Money

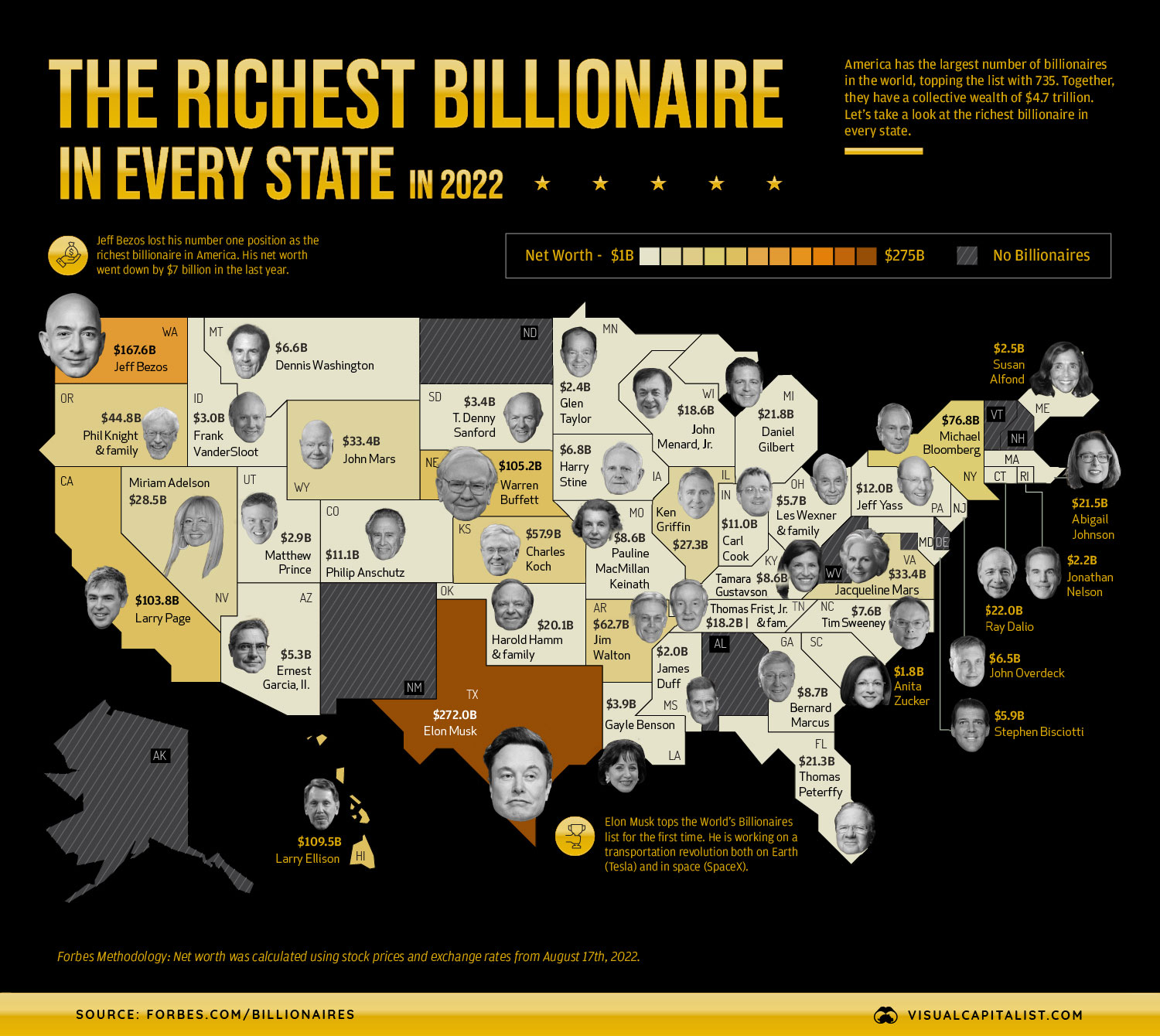

Mapped: The Wealthiest Billionaire in Each U.S. State in 2022

Check out the latest 2023 update of the richest person in each state.

Mapped: The Wealthiest Billionaire in Each U.S. State in 2022

Check out the latest 2023 update of the richest person in each state.

The U.S. is home to over a quarter of the world’s billionaires, representing about 720 of the roughly 2,700 that exist globally.

While the country has more billionaires than any other, the U.S. share of global billionaires has actually been shrinking in recent decades. In 2010, about 40% of the world’s billionaire population lived in America—and today, that number is closer to 27%.

But who is the richest billionaire in every American state in 2022? This graphic uses data from Forbes to find out.

The Richest of the Rich

The billionaires on this list have made their fortune in a wide range of industries, including tech, automobiles, asset management, and video games.

