Technology

India’s Taxi War: Uber vs. Ola

India’s Taxi War: Uber vs. Ola

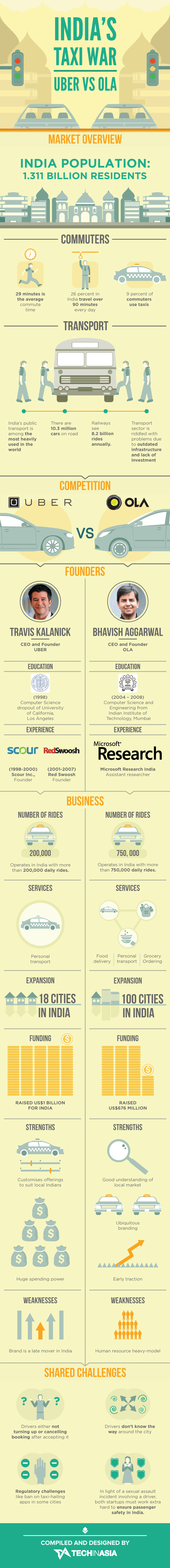

In the cities where Uber is permitted by municipalities to operate, the ensuing battle is typically between the massive tech giant and the local taxi companies. However, in India the competitive landscape is much different: a domestic tech company has an early head start with a soaring market share. In this case, for Uber, the stakes couldn’t be much higher.

India is the second most populous country in the world, but it is expected to surpass China as early as 2022 in this category. More importantly, the country will surely be an economic powerhouse and a center of global growth in the foreseeable future. India does have its challenges, but in a previous chart we showed that it will rival China for overall economic growth in the coming decades.

So who is bold enough to challenge Uber for the massive Indian rideshare market?

That company is Ola Cabs and so far it has raised five rounds of funding, with the most recent being for a hefty $210 million in October 2014. The company was founded in 2010 by Bhavish Aggarwal and provides 750,000 daily rides in the Indian market. Ola also recently acquired a major domestic competitor (TaxiForSure) for a sum of $200 million in cash and stock.

So far, Uber has committed $1 billion from investors to ensure its dominance in India, but currently the company only brings in about 200,000 daily rides. Uber has six years of experience of winning these types of battles: against Lyft, against local taxi companies, in courts, and in the public relations sphere.

India’s size and fragmented transit system also means that there could be room for two or more rideshare companies to co-exist in the future. Since ridesharing is still in its infancy in the market, there is plenty of room to still grow for both companies: but the battle could be heated.

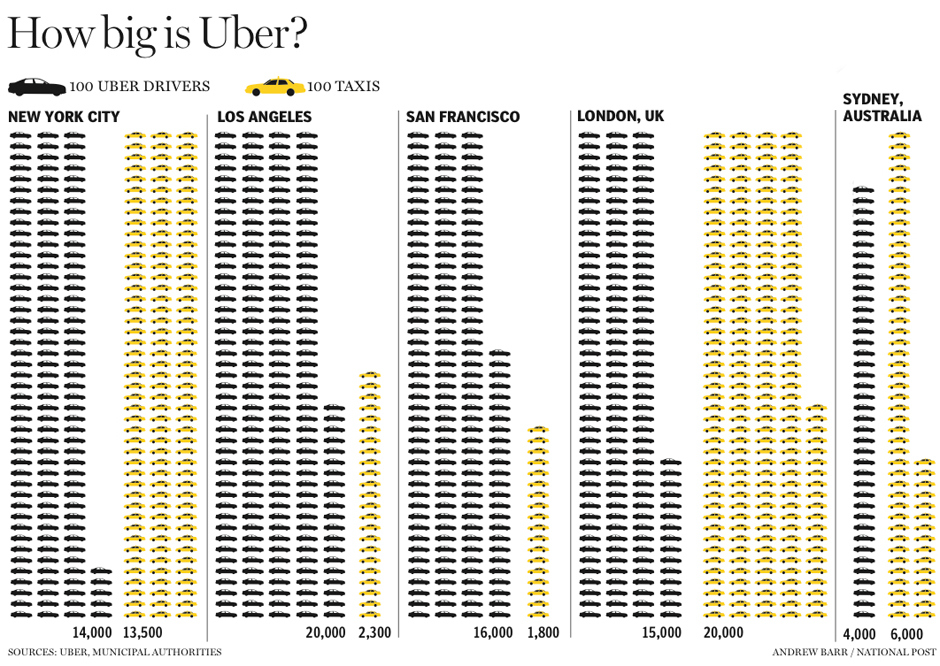

Lastly, for fun: here’s a graphic comparing Uber’s size in major markets against the legions of all taxi companies operating:

Original graphic by: Tech in Asia

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries