Mapped: EV Battery Manufacturing Capacity, by Region

The following content is sponsored by Scotch Creek Ventures.

Mapped: EV Battery Manufacturing Capacity, by Region

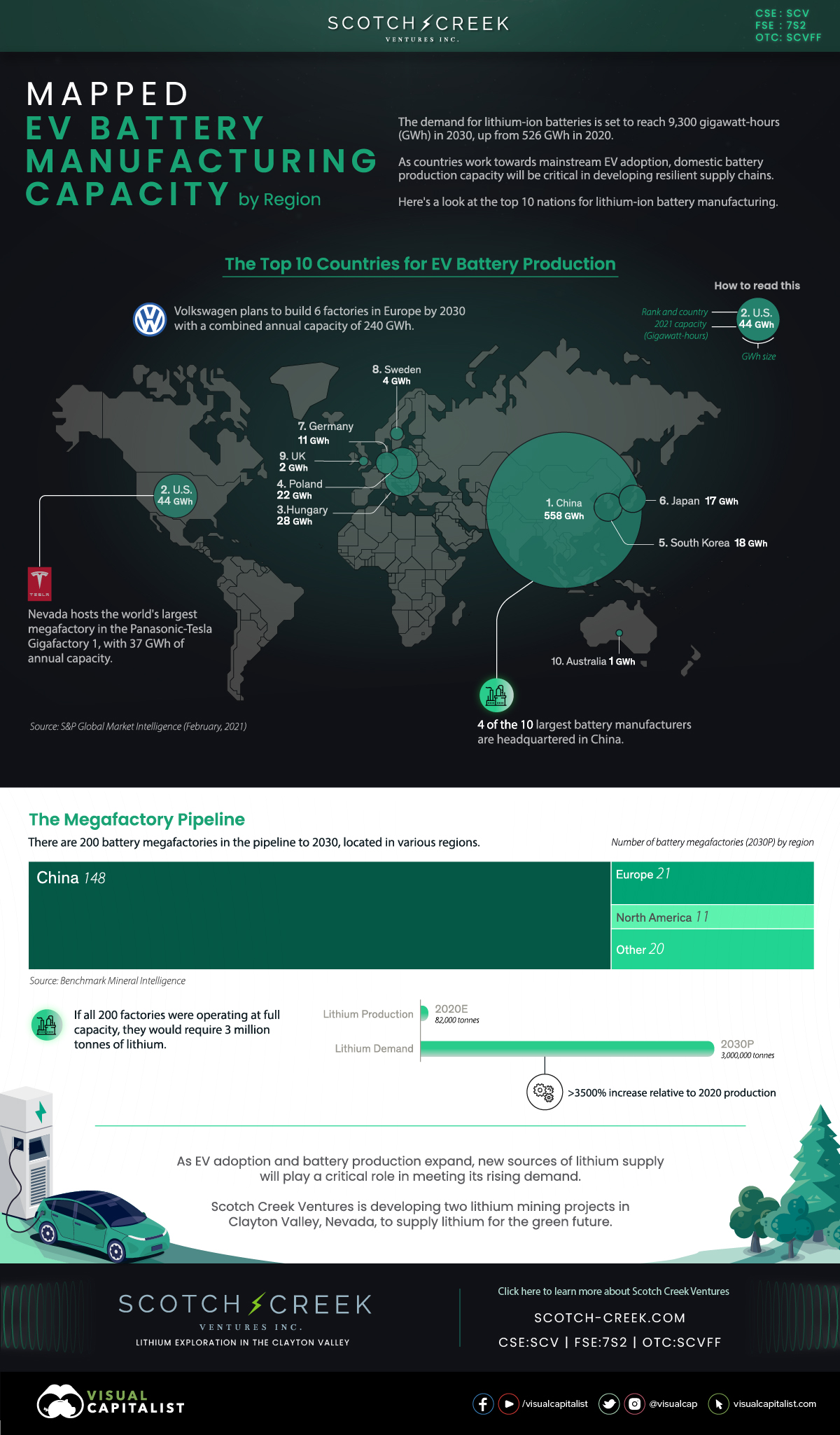

The demand for lithium-ion batteries for electric vehicles (EVs) is rising rapidly—it’s set to reach 9,300 gigawatt-hours (GWh) by 2030—up by over 1,600% from 2020 levels.

For that reason, developing domestic battery supply chains, including battery manufacturing capacity, is becoming increasingly important as countries strive to shift away from gasoline vehicles to EVs.

