Money

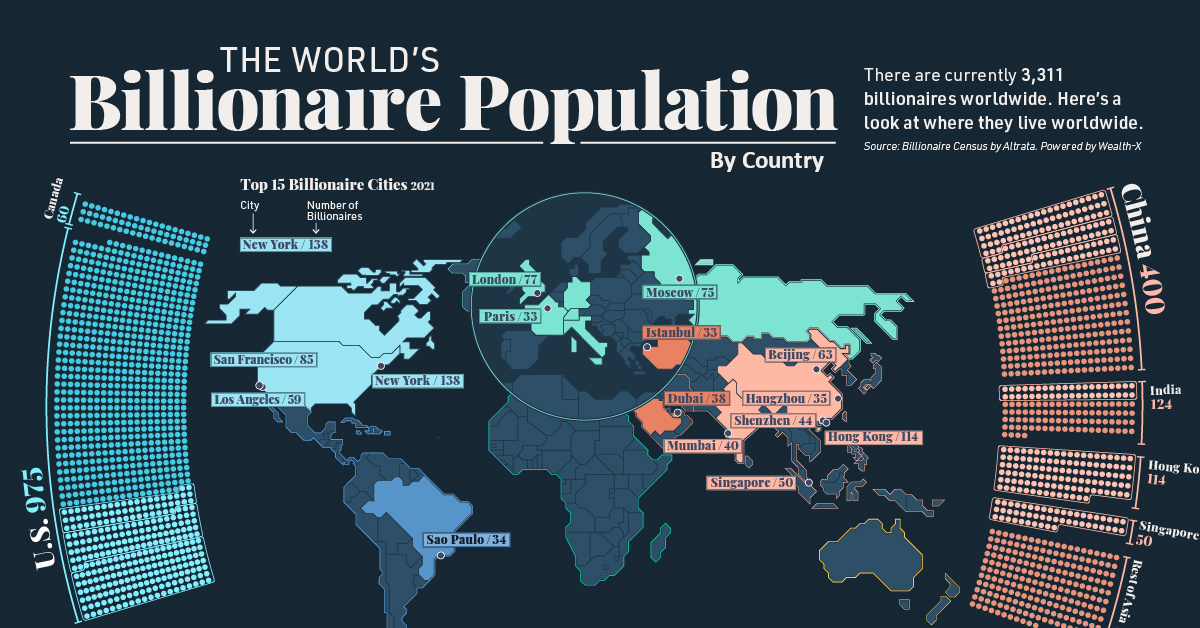

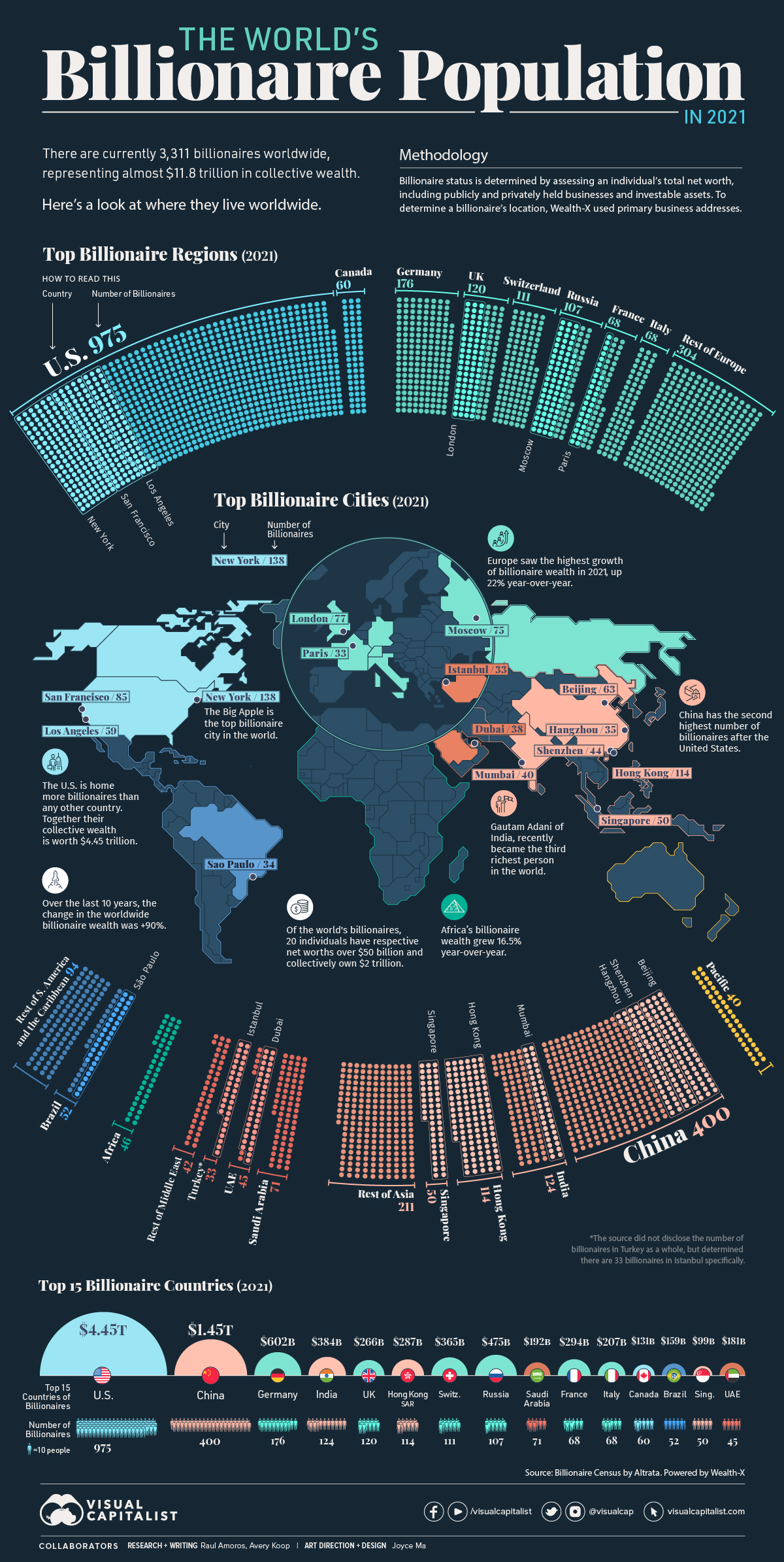

Mapped: The World’s Billionaire Population, by Country

Visualized: The World’s Billionaire Population

The world’s billionaires—only 3,311 individuals—represent almost $11.8 trillion in wealth. The global billionaire population continued to grow in 2021, increasing by 3%. Over the same period, billionaire wealth also increased by 18%.

This map uses data from the Wealth-X Billionaire Census to visualize where the world’s billionaires live and breaks down their collective wealth.

Note on methodology: The report uses proprietary data from Wealth-X. Billionaire status is determined by assessing an individual’s total net worth, including publicly and privately held businesses and investable assets. To determine a billionaire’s location, Wealth-X used their primary business address.

Billionaires by Region

We’ll begin by zooming out to look at how various continents and world regions rank in terms of their billionaire population.

North America is home to most billionaires, worth $4.6 trillion. The U.S., unsurprisingly, accounts for the majority of this wealth, with 975 billionaires and a collective net worth of $4.45 trillion.

| Rank | Region | Number of billionaires | Collective Billionaire Wealth |

|---|---|---|---|

| #1 | North America | 1,035 | $4.6 trillion |

| #2 | Europe | 954 | $3.1 trillion |

| #3 | Asia | 899 | $2.9 trillion |

| #4 | Middle East | 191 | $519 billion |

| #5 | Latin America and the Caribbean | 146 | $465 billion |

| #6 | Africa | 46 | $104 billion |

| #7 | Pacific | 40 | $89 billion |

In regional terms, Europe’s billionaire wealth is growing the fastest, up 22% year-over-year in 2021. In contrast, the year-over-year change in the Middle East was -12.5%.

Asia is inching towards Europe, holding almost a quarter of all billionaire wealth worldwide, compared to Europe’s 26.5%.

