Technology

The Jeff Bezos Empire in One Giant Chart

The Jeff Bezos Empire in One Giant Chart

With a fortune largely tied to his 79 million Amazon shares, the net worth of Jeff Bezos has continued to rise.

Most recently, the Amazon founder was even able to surpass Bill Gates on the global wealth leaderboard with $137 billion to his name – however, this ascent to the very top may be extremely short-lived.

On January 9th, 2019, Jeff Bezos announced on Twitter that he was divorcing MacKenzie Bezos, his wife of 25 years. While the precise ramifications of the news are not yet clear, it’s anticipated that MacKenzie Bezos could end up with a considerable portion of shares in Amazon as a result.

There is much to be decided as the world’s wealthiest couple splits their assets – but for now, here is a list of what Jeff Bezos owns today.

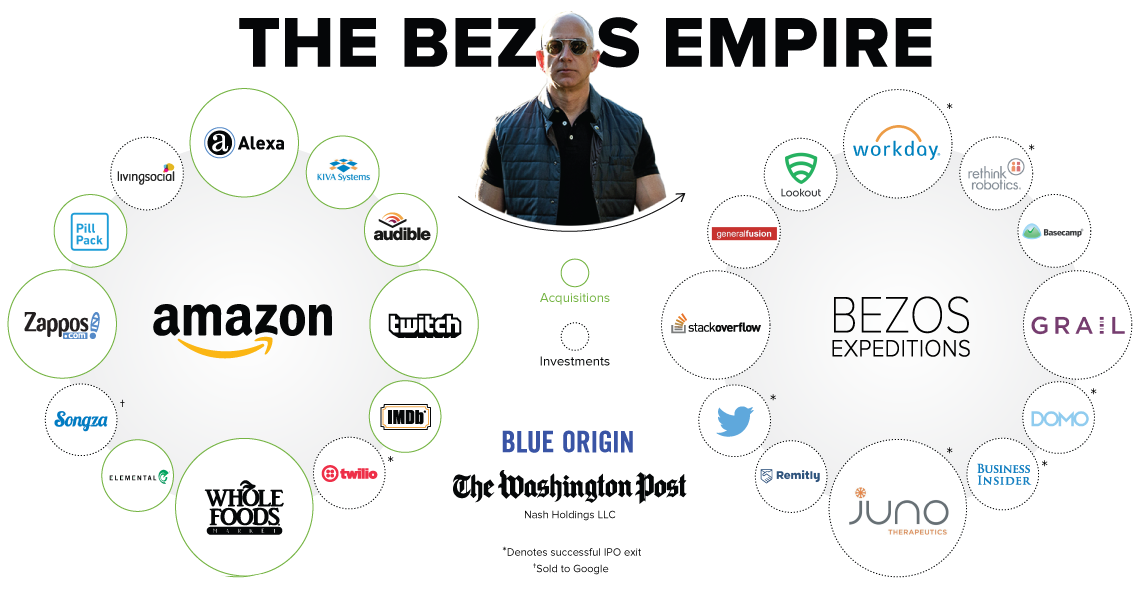

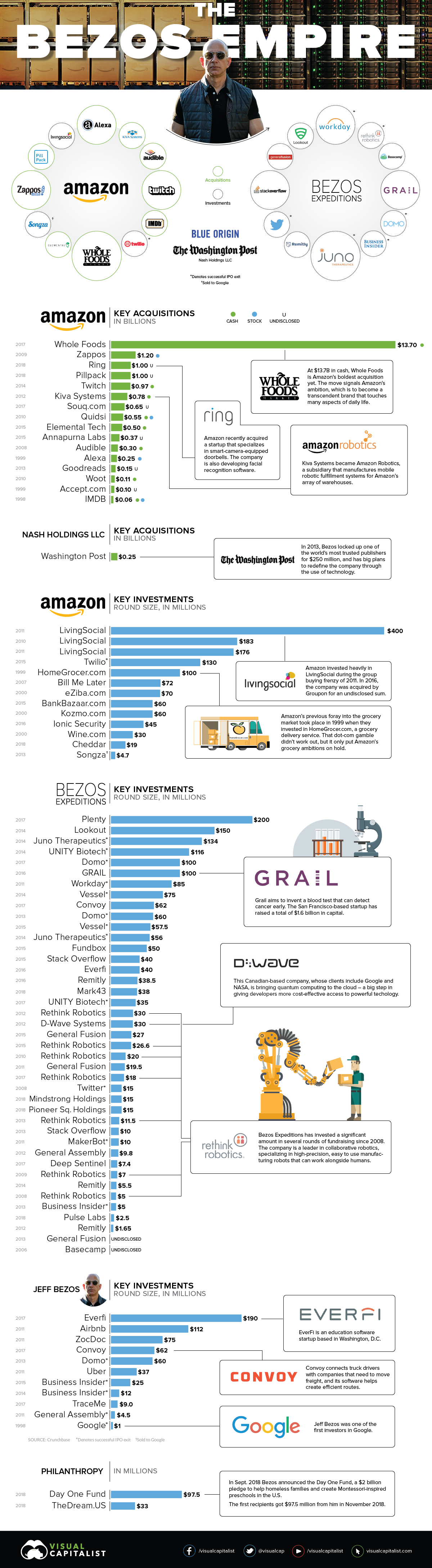

The Jeff Bezos Empire in 2019

The obvious centerpiece to the Jeff Bezos Empire is the 16% ownership stake in Amazon.com.

However, beyond that, there is a wide variety of other investments and acquisitions that Jeff Bezos has made through Amazon or his other investment vehicles. These range from household names to more secretive endeavors, and are worth looking at to truly understand his assets and fortune.

Amazon.com

Amazon makes acquisitions and investments that relate to the company’s core business and future ambitions. This includes acquisitions of Whole Foods ($13.7 billion in 2017), Zappos.com ($1.2 billion in 2009), PillPack ($1 billion in 2018), Twitch.tv ($970 million in 2014), and Kiva Systems ($780 million in 2012).

This also includes investments in everything form failed dot-com company Kozmo.com (2000) to Twilio, which successfully IPO’d in 2016.

Bezos Expeditions

Bezos Expeditions manages Jeff Bezos’ venture capital investments. Over the years, this venture arm has put money into Twitter, Domo, Juno Therapeutics, Workday, General Fusion, Rethink Robotics, Business Insider, MakerBot, and Stack Overflow.

More recent investments include GRAIL, a startup that recently raised over $900 million to cure cancer before it happens, as well as EverFi, an edtech startup.

Jeff Bezos

Jeff Bezos also invests money on a personal level. He was an angel investor in Google in 1998, and has also put money in Uber and Airbnb. (Note: these last two companies are listed on the Bezos Expeditions website, but on Crunchbase they are listed as personal investments.)

Nash Holdings LLC

Nash Holdings is the private company owned by Bezos that bought The Washington Post for $250 million.

Bezos Family Foundation

The BFF is run by Jeff Bezos’ parents, and is funded through Amazon stock. It focuses on early education, and has also made an investment in LightSail Education’s $11 million Series B round.

Blue Origin

Finally, it’s also worth noting that Jeff Bezos is the founder of Blue Origin, an aerospace company that is competing with SpaceX in mankind’s final frontier.

Note: This article and infographic were originally published in June 20, 2017. Both have been updated as of January 11, 2019 to include more up-to-date acquisitions and investments.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue