Technology

How Do Big Tech Giants Make Their Billions?

How Do Big Tech Giants Make Their Billions?

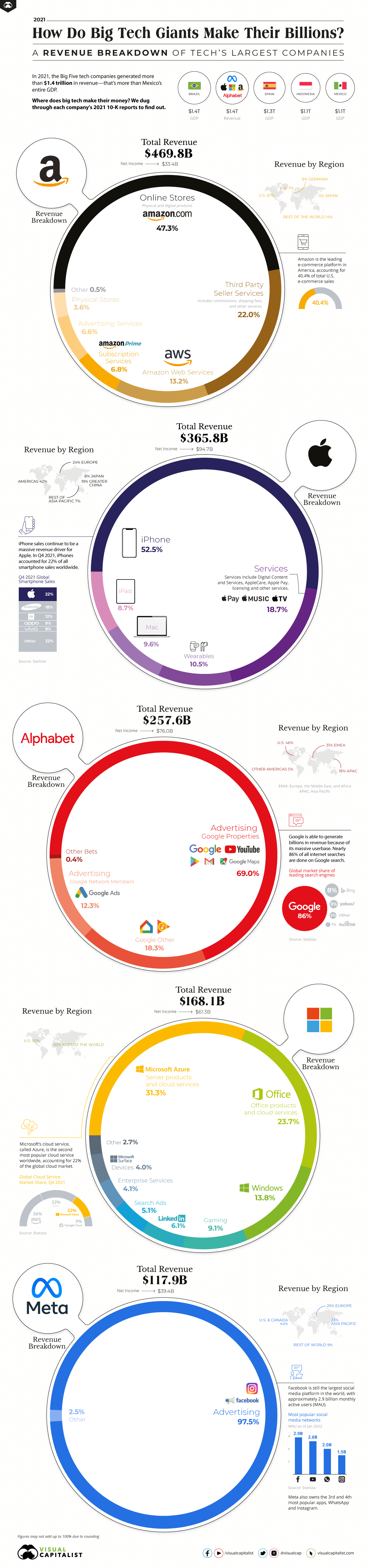

In 2021, the Big Five tech giants—Apple, Amazon, Google (Alphabet), Meta, and Microsoft—generated a combined $1.4 trillion in revenue.

What are the sources of this revenue, and how does it breakdown?

Below, we’ll dive into the main ways that these big tech giants generate revenue, and take a look at how much their revenues have increased in recent years.

Breaking Down Big Tech’s Revenue Streams

As we’ve mentioned in previous editions of this graphic, there are two main ways that big tech companies generate revenue:

- They either sell you a product

- Or sell you as the product to advertisers

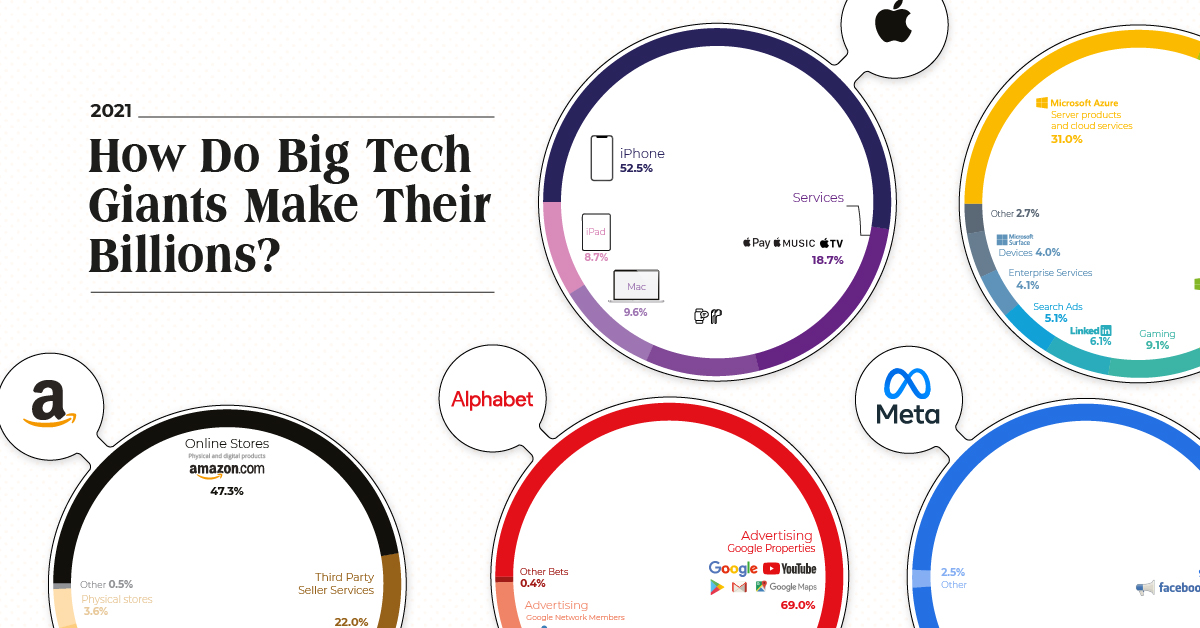

Apple, Microsoft, and Amazon fall into the first category—like most traditional businesses, these companies offer customers a physical (or digital) product in exchange for money. More than half of Apple’s revenue comes from iPhone sales, Azure cloud services generate almost a third of Microsoft’s total, and Amazon’s online stores account for nearly 50% of the company’s revenue.

On the other hand, Meta and Alphabet do things a bit differently. Rather than selling an actual product, these two tech giants make most of their money by selling their audience’s attention. Nearly 98% of Meta’s revenue comes from Facebook ads, and 81% of Google’s revenue comes from advertising on various Google products.

However, despite their varying ways of generating sales, these companies all have one thing in common: revenues have soared in recent years.

The Pandemic Has Sped Up Growth

Amidst rising unemployment and pandemic-induced chaos, the Big Five still managed to see a significant revenue uptick.

In 2019 (pre-pandemic), big tech’s combined revenue grew by 12%. The following year, throughout the onset of the global pandemic and the various economic challenges that came with it, big tech still increased its combined revenue by 19%.

And in the 2021 fiscal year, big tech saw a 27% growth in combined revenue, year-over-year.

| Company | Revenue (FY 2020) | Revenue (FY 2021) | Growth (YoY) |

|---|---|---|---|

| Apple | $274.5 billion | $365.8 billion | 33% |

| Amazon | $386.1 billion | $469.8 billion | 22% |

| Alphabet | $182.5 billion | $257.6 billion | 41% |

| Microsoft | $143.1 billion | $168.1 billion | 17% |

| Meta | $86.0 billion | $117.9 billion | 37% |

| Combined | $1.1 trillion | $1.4 trillion | 27% |

How did these companies continue to thrive throughout economic turmoil and global chaos? It was made possible because the societal changes triggered by COVID-19 ended up driving demand for big tech’s products and services.

For example, lockdown restrictions forced people to shop online, causing e-commerce sales to escalate. Demand for laptops and cloud-based services grew as offices shut down and companies pivoted to fully remote workspaces.

Is Growth Here to Stay?

These days, COVID-19 restrictions have eased in most countries, and the world has slowly returned to normalcy.

But that doesn’t mean growth for big tech will stop. In fact, the pandemic-induced changes to our work and shopping habits will likely stick around, meaning the increased demand for big tech’s offerings could be here to stay.

Two-thirds of employees from a global survey said their company would likely make remote work a permanent option. And global e-commerce sales are expected to grow steadily over the next few years to reach $7 trillion by 2025.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population