Markets

How Every Asset Class, Currency, and S&P 500 Sector Performed in 2021

How Every Market Performed in 2021

After the roller coaster of volatility in 2020, the majority of asset classes in 2021 saw positive returns as the world reopened for business.

The Federal Reserve’s accommodative monetary policy, supply chain struggles, and high demand for fuels and raw materials for the clean energy transition largely shaped the markets.

Alongside the rise in inflation, commodities and cryptocurrency outperformed as broad equity indices saw double-digit returns, with the S&P 500 rising by 26.9% in 2021.

Markets Roundup for 2021

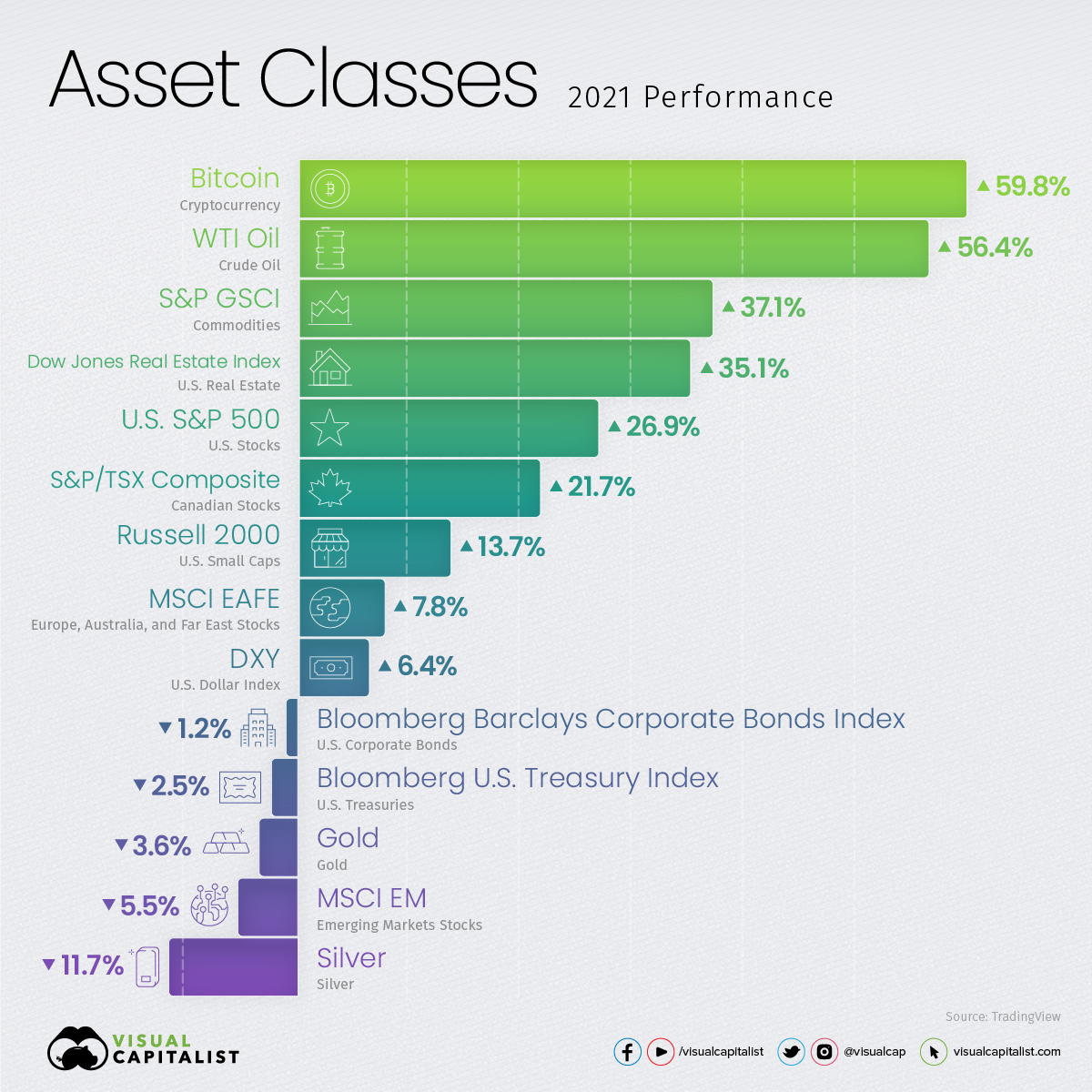

Speculation and the energy fuels for the world’s reopening were two of the main themes for markets in 2021, reflected in Bitcoin (59.8%) and crude oil (56.4%) being the top two performing assets in that time frame.

