Technology

Mapped: The Top Surveillance Cities Worldwide

#surveillance-cities-map{min-height: 672px;}@media (max-width: 1200px){#surveillance-cities-map{min-height: 820px;}}

The Top Surveillance Cities Worldwide

Since the world’s first CCTV camera was installed in Germany in 1942, the number of surveillance cameras around the world has grown immensely. In fact, it only took us 79 years to go from one camera to nearly one billion of these devices.

In the above interactive graphic, Surfshark maps out how prevalent CCTV surveillance cameras are in the world’s 130 most populous cities.

Big Brother is Watching

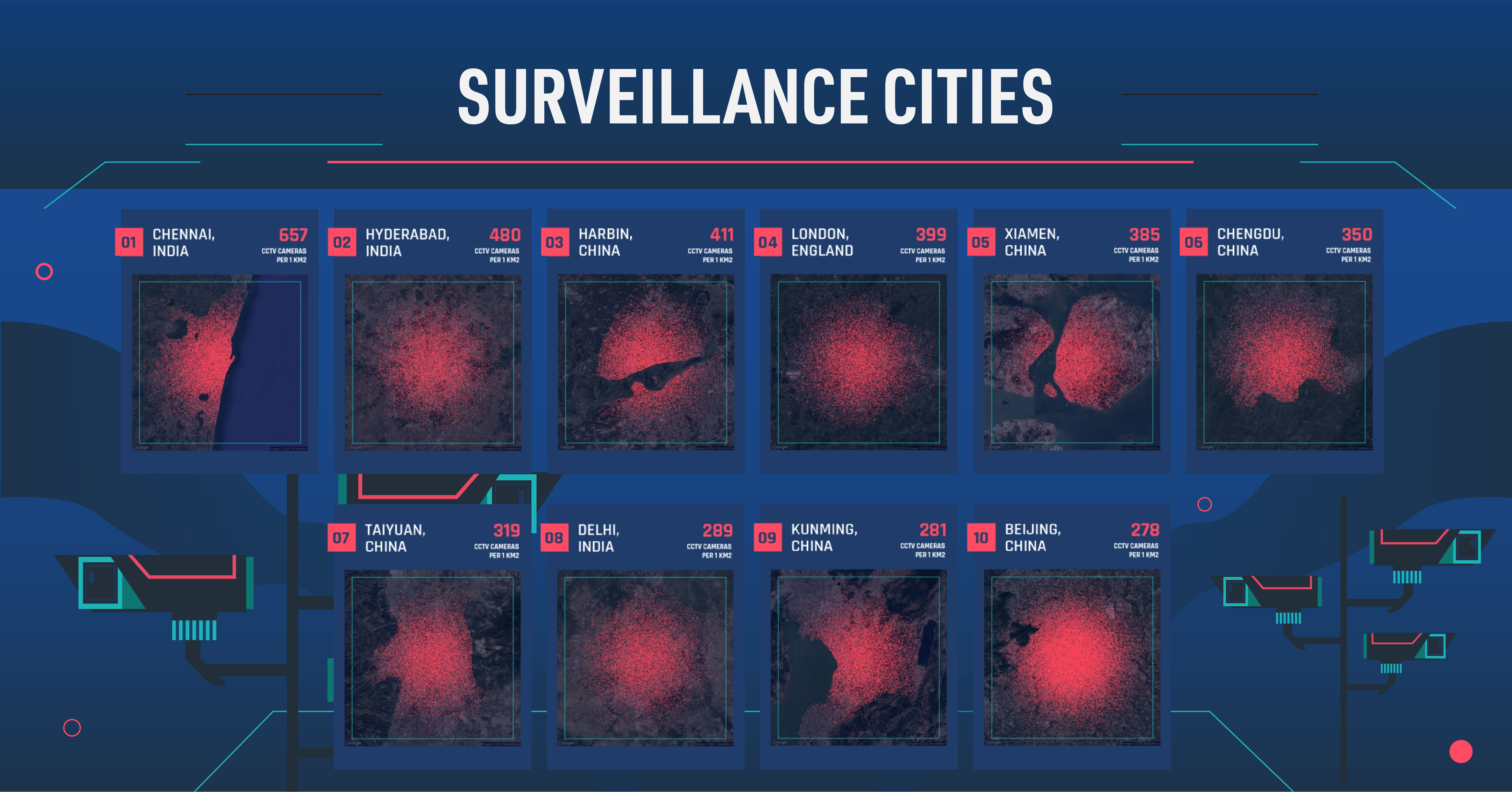

So how many of us are being watched? China and India are the countries with the highest densities of CCTV surveillance cameras in urban areas. Chennai, India has 657 cameras per square kilometer, making it the number one city in the world in terms of surveillance.

Here’s a closer look at the world’s top 10 cities by CCTV density.

| Rank | City | CCTVs per square km | CCTVs per 1,000 people |

|---|---|---|---|

| #1 | 🇮🇳 Chennai, India | 657 | 25.5 |

| #2 | 🇮🇳 Hyderabad, India | 480 | 30.0 |

| #3 | 🇨🇳 Harbin, China | 411 | 39.1 |

| #4 | 🇬🇧 London, England | 399 | 67.5 |

| #5 | 🇨🇳 Xiamen, China | 385 | 40.3 |

| #6 | 🇨🇳 Chengdu, China | 350 | 33.9 |

| #7 | 🇨🇳 Taiyuan, China | 319 | 119.6 |

| #8 | 🇮🇳 Delhi, India | 289 | 14.2 |

| #9 | 🇨🇳 Kunming, China | 281 | 45.0 |

| #10 | 🇨🇳 Beijing, China | 278 | 56.2 |

London is the only non-Asian city to crack the list with 399 CCTV cameras per square kilometer.

Beijing ranks in tenth place. The Chinese capital has the highest number of CCTV cameras in total, at just over 1.1 million installed in the city.

Although CCTV cameras have become extremely prevalent in cities around the world, this does not mean these cameras are seeing and recognizing our every move. In most instances, cameras are in a fixed position—and some of the more invasive aspects of CCTV, like accompanying facial recognition technology, are not universal yet.

The Need for CCTV

The ubiquity of surveillance cameras can be unnerving to some, as they represent diminishing privacy. However, there are also those that feel the presence of cameras creates added safety.

While governments like China’s claim that having high amounts of surveillance cameras helps reduce crime, the actual data gets messy. For example, the Chinese city of Taiyuan has roughly 120 cameras per every thousand people and yet the city has a higher crime index than most.

Freedom vs. Security

As surveillance networks become more sophisticated and granular, there is increasing concern about breaches to personal freedoms.

China is doubling down with surveillance in its cities by pioneering the usage and exportation of facial recognition technology. This technology is integral to China’s proposed social points system. With a database of 1.3 billion pictures that can be matched to a face on a CCTV camera in seconds, troublemaking citizens can easily be identified.

In India, on the other hand, the amount of cameras can be attributed to mass urbanization, rising crime, and scarcity of urban resources. Overall, there is a rising middle class that wishes to protect itself with the use of CCTV cameras.

As we close in on one billion CCTV surveillance cameras globally by the end of 2021, we will undoubtedly continue to be monitored well into the future.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?