Markets

Mapped: America’s $2 Trillion Economic Drop, by State and Sector

Mapped: America’s $2 Trillion Economic Drop

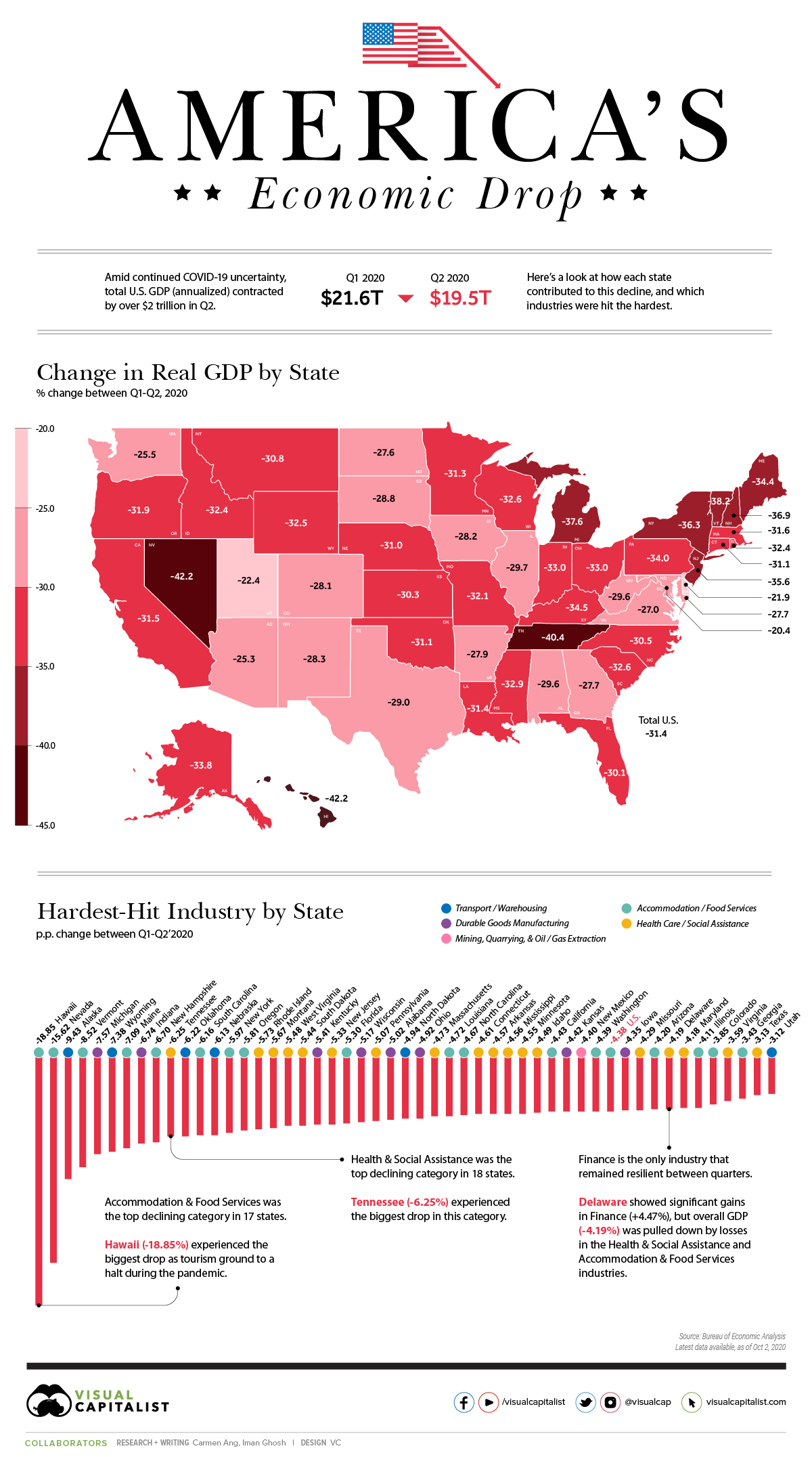

It only took a handful of months for the U.S. economy to reel from COVID-19’s effects.

As unemployment rates hit all-time highs and businesses scrambled to stay afloat, new data shows that current dollar GDP plummeted from nearly $21.6 trillion down to $19.5 trillion between Q1’2020 and Q2’2020 (seasonally adjusted at annual rates).