The S&P GSCI commodity index (37.1%) was another top performer, as agricultural and livestock food prices rose alongside the Dow Jones Real Estate Index (35.1%).

| Asset Class | 2021 Return | Asset Type |

|---|---|---|

| Bitcoin | 59.8% | Cryptocurrency |

| WTI Crude Oil | 56.4% | Commodity |

| S&P GSCI | 37.1% | Commodity |

| Dow Jones Real Estate Index | 35.1% | Real Estate |

| S&P 500 | 26.9% | Equities |

| S&P/TSX Composite | 21.7% | Equities |

| Russell 2000 | 13.7% | Equities |

| MSCI EAFE | 7.8% | Equities |

| U.S. Dollar | 6.4% | Currency |

| Bloomberg Barclays Corporate Bonds Index | -1.2% | Bonds |

| Bloomberg U.S. Treasury Index | -2.5% | Bonds |

| Gold | -3.6% | Commodity |

| MSCI Emerging Markets | -5.5% | Equities |

| Silver | -11.7% | Commodity |

Source: TradingView

Despite most physical and digital commodities seeing price gains, precious metals such as gold (-3.6%) and silver (-11.7%) struggled to hold onto their value, while industrial and battery metals like lithium (477.4%) and cobalt (207.7%) surged.

Large cap equity indices like the S&P 500 (26.9%) almost doubled the returns of small caps (Russell 2000, 13.7%), with emerging markets failing to keep up as they fell 5.5%.

How the S&P 500 Sectors Performed

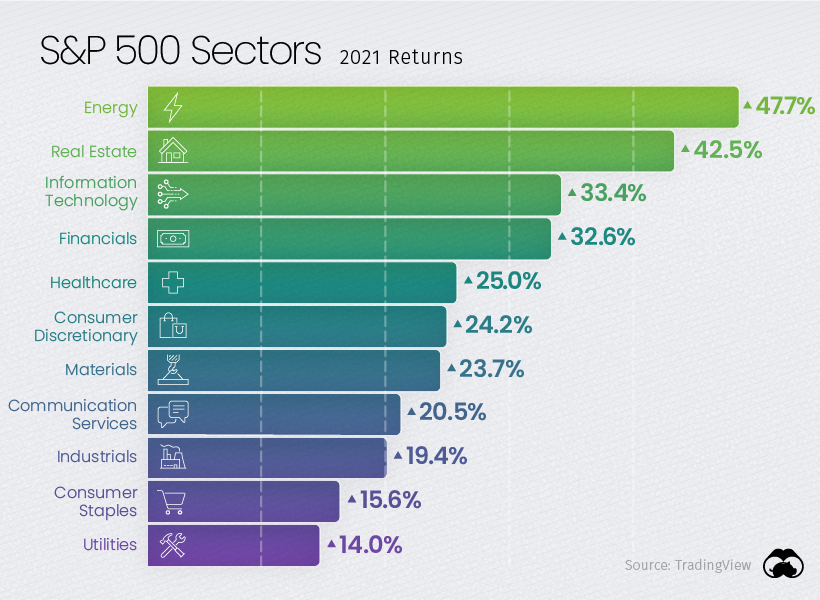

After last year’s poor performance as the worst-performing S&P 500 sector, energy (47.7%) was 2021’s best performing sector alongside the rise in crude oil and other energy commodities.

Two other negative performers last year, real estate (42.5%) and financials (32.6%), also turned it around and were among the top performing sectors this year.

Despite many value equities performing well, growth equities still managed to keep a strong pace. Information technology (33.4%) continued to provide strong returns with Microsoft (51.2%) outperforming many of the other tech giants.

As Amazon (2.38%) and Netflix lagged behind (11.4%), Apple (33.8%) capped off its strong 2021 returns by becoming the first U.S. company to reach a $3T market cap at the start of 2022.

