Mining

The History of Tungsten, the Strongest Natural Metal on Earth

The History of Tungsten

With a tensile strength of 1,510 megapascals, we now know tungsten as the strongest naturally occurring metal on Earth.

Today’s infographic is from Almonty Industries, a tungsten producer, and it reveals the history of tungsten.

Interestingly, the infographic shows that despite tungsten’s strength, most of civilization has lived without any practical use of the metal. That’s because tungsten wasn’t officially discovered until the 18th century – though, as you will see, it was a thorn in the side of metallurgists for many centuries before that.

From the Heavens

Like all elements with an atomic number higher than iron, tungsten cannot be created by nuclear fusion in stars like our sun.

Instead, tungsten is thought to be formed from the explosions of massive stars. Each supernova explosion has so much energy, that these newly created elements are jettisoned at incredible speeds of 30,000 km/s, or 10% of the speed of light – and that’s how they get dispersed throughout the universe.

Supernova explosions don’t happen often – as a result, in every 1,000,000 grams of the Earth’s crust, there are only 1.25 grams of tungsten.

An Unusual History

In the periodic table, tungsten is listed under the letter “W”. That’s because two names for the same metal actually arose simultaneously.

“Wolfram”

WOLFRAM: derived from the German words WOLF (English: wolf) and the Middle High German word RAM (English: dirt).

In the Middle Ages, tin miners in Germany complained about a mineral (wolframite) that accompanied tin ore and reduced tin yields when smelting.

With a longish, hair-like appearance, wolframite was thought to be a “wolf” that ate up the tin. Wolframite had plagued metallurgists for many centuries, until tungsten was discovered and proper methods were developed to deal with the heavy metal.

“Tungsten”

TUNGSTEN: derived from the Swedish words TUNG (English: heavy) and STEN (English: stone) due to its density

Scheelite, the other important tungsten ore, was discovered in an iron mine in Sweden in 1750.

It garnered interest for its incredible density – which is why it was named “heavy stone”.

The Discovery

The metal was discovered by Spanish nobleman Juan José D´Elhuyar, who eventually synthesized tungsten from both wolframite and scheelite – showing they were both minerals from the same new element.

History of Tungsten Uses

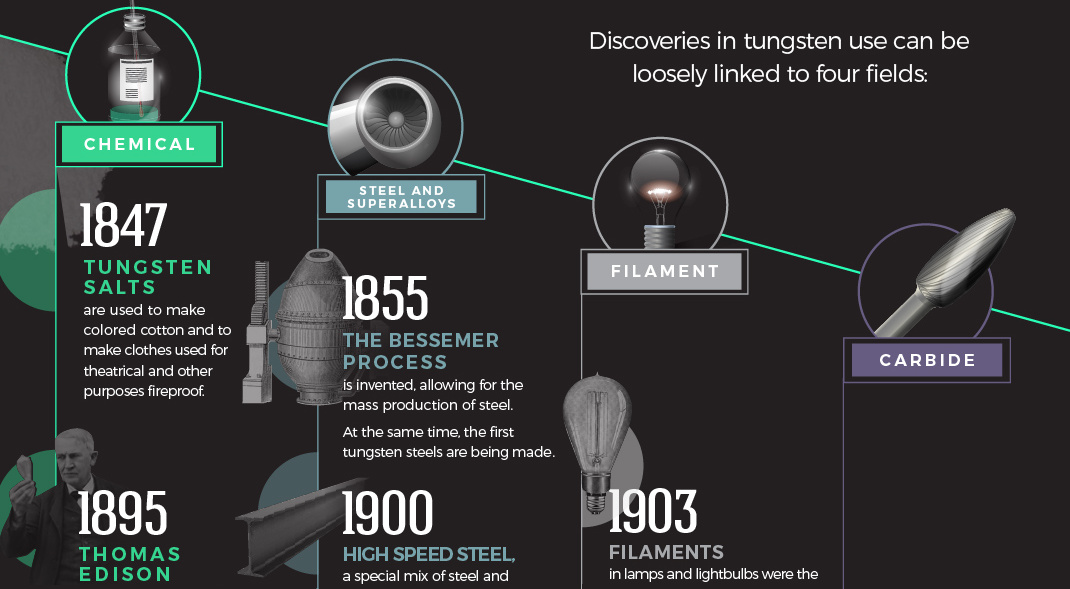

Discoveries in tungsten use can be loosely linked to four fields: chemicals, steel and super alloys, filaments, and carbides.

1847: Tungsten salts are used to make colored cotton and to make clothes used for theatrical and other purposes fireproof.

1855: The Bessemer process is invented, allowing for the mass production of steel. At the same time, the first tungsten steels are being made in Austria.

1895: Thomas Edison investigated materials’ ability to fluoresce when exposed to X-rays, and found that calcium tungstate was the most effective substance.

1900: High Speed Steel, a special mix of steel and tungsten, is exhibited at the World Exhibition in Paris. It maintains its hardness at high temperatures, perfect for use in tools and machining.

1903: Filaments in lamps and lightbulbs were the first use of tungsten that made use of its extremely high melting point and its electrical conductivity. The only problem? Early attempts found tungsten to be too brittle for widespread use.

1909: William Coolidge and his team at General Electric the U.S. are successful in discovering a process that creates ductile tungsten filaments through suitable heat treatment and mechanical working.

1911: The Coolidge Process is commercialized, and in a short time tungsten light bulbs spread all over the world equipped with ductile tungsten wires.

1913: A shortage in industrial diamonds in Germany during WWII leads researchers to look for an alternative to diamond dies, which are used to draw wire.

1914: “It was the belief of some Allied military experts that in six months Germany would be exhausted of ammunition. The Allies soon discovered that Germany was increasing her manufacture of munitions and for a time had exceeded the output of the Allies. The change was in part due to her use of tungsten high-speed steel and tungsten cutting tools. To the bitter amazement of the British, the tungsten so used, it was later discovered, came largely from their Cornish Mines in Cornwall.” – From K.C. Li’s 1947 book “TUNGSTEN”

1923: A German electrical bulb company submits a patent for tungsten carbide, or hardmetal. It’s made by “cementing” very hard tungsten monocarbide (WC) grains in a binder matrix of tough cobalt metal by liquid phase sintering.

The result changed the history of tungsten: a material which combines high strength, toughness and high hardness. In fact, tungsten carbide is so hard, the only natural material that can scratch it is a diamond. (Carbide is the most important use for tungsten today.)

1930s: New applications arose for tungsten compounds in the oil industry for the hydrotreating of crude oils.

1940: The development of iron, nickel, and cobalt-based superalloys begin, to fill the need for a material that can withstand the incredible temperatures of jet engines.

1942: During World War II, the Germans were the first to use tungsten carbide core in high velocity armor piercing projectiles. British tanks virtually “melted” when hit by these tungsten carbide projectiles.

1945: Annual sales of incandescent lamps are 795 million per year in the U.S.

1950s: By this time, tungsten is being added into superalloys to improve their performance.

1960s: New catalysts were born containing tungsten compounds to treat exhaust gases in the oil industry.

1964: Improvements in efficiency and production of incandescent lamps reduce the cost of providing a given quantity of light by a factor of thirty, compared with the cost at introduction of Edison’s lighting system.

2000: At this point, about 20 billion meters of lamp wire are drawn each year, a length which corresponds to about 50 times the earth-moon distance. Lighting consumes 4% and 5% of the total tungsten production.

Tungsten Today

Today, tungsten carbide is extremely widespread, and its applications include metal cutting, machining of wood, plastics, composites, and soft ceramics, chipless forming (hot and cold), mining, construction, rock drilling, structural parts, wear parts and military components.

Tungsten steel alloys are also used the in the production of rocket engine nozzles, which must have good heat resistant properties. Super-alloys containing tungsten are used in turbine blades and wear-resistant parts and coatings.

However, at the same time, the reign of the incandescent lightbulb has come to an end after 132 years, as they start to get phased out in the U.S. and Canada.

Copper

Brass Rods: The Secure Choice

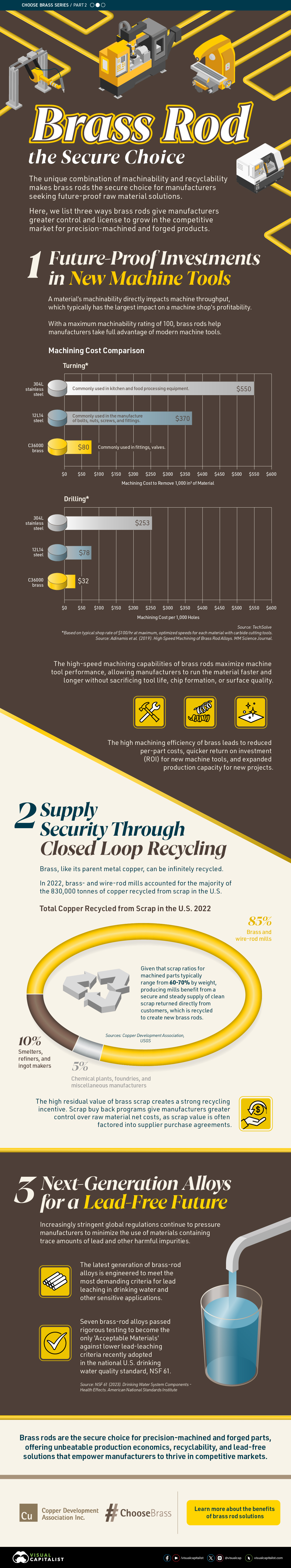

This graphic shows why brass rods are the secure choice for precision-machined and forged parts.

Brass Rods: The Secure Choice

The unique combination of machinability and recyclability makes brass rods the secure choice for manufacturers seeking future-proof raw material solutions.

This infographic, from the Copper Development Association, shows three ways brass rods give manufacturers greater control and a license to grow in the competitive market for precision-machined and forged products.

Future-Proof Investments in New Machine Tools

A material’s machinability directly impacts machine throughput, which typically has the largest impact on machine shop profitability.

The high-speed machining capabilities of brass rods maximize machine tool performance, allowing manufacturers to run the material faster and longer without sacrificing tool life, chip formation, or surface quality.

The high machining efficiency of brass leads to reduced per-part costs, quicker return on investment (ROI) for new machine tools, and expanded production capacity for new projects.

Supply Security Through Closed Loop Recycling

Brass, like its parent element copper, can be infinitely recycled.

In 2022, brass- and wire-rod mills accounted for the majority of the 830,000 tonnes of copper recycled from scrap in the United States.

Given that scrap ratios for machined parts typically range from 60-70% by weight, producing mills benefit from a secure and steady supply of clean scrap returned directly from customers, which is recycled to create new brass rods.

The high residual value of brass scrap creates a strong recycling incentive. Scrap buy back programs give manufacturers greater control over raw material net costs as scrap value is often factored into supplier purchase agreements.

Next Generation Alloys for a Lead-Free Future

Increasingly stringent global regulations continue to pressure manufacturers to minimize the use of materials containing trace amounts of lead and other harmful impurities.

The latest generation of brass-rod alloys is engineered to meet the most demanding criteria for lead leaching in drinking water and other sensitive applications.

Seven brass-rod alloys passed rigorous testing to become the only ‘Acceptable Materials’ against lower lead leaching criteria recently adopted in the national U.S. drinking water quality standard, NSF 61.

Learn more about the advantages of brass rods solutions.

-

Base Metals1 year ago

Base Metals1 year agoRanked: The World’s Largest Copper Producers

Many new technologies critical to the energy transition rely on copper. Here are the world’s largest copper producers.

-

Silver2 years ago

Silver2 years agoMapped: Solar Power by Country in 2021

In 2020, solar power saw its largest-ever annual capacity expansion at 127 gigawatts. Here’s a snapshot of solar power capacity by country.

