Inside ESG Ratings: How Companies are Scored

The following content is sponsored by MSCI.

Inside ESG Ratings: How Companies are Scored

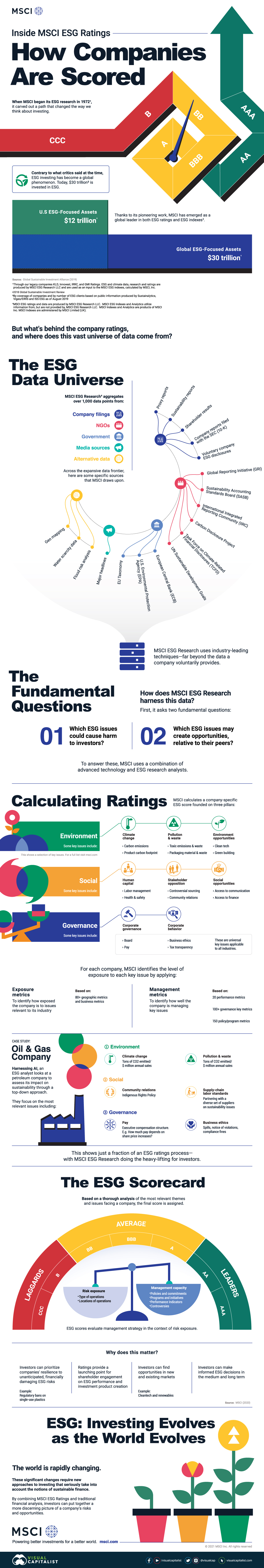

Back in 1972, environmental, social, and governance (ESG) investing had a long way to go.

At the time, ESG research was a nascent field, but it paved the way for the booming investment strategy. Now, it is estimated that one in every three investments in the world will be ESG-mandated by 2025—with assets projected to reach $53 trillion.

This infographic from MSCI shows what’s behind a company’s ESG rating, and where the expansive universe of data comes from.

The ESG Data Universe

Drawing on over 1,000 data points, MSCI ESG Research collects data from a variety of sources:

- Company filings: Proxy reports, sustainability reports, shareholder results, voluntary company ESG disclosures

- NGOs: Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), UN Sustainable Development Goals

- Government: U.S. Environmental Protection Agency, European Central Bank, EU Taxonomy

- Media sources: Major headlines

- Alternative data: Geo mapping, water scarcity data, flood risk analysis

Across the expansive data frontier, these are just some of the sources that are drawn on. Typically, a significant amount of data goes beyond what a company will voluntarily provide.

ESG Ratings: The Two Fundamental Questions

During this process, there are two key questions that underlie ESG ratings:

- Which ESG issues could cause harm to investors?

- Which ESG issues may create opportunities, relative to their peers?

To answer these, MSCI uses a combination of technology and ESG analysts.

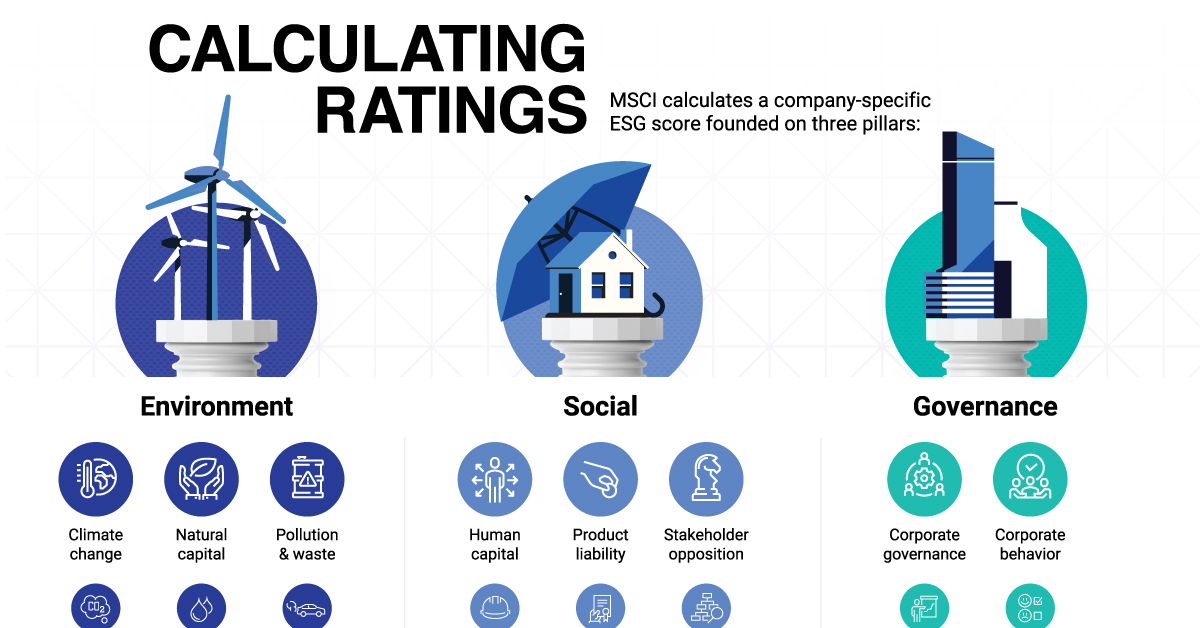

Calculating Ratings

Next, a company-specific score is calculated based on three pillars. Here is a snapshot of some of the key issues that fall within each of the E, S, and G pillars:

| Environmental | Social | Governance |

|---|---|---|

Climate Change

| Human capital

| Corporate governance

|

Pollution & Waste

| Stakeholder opposition

| Corporate behavior

|

Environment opportunities

| Social opportunities

|

So how does this break down for a specific company?

Case Study: Oil & Gas Company

Harnessing artificial intelligence, an ESG analyst looks at a petroleum company to assess its impact on sustainability through a top-down approach. They focus on the most relevant issues including:

| Environmental | Social | Governance |

|---|---|---|

| Climate change: Tons of CO2 emitted/$ million annual sales | Community relations: Indigenous Rights Policy | Pay: Executive compensation structure |

| Pollution & waste: Tons of CO2 emitted/$ million annual sales | Supply-chain labor standards: Partnering with a diverse set of suppliers on sustainability issues | Business ethics: Spills, notice of violations, compliance fines |

Importantly, this shows just a snapshot of the process, while ESG analysts do the heavy-lifting.

The ESG Ratings Scorecard

Finally, based on a thorough analysis of the most relevant themes and issues facing a company, a final score is assigned. Companies are grouped according to three primary tiers:

| Laggards | Average | Leaders |

|---|---|---|

| CCC, B | BB, BBB, A | AA, AAA |

These scores can influence investor decisions on many levels:

- Investors can prioritize a company’s resilience to unanticipated and financially damaging ESG risks.

- Ratings provide a launching point for shareholder engagement on ESG performance and how investment products are created.

- Investors can find opportunities in new and existing markets.

- Investors can make informed ESG decisions in the medium and long term.

Why Do ESG Ratings Matter?

Today, investor demand is one of the chief drivers of ESG investing.

Alongside this, reputational benefits and higher risk-reward tradeoff are playing a larger role in how investors think about sustainability and their investments. But of course, ESG ratings alone are not the entire picture.

By combining ESG ratings and traditional financial analysis, investors can put together a more discerning picture of a company’s risks and opportunities.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.