Money

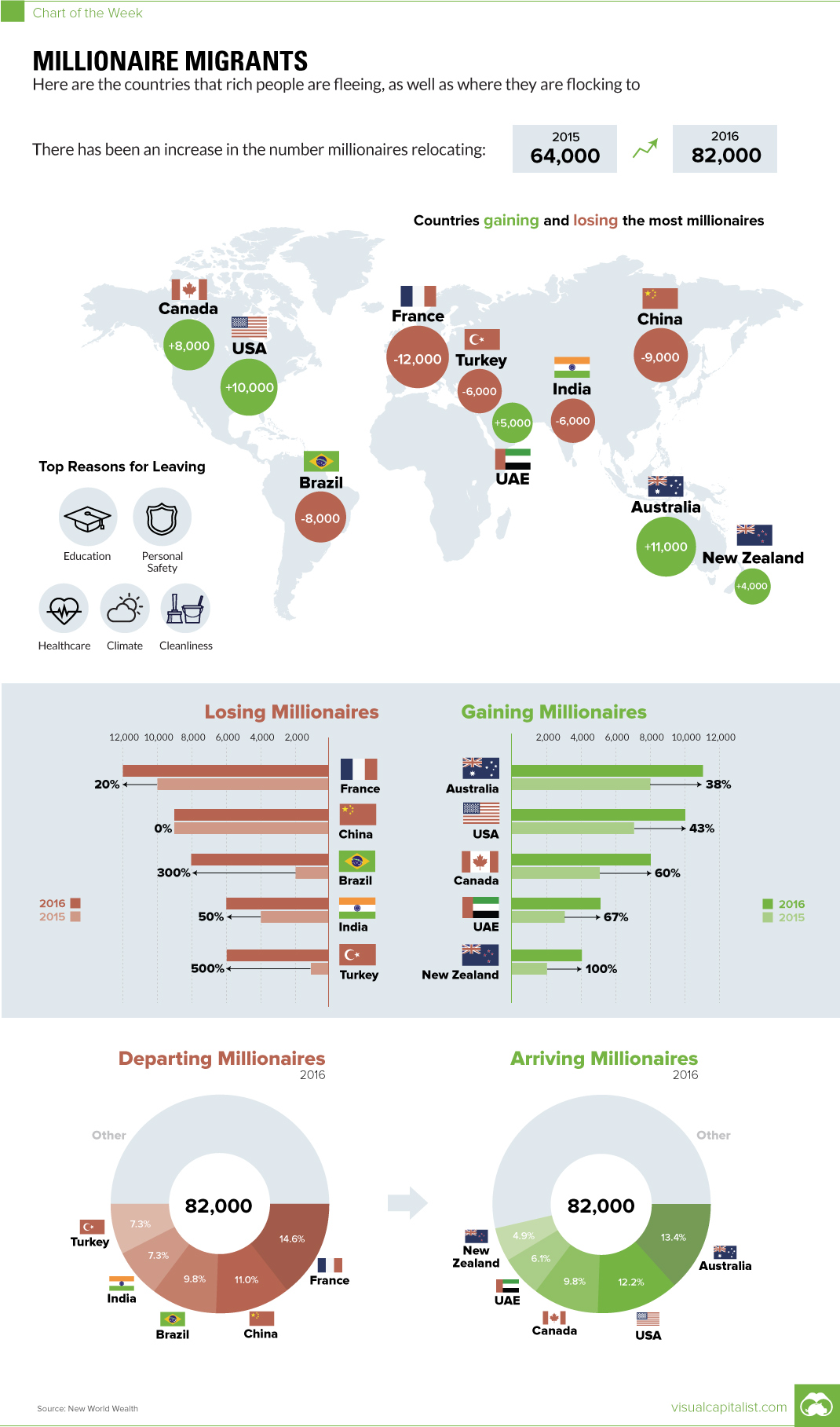

Millionaire Migrants: Countries That Rich People Are Flocking To

Millionaire Migrants: Countries That Rich People Are Flocking To

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Money may not buy happiness, but it does buy the ultimate flexibility for making financial and lifestyle decisions.

For many of the world’s millionaires, money provides a highly effective means to escape their home country when times get tough. They can pack their bags, and move their family and capital to a location that will provide superior opportunities for prosperity.

According to a new report by New World Wealth, this couldn’t have been truer for 2016, as the amount of millionaire migrants increased by 28% from the previous year.

Human and Capital Flight

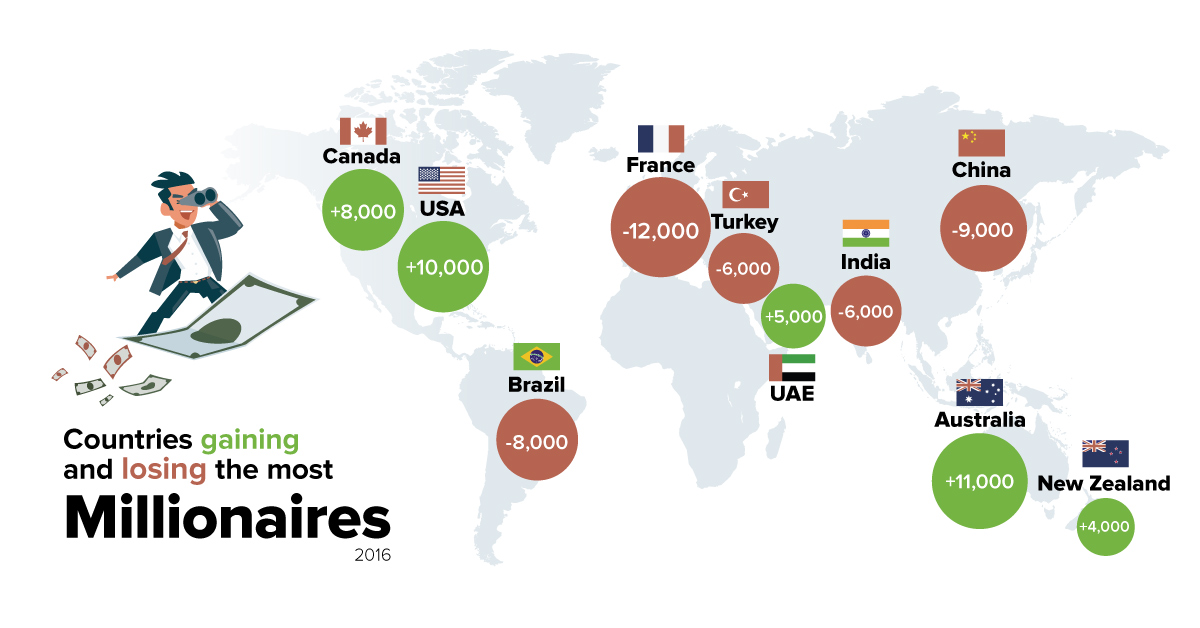

In 2016, there were a total of 82,000 millionaire migrants that left for greener pastures.

The Top Five Countries (Net Outflows)

| Country | 2016 | 2015 | Change | |

|---|---|---|---|---|

| 1 | France | -12,000 | -10,000 | 20% |

| 2 | China | -9,000 | -9,000 | 0% |

| 3 | Brazil | -8,000 | -2,000 | 300% |

| 4 | India | -6,000 | -4,000 | 50% |

| 5 | Turkey | -6,000 | -1000 | 500% |

France tops the list for a second straight year, as rich people dodge conditions that they consider to be adverse. France has rising religious tensions and populism, but it also has a tax system that is not particularly friendly to the ultra rich. The International Business Times calls the ongoing problem a “Millionaire Exodus”.

China and India both continue to have net outflows of millionaires, but two of the more interesting countries on this list are Brazil and Turkey.

Brazil continues to be deep in economic crisis, with its worst-ever recession likely continuing into its eighth-straight quarter in Q4 2016. The country also recently impeached Dilma Rousseff in August 2016. On the other hand, the Washington Post describes Turkey as a country that is in a “permanent state of crisis”. This may be a fair criticism, since in 2016 there was the assassination of a Russian ambassador, a currency crisis, an economic crisis, and also an attempted military coup.

Like most people, millionaires don’t like uncertainty – and they have the wherewithal and conviction to get out of places that have ongoing issues.

