Technology

How Technology is Disrupting the Construction Industry

View the full-resolution version of this infographic

How Technology is Disrupting the Construction Industry

See the full resolution version of this infographic.

The rate of digital disruption is escalating in almost every industry. However, despite being one of the fastest-growing industries globally—construction has been one of the last to get hit.

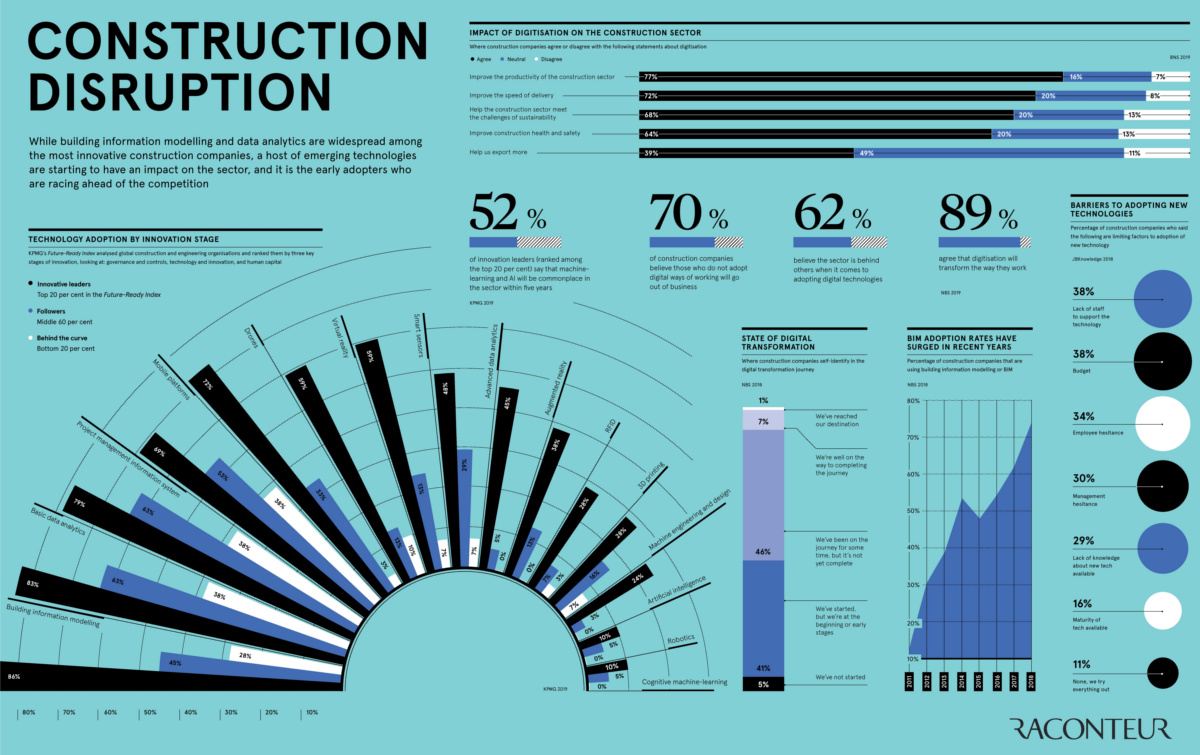

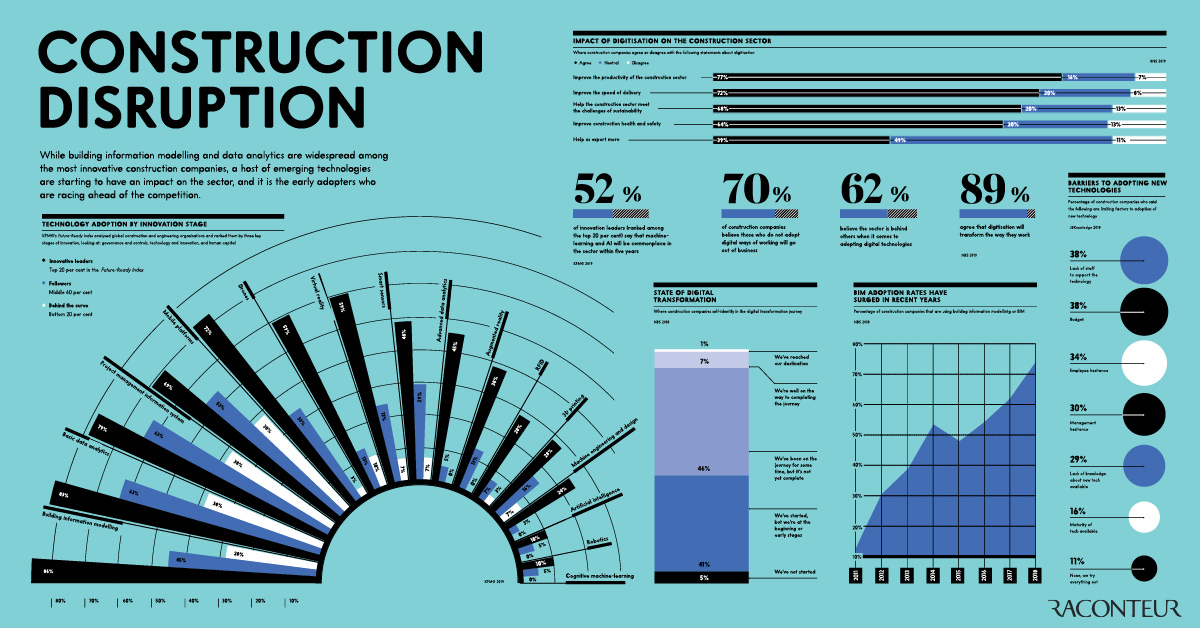

Today’s infographic from Raconteur ranks the adoption of emerging technologies that will have a major impact on the industry’s processes and bottom line. The technologies help solve four major challenge areas that the construction industry struggles with: productivity, safety and training, labor shortages, and collaboration.

Which technologies could improve the lives of industry workers, and which technologies may pose a threat to their jobs?

Towards a New Dimension

Output from the global construction industry is expected to rise to $12.7 trillion in 2022, up from $10.6 trillion in 2017. Despite this promising outlook, the industry has gained only 1% of productivity in the last 20 years due to lack of digitization. This creates an opportunity for an added $1.6 trillion by innovating in this area.

According to the infographic, the industry is divided when it comes to the current state of digital transformation. Almost half (46%) of construction companies self-identify as having been on a path towards digital transformation for some time, while 41% see their company as only in the very early stages of digital transformation.

The Spectrum of Tech Adoption

The technology adoption spectrum ranks construction companies by their stages of innovation and rate of technological adoption, using data from the KPMG Future-Ready Index.

Technologies that have the highest adoption rates in the top 20% of companies (considered innovative leaders), are as follows:

