Green Investing: How to Align Your Portfolio With the Paris Agreement

The following content is sponsored by MSCI.

Green Investing: The Paris Agreement and Your Portfolio

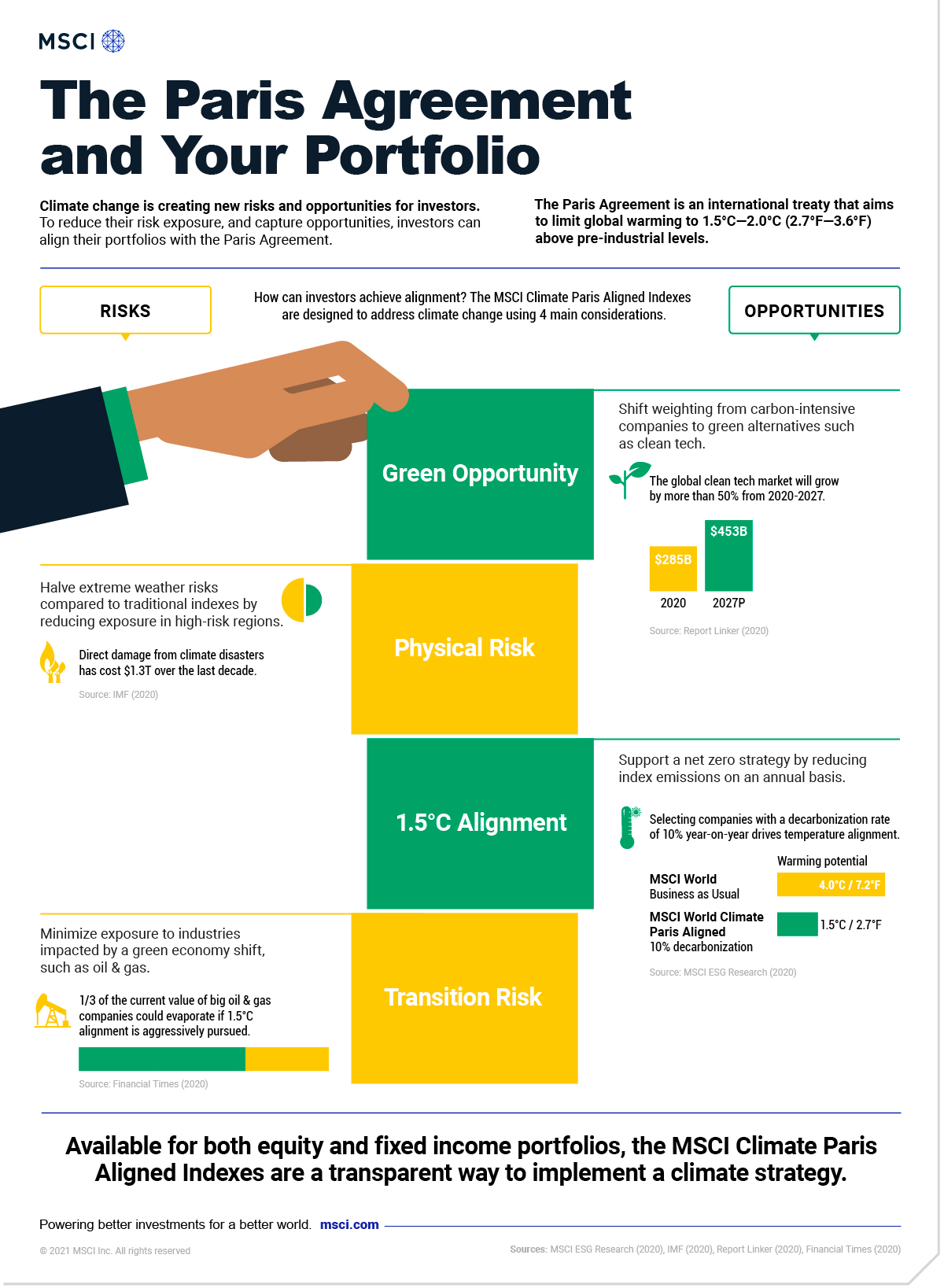

In Part 1 of the Paris Agreement series, we showed that the world is on track for 3.5 degrees Celsius global warming by 2100—far from the 1.5 degree goal. We also explained what could happen if the signing nations fall short, including annual economic losses of up to $400 billion in the United States.

How can you act on this information to implement a green investing strategy? This graphic from MSCI is part 2 of the series, and it explains how investors can align their investment portfolios with the Paris Agreement.

