Technology

Decoding Google’s AI Ambitions (and Anxiety)

Decoding Google’s AI Ambitions (and Anxiety)

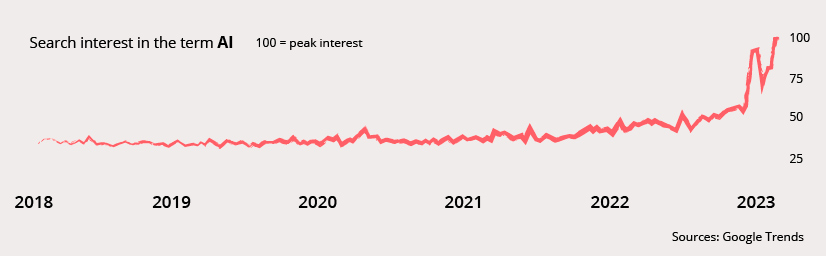

Anyone who’s experimented with ChatGPT can get a sense of the potential of generative AI—even in the technology’s earliest stages.

The hype around AI was rising throughout 2022, and has reached a fever pitch today.

We’ve seen hype cycles swell around specific technologies before. Blockchain, Metaverse, NFTs, the list goes on. It remains to be seen what tangible value is created after the heat dies down, but in the meantime, some of the world’s biggest companies are taking it very seriously.