Foreign Exchange and Currency Returns in 2021

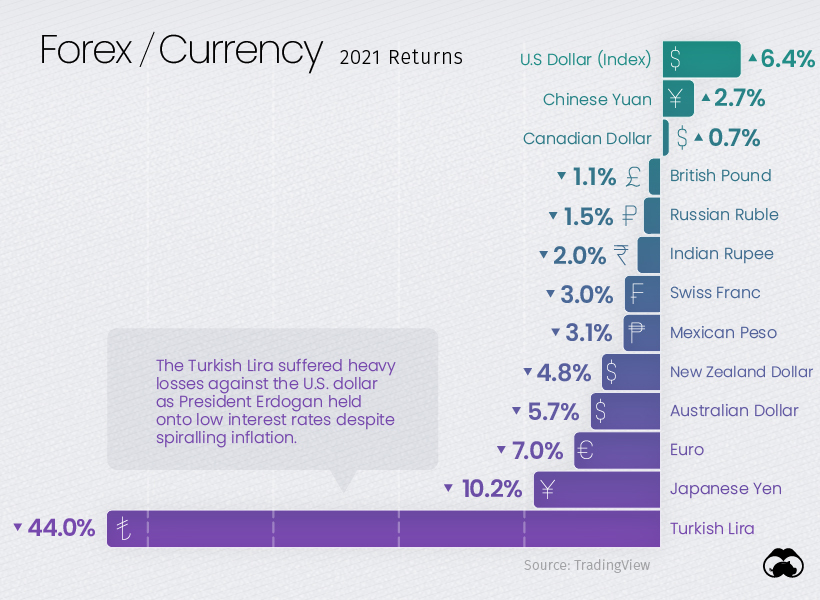

While the U.S. dollar struggled last year with most currencies outperforming it, 2021 saw the dollar index rise by 6.4%, outperforming most other currencies.

The Chinese yuan (2.7%) and Canadian dollar (0.7%) were the only major currencies that managed positive returns against the U.S. dollar, while the Australian dollar (-5.7%), Euro (-7.0%), and Japanese Yen (-10.2%) were among the worst performers.

The Turkish lira was the standout loser in foreign exchange, and the turmoil was punctuated by turnover in the country’s finance minister position. While most other emerging economies raised interest rates to fight against inflation, Turkey has continued cutting rates and looks set to default on its $446 million of external debt.

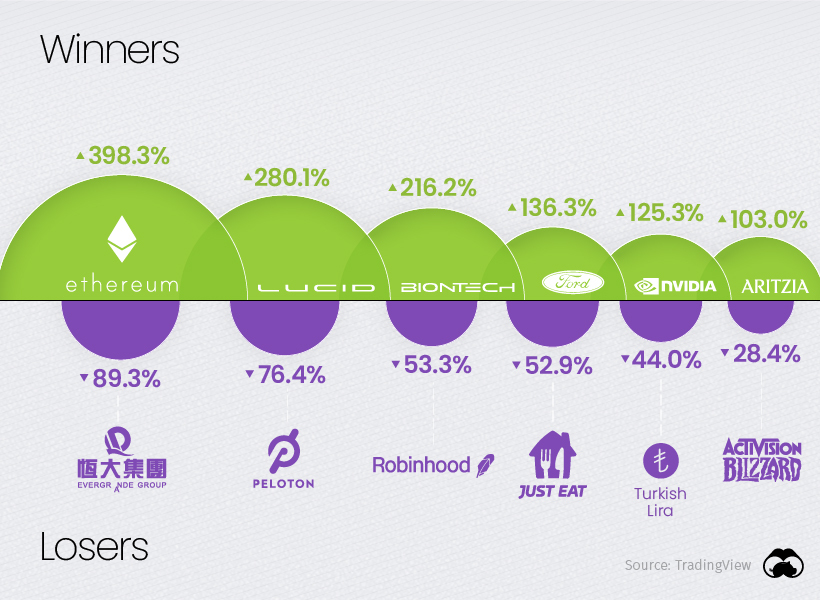

The Winners and Losers of 2021

As the COVID-19 pandemic defined many of the winners and losers in 2020, the gradual reopening of international travel and business shaped the over and underperformers of 2021.

Cryptocurrencies had a standout year beyond Bitcoin (59.8%), which was greatly outpaced by many other cryptocurrencies and smart contract platforms like Ethereum (398.3%), Solana (11,177.8%), Avalanche (3,334.8%), and Luna (12,967.3%).

While Tesla (49.8%) had another strong year, Lucid and Ford Motors greatly outperformed Elon Musk’s company and the rest of the auto industry with their EV efforts. Demand was so great that Ford had to halt reservations for its F-150 Lightning pickup trucks at the end of 2021.

The pain of Evergrande Group (89.3%) shareholders is set to end soon, with the company starting 2022 by halting shares in Hong Kong as its $300 billion in liabilities remain in limbo.

Peloton (-76.4%) was another big loser in 2021 as it gave back nearly all of its gains from last year, proving lockdown speculation fueled most of its former valuation. Just Eat (-52.9%) was similarly hit hard as restaurants reopened in 2021.

Robinhood’s (53.3%) weak performance since its IPO puts a bow on 2021’s retail “stonk” frenzy kicked off by the Wall Street Bets subreddit.

With 2021 being a breakout year for retail traders and investors online, we’ll see if 2022 remains risk-on as the Fed begins tapering, or if markets are due for a change in direction.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?