-

Batteries5 years ago

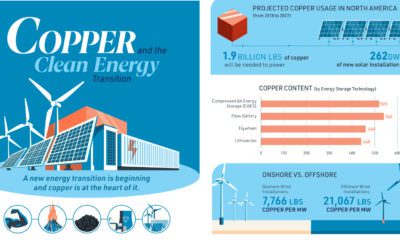

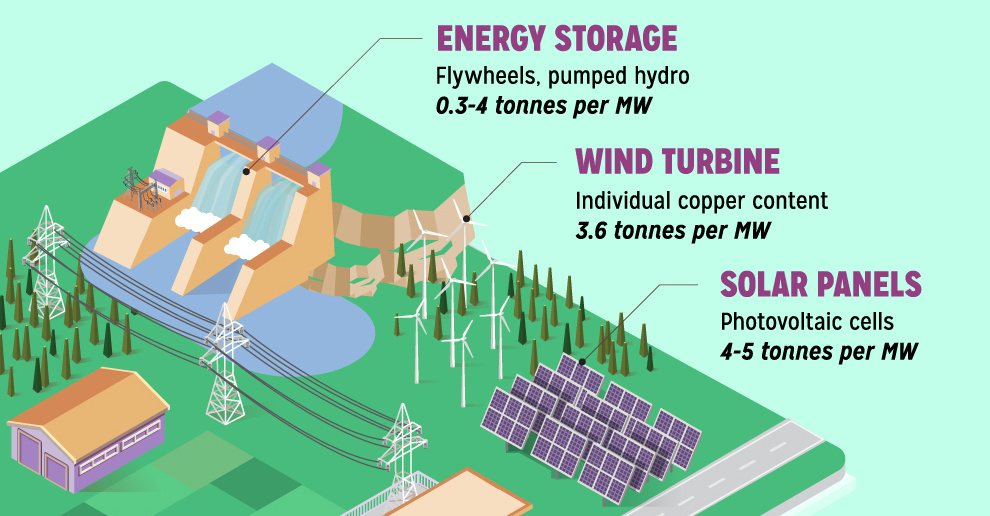

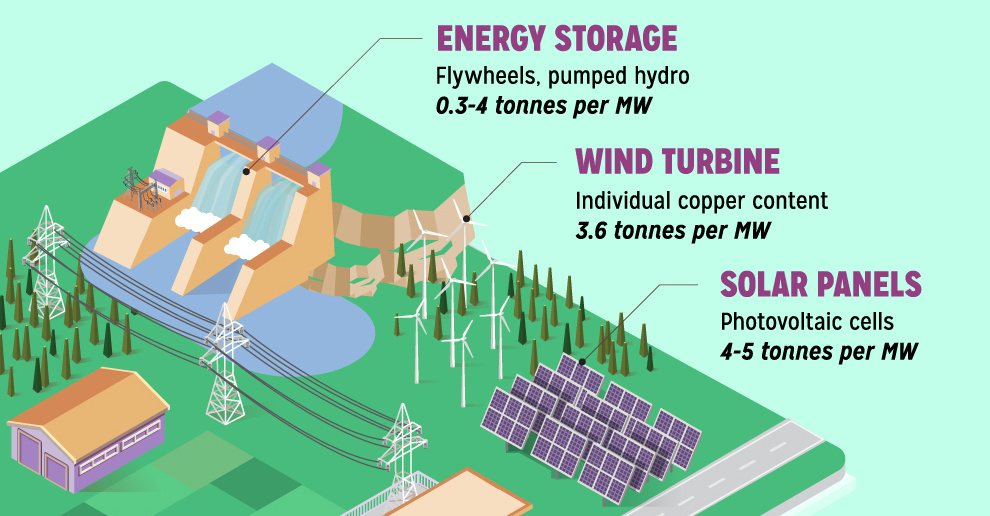

Batteries5 years agoVisualizing Copper’s Role in the Transition to Clean Energy

A clean energy transition is underway as wind, solar, and batteries take center stage. Here’s how copper plays the critical role in these technologies.

-

Science5 years ago

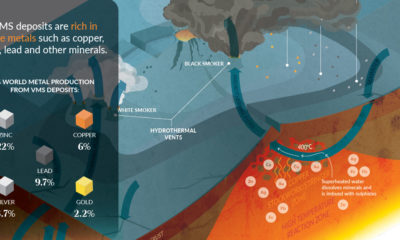

Science5 years agoEverything You Need to Know on VMS Deposits

Deep below the ocean’s waves, VMS deposits spew out massive amounts of minerals like copper, zinc, and gold, making them a key source of the metals…

-

Copper5 years ago

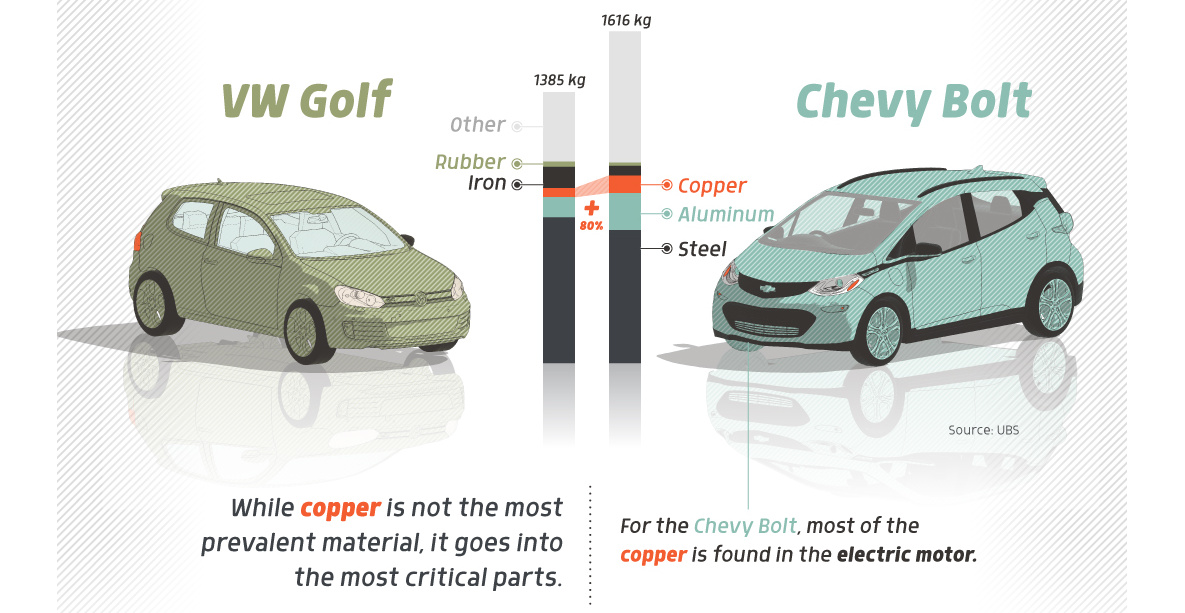

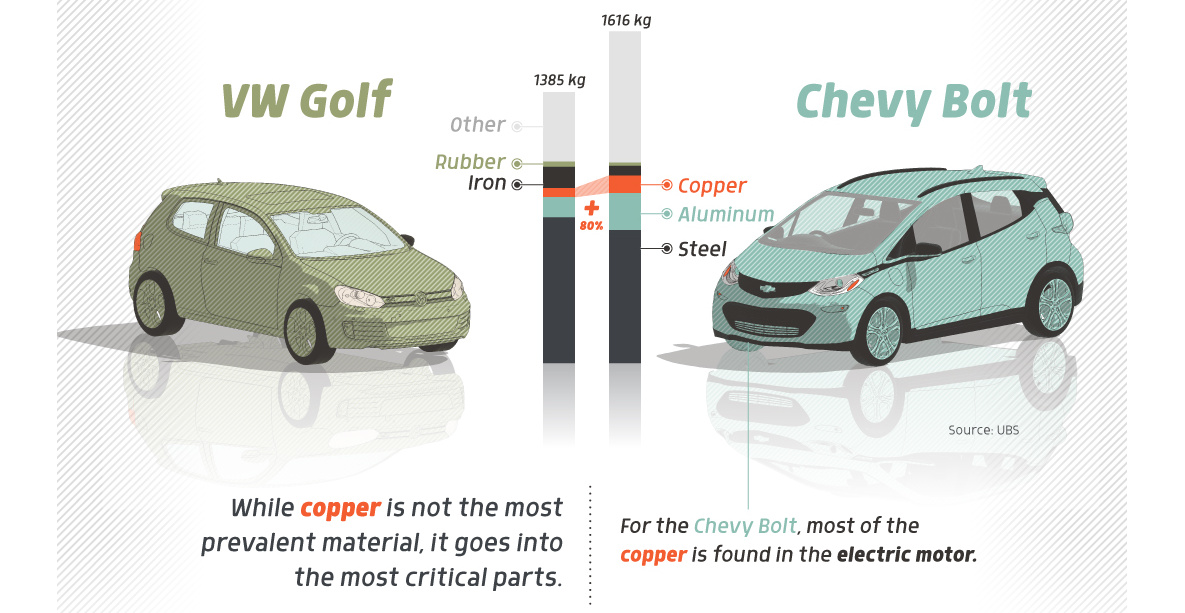

Copper5 years agoHow Much Copper is in an Electric Vehicle?

Have you ever wondered how much copper is in an electric vehicle? This infographic shows the metal’s properties as well as the quantity of copper used.

-

Copper6 years ago

Copper6 years agoCopper: Driving the Green Energy Revolution

Renewable energy is set to fuel a new era of copper demand – here’s how much copper is used in green applications from EVs to photovoltaics.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?