Technology

Investor Confidence in Cloud Storage is Sky High

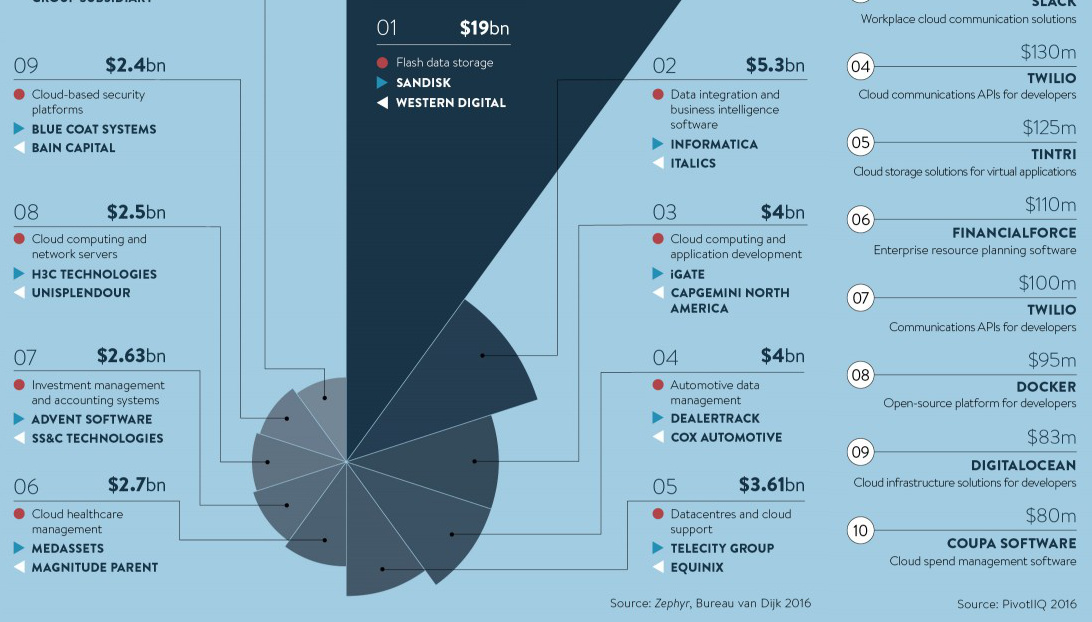

Image courtesy of: Raconteur

Investor Confidence in Cloud Storage is Sky High

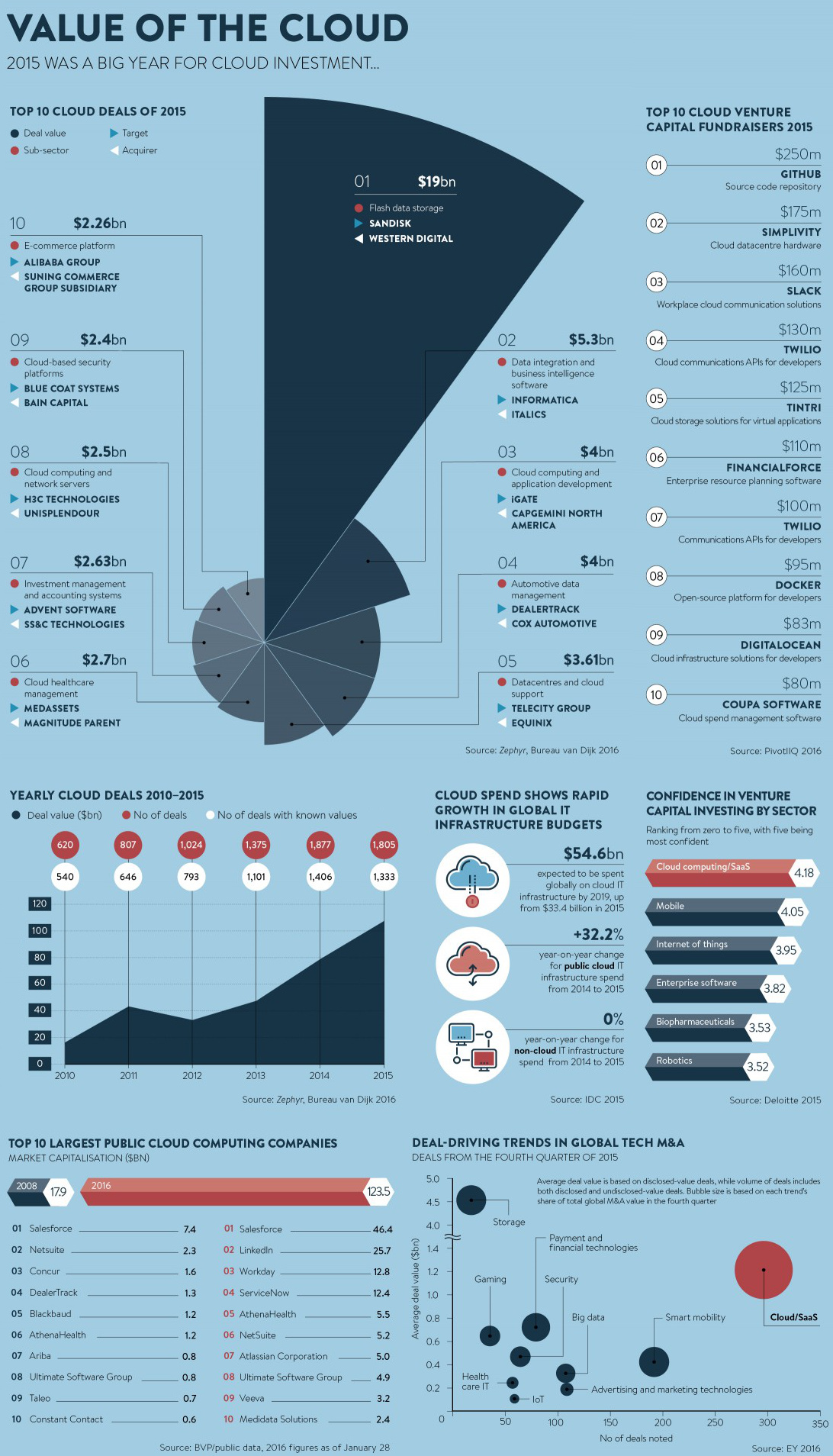

For technology investors in 2015, cloud was king.

Money continued to flow to the cloud storage sector, where a total of 1,800 transactions were made in 2015 for a total value of more than $100 billion. The largest of these deals was between two storage giants, with SanDisk getting gobbled up by competitor Western Digital for a $19 billion price tag.

Cloud storage, which allows users and businesses to store vast amounts of data remotely, has been in heavy demand lately. With approximately 2.5 quintillion bytes of data created every day and more people seeking to stream movies, video games, and music from the cloud on a regular basis, there is no other option but to grow the industry at a breakneck pace.

Cloud Nine

Why is the cloud another level above many other tech sub-sectors competing for investment?

The answer is simple.

Cloud is already proven to be effective, and it can scale. While the true viability of trends such as the internet of things (IoT), robotics, VR/AR, and artificial intelligence are still under scrutiny, cloud storage is being used effectively by millions every day. It’s why Amazon crushed its most recent earnings report with $2.57 billion in revenue (a 64% increase) just coming from its Amazon Web Services cloud play. It’s also why, according to a Deloitte survey, venture capitalists are most confident investing in the cloud sector over many other technologies.

It’s no surprise that quality startups focused on the cloud have had no problems raising money.

Enterprise SaaS startup Slack, which raised $160 million in 2015 and another $200 million in 2016, was selected as the “Company of the Year” according to Inc. Magazine. It has been one of the fastest growing startups ever, reaching a $1 billion valuation even before its product turned eight months old.

GitHub, a repository for software code, had the biggest raise for cloud-focused startups last year. The seven year-old company raked in $250 million at a $2 billion valuation to expand internationally and to invest in new products.

A Cloudy Horizon?

Despite a projection of $54.9 billion in annual spend going to cloud infrastructure by 2019, one major concern still remains about the future of cloud computing.

The cloud has vast amounts of sensitive data stored in a single place, making cloud providers a particularly attractive target for hackers. With the average cybercrime in the United States costing a company $15.4 million, organizations are actively seeking to shield their digital assets from the millions of cyber attacks launched each year. Cybersecurity is becoming a mission critical feature in both enterprise and government budgets moving forward.

If enterprise customers lose faith in the cloud’s ability to keep data secure, there will be a ripple effect on investment and industry growth. For further reading and to get an idea of what these companies are facing, here’s a recent list of the “Treacherous 12” security threats that organizations face when using cloud services.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001