How Differentiated Insights Lead to a Stronger Financial Portfolio

The following content is sponsored by MSCI

Differentiated Insights Lead to a Stronger Financial Portfolio

How can wealth managers build better portfolios for a better world? It all begins with the right insights. Using risk and return analytics, along with climate and ESG considerations, wealth managers can:

- Propose compelling solutions

- Build stronger portfolios

- Monitor portfolio performance

In this graphic from MSCI, we show how financial portfolio insights help a wealth manager meet their clients’ needs at each step of the process.

Insights in Action

Let’s look at how these benefits take shape for a hypothetical client and their wealth manager.

- Client: Faye

- Investable assets: $1 million

- Risk tolerance: Medium

- Preferred strategy: ESG integration

Given this profile, a variety of financial portfolio insights will help Faye understand how a new solution meets her needs.

Build a Strong Financial Portfolio

In the first stage, the wealth manager will begin building a model portfolio by conducting research and risk/return analytics. A stress test shows that the constructed model portfolio would have performed better than its benchmark during historical market downturns.

| Downturn Event | Portfolio Return | Benchmark Return |

|---|---|---|

| Global Financial Crisis (2007-2009) | -34.7% | -36.4% |

| Oil Crisis (1972-1974) | -29.3% | -31.4% |

| Argentine Economic Crisis (2000-2002) | -23.9% | -24.2% |

| Dot-com Slowdown (2001) | -22.2% | -24.2% |

| Market Crash (Oct 14-19, 1987) | -15.0% | -16.9% |

Financial portfolio construction can also include analyzing exposure to factors, or the investment characteristics that drive risk and return.

To take ESG into account, the wealth manager compares an ESG model portfolio to one of their traditional model portfolios across various metrics. They find that the ESG portfolio has similar risk and a higher historical return, along with a higher ESG quality score.

Propose Compelling Solutions

Once the wealth manager has built the financial portfolio, the advisor can use data and analytics to propose the solution to Faye. Relative to Faye’s current portfolio, the proposed portfolio has had higher returns during its best years and a smaller loss during its worst year. This is more in line with Faye’s risk tolerance.

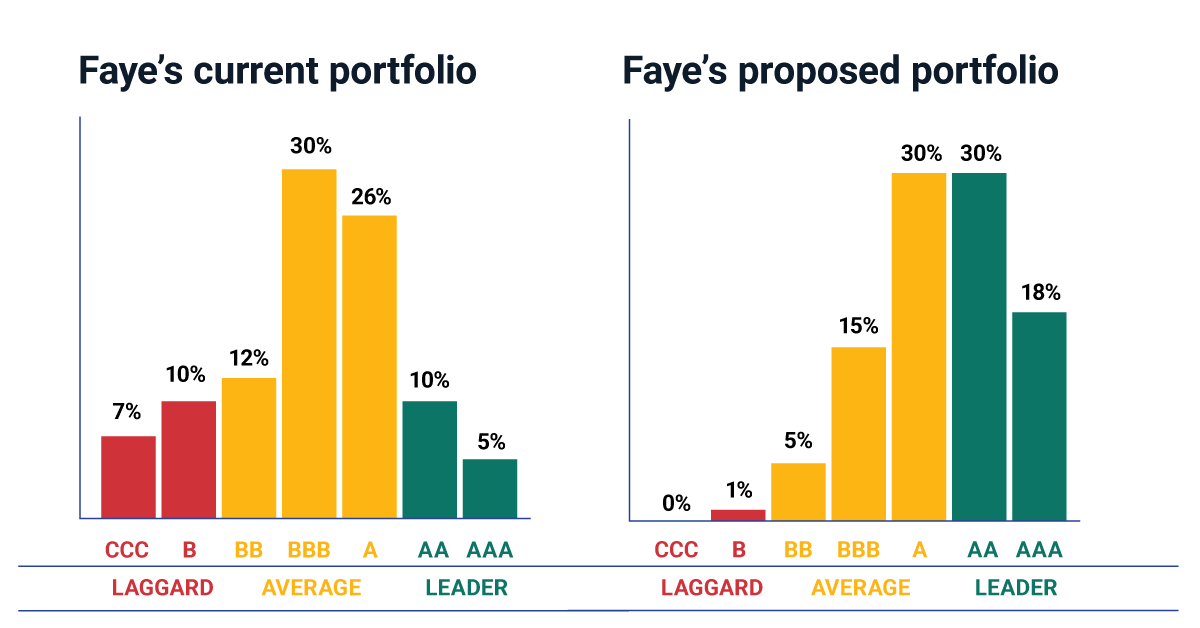

To highlight the ESG characteristics of the proposed portfolio, the advisor shows Faye the ESG ratings distribution for both portfolios.

| ESG Rating | Faye’s Current Portfolio | Faye’s Proposed Portfolio |

|---|---|---|

| AAA - Leader | 5% | 18% |

| AA - Leader | 10% | 30% |

| A - Average | 26% | 30% |

| BBB - Average | 30% | 15% |

| BB - Average | 12% | 5% |

| B - Laggard | 10% | 1% |

| CCC - Laggard | 7% | 0% |

Note: Numbers may not sum to 100 due to rounding.

Almost half of the proposed portfolio holdings are ESG leaders, compared to only 15% of Faye’s current portfolio holdings. The proposed portfolio also has a 53% lower carbon intensity than Faye’s current portfolio, a reduction that is equivalent to 406,843 miles driven by average passenger cars.

Monitor Financial Portfolio Performance

During portfolio reviews, Faye’s advisor provides meaningful information in order to increase Faye’s satisfaction. This also helps ensure they can make adjustments as needed. Faye’s advisor shows her a breakdown of her portfolio holdings according to their weighting and risk score.

| Investment | % of Portfolio | Risk Score |

|---|---|---|

| Delta Air Lines | 21% | 228 |

| The Walt Disney Company | 15% | 165 |

| UPS | 4% | 165 |

| Automatic Data Processing | 6% | 115 |

| iShares MSCI USA Equal Weighted ETF | 30% | 115 |

| iShares Total Return (TR) MSCI KLD 400 Social ETF | 12% | 101 |

| Nushares TR ESG Emerging MKTS Equity ETF | 12% | 100 |

Given Faye has a medium risk tolerance, she may consider reducing her portfolio’s concentration in Delta Airlines.

With regards to ESG, Faye’s advisor can show her how her financial portfolio has been performing in relation to a traditional benchmark. Her advisor shows her that her portfolio has outperformed the non-ESG benchmark year-to-date, and over a five year timeframe.

Positioned for Success

With insights tailored to their preferences, clients are more likely to understand and commit to their financial portfolio. This means wealth managers are positioned to increase client satisfaction—leveraging the power of better portfolios.

Learn more about how MSCI helps wealth managers generate insights here.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.