Alignment Through Indexing

When investors are building a portfolio, they typically choose to align their portfolio with benchmark indexes. For example, investors looking to build a global equity portfolio could align with the MSCI All Country World Index.

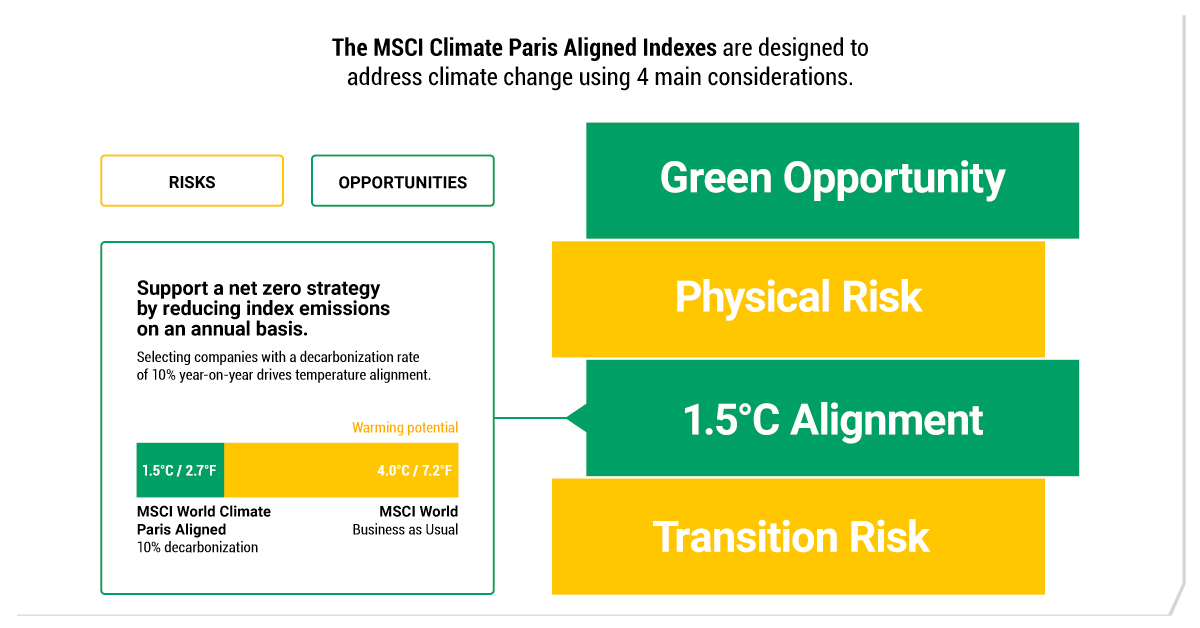

The same principle applies for climate-minded investors, who can benchmark against MSCI’s Climate Paris Aligned Indexes. These indexes are designed to reduce risk exposure and capture green investing opportunities using 4 main objectives.

1.5 Degree Alignment

The key element is determining if a company is aligned with 1.5 degree warming compared to pre-industrial levels. To accomplish this, data is collected on company climate targets, emissions data, and estimates of current and future green revenues. Then, the indexes include companies with a 10% year-on-year decarbonization rate to drive temperature alignment.

Green Opportunity

Environmentally-friendly companies may have promising potential. For instance, the global clean technology market is expected to grow from $285 billion in 2020 to $453 billion in 2027. The MSCI Climate Paris Aligned Indexes shift the weight of their constituents from “brown” companies that cause environmental damage to “green” companies providing sustainable solutions.

Transition Risk

Some companies are poorly positioned for the transition to a green economy, such as oil & gas businesses in the energy sector. In fact, a third of the current value of big oil & gas companies could evaporate if 1.5 degree alignment is aggressively pursued. To help manage this risk, the indexes aim to underweight high carbon emitters and lower their fossil fuel exposure.

Physical Risk

Climate change is causing more frequent and severe weather events such as flooding, droughts and storms. For example, direct damage from climate disasters has cost $1.3 trillion over the last decade. MSCI’s Climate Paris Aligned Indexes aim to reduce physical risks by at least 50% compared to traditional indexes by reducing exposure in high-risk regions.

Together, these four considerations support a net zero strategy, where all emissions produced are in balance with those taken out of the atmosphere.

Green Investing in Practice

Climate change is one of the top themes that investors would like to include in their portfolios. As investors work to build portfolios and measure performance, these sustainable indexes can serve as a critical reference point.

Available for both equity and fixed income portfolios, the MSCI Climate Paris Aligned Indexes are a transparent way to implement a green investing strategy.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.