Energy

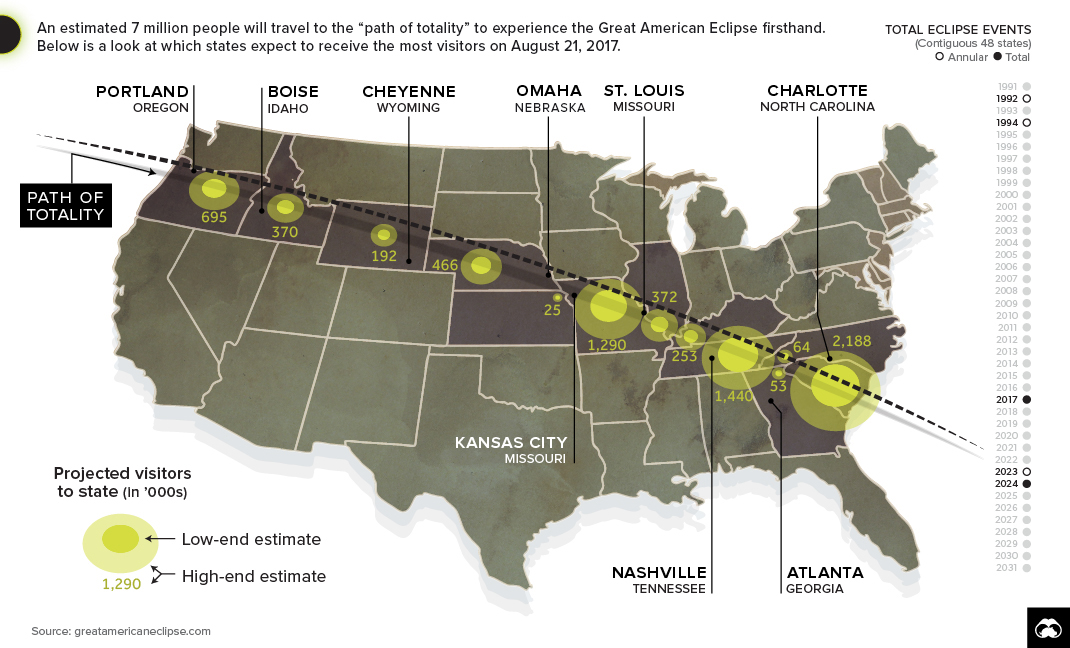

This Map Shows Which States Will Benefit From Solar Eclipse Tourism

This Map Shows Which States Will Benefit From Solar Eclipse Tourism

On August 21st, millions of Americans will migrate to towns along the path of the upcoming solar eclipse. The Great American Eclipse will stretch over 12 states, and it’s already being called the greatest temporary mass migration to see a natural event in U.S. history.

The last total eclipse occurred in the United States in 1979, and businesses are cashing in on the pent-up enthusiasm for this extremely rare celestial event.

Here are some high payoffs that “eclipse boom towns” are hoping for:

| City / Town | State | Population | Projected Visitors | Est. Economic Impact |

|---|---|---|---|---|

| Madras | OR | 6,200 | 100,000+ | $9 million |

| Carbondale | IL | 26,000 | 55,000+ | $7 million |

| Nashville | TN | 684,410 | 50,000+ | $15 million |

| Hopkinsville | KY | 32,000 | 100,000+ | $30 million |

Many of the towns in the path of totality have been aggressively marketing themselves to potential onlookers. One town, Hopkinsville, KY, has branded itself as “Eclipseville” leading up to the occasion. It’s likely to payoff, since it’s been reported that visitors from 19 countries and 46 states are descending upon the small town for the perfect glimpse of the phenomenon.

As another example, the sleepy agricultural town of Madras, OR, has an entire festival devoted to the solar eclipse. Appropriately named Oregon Solarfest and running from August 17-22, the festival takes advantage of the town’s perfect location in the high desert of Central Oregon and typical clear skies. Although it’s hard to really determine how many people are coming for the solar eclipse – Madras anticipates over 100,000 visitors, and millions of dollars pouring into the town’s economy.