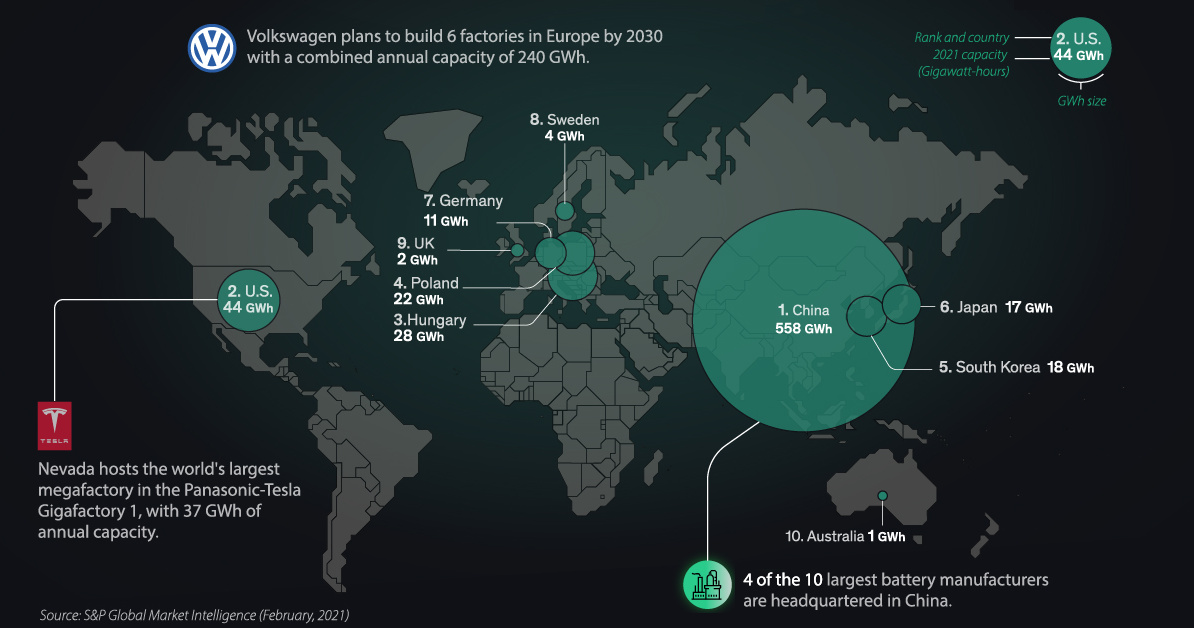

Which countries are leading the race for batteries? The above infographic from Scotch Creek Ventures highlights the top 10 nations for EV battery manufacturing.

The Top 10 Countries by Capacity

The biggest battery manufacturers are located in regions that have high demand for EVs, and that have wide access to raw materials:

| Rank | Country | 2021 Li-ion manufacturing capacity (GWh) | % of World Total |

|---|---|---|---|

| #1 | China 🇨🇳 | 558 | 79.0% |

| #2 | U.S. 🇺🇸 | 44 | 6.2% |

| #3 | Hungary 🇭🇺 | 28 | 4.0% |

| #4 | Poland 🇵🇱 | 22 | 3.1% |

| #5 | South Korea 🇰🇷 | 18 | 2.5% |

| #6 | Japan 🇯🇵 | 17 | 2.4% |

| #7 | Germany 🇩🇪 | 11 | 1.6% |

| #8 | Sweden 🇸🇪 | 4 | 0.6% |

| #9 | UK 🇬🇧 | 2 | 0.3% |

| #10 | Australia 🇦🇺 | 1 | 0.1% |

| N/A | Rest of the World 🌍 | 1 | 0.1% |

| N/A | Total | 706 | 100.0% |

Data as of February 1, 2021.

Source: S&P Global Market Intelligence

China is by far the leader in the battery race with nearly 80% of global Li-ion manufacturing capacity. The country also dominates other parts of the battery supply chain, including the mining and refining of battery minerals like lithium and graphite.

The U.S. is following China from afar, with around 6% or 44 GWh of global manufacturing capacity. Tesla and Panasonic’s Giga Nevada accounts for the majority of it with 37 GWh of annual capacity, making it the world’s largest battery manufacturing plant.

European countries collectively make up for 68 GWh or around 10% of global battery manufacturing. Moreover, Hungary and Poland also make the top five, hosting plants owned by large battery manufacturers like SK Innovation and LG Chem.

The Future of EV Battery Manufacturing

According to S&P Global Market Intelligence, global lithium-ion manufacturing capacity is expected to more than double by 2025.

Here’s how the top 10 countries could stack up in 2025:

| Rank | Country | 2025P Li-ion manufacturing capacity (GWh) | % of World Total |

|---|---|---|---|

| #1 | China 🇨🇳 | 944 | 65.2% |

| #2 | Germany 🇩🇪 | 164 | 11.3% |

| #3 | U.S. 🇺🇸 | 91 | 6.3% |

| #4 | Poland 🇵🇱 | 70 | 4.8% |

| #5 | Hungary 🇭🇺 | 47 | 3.2% |

| #6 | Sweden 🇸🇪 | 32 | 2.2% |

| #7 | France 🇫🇷 | 32 | 2.2% |

| #8 | South Korea 🇰🇷 | 18 | 1.2% |

| #9 | Japan 🇯🇵 | 17 | 1.2% |

| #10 | UK 🇬🇧 | 12 | 0.8% |

| N/A | Rest of the World 🌍 | 20 | 1.4% |

| N/A | Total | 1,447 | 100.0% |

Although China is expected to come out on top again, its share of worldwide capacity could fall to around 65% as other countries ramp up battery production. For instance, Germany’s capacity is projected to rise to 164 GWh, representing a 15-fold increase in just four years.

Furthermore, the U.S. is expected to more than double its capacity by 2025. In fact, 13 new plants are expected to be operational in the next five years, providing a boost to domestic EV battery manufacturing capabilities.

It’s important to note that the battery industry is evolving rapidly, and these rankings could change as manufacturers set up shop in different countries. However, it’s clear that both battery demand and manufacturing capacity are set to grow. And more batteries require more raw materials—especially critical metals like lithium.

Global lithium demand from battery factories could hit 3 million tonnes by 2030, requiring a massive increase over the 82,000 tonnes produced in 2020. As countries like the U.S. ramp up battery manufacturing, new sources of lithium could prove increasingly valuable in building sustainable battery supply chains.

Scotch Creek Ventures is developing two lithium mining projects in Clayton Valley, Nevada, to supply lithium for the green future.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.