Technology

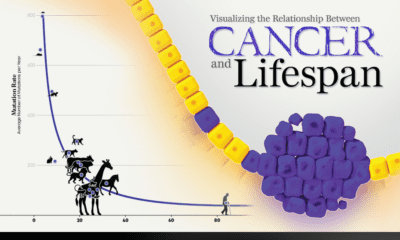

Investing in a Cure for Cancer: What You Need to Know

More than $100 billion is spent worldwide every year in the quest to cure cancer. However, despite this exhaustive effort, the number of cancer cases is estimated to increase by 70% over the next two decades, and is expected to reach 25 million new cases per year by 2030.

Is there a prospect of stopping – or even slowing – the spread of this debilitating disease?

What You Need to Know About Cancer

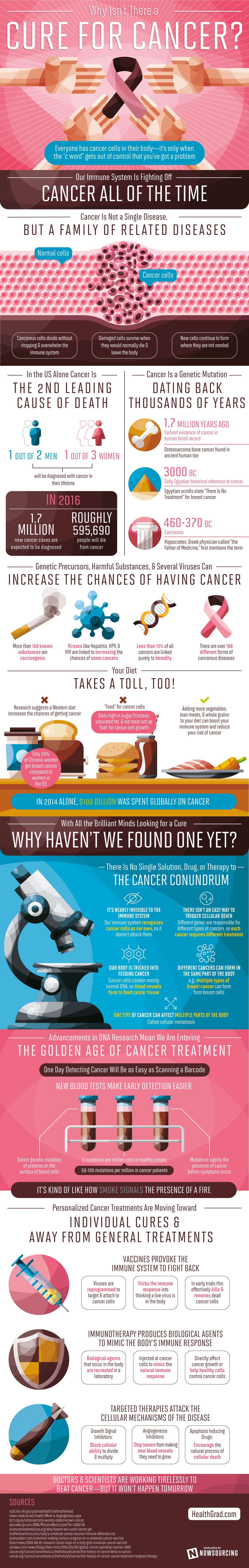

The below infographic from Healthgrad shows that although there have been huge advancements in the understanding of how cancers behave and the development of more effective treatments, there is still no single “cure” for cancer.

That said, there are some very promising advances in cancer treatment in progress, and we highlight some thoughts on gaining exposure to these companies later on in the article.

A Global Epidemic

As the infographic points out, we all have cancer cells in our bodies, which our immune systems are responsible for fighting off. Problems arise when these cells are triggered by certain external and internal factors, such as exposure to environmental toxins, viruses, or the natural process of aging.

Once these cancer cells are triggered, they begin to multiply rapidly and overwhelm the immune system.

No Single Cure

Cancer is not a single disease, so there can be no single cure. There are actually more than 100 different forms of verified cancerous diseases, however some sources claim this number is much higher.

New discoveries about the onset and behavior of cancer are being made all the time, and they are leading to the development of more effective therapies. For example, it was recently discovered that there are multiple subtypes of breast cancer, which may occur at the same time within a patient and have various degrees of responsiveness to different treatments.

Findings such as this are driving new forms of more personalized diagnostic and treatment methods, such as vaccines, immunotherapy products, and targeted therapies.

How to Invest in a Cure for Cancer

1.) Prepare to be patient:

Currently we are seeing a shift in medical innovation, whereby smaller biotech companies are producing game-changing breakthrough treatments in relatively new fields of oncology such as targeted immunotherapy. Investing in these smaller biotech companies can produce huge returns, but the risk is also high. If a promising biotech startup doesn’t end up getting its product approved by the FDA, the stock price will likely plummet.

Another point to keep in mind is that these stocks tend to be quite volatile along the road to marketability. Patience is a virtue when it comes to investing in pharmaceutical companies, and it can take stocks up to five or ten years to reach their full potential.

2.) Diversify among therapies:

Today, large pharmaceutical companies are bringing the latest cancer therapy products to market, while smaller biotech companies are working on the next wave of innovative new cancer therapies.

A good strategy is to diversify investments by seeking opportunities in both the current and future waves of cancer treatment innovation. Bear in mind that many big pharma companies are actively acquiring smaller biotechs and will continue to do so over the coming years.

3.) Opportunities in acquisitions:

In recent years, corporate interest in startups that are developing cancer therapies has been increasing.

According to CB Insights, corporate-backed deals in cancer-focused startups increased from around 30 in 2012 to nearly 50 in 2016 (as of October 2016). And it’s not just big pharma that’s taken notice: tech companies such as Google and IBM have entered this space recently, investing millions into startups developing immune-oncology and targeted therapy treatments.

Among the most notable deals:

- Biopharma company Celgene has been the most active investor in cancer therapy startups, backing 16 companies in the last five years including Cleave Biosciences ($37 million Series B round) and Quanticel Pharmaceuticals ($485 million acquisition) in 2015.

- Pharma company AbbVie acquired Stemcentrx for $10.2 billion in Q2 2016, one of the largest acquisitions of a VC-backed company in history.

- Drug development startup Petra Pharma was backed by five of the top corporate investors in a $48 million Series A round, including AbbVie Biotech Ventures, Eli Lilly & Co, Johnson & Johnson Innovation, Pfizer Venture Investments, and WuXi PharmaTech – as well as IBM Watson Group.

Preventive vs. Curative

Most cancers, once diagnosed, cost hundreds of thousands of dollars to treat. Many health care professionals in the field of oncology have argued that the way money is currently spent on cancer treatment is not sustainable. Their stance is that more funding should be allocated to preventive rather than curative measures. For example, granting widespread access to vaccinations against certain prevalent cancers – such as for Hepatitis B, the leading cause of liver cancer, and for HPV, the leading cause of cervical cancer – could go a long way to preventing the onset of this devastating disease.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?