- Building Information Modeling (BIM): 86%

- Basic data analytics: 83%

- Project management and information systems: 79%

- Drones: 72%

- Mobile platforms: 69%

BIM is a 3D modeling system that creates depictions of manufacturing facilities, buildings, and highways. While 3D modeling is widely used in construction today, next-generation 5D BIM represents both the physical and functional aspects of a project, and considers a project’s cost and schedule in addition to the standard parameters of 3D BIM.

Meanwhile, for the bottom 20% of companies (considered behind the curve), the rate of adoption can be low or even non-existent for many key technologies. Here are the ones with the lowest adoption rates within this group:

- Cognitive machine learning: 0%

- Robotics: 0%

- Artificial intelligence: 0%

- Machine engineering and design: 3%

- 3D printing: 7%

Both employers and employees are hesitant about adopting new technologies, due in part to the lack of knowledge surrounding them. More specifically, 29% of companies agree that lack of knowledge is a barrier for adoption, while 38% believe that it is due to lack of budget. A further 38% believe it is the lack of support from employees that inhibits mass adoption.

Despite these barriers, 52% of innovation leaders claim that technologies like artificial intelligence and cognitive machine learning will become commonplace within the industry over the next five years.

The Long-term Impact

Construction companies are now in a race to go digital, with the hope that technology will enhance profitability while also fending off competitors.

In total, 70% of construction companies believe that those who do not adopt digital tools will go out of business. Further, most believe digitization will improve productivity, speed of delivery, and help meet sustainability challenges.

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023