Wealth in Africa will also be important to watch in coming years. Although only home to 46 billionaires currently, the change in billionaire wealth increased by almost 17% year-over-year. Additionally, while they no longer live there, a number of the world’s billionaires hail from African countries originally.

Billionaires by Country

Now, let’s look at the ranking broken down by the top 15 countries:

| Rank | Country | Number of Billionaires | Collective Billionaire Wealth |

|---|---|---|---|

| #1 | 🇺🇸 US | 975 | $4.45 trillion |

| #2 | 🇨🇳 China | 400 | $1.45 trillion |

| #3 | 🇩🇪 Germany | 176 | $602 billion |

| #4 | 🇮🇳 India | 124 | $384 billion |

| #5 | 🇬🇧 UK | 120 | $266 billion |

| #6 | 🇭🇰 Hong Kong SAR | 114 | $287 billion |

| #7 | 🇨🇭 Switzerland | 111 | $365 billion |

| #8 | 🇷🇺 Russia | 107 | $475 billion |

| #9 | 🇸🇦 Saudi Arabia | 71 | $192 billion |

| #10 | 🇫🇷 France | 68 | $294 billion |

| #11 | 🇮🇹 Italy | 68 | $207 billion |

| #12 | 🇨🇦 Canada | 60 | $131 billion |

| #13 | 🇧🇷 Brazil | 52 | $159 billion |

| #14 | 🇸🇬 Singapore | 50 | $99 billion |

| #15 | 🇦🇪 UAE | 45 | $181 billion |

China is an obvious second in billionaire wealth to the United States, with famous billionaires like Zhang Yiming ($44.5 billion) of TikTok and Zhong Shanshan ($67.1 billion), whose wealth primarily comes from the pharmaceutical and beverages industries.

That said, Chinese billionaire wealth actually decreased 2% last year. It was India that came out on top in terms of growth, seeing a 19% increase in 2021.

Billionaires by City

Looking at cities, New York is home to the most billionaires—with 13 added billionaire residents last year—followed by Hong Kong.

| Rank | City | Country | Number of Billionaires |

|---|---|---|---|

| #1 | New York City | 🇺🇸 U.S. | 138 |

| #2 | Hong Kong | 🇭🇰 China | 114 |

| #3 | San Francisco | 🇺🇸 U.S. | 85 |

| #4 | London | 🇬🇧 UK | 77 |

| #5 | Moscow | 🇷🇺 Russia | 75 |

| #6 | Beijing | 🇨🇳 China | 63 |

| #7 | Los Angeles | 🇺🇸 U.S. | 59 |

| #8 | Singapore | 🇸🇬 Singapore | 50 |

| #9 | Shenzhen | 🇨🇳 China | 44 |

| #10 | Mumbai | 🇮🇳 India | 40 |

| #11 | Dubai | 🇦🇪 UAE | 38 |

| #12 | Hangzhou | 🇨🇳 China | 35 |

| #13 | São Paulo | 🇧🇷 Brazil | 34 |

| #14 | Istanbul | 🇹🇷 Turkey | 33 |

| #15 | Paris | 🇫🇷 France | 33 |

Billionaire Wealth in 2022

Billionaires have significant power and influence, not in the least because their collective wealth is equivalent to about 11.8% of global GDP.

In recent billionaire news, Gautam Adani’s wealth has been soaring, most recently hitting the $145 billion mark, making him the third-richest person in the world according to Bloomberg’s Billionaire Index. However, not all billionaires are holding on to their wealth. Patagonia founder, Yvon Chouinard, recently transferred ownership of his company to an organization that fights climate change.

Over the last decade, billionaires have been grown their fortunes considerably, with wealth increasing at a faster rate than the growth in the number of billionaires themselves. According to Wealth-X, collective billionaire net worth grew by an astonishing 90% in the last 10 years.

But in the shorter term, the situation is often more volatile. With markets reeling in 2022, Bloomberg reported that billionaires lost a record $1.4 trillion over the first half of the year. Once the year is over and the final numbers are in, it will be interesting to see how the billionaire landscape shapes up in comparison to the more long-term trend.

Money

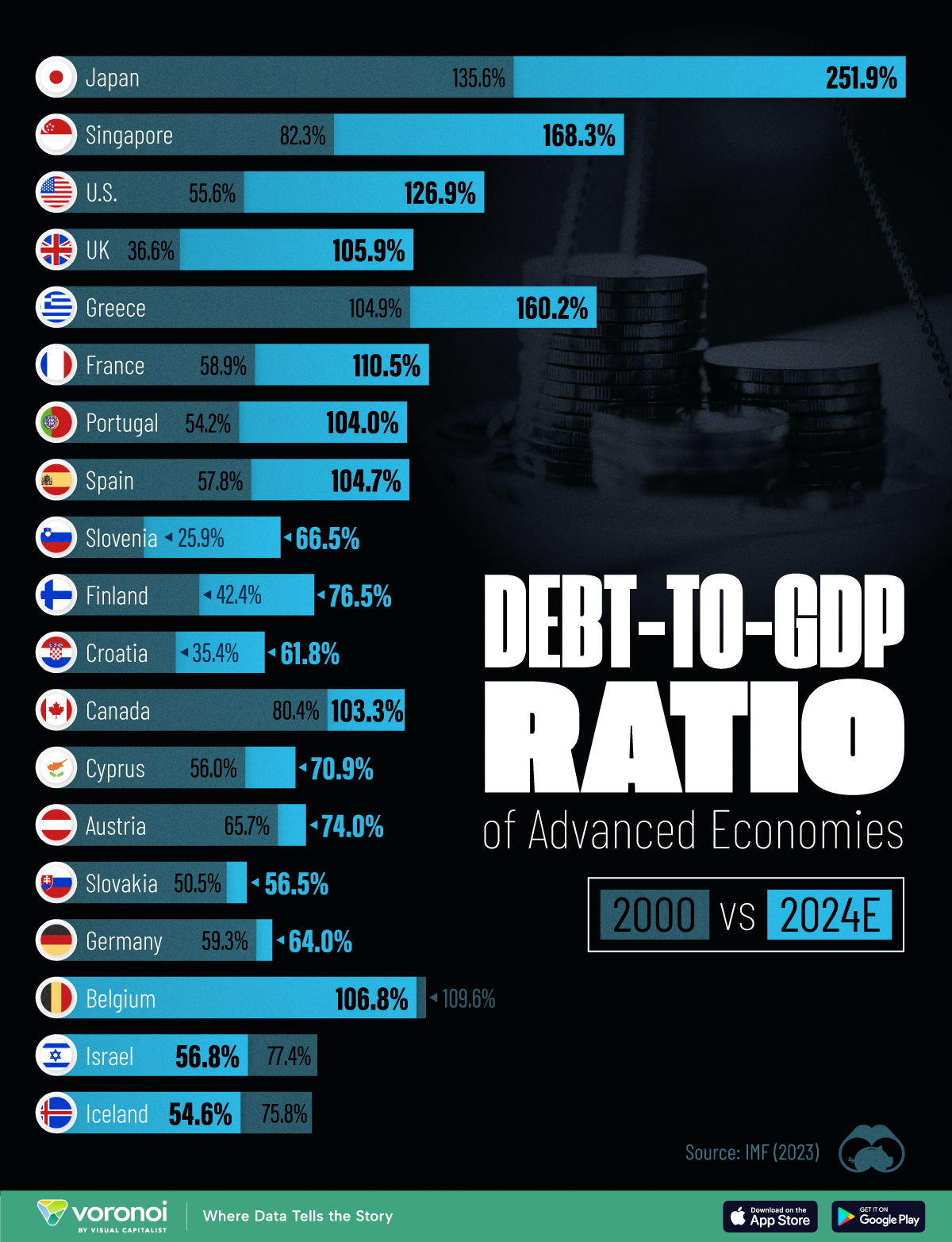

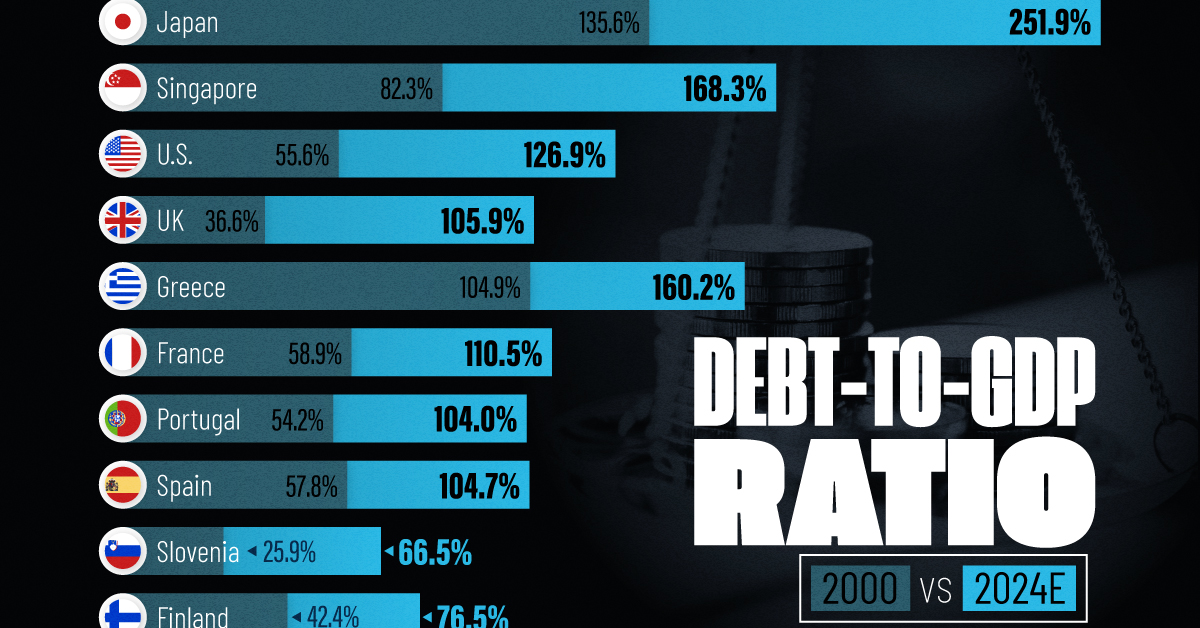

How Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

| Country | 2000 (%) | 2024 (%) | Change (pp) |

|---|---|---|---|

| 🇯🇵 Japan | 135.6 | 251.9 | +116.3 |

| 🇸🇬 Singapore | 82.3 | 168.3 | +86.0 |

| 🇺🇸 United States | 55.6 | 126.9 | +71.3 |

| 🇬🇧 United Kingdom | 36.6 | 105.9 | +69.3 |

| 🇬🇷 Greece | 104.9 | 160.2 | +55.3 |

| 🇫🇷 France | 58.9 | 110.5 | +51.6 |

| 🇵🇹 Portugal | 54.2 | 104.0 | +49.8 |

| 🇪🇸 Spain | 57.8 | 104.7 | +46.9 |

| 🇸🇮 Slovenia | 25.9 | 66.5 | +40.6 |

| 🇫🇮 Finland | 42.4 | 76.5 | +34.1 |

| 🇭🇷 Croatia | 35.4 | 61.8 | +26.4 |

| 🇨🇦 Canada | 80.4 | 103.3 | +22.9 |

| 🇨🇾 Cyprus | 56.0 | 70.9 | +14.9 |

| 🇦🇹 Austria | 65.7 | 74.0 | +8.3 |

| 🇸🇰 Slovak Republic | 50.5 | 56.5 | +6.0 |

| 🇩🇪 Germany | 59.3 | 64.0 | +4.7 |

| 🇧🇪 Belgium | 109.6 | 106.8 | -2.8 |

| 🇮🇱 Israel | 77.4 | 56.8 | -20.6 |

| 🇮🇸 Iceland | 75.8 | 54.6 | -21.2 |

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

See More Debt Graphics from Visual Capitalist

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001