Money

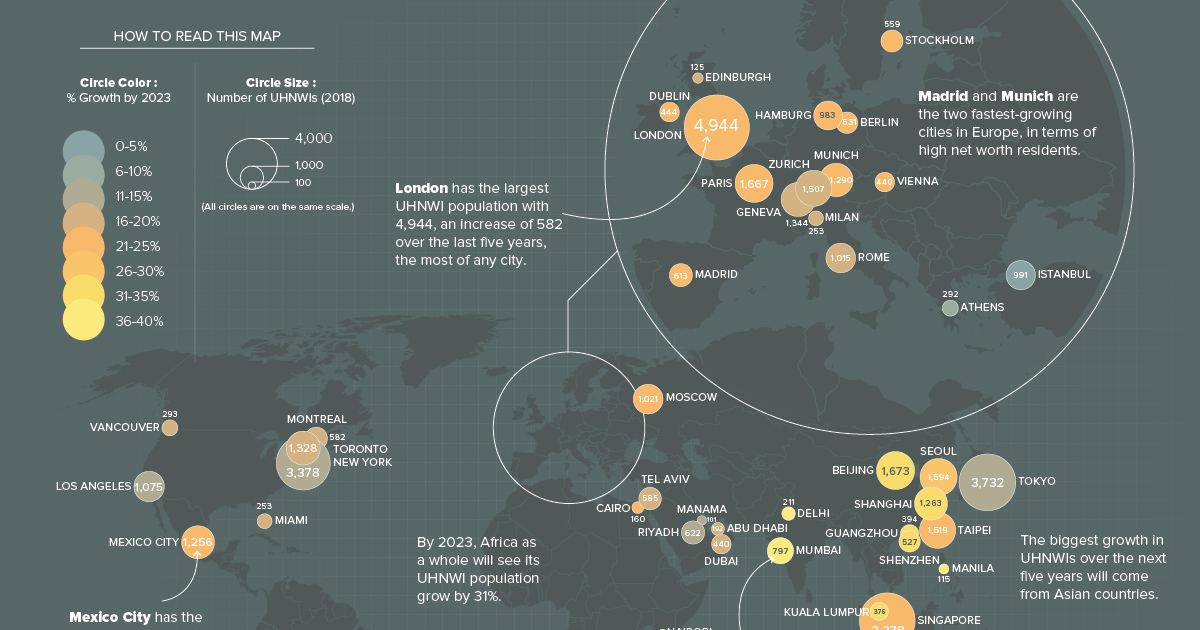

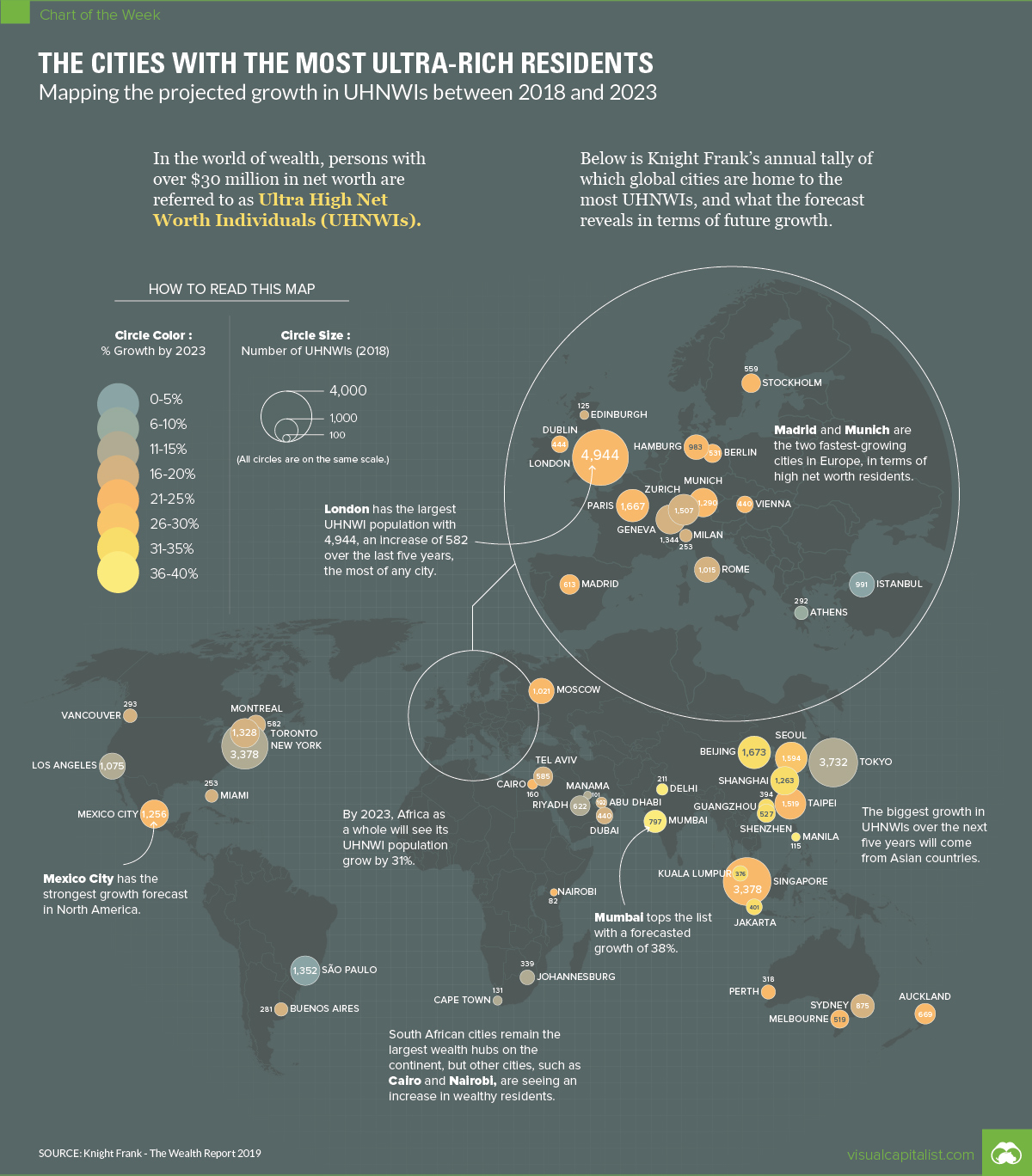

Map: Cities With the Most Ultra-Rich Residents

Mapped: The Cities With the Most Ultra-Rich Residents

As of 2018, there is a grand total of 198,342 ultra high net worth individuals (UHNWIs) globally with assets over US$30 million, according to the most recent edition of Knight Frank’s Wealth Report.

Although these millionaires and billionaires can be found all over the globe, the reality is that most of the world’s ultra-rich population tends to congregate in world-class cities.

Generally speaking, UHNWIs are looking to live in places that are conducive to safeguarding and growing their wealth, but that also give them access to top-end amenities that allow them to live comfortably and luxuriously.

Top 10 Cities for the Ultra-Rich

To start, we’ll look at a list of global cities, organized by expected number of UHNWIs in 2023:

| Rank | City | UHNWIs (2018) | UHNWIs (2023e) | Change (%) |

|---|---|---|---|---|

| #1 | 🇬🇧 London | 4,944 | 6,015 | 21.7% |

| #2 | 🇸🇬 Singapore | 3,598 | 4,393 | 22.1% |

| #3 | 🇯🇵 Tokyo | 3,732 | 4,125 | 10.5% |

| #4 | 🇺🇸 New York City | 3,378 | 3,891 | 15.2% |

| #5 | 🇨🇳 Beijing | 1,673 | 2,247 | 34.3% |

| #6 | 🇫🇷 Paris | 1,667 | 2,031 | 21.8% |

| #7 | 🇰🇷 Seoul | 1,594 | 2,020 | 26.7% |

| #8 | 🇹🇼 Taipei | 1,519 | 1,864 | 22.7% |

| #9 | 🇨🇭 Zurich | 1,507 | 1,796 | 19.2% |

| #10 | 🇨🇳 Shanghai | 1,263 | 1,690 | 33.8% |

London continues to top the list, with a roster of 4,944 ultra-rich residents today and the projected growth over the coming years to eclipse the 6,000 mark by 2023.

Tokyo has the second highest amount of UHNWIs today, but the city is adding them at a slower rate than other rival cities. As a result, Singapore will move into the #2 spot overall by 2023, with an expected total of 4,393 high net worth residents.

Finally, it’s worth noting that only two cities on the top 10 list are expected to see growth above a 30% clip over this five-year period. Shanghai and Beijing could be cities to watch for decades to come, as they add millionaires and billionaires at a faster rate than any of the other heavyweights.

Fastest Growing Cities

Where are the billionaire meccas of the future?

Here are the 10 cities that are expected to add UHNWIs the fastest between 2018-2023:

| Rank | City | UHNWIs (2018) | UHNWIs (2023e) | Change (%) |

|---|---|---|---|---|

| #1 | 🇮🇳 Mumbai | 797 | 1,101 | 38.1% |

| #2 | 🇮🇳 Delhi | 211 | 291 | 37.9% |

| #3 | 🇵🇭 Manila | 115 | 157 | 36.5% |

| #4 | 🇨🇳 Shenzhen | 527 | 708 | 34.3% |

| #5 | 🇨🇳 Beijing | 1,673 | 2,247 | 34.3% |

| #6 | 🇨🇳 Guangzhou | 394 | 529 | 34.3% |

| #7 | 🇨🇳 Shanghai | 1,263 | 1,690 | 33.8% |

| #8 | 🇮🇩 Jakarta | 401 | 529 | 31.9% |

| #9 | 🇲🇾 Kuala Lumpur | 376 | 496 | 31.9% |

| #10 | 🇰🇷 Seoul | 1,594 | 2,020 | 26.7% |

Not surprisingly, all 10 of these cities are located in Asia.