Jeff Bezos and Elon Musk have had their relative fortunes fluctuate in tandem with Amazon and Tesla stock prices in recent years. The volatility in share prices has meant they’ve each carried the title of the world’s wealthiest person at varying points.

| Rank | Name | Net Worth ($B) | Residence (State) |

|---|---|---|---|

| #1 | Elon Musk | 272.0 | Texas |

| #2 | Jeff Bezos | 167.6 | Washington |

| #3 | Larry Ellison | 109.5 | Hawaii |

| #4 | Warren Buffett | 105.2 | Nebraska |

| #5 | Larry Page | 103.8 | California |

| #6 | Michael Bloomberg | 76.8 | New York |

| #7 | Jim Walton | 62.7 | Arkansas |

| #8 | Charles Koch | 57.9 | Kansas |

| #9 | Phil Knight & Family | 44.8 | Oregon |

| #10 | Jacqueline Mars | 33.4 | Virginia |

| #11 | John Mars | 33.4 | Wyoming |

| #12 | Miriam Adelson | 28.5 | Nevada |

| #13 | Ken Griffin | 27.3 | Illinois |

| #14 | Ray Dalio | 22.0 | Connecticut |

| #15 | Daniel Gilbert | 21.8 | Michigan |

| #16 | Abigail Johnson | 21.5 | Massachusetts |

| #17 | Thomas Peterffy | 21.3 | Florida |

| #18 | Harold Hamm & family | 20.1 | Oklahoma |

| #19 | John Menard, Jr. | 18.6 | Wisconsin |

| #20 | Thomas Frist, Jr. & family | 18.2 | Tennessee |

| #21 | Jeff Yass | 12.0 | Pennsylvania |

| #22 | Philip Anschutz | 11.1 | Colorado |

| #23 | Carl Cook | 11.0 | Indiana |

| #24 | Bernard Marcus | 8.7 | Georgia |

| #25 | Pauline MacMillan Keinath | 8.6 | Missouri |

| #26 | Tamara Gustavson | 8.6 | Kentucky |

| #27 | Tim Sweeney | 7.6 | North Carolina |

| #28 | Harry Stine | 6.8 | Iowa |

| #29 | Dennis Washington | 6.6 | Montana |

| #30 | John Overdeck | 6.5 | New Jersey |

| #31 | Stephen Bisciotti | 5.9 | Maryland |

| #32 | Les Wexner & family | 5.7 | Ohio |

| #33 | Ernest Garcia, II. | 5.3 | Arizona |

| #34 | Gayle Benson | 3.9 | Louisiana |

| #35 | T. Denny Sanford | 3.4 | South Dakota |

| #36 | Frank VanderSloot | 3.0 | Idaho |

| #37 | Matthew Prince | 2.9 | Utah |

| #38 | Susan Alfond | 2.5 | Maine |

| #39 | Glen Taylor | 2.4 | Minnesota |

| #40 | Jonathan Nelson | 2.2 | Rhode Island |

| #41 | James Duff | 2.0 | Mississippi |

| #42 | Anita Zucker | 1.8 | South Carolina |

Jeff Bezos previously had the top spot but now has a net worth of $162 billion. While he’s stepped down from the CEO role and has sold large amounts of Amazon stock, his ranking will likely still tie in closely to the company’s performance for the foreseeable future.

Elon Musk is the richest billionaire in Texas, however, he only recently became a resident of the state. His move is part of a broader migration trend occurring in the U.S. today, where California is experiencing a population decline for the first time ever. Last year, 68% of counties in California saw population declines, and data from the U.S. Census Bureau suggests many of these Americans opted for states like Florida and Texas.

| Region | Net Domestic Migration 2019-2020 | Net Domestic Migration 2020-2021 |

|---|---|---|

| Northeast | -315,166 | -399,638 |

| Midwest | -207,685 | -123,103 |

| South | +503,502 | +657,682 |

| West | 19,349 | -144,941 |

Between 2019 to 2021, the South is the only region that saw positive net flows of over a million people, while the Northeast, Midwest, and West all saw declines.

Warren Buffett, the “Oracle of Omaha,” is the richest billionaire in Nebraska by a wide margin, with a net worth of $105 billion. Despite the stock market experiencing one of its worst starts to the year historically, Buffett’s net worth has been surprisingly steady.

This might be due to value assets rotating back into fashion in favor of growth and tech themes this year. Also, historically Buffett has been bullish in environments where fear and negative sentiment reflect through lower asset prices.

Female Billionaires

There are eight different women that hold the title of richest billionaire in their state.

Tamara Gustavson is Public Storage’s largest shareholder, with an 11% stake in the company, valued at $60 billion on the New York Stock Exchange. In addition, she acts as the director of the company and is the daughter of founder B. Wayne Hughes, who recently passed away last year. Incredibly, Public Storage operates more than 170 million square feet of real estate.

Abigail Johnson and Jacqueline Mars were featured on our infographic showing the richest women in the world last year. Johnson has served as CEO of top asset manager Fidelity, which her grandfather Edward Johnson founded. And Jacqueline Mars is part of the Mars family, which owns the world’s largest candy maker.

Big Disparities

The U.S. wealth landscape is one of extremes. On one end, there are ample opportunities to earn substantial wealth, but on the other, wealth inequality and income disparity are higher than many other peer countries.

This productivity and hustle-oriented culture suggests that while there isn’t a billionaire in every state in 2022, it seems like it’s only a matter of time before the likes of Alabama, New Mexico, and North Dakota add a billionaire to their ranks.

Money

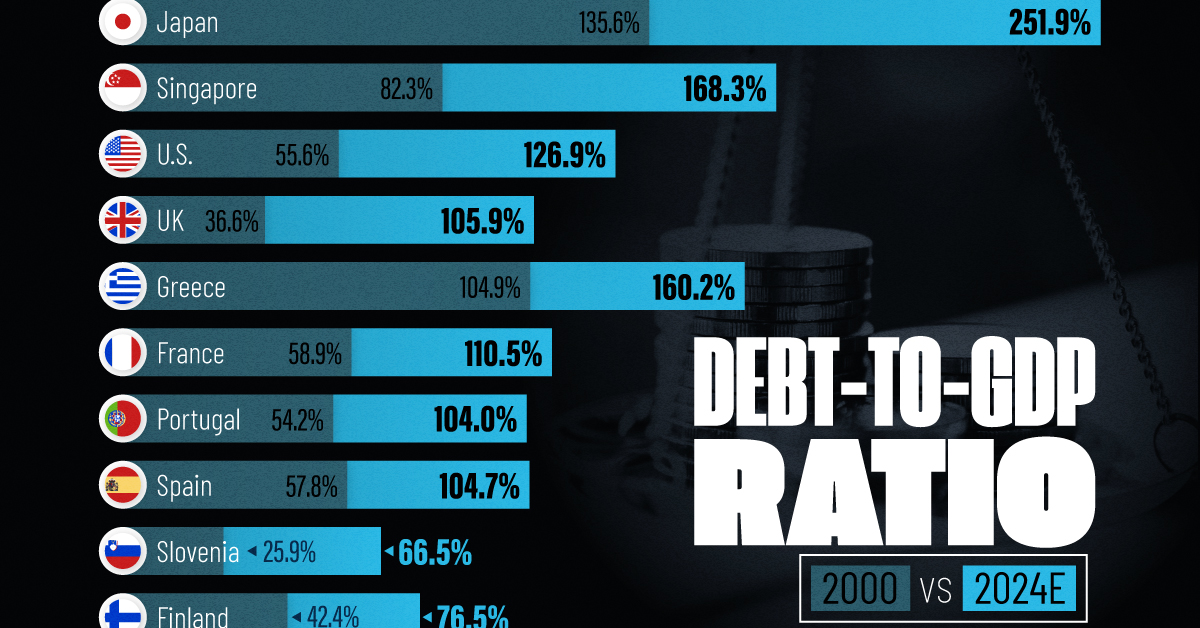

How Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

| Country | 2000 (%) | 2024 (%) | Change (pp) |

|---|---|---|---|

| 🇯🇵 Japan | 135.6 | 251.9 | +116.3 |

| 🇸🇬 Singapore | 82.3 | 168.3 | +86.0 |

| 🇺🇸 United States | 55.6 | 126.9 | +71.3 |

| 🇬🇧 United Kingdom | 36.6 | 105.9 | +69.3 |

| 🇬🇷 Greece | 104.9 | 160.2 | +55.3 |

| 🇫🇷 France | 58.9 | 110.5 | +51.6 |

| 🇵🇹 Portugal | 54.2 | 104.0 | +49.8 |

| 🇪🇸 Spain | 57.8 | 104.7 | +46.9 |

| 🇸🇮 Slovenia | 25.9 | 66.5 | +40.6 |

| 🇫🇮 Finland | 42.4 | 76.5 | +34.1 |

| 🇭🇷 Croatia | 35.4 | 61.8 | +26.4 |

| 🇨🇦 Canada | 80.4 | 103.3 | +22.9 |

| 🇨🇾 Cyprus | 56.0 | 70.9 | +14.9 |

| 🇦🇹 Austria | 65.7 | 74.0 | +8.3 |

| 🇸🇰 Slovak Republic | 50.5 | 56.5 | +6.0 |

| 🇩🇪 Germany | 59.3 | 64.0 | +4.7 |

| 🇧🇪 Belgium | 109.6 | 106.8 | -2.8 |

| 🇮🇱 Israel | 77.4 | 56.8 | -20.6 |

| 🇮🇸 Iceland | 75.8 | 54.6 | -21.2 |

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

See More Debt Graphics from Visual Capitalist

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024