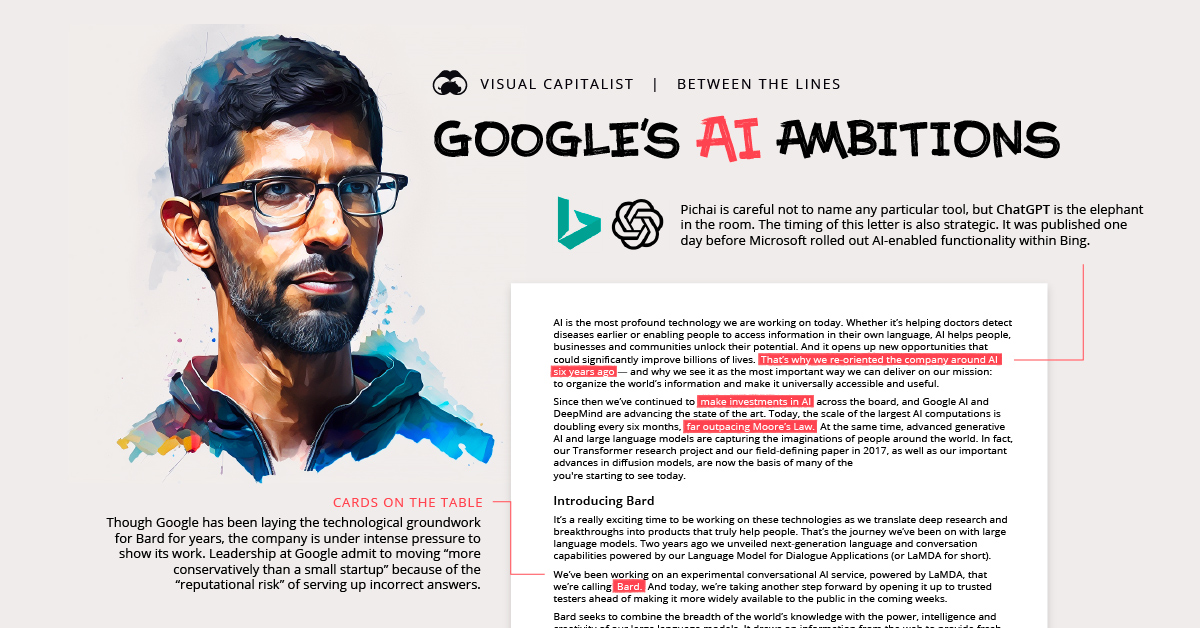

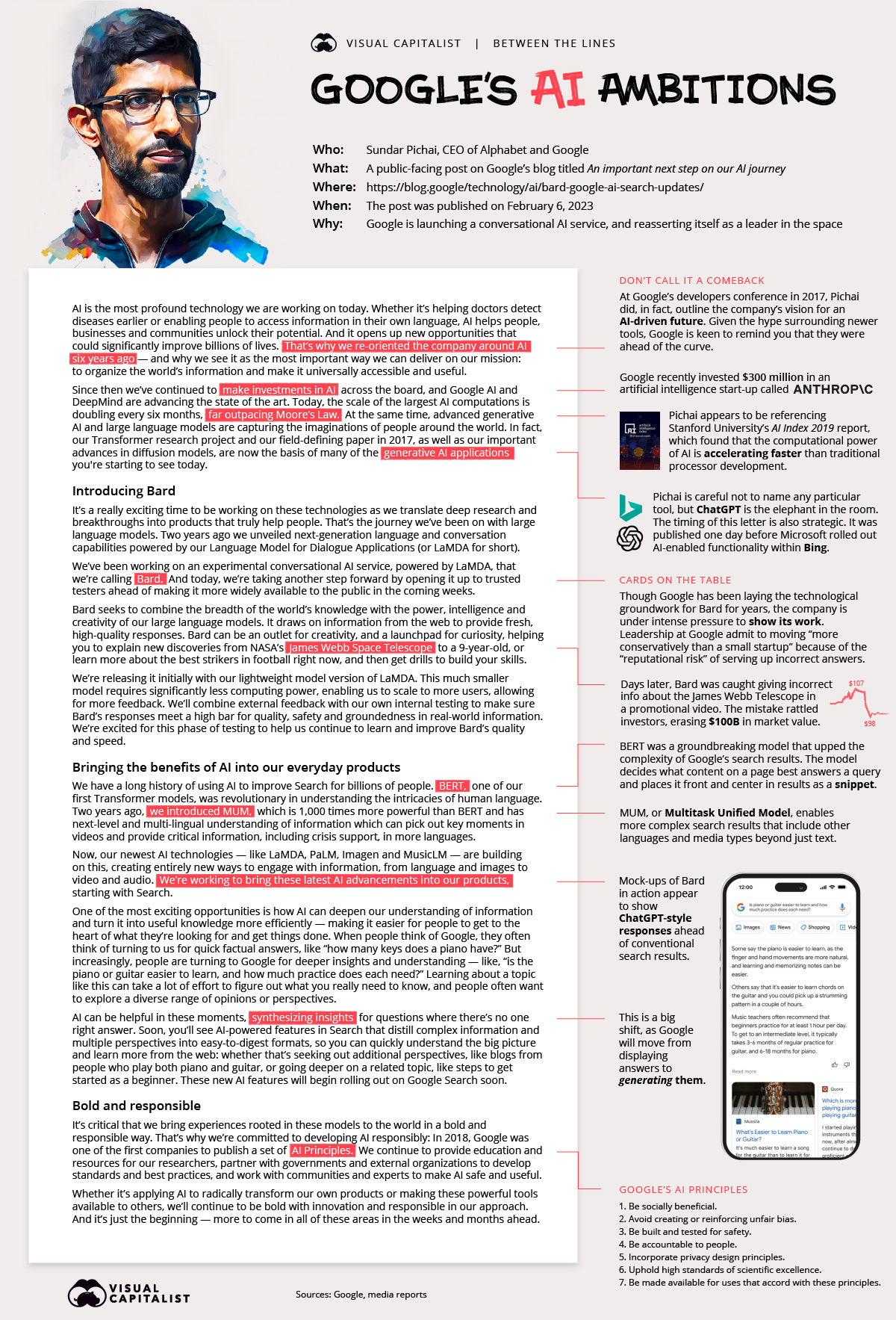

Google—which internally reoriented itself around AI years ago—is at the forefront of this movement, so the recent letter published by Google CEO Sundar Pichai is consequential.

After all, billions of people use Google Search to learn about the world, and Alphabet is one of the world’s most valuable, powerful tech companies. But before we “read between the lines” of the letter, it’s worth revisiting the larger context that this letter addresses.

OpenAI Has Entered The Chat

Artificial intelligence has been chalking up a number of wins in recent months, but it was DALL-E Mini and ChatGPT that really allowed generative AI to burst into the public consciousness. In fact, ChatGPT became so popular in a short amount of time, that Google declared an internal “code red” to address the issue. Leaders at Google were well aware of the disruptive power of conversational AI because they were already testing their own models internally.

Microsoft recognized the potential as well, and invested $10 billion in OpenAI, which runs ChatGPT as well as a number of other publicly-accessible AI tools. Microsoft’s intention was to bring the magic of ChatGPT over to their Bing search engine—and perhaps steal market share away from Google.

This sets the stage for what we’re seeing today. Essentially every big tech firm is singing AI’s praises, and Microsoft and Google appear to be entering into an AI race.

The AI Race is Heating Up

If there were any questions about how seriously Google was taking Microsoft’s new partnership with OpenAI, recent messaging should remove all doubt. The letter above, by Sundar Pichai speaks volumes while never straying far from official talking points. First, here is the high-level messaging in Pichai’s letter:

- Google has already been in the AI game for years now

- Bard is going to make Google search more ChatGPT-like

- Google is only late to the party because they’ve been careful

On this last point: a message from the CEO, which reaffirms the company’s commitment to AI would normally coincide with a product launch, not one that will be released to the public “in the coming weeks”. This messaging highlights a key barrier that Google is facing. Fearing the “reputational damage” that could come from rolling products out prematurely, the company has been forced to move slower than the market now expects.

Google has already endured a painful misstep after reporters discovered an incorrect answer in a promotional video touting the conversational AI service, Bard. This simple mistake cost Alphabet $100 billion in market value—demonstrating how high the stakes are now that Big Tech’s AI progress is under the microscope.

The timing of this letter is also very telling. The letter was published the day before Bing rolled out new AI-enabled features to the public.

Let the jockeying for position begin.

Nobody Wants to be Left Behind

Google and Microsoft may be the biggest players battling it out in the AI space, but there are indicators all over that AI represents a massive technological shift that will impact a number of industries. From Fiverr’s “Open Letter to AI” to Baidu’s recent AI chatbot announcement, it seems that every day brings fresh news that fuels AI hype.

One thing’s for sure: AI will be integrated into digital tools in more noticeable ways. And for better or worse, we’ll all be participating the experiment.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024