Two Indian cities (Delhi and Mumbai) top the list, and are likely to add nearly 40% to their ultra-rich populations over the next five years. China also has a strong showing here.

Interestingly, just missing the above top 10 were a few non-Asian cities: Auckland (#11), Madrid (#12), Munich (#13), and Nairobi (#14) are all expected to grow their UHNWI populations by roughly 25% by 2023.

Money

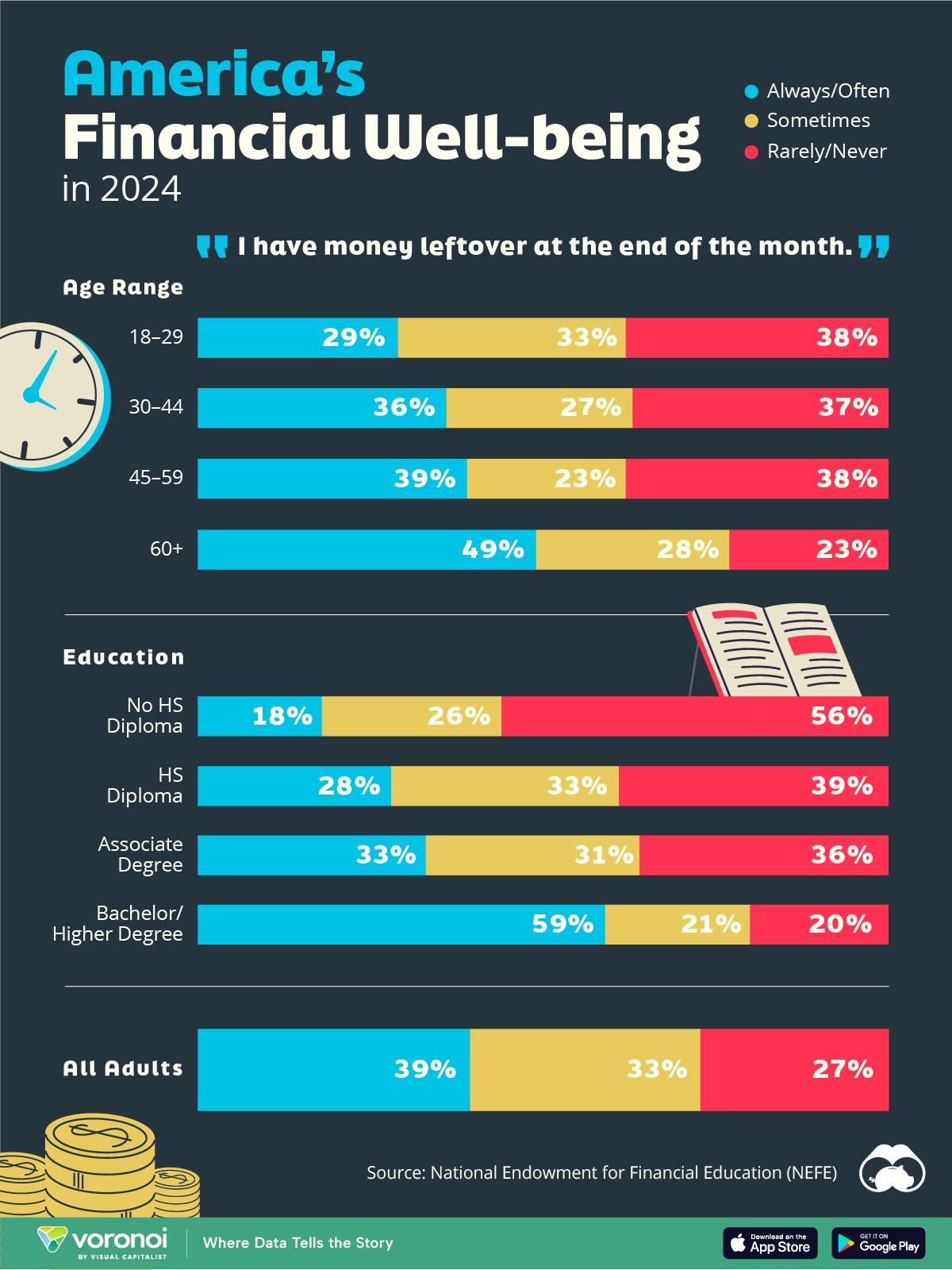

Charted: Who Has Savings in This Economy?

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Green1 week ago

Green1 week agoRanking the Top 15 Countries by Carbon Tax Revenue

-

Technology2 weeks ago

Technology2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075