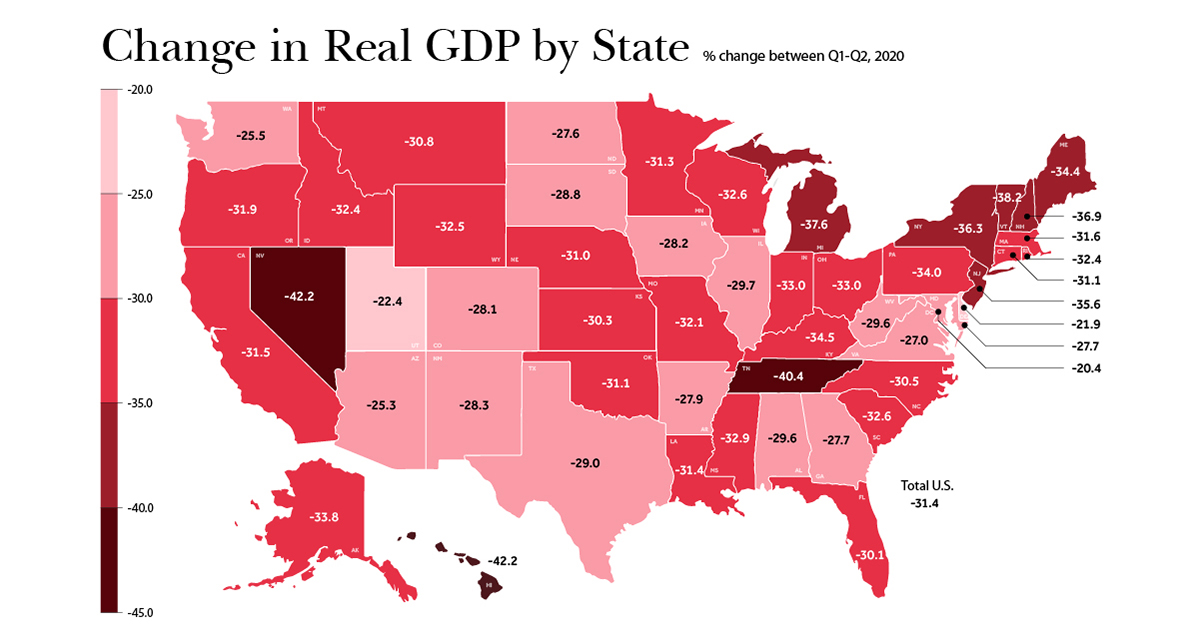

While all states experienced a decline, the effects were not distributed equally across the nation. This visualization takes a look at the latest data from the Bureau of Economic Analysis, uncovering the biggest declines across states, and which industries were most affected by COVID-19 related closures and uncertainty.

Change in GDP by State and Industry

Between March-June 2020, stay-at-home orders resulted in disruptions to consumer activity, health, and the broader economy, causing U.S. GDP to fall by 31.4% from numbers posted in Q1.

The U.S. economy is the sum of its parts, with each state contributing to the total output—making the COVID-19 decline even more evident when state-by-state change in GDP is taken into consideration.

| State | Real GDP Change | Biggest Industry Decline | Industry Change (p.p.) |

|---|---|---|---|

| Alabama | -29.6 | Durable Goods Manufacturing | -5.02 |

| Alaska | -33.8 | Transport and Warehousing | -9.43 |

| Arizona | -25.3 | Accommodation and Food Services | -4.2 |

| Arkansas | -27.9 | Health Care and Social Assistance | -4.57 |

| California | -31.5 | Accommodation and Food Services | -4.43 |

| Colorado | -28.1 | Accommodation and Food Services | -3.85 |

| Connecticut | -31.1 | Health Care and Social Assistance | -4.61 |

| Delaware | -21.9 | Health Care and Social Assistance | -4.19 |

| Florida | -30.1 | Accommodation and Food Services | -5.3 |

| Georgia | -27.7 | Accommodation and Food Services | -3.43 |

| Hawaii | -42.2 | Accommodation and Food Services | -18.85 |

| Idaho | -32.4 | Health Care and Social Assistance | -4.49 |

| Illinois | -29.7 | Accommodation and Food Services | -4.11 |

| Indiana | -33.0 | Durable Goods Manufacturing | -6.74 |

| Iowa | -28.2 | Durable Goods Manufacturing | -4.35 |

| Kansas | -30.3 | Durable Goods Manufacturing | -4.42 |

| Kentucky | -34.5 | Durable Goods Manufacturing | -5.41 |

| Louisiana | -31.4 | Accommodation and Food Services | -4.72 |

| Maine | -34.4 | Accommodation and Food Services | -7.09 |

| Maryland | -27.7 | Health Care and Social Assistance | -4.18 |

| Massachusetts | -31.6 | Health Care and Social Assistance | -4.73 |

| Michigan | -37.6 | Durable Goods Manufacturing | -7.57 |

| Minnesota | -31.3 | Health Care and Social Assistance | -4.55 |

| Mississippi | -32.9 | Health Care and Social Assistance | -4.56 |

| Missouri | -32.1 | Health Care and Social Assistance | -4.29 |

| Montana | -30.8 | Health Care and Social Assistance | -5.67 |

| Nebraska | -31.0 | Transport and Warehousing | -6.13 |

| Nevada | -42.2 | Accommodation and Food Services | -15.62 |

| New Hampshire | -36.9 | Accommodation and Food Services | -6.7 |

| New Jersey | -35.6 | Health Care and Social Assistance | -5.33 |

| New Mexico | -28.3 | Mining, Quarrying, and Oil and Gas Extraction | -4.4 |

| New York | -36.3 | Accommodation and Food Services | -5.97 |

| North Carolina | -30.5 | Accommodation and Food Services | -4.67 |

| North Dakota | -27.6 | Transport and Warehousing | -4.94 |

| Ohio | -33.0 | Durable Goods Manufacturing | -4.92 |

| Oklahoma | -31.1 | Transport and Warehousing | -6.22 |

| Oregon | -31.9 | Accommodation and Food Services | -5.81 |

| Pennsylvania | -34.0 | Health Care and Social Assistance | -5.07 |

| Rhode Island | -32.4 | Health Care and Social Assistance | -5.73 |

| South Carolina | -32.6 | Accommodation and Food Services | -6.16 |

| South Dakota | -28.8 | Health Care and Social Assistance | -5.44 |

| Tennessee | -40.4 | Health Care and Social Assistance | -6.25 |

| Texas | -29.0 | Health Care and Social Assistance | -3.13 |

| Utah | -22.4 | Transport and Warehousing | -3.12 |

| Vermont | -38.2 | Accommodation and Food Services | -8.52 |

| Virginia | -27.0 | Health Care and Social Assistance | -3.59 |

| Washington | -25.5 | Accommodation and Food Services | -4.39 |

| West Virginia | -29.6 | Health Care and Social Assistance | -5.48 |

| Wisconsin | -32.6 | Durable Goods Manufacturing | -5.17 |

| Wyoming | -32.5 | Transport and Warehousing | -7.38 |

| 🇺🇸 U.S. | -31.4 | Accommodation and Food Services | -4.38 |

Note: Industry changes are reported in percentage points (p.p.) of total current dollar GDP between Q1 and Q2.

A total of 18 states took the biggest hit within the Accommodation & Food Services sector, which was also the industry that suffered the most nationally, dropping by 4.38%.

Highly dependent on tourism, Hawaii bore the brunt of decline in this industry with a 18.85% drop. According to The Economic Research Organization at the University of Hawaii (UHERO), a second wave of infections and expired financial assistance were behind this contraction.

Next, the Health Care & Social Assistance sector was most impacted in 17 states between the two quarters, falling the most in Tennessee (-6.25%).

The most resilient industry amid the pandemic was Financial Services. In the state of Delaware, home to major banks such as JPMorgan Chase and Capital One, the sector actually grew by 4.47%. However, Delaware’s GDP ultimately still fell due to contractions in other sectors.

Each Industry’s Worst Performing State

Looking at it another way, the worst-performing state by industry also becomes clear when the change in percentage points (p.p.) Q1’–Q2’2020 GDP contributions are measured. Of the 21 industries profiled, Nevada shows up in the lower end of the spectrum four times.

| Industry | Worst-performing state | Change (p.p.) |

|---|---|---|

| Agriculture, forestry, fishing and hunting | Nebraska | -4.99% |

| Mining, quarrying, and oil and gas extraction | Wyoming | -5.76% |

| Utilities | Nebraska | -0.33% |

| Construction | New York | -2.02% |

| Durable goods manufacturing | Michigan | -7.57% |

| Nondurable goods manufacturing | Indiana | -2.65% |

| Wholesale trade | New Jersey | -3.35% |

| Retail trade | Nevada | -2.88% |

| Transportation and warehousing | Alaska | -9.43% |

| Information | California | -0.88% |

| Finance and insurance | South Dakota | -1.53% |

| Real estate and rental and leasing | Florida | -2.00% |

| Professional, scientific, and technical services | District of Columbia | -4.46% |

| Management of companies and enterprises | Nevada | -0.38% |

| Administrative/ support /waste management / remediation | Nevada | -2.48% |

| Educational services | Rhode Island | -1.47% |

| Health care and social assistance | Tennessee | -6.25% |

| Arts, entertainment, and recreation | Nevada | -4.44% |

| Accommodation and food services | Hawaii | -18.85% |

| Other services (ex. govt) | District of Columbia | -2.40% |

| Government and government enterprises | Alaska | -4.19% |

With many U.S. business leaders expecting a second contraction to occur in the economy, will future figures reflect further declines, or will states manage to bounce back?

