NI 43-101, and Due Diligence

The following content is sponsored by Prospector Portal

Clearing the Clutter of Research: NI 43-101 and Due Diligence

Mining companies offer the potential for great investment returns, but they also carry many risks because of the complex science behind mining and mineral exploration. This complexity can deceive, so it is important to have standards on how companies report the technical data.

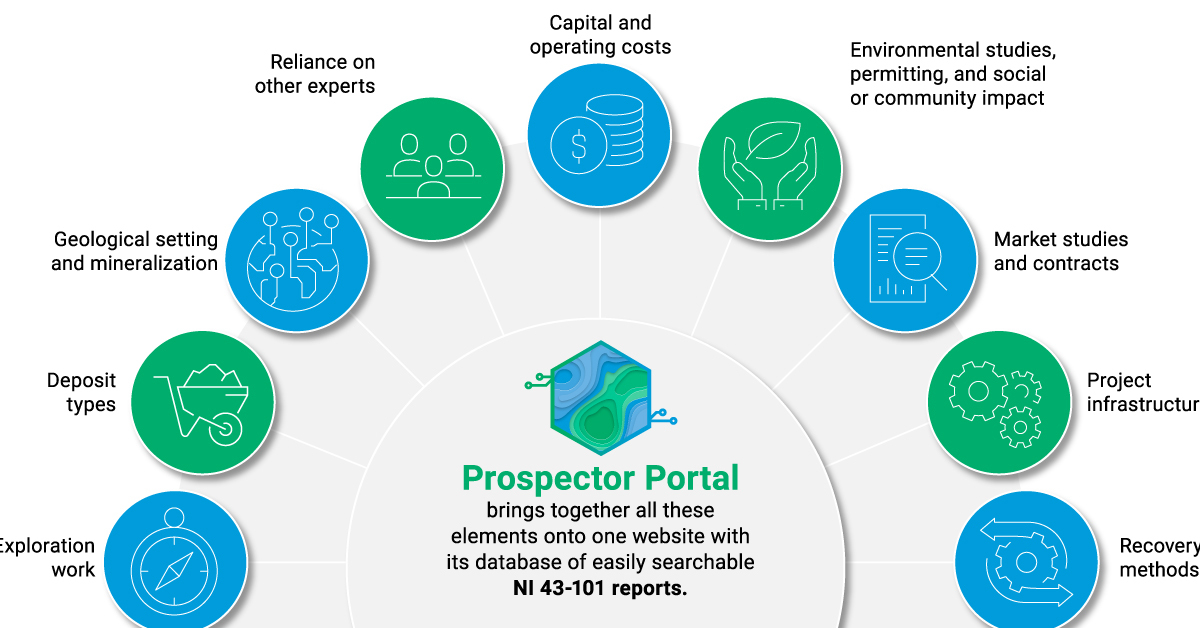

This infographic comes to us from Prospector Portal and takes a look at the events that led to the creation of the the NI 43-101, and the variety of information a mining project generates.

Why Does Mining Research Matter?

Bre-X and the Creation of the NI 43-101

The 1997 PDAC was the peak for one mineral exploration company, Bre-X. The annual event in Toronto serves as the gathering point for the global mining industry to raise capital, sell services, and highlight successes. It was there that Bre-X received an award for finding one of the largest gold deposits in the world, the Busang gold deposit in Indonesia.

Soon after the conference, Bre-X’s exploration manager fell to his death from a helicopter. There was mounting evidence that the junior’s project was a hoax and that the company’s geologist salted samples with gold from other sources.

In May 1997, the Toronto Stock Exchange (TSE) delisted Bre-X, vaporizing $3 billion in value as the company’s shares became worthless. The fraud deceived investors and undermined confidence in financial markets.

The TSE and the Ontario Securities Commission established the Mining Standards Task Force. This task force recommended stricter disclosure of drill results to ensure accuracy and a requirement to have a qualified geoscientist back up the technical data.

These recommendations culminated in the creation of the National Instrument 43-101 Standards for Disclosure of Mineral Projects.

How the NI 43-101 Can Answer Questions

Understanding the Due Diligence Process

Along with providing clear definitions for mining terms, the NI 43-101 outlines the necessary information for the technical reports in several sections. Each section can help to answer some questions that could arise when researching a company.

- Accessibility, Climate, Local Resources, Infrastructure, and Physiography:

Is a mining project logistically viable at this property’s location?

This portion of the NI 43-101 describes the topography, elevation, and vegetation around the property, along with the means of access, proximity to a population center, and the nature of transport to and from the site. In addition, the report can contain potential climate impacts on the length of operating season, and the availability of power, water, and personnel. - Property Description and Location:

Are there any potential ownership or issuance problems with the property?

In this section, you will find information about the location and area of the property, type of mineral tenure, and the company’s ownership along with any obligations to retain the property. This section must also include any other risks that can affect access, title, or the right and ability to perform work on the property. - History

What is the property’s history of development and production?

The history of the project outlines prior ownership and changes of ownership of the property, along with the work and results of previous exploration and development work at the property. Companies include historical mineral resource and mineral reserve estimates and any past production from the property. - Drilling

What kind of drilling will take place, and what are the results?

This section includes the type and extent of drilling, procedures followed, and a summary of results. These factors could impact the accuracy and reliability of the results. - Mineral Resource Estimates

How are the mineral resource estimates derived, and what factors are affecting those estimates?

This section outlines the key assumptions and methods used to estimate mineral resources. There is a report of the individual grade of each metal or mineral, along with relevant factors used to estimate this. There is also an outline of any external factors that affect mineral resource estimates such as taxation, environmental, or political. - Economic Analysis

What is the economic forecast for this property?

This includes any economic analysis for the project such as cash flow forecasts, net present value, and internal rate of return, along with summaries of taxes, royalties, or other interests applicable.

Mining and mineral exploration companies regularly disclose NI 43-101 reports as new information comes in. Management will file any material information on a system called SEDAR. However, SEDAR is an older format that makes the process difficult to search for specific information.

Clearing the Clutter to Know Your Risks

There are many factors that affect an investment decision, especially in the mining industry. This complexity can lead to volatile returns as one of the many variety of factors can affect the outcomes of a mineral project. The first step in understanding these risks is to know where to find the information in the NI 43-101.

“People aren’t allowed to just calculate resources on the back of an envelope anymore…You look at the resource boom we’re going through. The companies that don’t follow the rules, they stand out.”

– Maureen Jensen, Former Chair of the Ontario Securities Commission, 2007

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.