Astronomical Prices

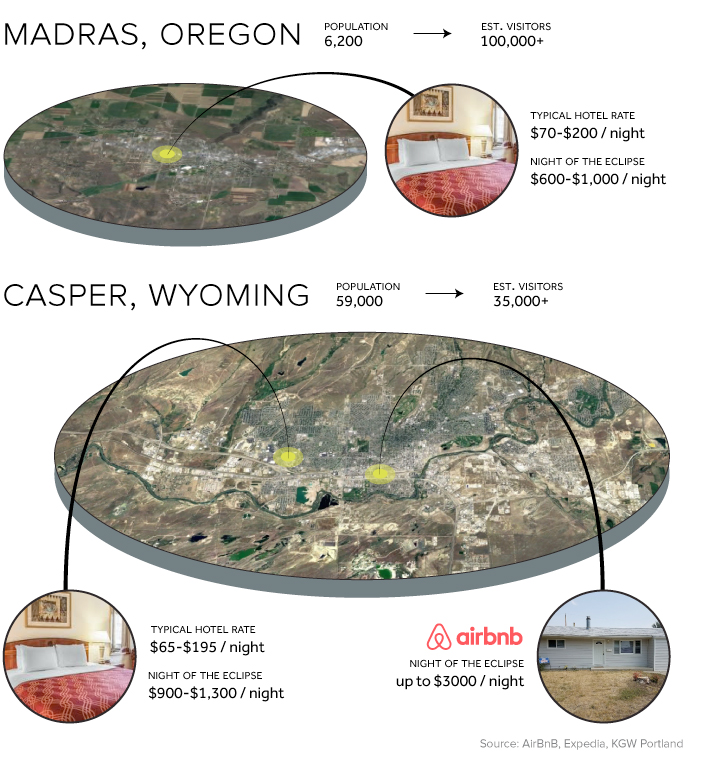

Accommodation and short-term rentals are skyrocketing thanks to the eclipse craze. Hotels along the route have been 95% booked since 2013, so remaining rooms are going at a premium. Here are a couple examples:

Airbnb reports that over 40,000 guests have been booked along the path of totality so far, with Nashville and towns in South Carolina making up nearly half of that activity.

Total Eclipse of the Grid

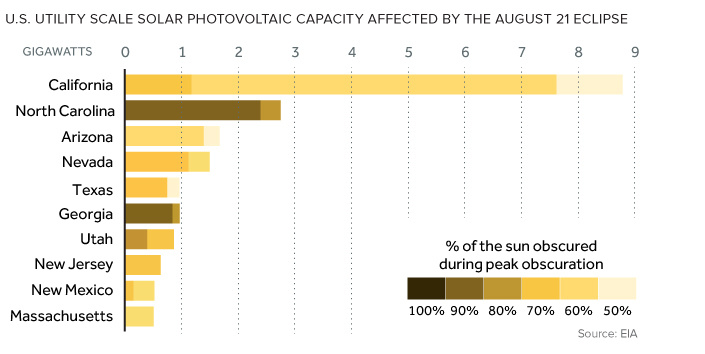

The other big impact the eclipse will have is on the U.S. power grid – particularly in states that have a higher reliance on solar energy.

Out of 1,900 power plants, only 17 of them are in the path of totality (mostly in eastern Oregon), but hundreds of others will be at least 90% obscured (mostly around North Carolina and Georgia).

More than 100 million solar panels are expected to be affected, dropping output by 20% — equivalent to all the energy the city of San Francisco uses in a week.

At first glance, the eclipse might seem like a major headache for utilities, power generators, and grid operators. However, David Shepheard, a managing director at Accenture, sees it instead as a rare opportunity for a “forecastable dress rehearsal” for dealing with major grid interruptions. Some companies are even using the brief interruption to measure exactly how much rooftop solar power is actually connected to their grids.

Party like it’s 2024

If you aren’t able to watch the upcoming eclipse, don’t worry. The next total solar eclipse in the United States will take place in 2024. (You may want to book your room now though!)

