Technology

Cents and Sounds: How Music Streaming Makes Money

How Music Streaming Makes Money

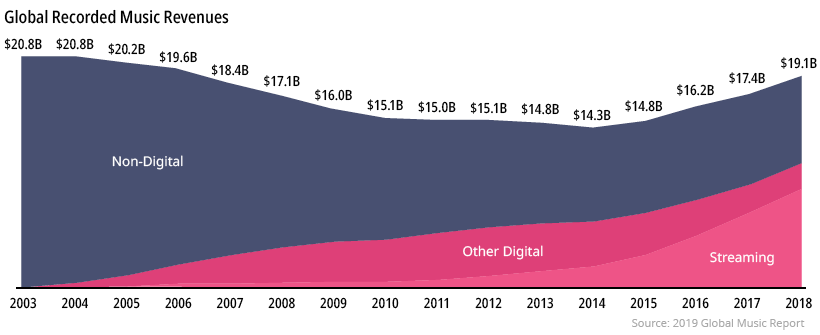

The global music market experienced its fourth consecutive year of growth in 2018, generating over $19 billion in revenue. Music streaming now accounts for almost half of that revenue, with 255 million paid users worldwide.

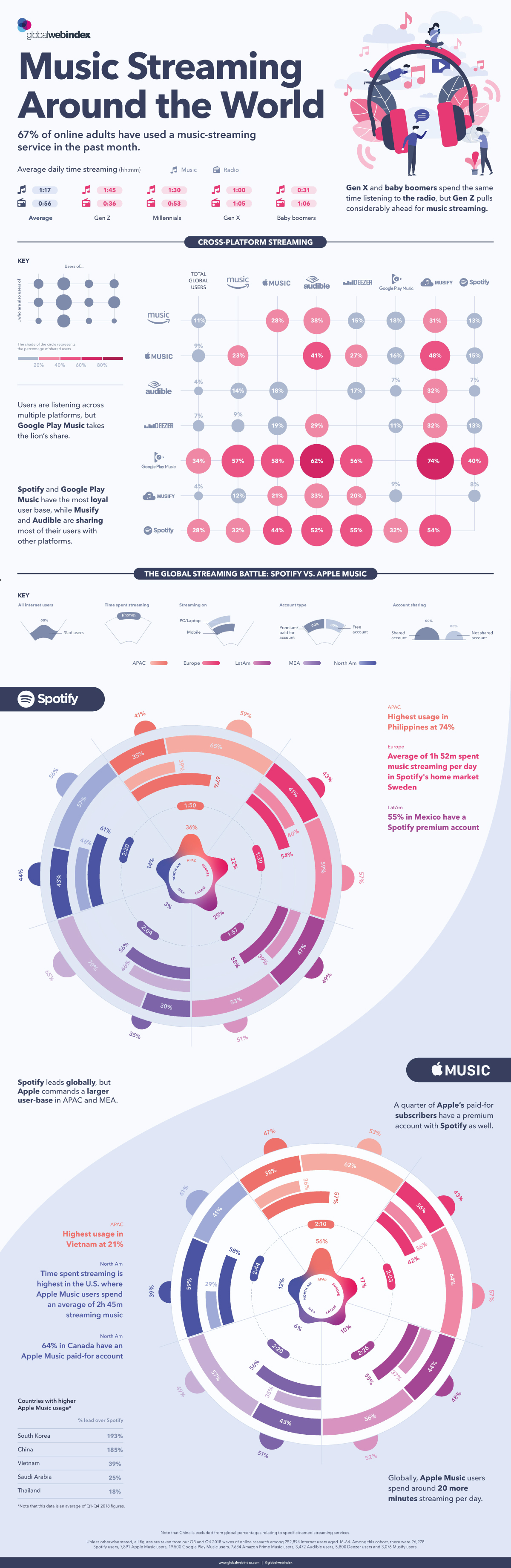

Today’s infographic from Global Web Index compares the popularity of streaming services, exploring how streaming behavior differs by age group and region.