Markets

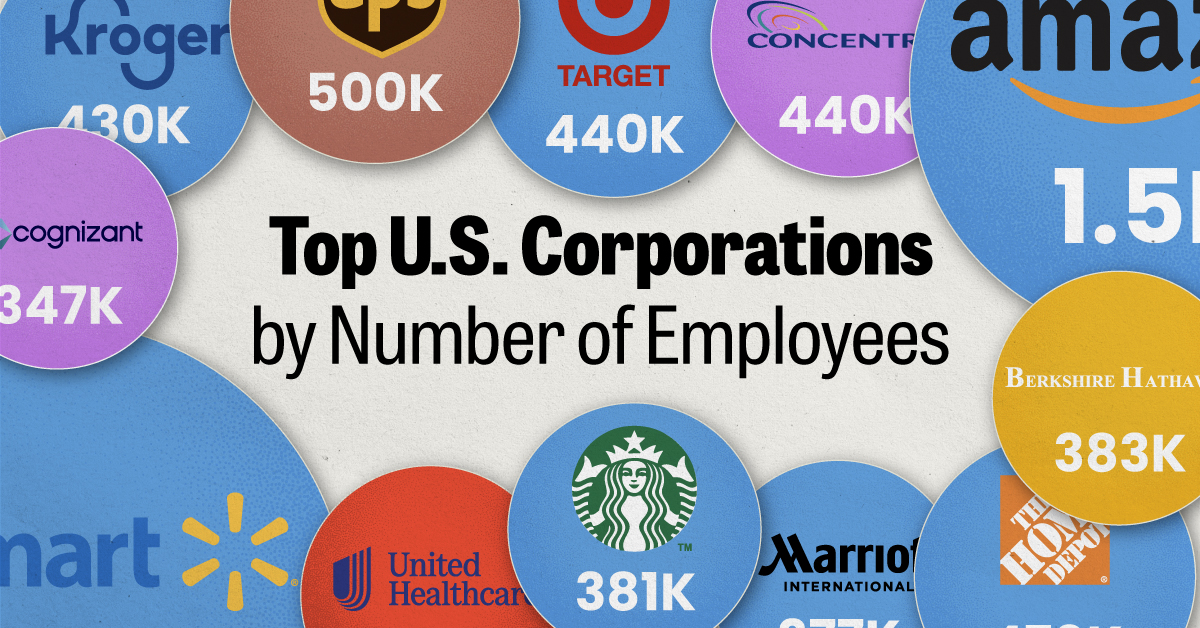

Ranked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

The Largest U.S. Corporations by Number of Employees

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Revenue and profit are common measures for measuring the size of a business, but what about employee headcount?

To see how big companies have become from a human perspective, we’ve visualized the top U.S. companies by employees. These figures come from companiesmarketcap.com, and were accessed in March 2024. Note that this ranking includes publicly-traded companies only.

Data and Highlights

The data we used to create this list of largest U.S. corporations by number of employees can be found in the table below.

| Company | Sector | Number of Employees |

|---|---|---|

| Walmart | Consumer Staples | 2,100,000 |

| Amazon | Consumer Discretionary | 1,500,000 |

| UPS | Industrials | 500,000 |

| Home Depot | Consumer Discretionary | 470,000 |

| Concentrix | Information Technology | 440,000 |

| Target | Consumer Staples | 440,000 |

| Kroger | Consumer Staples | 430,000 |

| UnitedHealth | Health Care | 400,000 |

| Berkshire Hathaway | Financials | 383,000 |

| Starbucks | Consumer Discretionary | 381,000 |

| Marriott International | Consumer Discretionary | 377,000 |

| Cognizant | Information Technology | 346,600 |

Retail and Logistics Top the List

Companies like Walmart, Target, and Kroger have a massive headcount due to having many locations spread across the country, which require everything from cashiers to IT professionals.

Moving goods around the world is also highly labor intensive, explaining why UPS has half a million employees globally.

Below the Radar?

Two companies that rank among the largest U.S. corporations by employees which may be less familiar to the public include Concentrix and Cognizant. Both of these companies are B2B brands, meaning they primarily work with other companies rather than consumers. This contrasts with brands like Amazon or Home Depot, which are much more visible among average consumers.

A Note on Berkshire Hathaway

Warren Buffett’s company doesn’t directly employ 383,000 people. This headcount actually includes the employees of the firm’s many subsidiaries, such as GEICO (insurance), Dairy Queen (retail), and Duracell (batteries).

If you’re curious to see how Buffett’s empire has grown over the years, check out this animated graphic that visualizes the growth of Berkshire Hathaway’s portfolio from 1994 to 2022.

-

Business2 weeks ago

Business2 weeks agoAmerica’s Top Companies by Revenue (1994 vs. 2023)

-

Environment1 week ago

Environment1 week agoRanked: Top Countries by Total Forest Loss Since 2001

-

Markets1 week ago

Markets1 week agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.