Energy

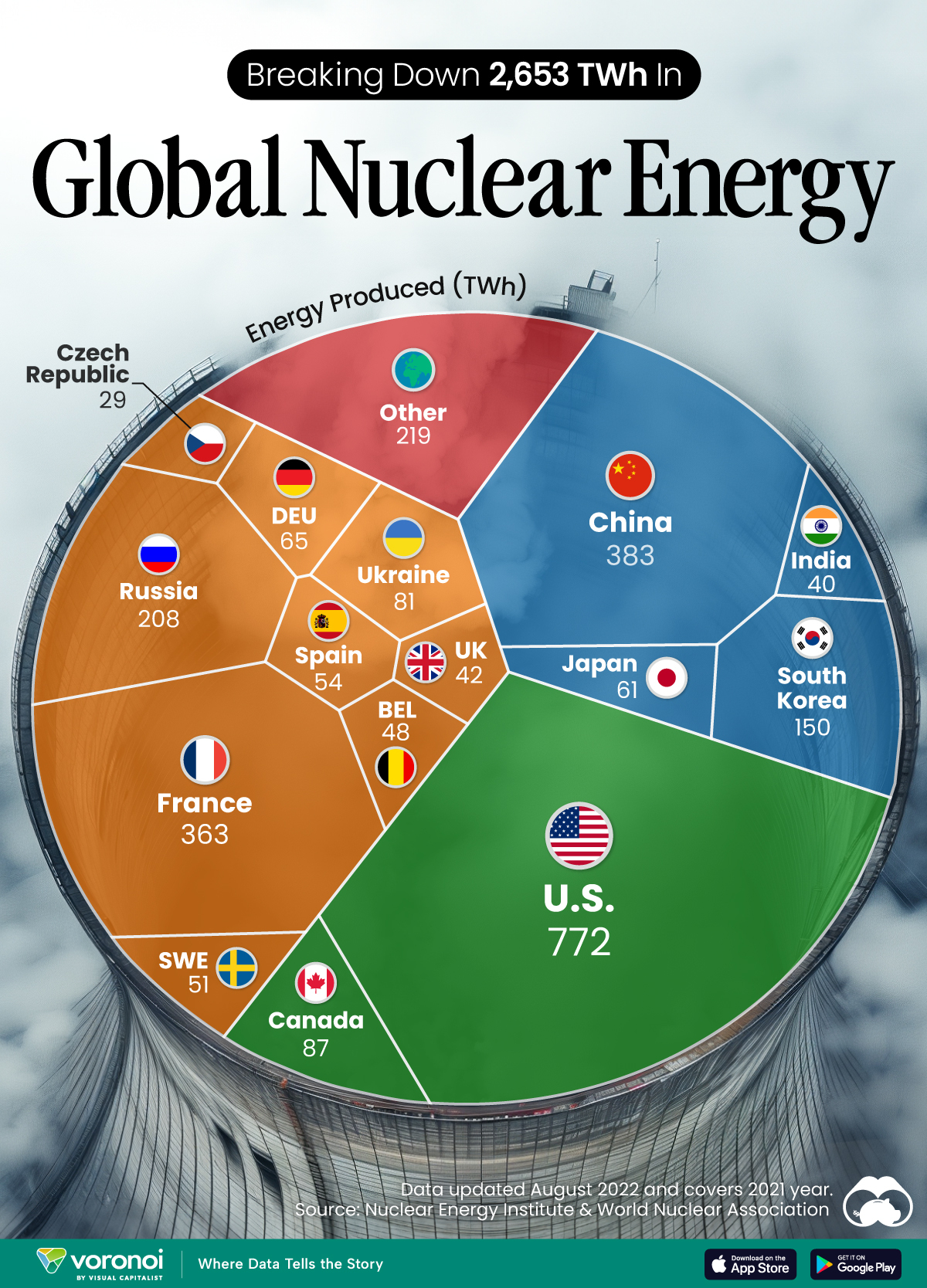

The World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

The World’s Biggest Nuclear Energy Producers

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Scientists in South Korea recently broke a record in a nuclear fusion experiment. For 48 seconds, they sustained a temperature seven times that of the sun’s core.

But generating commercially viable energy from nuclear fusion still remains more science fiction than reality. Meanwhile, its more reliable sibling, nuclear fission, has been powering our world for many decades.

In this graphic, we visualized the top producers of nuclear energy by their share of the global total, measured in terawatt hours (TWh). Data for this was sourced from the Nuclear Energy Institute, last updated in August 2022.

Which Country Generates the Most Nuclear Energy?

Nuclear energy production in the U.S. is more than twice the amount produced by China (ranked second) and France (ranked third) put together. In total, the U.S. accounts for nearly 30% of global nuclear energy output.

However, nuclear power only accounts for one-fifth of America’s electricity supply. This is in contrast to France, which generates 60% of its electricity from nuclear plants.

| Rank | Country | Nuclear Energy Produced (TWh) | % of Total |

|---|---|---|---|

| 1 | 🇺🇸 U.S. | 772 | 29% |

| 2 | 🇨🇳 China | 383 | 14% |

| 3 | 🇫🇷 France | 363 | 14% |

| 4 | 🇷🇺 Russia | 208 | 8% |

| 5 | 🇰🇷 South Korea | 150 | 6% |

| 6 | 🇨🇦 Canada | 87 | 3% |

| 7 | 🇺🇦 Ukraine | 81 | 3% |

| 8 | 🇩🇪 Germany | 65 | 2% |

| 9 | 🇯🇵 Japan | 61 | 2% |

| 10 | 🇪🇸 Spain | 54 | 2% |

| 11 | 🇸🇪 Sweden | 51 | 2% |

| 12 | 🇧🇪 Belgium | 48 | 2% |

| 13 | 🇬🇧 UK | 42 | 2% |

| 14 | 🇮🇳 India | 40 | 2% |

| 15 | 🇨🇿 Czech Republic | 29 | 1% |

| N/A | 🌐 Other | 219 | 8% |

| N/A | 🌍 Total | 2,653 | 100% |

Another highlight is how China has rapidly grown its nuclear energy capabilities in the last decade. Between 2016 and 2021, for example, it increased its share of global nuclear energy output from less than 10% to more than 14%, overtaking France for second place.

On the opposite end, the UK’s share has slipped to 2% over the same time period.

Meanwhile, Ukraine has heavily relied on nuclear energy to power its grid. In March 2022, it lost access to its key Zaporizhzhia Nuclear Power Station after Russian forces wrested control of the facility. With six 1,000 MW reactors, the plant is one of the largest in Europe. It is currently not producing any power, and has been the site of recent drone attacks.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?