While listeners can now gain access to an abundance of streaming options—is the success of the industry good news for everyone?

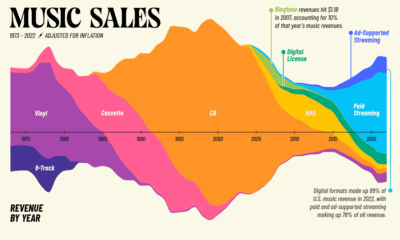

The Age of Streaming

Streaming platforms are web-based services that allow users to listen to high-definition music without having to download and store large files.

The foundations of music streaming were laid by peer-to-peer file sharing system Napster when it was created in 2001, followed by Apple’s iTunes a couple of years later. Spotify, in an attempt to combat music piracy, was founded in 2006 by Swedish duo Daniel Ek and Martin Lorentzon.

Today, 68% of adults use a music streaming service of some kind. According to Global Web Index, Gen Z leads the way with the highest average streaming times, accessing their favorite tracks across multiple platforms.

How Streaming Platforms Make Money

There are currently 33 active streaming platforms available, with a range of different features and characteristics available. Spotify and Apple Music, the largest of the streaming giants, rely on almost identical models to generate revenue:

- Paid Subscriptions: Advertising drives free users towards monthly subscription packages, which include a premium offering for $10 a month and a family offering for $15 a month.

- Advertising: Advertisers pay for exposure, with ads played every 15 minutes for 30 seconds, and can also include sponsored playlists, and homepage takeovers.

Spotify

With 217 million active users, and revenues of almost $6 billion in 2018, Spotify is the global leader in music streaming.

For Spotify, 91% of the company’s revenue comes from its 100 million paid subscriptions—double that of Apple Music—while the other 9% comes from advertising.

Apple Music

Apple’s streaming service commands a larger user-base than Spotify in the Asia Pacific and the Middle East and Africa regions.

While Apple Music has not been a profitable move for the company, the streaming platform bolsters Apple’s ecosystem of services—encouraging a more loyal consumer base.

How Artists Make Money

For both Spotify and Apple Music, 70% of the revenue generated from paid subscriptions and advertising goes towards paying music labels and artists.

Both platforms use the pro-rata model, which pays based on the total share of streams each artist has. For example, if $100 million is generated in revenue, and an artist accounts for 1% of all streams, then they would receive $1 million in royalties.

However, artists advocate for a fairer, more user-centric model that would pay artists based on who each user listens to the most, using their subscription fee. Smaller platforms like Deezer are moving towards a user-centric model and pressuring more established platforms to do the same.

The Future of Streaming

Over the next decade, the music streaming industry will continue to transform, with new innovations presenting significant opportunities and challenges for both streaming platforms and consumers alike.

- Personalization: Streaming platforms are using technology to fully understand a user’s listening habits and to tailor music recommendations directly to them.

- Original Content: Spurred on by the growth of streaming services like Netflix and YouTube, Spotify’s purchase of Gimlet Media for over $200 million signals the beginning of streaming platforms investing in original content.

- Premium Prices: Artists and music labels are demanding more for music, forcing streaming platforms to hike their subscription rates in an attempt to make up for lost revenue.

- Live Streaming: With live streaming rising in popularity, artists can offer audiences an intimate connection and more authentic version of their music.

Currently, artists can increase their chances of being featured on more playlists and ultimately earn more money by altering their music based on streaming platform algorithms. For example, artists only get paid if their song is listened to for 30 seconds, which results in much shorter songs that open with the chorus to keep the listener’s attention.

While streaming platforms continue to provide more avenues for artists to get in front of the right ears, many industry critics argue that music is no longer about creating something for pure enjoyment, but rather about using a formulaic approach to make more money.

Is the future of music safe in the hands of tech giants?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?