The Top Five Countries (Net Inflows)

| Country | 2016 | 2015 | Increase | |

|---|---|---|---|---|

| 1 | Australia | +11,000 | +8,000 | 38% |

| 2 | USA | +10,000 | +7,000 | 43% |

| 3 | Canada | +8,000 | +5,000 | 60% |

| 4 | UAE | +5,000 | +3,000 | 67% |

| 5 | New Zealand | +4,000 | +2,000 | 100% |

In 2016, Australia was the number one destination for millionaire migrants, with the United States and Canada being close behind.

New Zealand also had the amount of net inflows double, while the UAE remained a popular location for the wealthy in the Middle East.

Money

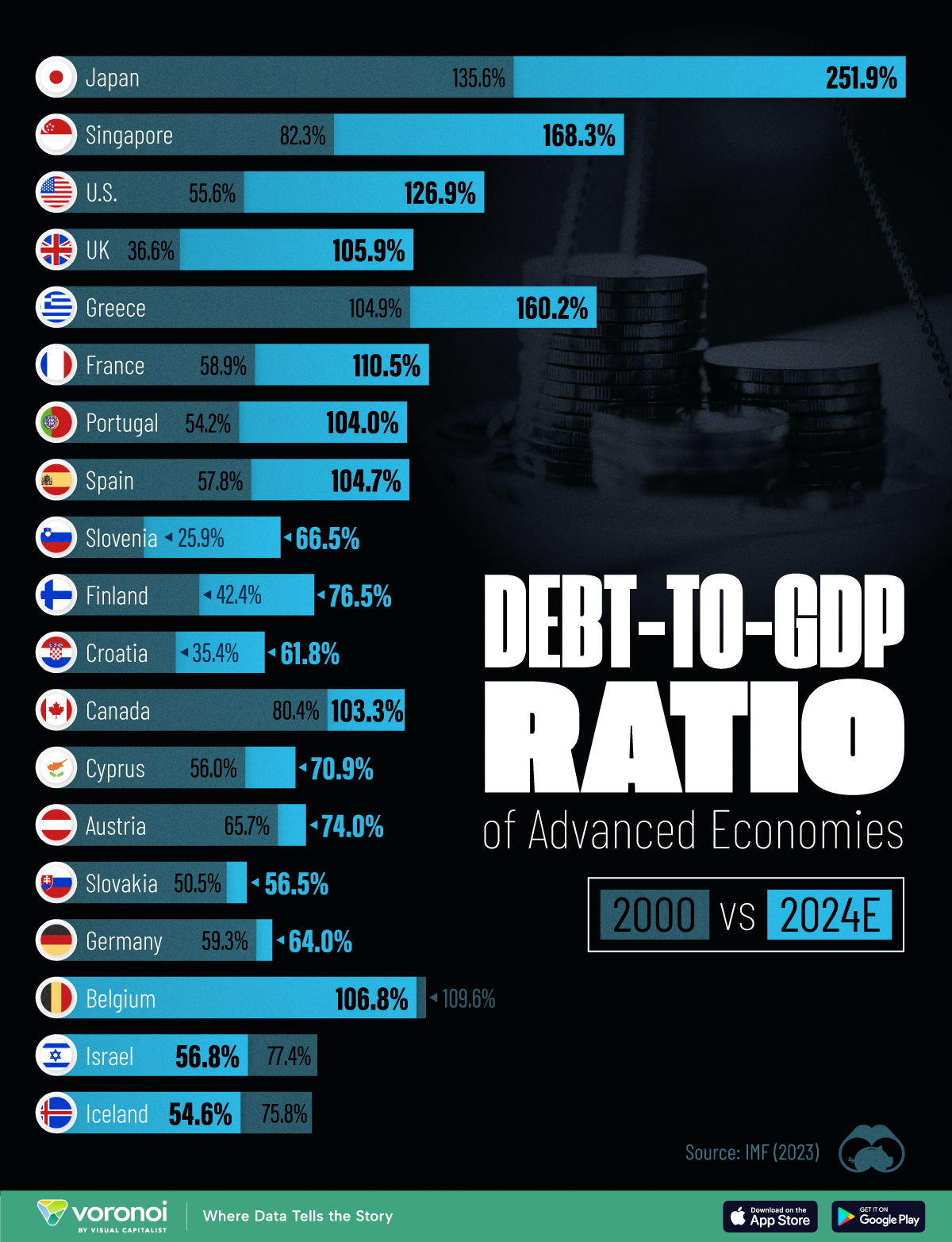

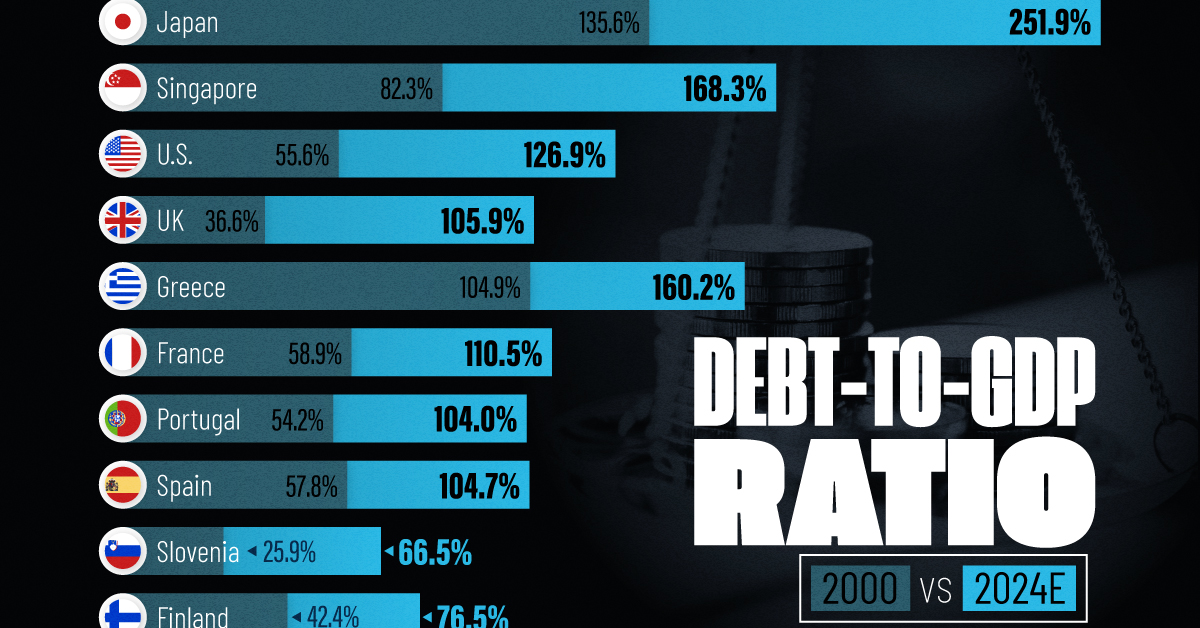

How Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

| Country | 2000 (%) | 2024 (%) | Change (pp) |

|---|---|---|---|

| 🇯🇵 Japan | 135.6 | 251.9 | +116.3 |

| 🇸🇬 Singapore | 82.3 | 168.3 | +86.0 |

| 🇺🇸 United States | 55.6 | 126.9 | +71.3 |

| 🇬🇧 United Kingdom | 36.6 | 105.9 | +69.3 |

| 🇬🇷 Greece | 104.9 | 160.2 | +55.3 |

| 🇫🇷 France | 58.9 | 110.5 | +51.6 |

| 🇵🇹 Portugal | 54.2 | 104.0 | +49.8 |

| 🇪🇸 Spain | 57.8 | 104.7 | +46.9 |

| 🇸🇮 Slovenia | 25.9 | 66.5 | +40.6 |

| 🇫🇮 Finland | 42.4 | 76.5 | +34.1 |

| 🇭🇷 Croatia | 35.4 | 61.8 | +26.4 |

| 🇨🇦 Canada | 80.4 | 103.3 | +22.9 |

| 🇨🇾 Cyprus | 56.0 | 70.9 | +14.9 |

| 🇦🇹 Austria | 65.7 | 74.0 | +8.3 |

| 🇸🇰 Slovak Republic | 50.5 | 56.5 | +6.0 |

| 🇩🇪 Germany | 59.3 | 64.0 | +4.7 |

| 🇧🇪 Belgium | 109.6 | 106.8 | -2.8 |

| 🇮🇱 Israel | 77.4 | 56.8 | -20.6 |

| 🇮🇸 Iceland | 75.8 | 54.6 | -21.2 |

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

See More Debt Graphics from Visual Capitalist

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?